Global Ammonia Fuel Market Size, Share, and COVID-19 Impact Analysis, By Product (Green Ammonia, Blue Ammonia, Grey Ammonia, and Other Product), By Application (Power Generation Fuel, Maritime Shipping Fuel, Industrial Process & Heat Fuel, and Other Application), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ammonia Fuel Market Insights Forecasts To 2035

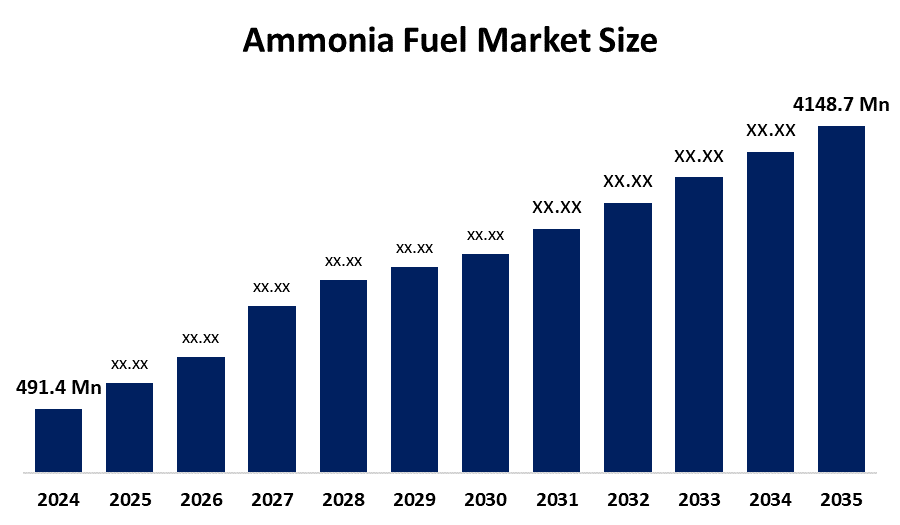

- The Global Ammonia Fuel Market Size Was Estimated At USD 491.4 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 21.4% From 2025 To 2035

- The Worldwide Ammonia Fuel Market Size Is Expected To Reach USD 4148.7 Million By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Ammonia Fuel Market Size Was Worth Around USD 491.4 Million In 2024 And Is Predicted To Grow To Around USD 4148.7 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 21.4% From 2025 To 2035. Growth within the global ammonia fuel marketplace is driven by increasing demand for carbon-free energy alternatives, more stringent emission regulations, an increase in investments pertaining to green hydrogen and ammonia projects, and the suitability of ammonia towards decarbonizing shipping, power generation, and heavy industries across the globe.

Market Overview

The Global Ammonia Fuel Market Size Is Referred To As That Emerging Energy Market Focused On The Use Of Ammonia As A Low-Carbon Or Carbon-Free Fuel, Either Directly For Combustion Or As A Carrier Of Hydrogen. Due to its higher energy density and nil carbon dioxide emissions at the point of use, applications will be major in marine shipping, power generation, gas turbines, and industrial heating. Major growth drivers will be driven by global decarbonization goals, stringent emission regulations imposed by IMO targets, among others, growing adoption of green hydrogen, and investments in renewable energy-based ammonia production.

Opportunities will increase further through technological development in ammonia engines, co-firing applications, and international trade of green ammonia for energy security. Besides this, existing ammonia storage and transportation infrastructure supports faster commercialisation. The market is fueled by key players Yara International, CF Industries, Siemens Energy, MAN Energy Solutions, Mitsubishi Heavy Industries, and young green ammonia projects, and is expected to be fueled by these players, with the support and investment of young green ammonia projects for the growth of the market. In November 2025, following IMO's postponement of its zero and near-zero fuels plan, the European Commission initiated the support scheme for the development of Sustainable Aviation Fuel (SAF) and Sustainable Maritime Fuel (SMF) production in the EU. The plan targets 13.2 million tons of SAF and 6.8 million tons of marine fuels by 2035 through 2027 funding cycles.

Report Coverage

This Research Report Categorizes The Ammonia Fuel Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ammonia fuel market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ammonia fuel market.

Ammonia Fuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 491.4 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 21.4% |

| 2023 Value Projection: | USD 4148.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product By Application |

| Companies covered:: | Yara International, Siemens Energy, CF Industries Holdings, Inc., ExxonMobil Corporation, SABIC, BASF SE, Royal Dutch Shell plc, QatarEnergy, Nutrien Ltd., OCI Global, Air Liquide S.A., ThyssenKrupp AG, Eni S.p.A., Mitsubishi Heavy Industries, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Ammonia Fuel Market Size Is Getting Propelled With The Urge For Decarbonization, Especially In The Maritime, Power, And Industrial Sectors. This is due to the zero-emission combustion and higher energy density properties of ammonia, which are considered to be important attributes for a hydrogen carrier and a fuel alternative. The rigorous regulations being followed, like the IMO requirements in maritime transport, are propelling the growth of the ammonia fuel market. The existence of global infrastructure for the storage and transport of ammonia reduces the barriers to adoption. Growing energy security concerns and increasing interest in long-duration energy storage also strengthen the market demand in the world.

Restraining Factors

The Global Ammonia Fuel Market Size Is Restrained By Such Factors As High Production Costs Of Green Ammonia, a scant number of large-scale fuel-ready engines, and safety concerns due to ammonia's toxicity. Infrastructure modifications have to be conducted for end-use. Low combustion efficiency and challenges from NOx emissions raise technological and regulatory obstacles.

Market Segmentation

The ammonia fuel market share is classified into product and application.

- The blue ammonia segment dominated the market in 2024, approximately 66% and is projected to grow at a substantial CAGR during the forecast period.

Based On The Product, The Ammonia Fuel Market Size Is Divided Into Green Ammonia, Blue Ammonia, Grey Ammonia, And Other Product. Among these, the blue ammonia segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. It leads the market due to its first-mover advantage and the development of manufacturing facilities. Blue ammonia, produced using natural gas with carbon capture, provides an alternative with lower carbon intensity and doesn’t completely rely on renewable energy sources. It captures the dominant market through the massive scale of co-firing in the power sector and export contracts, with high levels of production and growing demands in the industry contributing to its high revenue and market growth.

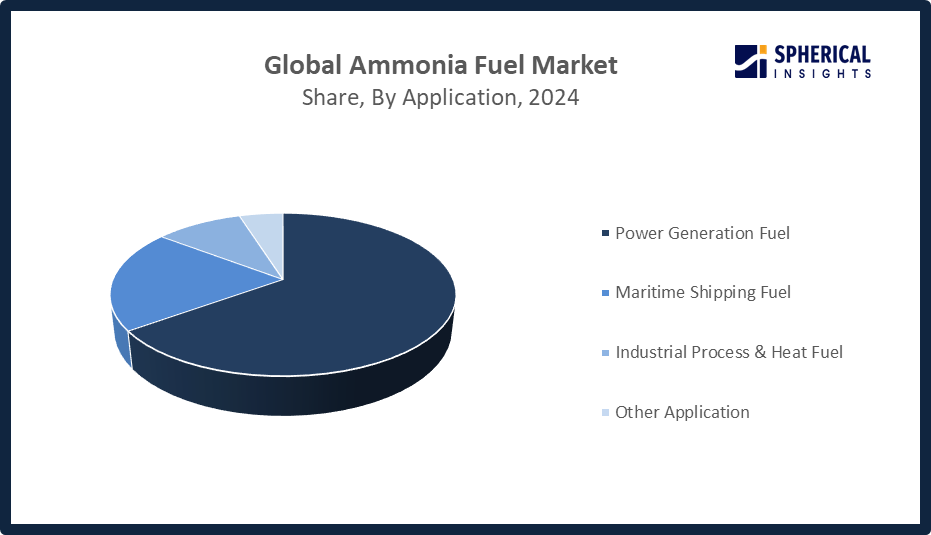

- The power generation fuel segment accounted for the highest market revenue in 2024, approximately 65% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Application, The Ammonia Fuel Market Size Is Divided Into Power Generation Fuel, Maritime Shipping Fuel, Industrial Process & Heat Fuel, And Other Application. Among these, the power generation fuel segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The fuel used for generating power contributed to the growth of the market due to its increased application in co-firing processes for coal and gas-based power generation to produce lower-carbon electricity. The fuel is propelled by the influence of government policies supporting its adoption on a mass pilot project level through supply contracts based on its pivotal role in the decarbonization of the energy sector.

Get more details on this report -

Regional Segment Analysis of the Ammonia Fuel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is expected to hold the largest share of the ammonia fuel market during the forecast period.

Get more details on this report -

The Region Is Projected To Account For 57 Percent Of The Global Ammonia Fuel Market Size Due To Rapid Industrialization, increasing energy demand, and strong government support for decarbonization. Japan, China, and South Korea are making significant investments in green and blue ammonia production, co firing power plants, and ammonia powered shipping. Japan leads in imports and pilot projects. China focuses on large scale production and domestic consumption, while South Korea emphasizes maritime and power generation applications. As of July 2024, India plans to continue viability gap funding for two years with support from MNRE, MoCF, MoPSW, and MoPNG, totaling Rs 10000 crore. This initiative is expected to increase green ammonia production by 2 million tonnes by 2025 to 2026.

North America Is Expected To Grow At A Rapid CAGR In The Ammonia Fuel Market Size During The Forecast Period. North America is expected to have a 18% market share of the ammonia fuel market, owing to increasing investments in green ammonia, favorable government policies, and the power sector's move towards low carbon energy. The U.S. currently leads with ammonia initiatives into the marine and power generation industries, along with co-firing pilot projects and funding for hydrogen-based ammonia. Canada is moving ahead with its renewable ammonia projects. In December 2024, the IMO has published an update on its safety recommendations, amending the IGF/IGC Codes to include the use of ammonia in shipping. Further safety recommendations are expected in the form of final guidelines in 2025/2026.

Europe Is Experiencing The Development Of Its Ammonia Fuel Market Size Due To Strict Carbon Emissions Regulations, massive government support for eco-friendly fuel sources, as well as infrastructure development for eco-friendly shipping and power production. The key countries covered include Germany, Norway, and the Netherlands, with Germany concentrating on the production of eco-friendly ammonia fuel, Norway on the trial of ammonia transport fuel, and the Netherlands on the development of joint power production.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Ammonia Fuel Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International

- Siemens Energy

- CF Industries Holdings, Inc.

- ExxonMobil Corporation

- SABIC

- BASF SE

- Royal Dutch Shell plc

- QatarEnergy

- Nutrien Ltd.

- OCI Global

- Air Liquide S.A.

- ThyssenKrupp AG

- Eni S.p.A.

- Mitsubishi Heavy Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In September 2025, Yara Clean Ammonia signed a long-term contract with Navigator Ammon Shipping for two 51,000 cbm dual-fuel, ice-class vessels. The agreement strengthens Yara’s global low-emission ammonia supply by ensuring reliable, year-round shipping to Northern Europe and supporting flexible, energy-efficient, and scalable intercontinental supply chains.

• In August 2025, Air Products and Yara International partnered to integrate low-carbon hydrogen with ammonia production at the Louisiana Clean Energy Complex. The facility produces over 750 million cubic feet per day of low-carbon hydrogen with 95 percent CO2 capture, enabling Yara to acquire and operate ammonia facilities and integrate their output into its global network.

• In June 2025, IHI Corporation and GE Vernova inaugurated a large-scale combustion test facility at IHI’s Aioi Works in Japan. The facility advances the development of gas turbine combustors capable of operating on 100 percent ammonia and, following a 2024 joint development agreement, will accelerate prototype testing toward commercial deployment by 2030.

• In May 2025, RIC Energy and Siemens signed a memorandum of understanding to develop renewable hydrogen, green ammonia, and e-fuel projects in Spain. The collaboration will support RIC’s Compostilla Green e-SAF plant, recognized under Hydrogen Valleys, with joint technical and financial support from multiple entities within the Siemens Group.

• In April 2025, CF Industries formed a joint venture with JERA and Mitsui to construct, produce, and offtake low-carbon ammonia. The partnership combines global expertise to advance sustainable ammonia production and support decarbonization efforts across energy and industrial markets.

• In July 2024, SABIC Agri-Nutrients received approval from the Saudi Energy Ministry for feedstock allocation for its planned blue ammonia facility in Jubail Industrial City. The complex, SABIC’s sixth, is expected to produce 1.2 million tonnes per year of blue ammonia and 1.1 million tonnes per year of urea and specialized agri-nutrients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ammonia fuel market based on the below-mentioned segments:

Global Ammonia Fuel Market, By Product

- Green Ammonia

- Blue Ammonia

- Grey Ammonia

- Other Product

Global Ammonia Fuel Market, By Application

- Power Generation Fuel

- Maritime Shipping Fuel

- Industrial Process & Heat Fuel

- Other Application

Global Ammonia Fuel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ammonia fuel market over the forecast period?The global ammonia fuel market is projected to expand at a CAGR of 21.4% during the forecast period.

-

2. What is the ammonia fuel market?The ammonia fuel market involves production, distribution, and use of ammonia as a low-carbon fuel for power, shipping, and industry.

-

3. What is the market size of the ammonia fuel market?The global ammonia fuel market size is expected to grow from USD 491.4 million in 2024 to USD 4148.7 million by 2035, at a CAGR of 21.4% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the ammonia fuel market?Asia Pacific is anticipated to hold the largest share of the ammonia fuel market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global ammonia fuel market?Yara International, Siemens Energy, CF Industries Holdings, Inc., ExxonMobil Corporation, SABIC, MAN Energy Solutions, BASF SE, Royal Dutch Shell plc, QatarEnergy, Nutrien Ltd, and Others.

-

6. What factors are driving the growth of the ammonia fuel market?Growth of the ammonia fuel market is driven by decarbonization goals, government incentives, shipping and power sector adoption, technological advancements, demand for green fuels, and global efforts to reduce carbon emissions.

-

7. What are the market trends in the ammonia fuel market?Growing green and blue ammonia, marine fuel adoption, power co‑firing, policy support, emissions regulations, and investment in low‑carbon infrastructure are key ammonia fuel market trends.

-

8. What are the main challenges restricting wider adoption of the ammonia fuel market?The main challenges restricting the wider adoption of the ammonia fuel market involve significant safety concerns, a lack of a global bunkering infrastructure, lower fuel efficiency, and technical issues with combustion and emissions.

Need help to buy this report?