North America Ethylene Vinyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Type (Low-Density, Medium-Density, and High-Density), By End-User (Packaging, Renewable Energy, Adhesive & Sealants, Footwear, Construction, Electrical & Electronics, Automotive, Pharmaceuticals, Agriculture, and Others), and North America Ethylene Vinyl Acetate Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Ethylene Vinyl Acetate Market Insights Forecasts to 2035

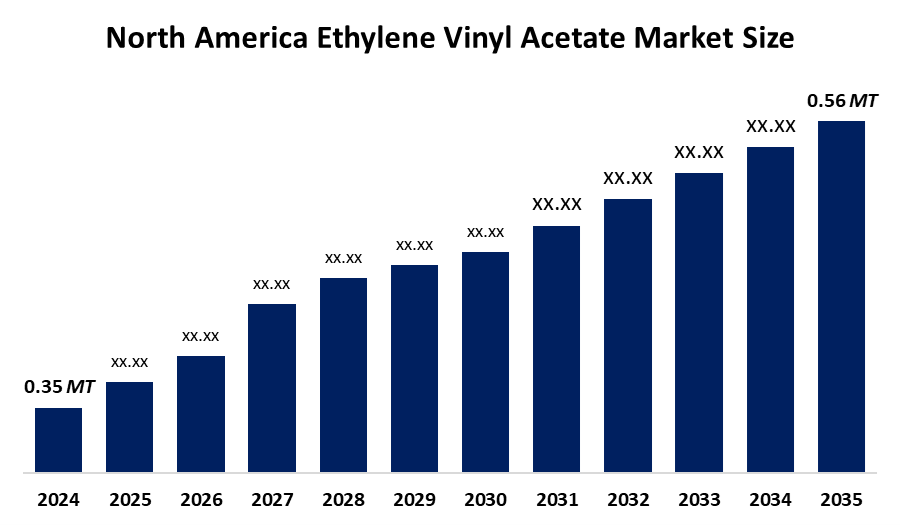

- The North America Ethylene Vinyl Acetate Market Size Was Estimated at 0.35 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.37% from 2025 to 2035

- The North America Ethylene Vinyl Acetate Market Size is Expected to Reach 0.56 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Ethylene Vinyl Acetate Market Size is anticipated to reach 0.56 Million Tonnes by 2035, Growing at a CAGR of 4.37% from 2025 to 2035. The market is driven by growing industrialization and commercial activities in the region are contributing significantly to the North America EVA market growth.

Market Overview

The North America ethylene vinyl acetate (EVA) market is referred to as a vital and growing industry that uses its various applications to support all current manufacturing operations, which supply renewable energy and packaging industries. Manufacturers produce ethylene vinyl acetate as a thermoplastic copolymer through the random copolymerization process that combines ethylene and vinyl acetate (VA) monomers. The industry uses the material as an encapsulation film to protect photovoltaic cells from moisture and UV degradation in more than 80% of solar modules.

The Environmental Protection Agency's Solar for All Program will distribute its $7 billion federal funding through 2025 to finance residential solar initiatives in all 50 states, which will create an unintentional increase in demand for EVA encapsulation films.

EVA copolymers from ExxonMobil are used in extrusion film operations that create packaging materials, greenhouse coverings, surface protection products, and materials for encapsulating solar cells. Vinyl acetate was listed as a carcinogen under Proposition 65 by the Office of Environmental Health Hazard Assessment (OEHHA) in January 2025.

Various industrial applications are seeing a rising trend of organizations implementing advanced digital technologies through the development of specialized digital solutions. The company improves its market position through active research and development and ongoing digital transformation efforts. The organization maintains its expansion potential because it focuses on both operational productivity improvements and the development of precise operational methods.

Report Coverage

This research report categorizes the market for the North America ethylene vinyl acetate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America ethylene vinyl acetate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America ethylene vinyl acetate market.

North America Ethylene Vinyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.35 Million Tonnes i |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.37% |

| 2035 Value Projection: | 0.56 Million tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | DuPont, ExxonMobil Corporation, Hanwha Total Petrochemical Co., Ltd., LyondellBasell Industries N.V., Arkema SA, Braskem S.A., Celanese Corporation, Sumitomo Chemical Co., Ltd., Formosa Plastics Corporation, LG Chem Ltd., and Other key players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The ethylene vinyl acetate market in North America is driven by investments in infrastructure modernization and digital enablement projects continue to grow. Companies select platforms that enable them to operate with agility while they automate tasks and achieve long-lasting system expansion. The North America Ethylene Vinyl Acetate Market will experience continuous new business prospects because companies now focus more on increasing productivity and reducing operational expenses. Manufacturers are moving toward bio-based EVA because of rising regulatory demands and consumer preferences for environmentally friendly products.

Restraining Factors

The ethylene vinyl acetate market in North America is hindered by data security and privacy issues. The production costs and profit margins of the company experience direct effects from fluctuating prices of raw materials, which include ethylene and vinyl acetate monomer (VAM) as essential components.

Market Segmentation

The North America ethylene vinyl acetate market share is categorised into type and end-user.

- The low-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North Amerca ethylene vinyl acetate market is segmented by type into low-density, medium-density, and high-density. Among these, the low-density segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the material, which demonstrates superior flexibility and low-cost performance and shows multiple application possibilities, which include adhesive and flexible packaging. The material composition delivers exceptional elastic properties with transparent characteristics make it ideal for products that need to stretch and maintain visibility.

- The packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America ethylene vinyl acetate market is segmented into packaging, renewable energy, adhesive & sealants, footwear, construction, electrical & electronics, automotive, pharmaceuticals, agriculture, and others. Among these, the packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the material, which is widely used for packaging food products and consumer items, and for shipping e-commerce packages. Manufacturers select EVA because it offers superior sealing capabilities and flexible material properties and protects against temperature changes, which makes it their top choice for improving product shelf life and appearance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America ethylene vinyl acetate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DuPont

- ExxonMobil Corporation

- Hanwha Total Petrochemical Co., Ltd.

- LyondellBasell Industries N.V.

- Arkema SA

- Braskem S.A.

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Formosa Plastics Corporation

- LG Chem Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In May 2025, Borealis launched a renewable EVA grade for footwear midsoles, reducing carbon footprint by 45%. EVA offers the comfort, cushioning and structural support essential in midsole applications.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Ethylene Vinyl Acetate Market based on the below-mentioned segments:

North America Ethylene Vinyl Acetate Market, By Type

- Low-Density

- Medium-Density

- High-Density

North America Ethylene Vinyl Acetate Market, By End-User

- Packaging

- Renewable Energy

- Adhesive & Sealants

- Footwear

- Construction

- Electrical & Electronics

- Automotive

- Pharmaceuticals

- Agriculture

- Others

Frequently Asked Questions (FAQ)

-

What is the North America ethylene vinyl acetate market size?The North America ethylene vinyl acetate market size is expected to grow from 0.35 million tonnes in 2024 to 0.56 million tonnes by 2035, growing at a CAGR of 4.37% during the forecast period 2025-2035

-

What is ethylene vinyl acetate, and its primary use?The North America ethylene vinyl acetate (EVA) market functions as a vital and growing industry that uses its various applications to support all current manufacturing operations, which supply renewable energy and packaging industries.

-

What are the key growth drivers of the market?Market growth is driven by investments in infrastructure modernization and digital enablement projects continue to grow. Companies select platforms that enable them to operate with agility while they automate tasks and achieve long-lasting system expansion

-

What factors restrain the North America ethylene vinyl acetate market?The market is restrained by data security and privacy issues. The production costs and profit margins of the company experience direct effects from fluctuating prices of raw materials

-

How is the market segmented by type?The market is segmented into low-density, medium-density, and high-density

-

Who are the key players in the North America ethylene vinyl acetate market?Key companies include DuPont, ExxonMobil Corporation, Hanwha Total Petrochemical Co., Ltd., LyondellBasell Industries N.V., Arkema SA, Braskem S.A., Celanese Corporation, Sumitomo Chemical Co., Ltd., Formosa Plastics Corporation, and LG Chem Ltd.

Need help to buy this report?