Global Aluminosilicate Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product (Zeolites, Mullite, and Feldspar/Other Aluminosilicates), By End Use (Chemicals/Adsorbents, Ceramics/Refractories, and Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsAluminosilicate Market Summary, Size & Emerging Trends

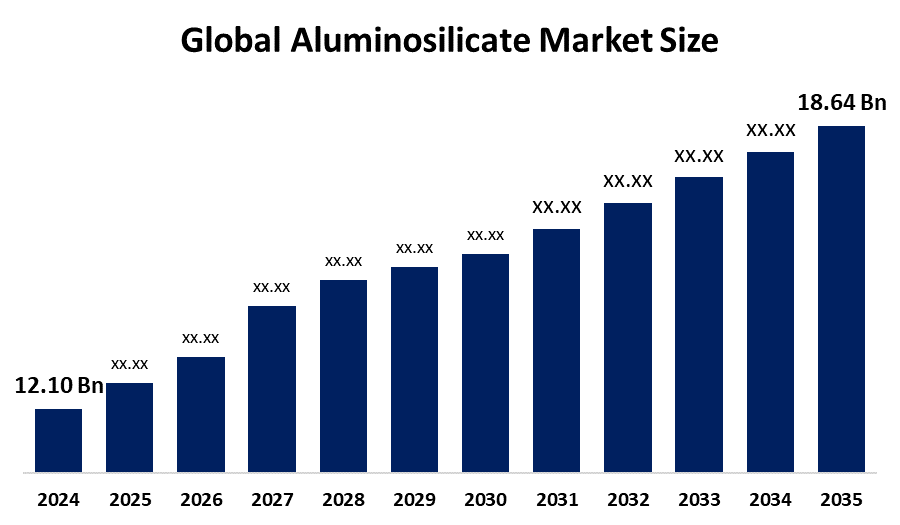

According to Decision Advisor, The Global Aluminosilicate Market Size is expected to grow from USD 12.10 Billion in 2024 to USD 18.64 Billion by 2035, at a CAGR of 4.01% during the forecast period 2025-2035. Rising demand for advanced materials in ceramics and adsorbents, coupled with expanding construction activities, is a key driver of the aluminosilicate market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to hold the largest share in the aluminosilicate market during the forecast period.

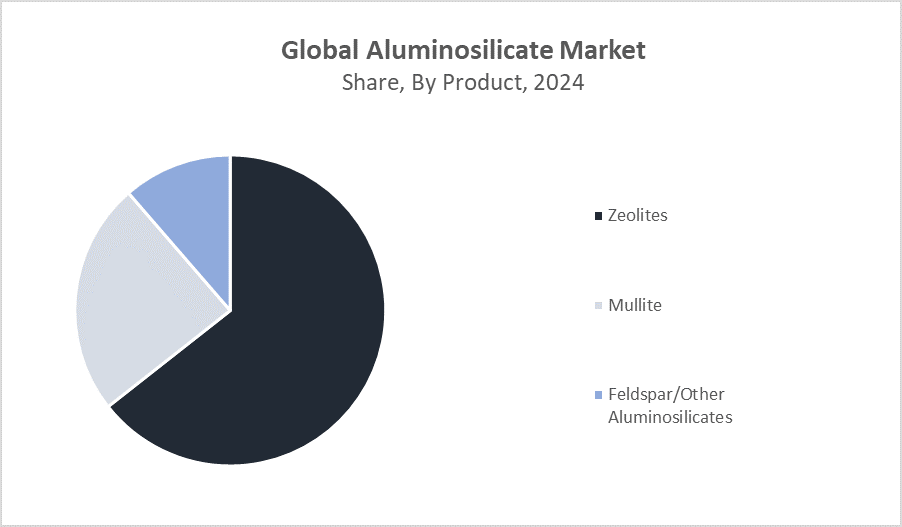

- Among products, Zeolites dominate in terms of revenue due to their extensive application in chemicals and adsorption industries.

- Ceramics Refractories end-use segment accounts for the largest revenue share in the global aluminosilicate market.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12.10 Billion

- 2035 Projected Market Size: USD 18.64 Billion

- CAGR (2025-2035): 4.01%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Aluminosilicate Market

The aluminosilicate market revolves around minerals made of aluminum, silicon, and oxygen, such as zeolites, mullite, and feldspar. These minerals are prized for their thermal stability, excellent adsorption capabilities, and mechanical strength, making them essential in various industries including chemicals, ceramics, and construction. Zeolites serve as effective adsorbents and catalysts, while mullite and feldspar are crucial in ceramics and refractory applications due to their durability under high temperatures. Governments worldwide support the market by promoting sustainable mining practices and encouraging technological innovations aimed at improving product quality and environmental sustainability. Increasing demand for advanced ceramics in electronics and aerospace, as well as adsorbents for water and air purification, drives market growth. Additionally, aluminosilicates play a vital role in manufacturing refractory materials, further bolstering their industrial importance and market expansion.

Aluminosilicate Market Trends

- Increasing use of zeolites in environmental applications such as water purification and gas adsorption.

- Growth in advanced ceramic applications in electronics and aerospace sectors.

- Rising construction activities boosting demand for feldspar and mullite-based materials.

Aluminosilicate Market Dynamics

Driving Factors: Environmentally friendly adsorbents like zeolites are increasingly applied in water

The aluminosilicate market is growing due to rising demand for high-performance ceramics used in electronics and aerospace. Environmentally friendly adsorbents like zeolites are increasingly applied in water and air purification, boosting their use. Rapid construction growth, especially in Asia Pacific, drives demand for feldspar and mullite. Advances in refining technologies enhance mineral purity and performance, improving product quality and expanding application possibilities, which collectively propel the market forward.

Restrain Factors: Strict regulatory restrictions on mining activities limit access to natural aluminosilicate sources

The market faces challenges from fluctuating raw material prices that increase production costs and reduce profitability. Strict regulatory restrictions on mining activities limit access to natural aluminosilicate sources, affecting supply stability. Furthermore, the presence of synthetic alternatives in certain applications, which can offer similar properties at competitive costs, restricts market growth by providing manufacturers with other viable options.

Opportunity: Expanding product applications and reaching new customer segments

Zeolites and mullite minerals find growing use in emerging technologies such as catalysis for chemical reactions, energy storage systems, and eco-friendly construction materials, creating new market opportunities. Investments in sustainable mining practices and advanced processing technologies aimed at reducing environmental impact offer further growth potential. These innovations allow companies to meet increasing demand for green solutions while expanding product applications and reaching new customer segments.

Challenges: Supply chain disruptions

Supply chain disruptions caused by geopolitical issues or natural disasters affect raw material availability. Environmental regulations impose strict standards, increasing compliance costs and limiting production processes. Aluminosilicate processing is energy-intensive, adding to operational expenses. Ensuring consistent product quality requires specialized technical expertise, creating barriers for new entrants. These challenges complicate scaling production and maintaining competitive advantage in the market.

Global Aluminosilicate Market Ecosystem Analysis

The global aluminosilicate market ecosystem comprises raw material miners, processing firms, and end-users in chemicals, ceramics, and construction sectors. Major players like Zeochem AG, Imerys Group, and BASF lead innovation, enhancing product quality and expanding applications. These companies also manage complex supply chains to ensure steady raw material availability and efficient distribution. Regulatory bodies play a crucial role by enforcing environmental and safety standards, pushing companies to adopt sustainable practices and comply with laws, which shapes market dynamics and promotes responsible growth.

Global Aluminosilicate Market, By Product

What key advantages helped Zeolites outperform other products to dominate the global aluminosilicate market with a 55% segment share?

Zeolites dominate the global aluminosilicate market, accounting for approximately 55% of the product segment share, due to their exceptional adsorption, ion-exchange, and catalytic properties. Their widespread application across industries such as water treatment, petrochemicals, agriculture, and detergents drives strong demand. Additionally, Zeolites’ natural abundance, cost-effectiveness, and versatility contribute to their dominant position. Continuous innovations and improvements in synthetic Zeolites have further expanded their applications, helping them maintain a competitive edge and a leading share in the aluminosilicate market.

Get more details on this report -

How did Mullite achieve a significant market presence with around 30% share in the aluminosilicate product segment?

Mullite holds a significant share of around 30% in the aluminosilicate product segment due to its excellent thermal stability, high mechanical strength, and resistance to corrosion and chemical attack. These properties make it ideal for high-temperature applications such as refractory materials, ceramics, and kiln furniture. Additionally, its ability to withstand harsh industrial environments and its cost-effectiveness compared to other materials have driven strong demand. The growing use of Mullite in various manufacturing sectors, combined with advancements in production technologies, has helped it maintain a substantial share in the aluminosilicate market.

Global Aluminosilicate Market, By End Use

Why was the chemicals and adsorbents segment preferred over other segments, holding about 40% of the market share in the aluminosilicate industry?

The chemicals and adsorbents segment holds a significant share of about 40% in the aluminosilicate market due to the extensive use of aluminosilicates in water purification, gas absorption, and chemical processing applications. Their excellent adsorption properties, chemical stability, and ability to remove impurities make them indispensable in these industries. Additionally, rising environmental regulations and increasing demand for clean water and air have propelled the growth of this segment. The segment’s versatility and effectiveness in industrial and environmental applications have ensured its strong market presence and substantial share in the aluminosilicate market.

What made the ceramics and refractories segment the top revenue-generating sector with about 45% share in the aluminosilicate market?

The ceramics and refractories segment commands the largest revenue share of approximately 45% in the aluminosilicate market due to aluminosilicates’ exceptional thermal stability, high melting points, and resistance to chemical corrosion. These properties make them essential for manufacturing refractory materials used in furnaces, kilns, and reactors in industries like steel, glass, and cement. Additionally, the growing demand for high-performance ceramics in electronics, automotive, and construction sectors has fueled the segment’s growth. The combination of wide industrial applications and the critical role aluminosilicates play in enhancing product durability and performance has helped this segment maintain its dominant revenue share.

Asia Pacific holds the largest share of approximately 48% in the global aluminosilicate market.

Get more details on this report -

The region’s rapid industrialization, particularly in countries like China, Japan, and India, drives this dominance. Extensive infrastructure projects and booming manufacturing sectors increase demand for aluminosilicate minerals used in ceramics, refractories, and chemicals. Government initiatives promoting industrial growth and sustainable mining further boost market expansion. Additionally, rising urbanization and investments in advanced technologies support continuous growth, making Asia Pacific a critical hub for aluminosilicate production and consumption.

North America is the fastest-growing aluminosilicate market, expected to capture around 28% of the global share by the forecast period.

This growth is propelled by increasing adoption of clean and advanced technologies, especially in aerospace, electronics, and environmental applications. The region benefits from well-established research and development infrastructure, fostering innovation in aluminosilicate-based products like high-performance ceramics and eco-friendly adsorbents. Strong regulatory support for sustainable manufacturing and robust industrial frameworks further accelerate market growth, positioning North America as a key emerging market.

Product Launches in Aluminosilicate Market

- In February 2024, Imerys Group launched a high-purity zeolite product designed specifically to improve industrial water treatment processes. This new product emphasizes both sustainability and enhanced performance, offering better adsorption and filtration capabilities. By targeting industrial water purification, Imerys aims to support eco-friendly practices while meeting increasing demand for efficient and reliable treatment solutions in various sectors. This innovation reflects the company’s commitment to advancing sustainable materials technology in response to environmental challenges.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the aluminosilicate market based on the below-mentioned segments:

Global Aluminosilicate Market, By Product

- Zeolites

- Mullite

- Feldspar/Other Aluminosilicates

Global Aluminosilicate Market, By End Use

- Chemicals/Adsorbents

- Ceramics/Refractories

- Construction

Global Aluminosilicate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the Global Aluminosilicate Market in 2025?A: The Global Aluminosilicate Market is estimated to be valued at approximately USD 12.10 billion in 2025.

-

Q: What is the forecasted CAGR of the Global Aluminosilicate Market from 2025 to 2035?A: The market is projected to grow at a CAGR of around 4.01% during the forecast period 2025–2035.

-

Q: What is the projected market value of the Aluminosilicate Market by 2035?A: The Global Aluminosilicate Market is expected to reach approximately USD 18.64 billion by 2035.

-

Q: Which region held the largest share of the Aluminosilicate Market in 2024?A: Asia Pacific held the largest share of the global market in 2024, accounting for around 48%.

-

Q: Which region is expected to grow the fastest in the Aluminosilicate Market during the forecast period?A: North America is projected to be the fastest-growing market, expected to capture around 28% of global share by 2035.

-

Q: What product segment dominates the Global Aluminosilicate Market?A: Zeolites dominate the market with a 55% share due to their widespread use in chemicals, water treatment, and adsorption applications.

-

Q: What end-use segment generates the highest revenue in the Aluminosilicate Market?A: The ceramics and refractories segment leads in revenue, holding about 45% market share due to strong demand in high-temperature industrial applications.

-

Q: Who are the top 10 companies operating in the Global Aluminosilicate Market?A: Key players include BASF SE, Clariant AG, Huber Engineered Materials (JM Huber Corporation), Zeochem AG, Imerys Group, W. R. Grace & Co., Tosoh Corporation, Albemarle Corporation, Solvay SA, and Wacker Chemie AG.

Need help to buy this report?