Global Amines for Natural Gas Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Primary Amines, Secondary Amines, Tertiary Amines), By Application (Gas Sweetening, Gas Dehydration, Gas Treatment, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Amines for Natural Gas Market Insights Forecasts to 2033

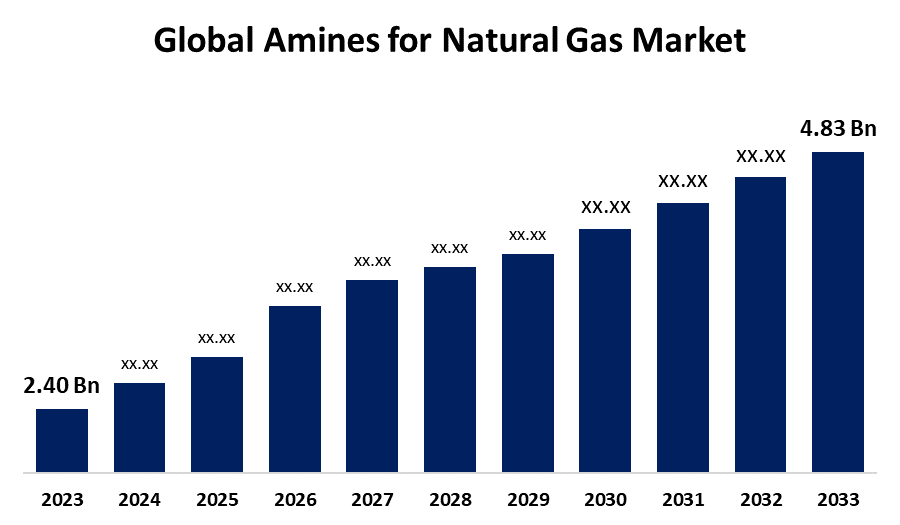

- The Global Amines for Natural Gas Market Size was Valued at USD 2.40 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 7.24% from 2023 to 2033

- The Worldwide Amines for Natural Gas Market Size is Expected to Reach USD 4.83 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Amines for Natural Gas Market size was valued at USD 2.40 billion in 2023 and is slated to cross USD 4.83 billion by 2033, growing at a CAGR of 7.24% from 2023 to 2033. The amines for natural gas market is driven by growing demand for cleaner energy and stricter environmental regulations. Amines are crucial in the process of gas sweetening, removing harmful components such as CO2 and H2S, ensuring the quality of the gas, and therefore supporting the growth of the natural gas industry.

Market Overview

Amines are organic compounds developed from ammonia (NH3) by replacing one or more hydrogen atoms with alkyl or aryl groups. In the natural gas industry, amines, specifically alkanol amines, are used in treatment processes to remove impurities, such as carbon dioxide (CO2), hydrogen sulfide (H2S), and other acid gases, from natural gas. These impurities may have impacts on the quality, safety, and environmental effects of natural gas, which makes it critical to use amine-based gas treatments. Moreover, amines are used in the purification of natural gas, primarily for the removal of CO2 and H2S during the sweetening process, which guarantees the quality of the gas to be transported and consumed. They remove sulfur compounds and CO2, ensuring that environmental standards are met. The economic feasibility of extracting gas from contaminated reserves also increases with the use of amines, further fueling growth in demand for natural gas. Improvements in amine technology enhance efficiency, reduce costs, and increase the environmental benefits of natural gas, further driving market growth. Furthermore, opportunities in the market for natural gas include increasing demand for cleaner energy, expansion of unconventional reserves, and advancements in amine technology with more efficient treatment of gas. Trends include ever-increasing regulations on the environment, sustainability measures, and the development of new methods for gas purification and carbon capture solutions.

Report Coverage

This research report categorizes the global amines for the natural gas market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global amines for the natural gas market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global amines for the natural gas market.

Global Amines for Natural Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.40 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.24% |

| 023 – 2033 Value Projection: | USD 4.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Application, By Regional |

| Companies covered:: | BASF SE, Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, INEOS Group Holdings S.A., Air Products and Chemicals, Inc., Arkema S.A., Albemarle Corporation, Clariant AG, Mitsubishi Gas Chemical Company, Inc., Solvay S.A., Taminco Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

This includes rising demand for energy at a global scale, the gradual transition towards clean fuels, and rising industrialization in emerging markets. Technological innovations in gas extraction and purification, such as amine-based treatments, upgrade gas quality and efficiency. Other drivers include policy directives aimed at curbing carbon emissions and further transitioning towards an energy mix without reliance on coal. The increasing demand for efficient and low-cost energy supply also contributes to investments in the sector, hence supporting overall market growth and innovation.

Restraints & Challenges

Inherent challenges for natural gas markets lie in the vagaries of fluctuating prices, limited infrastructure availability, and overcomplicated regulation. Environmental restrictions, such as methane emissions, and competition with renewable energy resources are other kinds of restraints that hinder investment and long-term growth in this sector.

Market Segmentation

The amines for natural gas market share are classified into product type and application.

- The tertiary amines segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the product type, the amines for the natural gas market are divided into primary amines, secondary amines, and tertiary amines. Among these, the tertiary amines segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This is mainly because they have better performance in gas sweetening processes, as they are more efficient in absorbing CO2 and H2S, which are common impurities in natural gas. Tertiary amines have better stability, less degradation, and lower corrosion rates than primary and secondary amines, making them more cost-effective and sustainable for long-term use in gas purification. In addition, their low energy consumption during regeneration processes contributes to their increasing preference in the industry.

- The gas sweetening segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the amines for the natural gas market are divided into gas sweetening, gas dehydration, gas treatment, and others. Among these, the gas sweetening segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. This is because natural gas sweetening involves the removal of impurities, such as carbon dioxide (CO2) and hydrogen sulphide (H2S), for a natural gas stream to qualify as quality sufficient for transportation and usage. Therefore, with higher demands for clean energy, stiffer environmental standards, and production of more supplies from natural gas fields, demand for effective sweetening processes for gases using amines is bound to skyrocket significantly.

Regional Segment Analysis of the Amines for Natural Gas Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Amines for natural gas market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Amines for natural gas market over the predicted timeframe. This is because of the significant amount of natural gas production in the region, especially in the U.S. and Canada, which has been driven by shale gas extraction technologies. The growing demand for natural gas as a cleaner source of energy and the need for effective gas sweetening and treatment technologies are also drivers of this region. Also, strong environmental regulations and continued investment in infrastructure boost the demand for amines in natural gas processing.

Asia Pacific is expected to grow at a rapid CAGR of the amines for the natural gas market during the forecast period. This growth is led by the increasing demand for natural gas as a cleaner energy alternative, particularly from China, India, and Japan. The rapid industrialization, urbanization, and energy consumption within these nations, accompanied by government policies to curb carbon emissions, generate significant demand for efficient gas purification technologies, which include amines for gas sweetening and treatment. The focus of the region on energy security and the development of infrastructures propels this growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the amines for the natural gas market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Huntsman Corporation

- INEOS Group Holdings S.A.

- Air Products and Chemicals, Inc.

- Arkema S.A.

- Albemarle Corporation

- Clariant AG

- Mitsubishi Gas Chemical Company, Inc.

- Solvay S.A.

- Taminco Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, ExxonMobil Upstream Research introduced new inlet feed gas conditioning technology for contaminant removal in amine units. Amine solvent foaming is a common challenge in gas-treating plants, including those ahead of LNG manufacturing facilities. This can lead to reduced gas throughput and, in severe cases, solvent carryover and even plant shutdown.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global amines for the natural gas market based on the below-mentioned segments:

Global Amines for Natural Gas Market, By Product Type

- Primary Amines

- Secondary Amines

- Tertiary Amines

Global Amines for Natural Gas Market, By Application

- Gas Sweetening

- Gas Dehydration

- Gas Treatment

- Others

Global Amines for Natural Gas Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global amines for natural gas market over the forecast period?The global amines for natural gas market size was valued at USD 2.40 billion in 2023 and is slated to cross USD 4.83 billion by 2033, growing at a CAGR of 7.24% from 2023 to 2033.

-

2. Which region holds the largest share of the global amines for the natural gas market?North America is estimated to hold the largest share of the global amines for the natural gas market over the predicted timeframe.

-

3. Who are the top key players in the global amines for natural gas market?BASF SE, Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, INEOS Group Holdings S.A., Air Products and Chemicals, Inc., Arkema S.A., Albemarle Corporation, Clariant AG, Mitsubishi Gas Chemical Company, Inc., Solvay S.A., Taminco Corporation, and Others.

Need help to buy this report?