Global Aluminum Sheet Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Plain Aluminium Sheets, Anodized Aluminium Sheets, Composite Aluminium Sheets, and Others), By Thickness (Up to 1mm, 1mm to 6mm, and Above 6mm), By Application (Construction, Automotive, Aerospace, Packaging, Industrial Machinery, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Aluminum Sheet Market Insights Forecasts to 2035

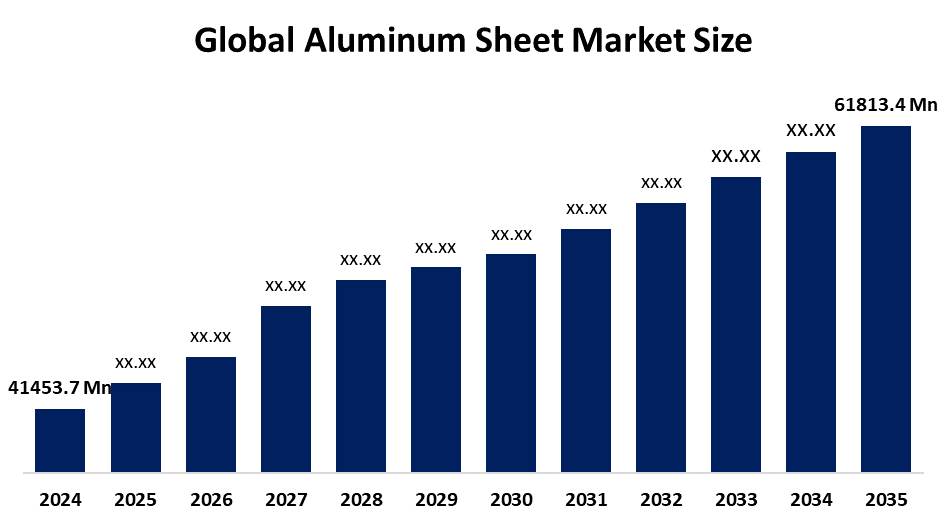

- The Global Aluminum Sheet Market Size Was Estimated at USD 41453.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.7% from 2025 to 2035

- The Worldwide Aluminum Sheet Market Size is Expected to Reach USD 61813.4 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Aluminum Sheet Market Size was worth around USD 41453.7 Million in 2024 and is predicted to grow to around USD 61813.4 Million by 2035 with a compound annual growth rate (CAGR) of 3.7% from 2025 to 2035. The aluminum sheet market is expanding due to increasing demand in the automotive, construction, and packaging sectors on the back of lightweight, corrosion-resistant materials, sustainability patterns, and rising infrastructure development, particularly in emerging nations such as China and India.

Market Overview

The aluminum sheet market refers to the production, processing, and distribution of aluminum flat-rolled products applied in numerous industries. The materials are characterized by their light weight, ruggedness, resistance to corrosion, and recyclability, and thus are a material of choice in sectors like automotive, construction, aerospace, packaging, and marine. They find application in car bodies, aircraft panels, building facades, and beverage cans, among others. The market is witnessing rapid growth due to increasing demand for lightweight materials for enhancing fuel efficiency in transportation and lowering carbon footprints. The construction sector is also helping the market grow, fuelled by urbanization and infrastructure development across the globe. Market prospects are arising from the increasing need for EVs, the trend towards green packaging, and aerospace and defense requirements for high-performance materials.

Innovation is the main factor influencing the aluminum sheet market. New developments in alloy technology and rolling techniques have enhanced product performance and allowed manufacturers to address niche applications, such as electric vehicles (EVs), which need lightweight yet strong materials for battery enclosures and structural components. In addition, automation and AI integration in manufacturing operations are enhancing the efficiency and consistency of products. Major industry players like Novelis Inc., Constellium SE, Hindalco Industries, Arconic Corporation, and Norsk Hydro ASA are investing in research, production capacity, and sustainability. On 14th November 2024, the Aluminium Association of India (AAI) made its pre-budget representation to DPIIT, emphasizing aluminium's critical importance to India's development and to its Viksit Bharat 2047 vision. Stressing aluminium's pervasive application in existing and emerging technologies, AAI called for its identification as a strategic sector, following suit with the USA, Malaysia, and Indonesia.

Report Coverage

This research report categorizes the aluminum sheet market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aluminum sheet market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aluminum sheet market.

Global Aluminum Sheet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 41453.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.7% |

| 2035 Value Projection: | USD 61813.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product Type, By Thickness, By Application and By Region |

| Companies covered:: | Novelis Inc., Alcoa, Constellium, Arconic, Rio Tinto, Norsk Hydro ASA, Kaiser Aluminum, Aleris, Vedanta Aluminium, Chalco, UACJ Corporation, Viohalco S.A., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for aluminum sheet is driven by growing demand in automotive, construction, aerospace, and packaging sectors. The lightweight and corrosion-resistant nature of aluminum sheets makes them suitable for enhanced fuel efficiency and strength, particularly in electric cars and airplanes. Fast urbanization and infrastructure growth in emerging markets also drive demand higher. Growing interest in sustainable and recyclable materials increases the appeal of aluminum, driven by circular economy activities. Advances in rolling and alloying technology enhance product quality and usage scope. Further, government policies encouraging energy efficiency, emission control, and environmentally friendly building materials are fueling the use of aluminum sheets across the globe, which is responsible for steady market growth.

Restraining Factors

The aluminum sheet market is constrained by volatile raw materials prices, notably bauxite and energy prices, which affect the margin of production. The high initial investment and operational expenses of new manufacturing technologies are also constraints. The heavy regulatory compliance and issues surrounding environmental concerns with mining and smelting processes further hinder market growth and profitability.

Market Segmentation

The aluminum sheet market share is classified into product type, thickness, and application.

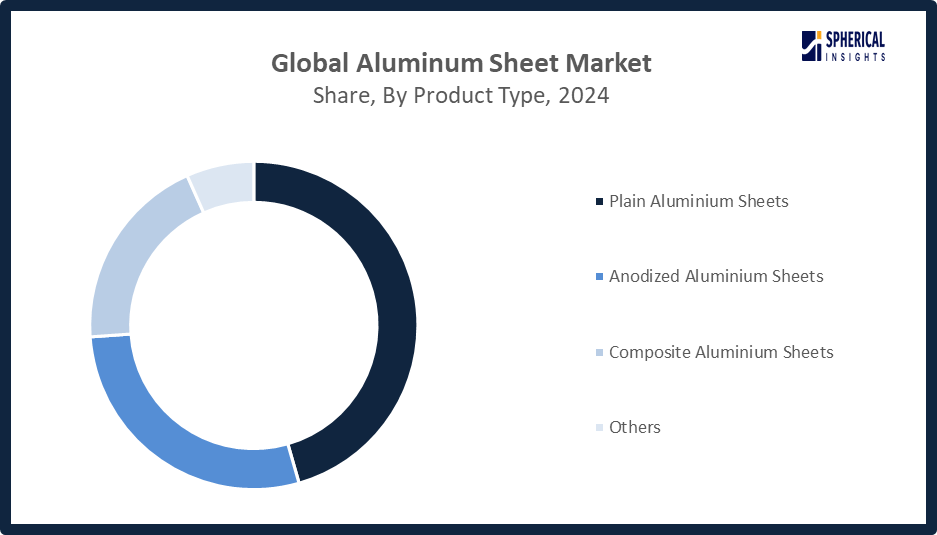

- The plain aluminium sheets segment dominated the market in 2024, approximately 46% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the aluminum sheet market is divided into plain aluminium sheets, anodized aluminium sheets, composite aluminium sheets, and others. Among these, the plain aluminium sheets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment is dominated due to their versatility, price sensitivity, and mass use across automotive, construction, packaging, and industrial industries. The ease of workability, recyclable nature, and availability in numerous grades enable them to register high demand. Increasing infrastructure development and adoption of lightweight material further add to their high estimated CAGR in the forecast period.

Get more details on this report -

- The 1mm to 6mm segment accounted for the largest share in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the thickness, the aluminum sheet market is divided into up to 1mm, 1mm to 6mm, and above 6mm. Among these, the 1mm to 6mm segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to its optimal strength-to-flexibility balance, finding application in automotive panels, building facades, and machinery parts. Its extensive industrial usage, increased application in electric vehicles, and expanding infrastructure development projects worldwide are some major drivers propelling its high forecasted CAGR over the next few years.

- The automotive segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the aluminum sheet market is divided into construction, automotive, aerospace, packaging, industrial machinery, and others. Among these, the automotive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The automotive industry is led by the growth in demand for light materials to enhance fuel efficiency and minimize emissions. Growing production of electric vehicles (EVs) and stringent pollution regulations are driving the usage of aluminum sheet in bodywork panels, battery housing, and structural elements, propelling its robust growth and high anticipated CAGR over the forecast period.

Regional Segment Analysis of the Aluminum Sheet Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the aluminum sheet market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the aluminum sheet market over the predicted timeframe. Asia Pacific is leading market share of aluminum sheets with rapid industrialization, urbanization, and automotive and construction industries. China, India, and Japan are the key countries that steer demand through mega infrastructure development, increasing vehicle manufacturing, and expanding lightweight material use. China, being the world's largest producer and consumer of aluminum, leads with high-scale manufacturing and exportation. India's growing infrastructure and automotive sectors additionally drive growth. Moreover, government support for green building and clean transportation further stimulates aluminum sheet uptake, enhancing the region's market leadership.

North America is expected to grow at a rapid CAGR in the aluminum sheet market during the forecast period. The North American market is rapidly growing in the aluminum sheet market with rising demand from the automotive, aerospace, and construction sectors. The U.S., being the region's largest economy, dominates this growth fueled by more stringent environmental laws encouraging light materials to enhance fuel efficiency and lower emissions. The growth in electric vehicle manufacturing and the development of supporting infrastructure further fuels increasing aluminum sheet consumption. Canada and Mexico similarly facilitate market growth through industrial diversification and free trade agreements, enhancing the overall regional demand over the forecast period.

Europe's rise in the aluminum sheet market is spurred by robust demand from the automotive and construction industries, particularly in Germany, France, and the UK. Strong environmental regulations promote the use of light materials such as aluminum, which is recyclable, to save carbon emissions. Growing investments in electric vehicles and green infrastructure projects further drive market demand. Germany's strong manufacturing sector and green technology innovation contribute significantly to Europe's growing aluminum sheet demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aluminum sheet market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novelis Inc.

- Alcoa

- Constellium

- Arconic

- Rio Tinto

- Norsk Hydro ASA

- Kaiser Aluminum

- Aleris

- Vedanta Aluminium

- Chalco

- UACJ Corporation

- Viohalco S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Vedanta Aluminium, India’s leading aluminium producer, launched its new 5-inch aluminium billets at ALUMEX India 2025. Designed for precision applications across sectors, the billets aim to meet rising demand and unlock new opportunities for downstream industries in India and global markets.

- In April 2025, Constellium announced the successful completion of the ISA3 R&D project, launched in 2021 to develop next-generation aluminium components for lightweight automotive design focusing on enhanced recyclability, reduced cost, and improved performance.

- In December 2024, Chalco began construction of its high-precision aluminum plate/sheet, strip, and foil project in Yunnan’s Qidian Industrial Park. With a 2.103 billion yuan investment, the project will have a 170,000 mt annual capacity and is expected to be completed by late 2026 or early 2027.

- In October 2023, Vedanta Aluminium, India’s largest aluminium producer, launched advanced wire rods, T4, AL59, and the 8xxx series, at Cable & Wire Fair 2023 in New Delhi. Manufactured using innovative continuous casting technology, these high-performance products serve power, automotive, infrastructure, building, and electronics sectors globally.

- In April 2020, Arconic Corporation launched as a leader in advanced aluminum sheet, plate, extruded, and architectural products, serving key markets including aerospace, ground transportation, industrial, packaging, and commercial construction.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aluminum sheet market based on the below-mentioned segments:

Global Aluminum Sheet Market, By Product Type

- Plain Aluminium Sheets

- Anodized Aluminium Sheets

- Composite Aluminium Sheets

- Others

Global Aluminum Sheet Market, By Thickness

- Up to 1mm

- 1mm to 6mm

- Above 6mm

Global Aluminum Sheet Market, By Application

- Construction

- Automotive

- Aerospace

- Packaging

- Industrial Machinery

- Others

Global Aluminum Sheet Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aluminum sheet market over the forecast period?The global aluminum sheet market is projected to expand at a CAGR of 3.7% during the forecast period.

-

2. What is the market size of the aluminum sheet market?The global aluminum sheet market size is expected to grow from USD 41453.7 million in 2024 to USD 61813.4 million by 2035, at a CAGR of 3.7% during the forecast period 2025-2035.

-

3. What is the aluminum sheet market?The aluminum sheet market is a global industry focused on the production and sale of flat-rolled aluminum products used across various sectors, including automotive, construction, and packaging.

-

4. Which region holds the largest share of the aluminum sheet market?Asia Pacific is anticipated to hold the largest share of the aluminum sheet market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global aluminum sheet market?Novelis Inc., Alcoa, Constellium, Arconic, Rio Tinto, Norsk Hydro ASA, Kaiser Aluminum, Aleris, Vedanta Aluminium, Chalco, UACJ Corporation, Viohalco S.A., and Others.

-

6. What factors are driving the growth of the aluminum sheet market?The growth of the aluminum sheet market is primarily driven by increasing demand from the automotive, construction, and packaging sectors, where the metal's lightweight, durability, and recyclable properties offer significant advantages. Other factors include a global shift towards sustainability and advancements in manufacturing technology.

-

7. What are the market trends in the aluminum sheet market?Key trends include the surging use of aluminum in electric vehicles (EVs), advancements in sustainable and low-carbon production methods, and growing demand fueled by urban development, especially in the Asia Pacific region.

-

8. What are the main challenges restricting wider adoption of the aluminum sheet market?The main challenges restricting wider adoption of the aluminum sheet market are high production costs, intense competition from substitute materials, and increasing environmental pressures. The market is also hindered by volatile raw material prices and significant supply chain disruptions.

Need help to buy this report?