Global Aluminium Alloy Ingot Market Size, Share, and COVID-19 Impact Analysis, By Application (Aircraft Components, Automotive Parts, Building Structures, Electric Conductors, and Machinery Components), By End-Use (Automotive, Construction, Packaging, High-Tech Engineering, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Aluminium Alloy Ingot Market Insights Forecasts to 2035

- The Market Size is Expected to Grow at a CAGR of around 3.04% from 2025 to 2035

- The Worldwide Aluminium Alloy Ingot Market Size is Expected to hold a Significant Share by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Aluminium Alloy Ingot Market Size is predicted to hold a significant share by 2035 with a compound annual growth rate (CAGR) of 3.04% from 2025 and 2035. The market for aluminium alloy ingot has a number of opportunities to grow due to its increasing need from the automotive, aerospace, and construction sectors, along with the advancements in the recycling industry for enhancing overall efficiency.

Market Overview

The global industry of aluminium alloy ingot includes the solid blocks of aluminium combined with other elements to create materials with specific properties such as strength and corrosion resistance. Aluminium alloy ingots are made from one or more alloying elements like silicon, magnesium, copper, or zinc, designed to enhance the specific performance characteristics such as strength, corrosion resistance, and thermal stability. In various industries, including automotive, aerospace, construction, consumer electronics, packaging, and appliances, aluminium alloy ingots are essentially used, contributing to lightweight engineering solutions. The growing electric vehicle sector is driving the use of aluminium due to its lightweight and strength properties, supporting sustainability and energy-efficient transportation. For instance, in June 2025, National Aluminium Company Limited (NALCO), a Navratna CPSE under the Ministry of Mines, Government of India, has broadened its product portfolio with the launch of its latest innovation, the IA90 Grade Aluminium Alloy Ingot, to meet the growing demand for advanced materials in the automotive industry.

Innovation and market expansion are anticipated as a result of major players' growing R&D efforts and the increasing collaborations for designing groundbreaking alloy design strategies. The growing advancements, including the development of purification treatment of aluminium alloy melt, are driving a huge surge in the global aluminium alloy ingot market.

Report Coverage

This research report categorizes the aluminium alloy ingot market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aluminium alloy ingot market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aluminium alloy ingot market.

Global Aluminium Alloy Ingot Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.04% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Application, By End-Use and By Region |

| Companies covered:: | Pooja Steel & Alloys, Vedanta Aluminium Ltd., JM Aluminium, Indo Alusys Industries Limited, Global Aluminium Private Limited, Alcoa, Rio Tinto Group, Norsk Hydro ASA, Aluminum Corporation of China (Chalco), Rusal (UC Rusal), China Hongqiao Group, Hindalco Industries, Chalco, Rio Tinto, Hongqiaqo Group, Alva Aluminium Limited, Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The aluminium alloy ingot market is significantly driven by an increasing application in transportation & associated industry for supporting cleaner and more sustainable means of transportation. With the changing inclination towards decarbonization, the growing investment in low-carbon technologies for sustainable production of aluminium is contributing to propelling the market growth of aluminium alloy ingot. For instance, in August 2024, Mitsui & Co. Ltd. participated in a third-party allotment of new shares for Nippon Amazon Aluminium Co., Ltd., which holds a 49% stake in ALBRAS. Additionally, the use of aluminium alloy ingots in the construction sector, with the growing urbanization and modernization of infrastructure projects, aids in propelling market demand.

Restraining Factors

The aluminium alloy ingot market is restricted by factors like raw material prices, supply chain disruptions due to complex environmental regulations, and increased operational costs, in the industries and manufacturing sector.

Market Segmentation

The aluminium alloy ingot market share is classified into application and end-use.

- The automotive parts segment dominated the market with the largest share of 34% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the aluminium alloy ingot market is divided into aircraft components, automotive parts, building structures, electric conductors, and machinery components. Among these, the automotive parts segment dominated the market with the largest share of 34% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Aluminium is a favourable metal for making automotive parts lighter with better fuel-sensitive performances. Further, the prime aluminium ingots are usually available for producing classy components. The segment includes automotive parts like engine components (blocks, cylinder heads, pistons, crankshafts), transmission parts, wheels, suspension components, and structural elements for vehicle bodies and chassis. The growing need for lightweight materials for improving fuel efficiency and reducing emissions is a key driving factor of the market in the automotive parts segment.

Get more details on this report -

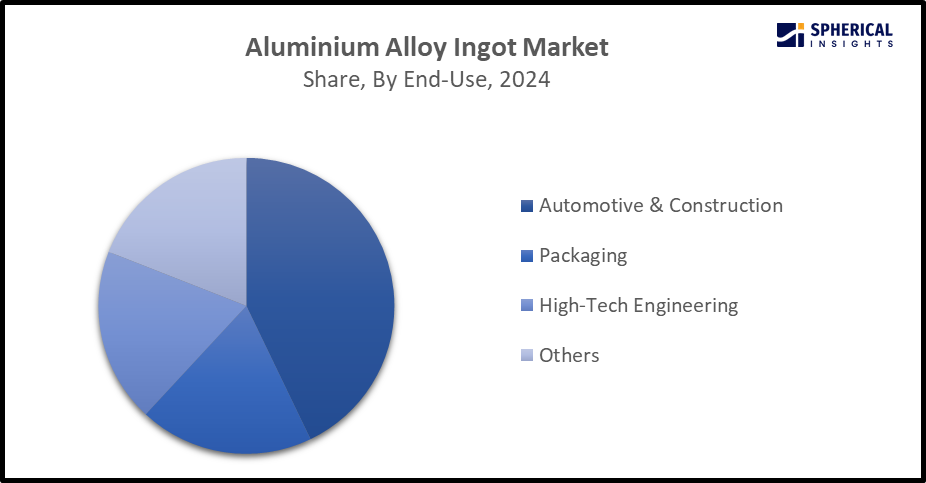

- The automotive & construction segment accounted for the largest market share of around 56.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the aluminium alloy ingot market is divided into automotive, construction, packaging, high-tech engineering, and others. Among these, the automotive & construction segment accounted for the largest market share of around 56.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The changing inclination towards electric vehicles is driving the demand for aluminium alloy ingots as lightweight, durable materials in the automotive industry. Further, in the construction industry, aluminium alloys are used for applications like doors, windows, roofing, and fascades owing to their corrosion resistance, durability, and aesthetic appeal. The rising need for lightweight and energy-efficient materials across the automotive and construction sectors, along with the expansion of recycling initiatives & adoption of circular economy practices, are contributing to propel the market.

Regional Segment Analysis of the Aluminium Alloy Ingot Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the aluminium alloy ingot market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of about 68.0% in the aluminium alloy ingot market over the predicted timeframe. The Asia Pacific area has a thriving market for aluminium alloy ingot due to its rapid economic growth, use of lightweight materials, and emphasis on sustainable & energy-efficient production processes. Further, the strategic partnerships between key companies are contributing to promoting the aluminium alloy ingot market. For instance, in December 2021, Dazheng Metal (Holdings) Co. Ltd., which is committed to producing high-quality aluminium alloy and SMM signed an annual brand service strategic cooperation agreement in 2022. China is leading the aluminium alloy ingot market in the Asia Pacific region with about 35-40% share, owing to the rising auto sales and investments in sustainability & die casting innovations.

North America is expected to grow at a rapid CAGR of nearly 7% in the aluminium alloy ingot market during the forecast period. The market ecosystem in North America is strong, due to the robust automotive recycling and favourable scrap flows. Due to their innovation in the aluminium casting industry, including the integration of advanced machining centres, automated welding systems, and digital inspection tools, played a significant role in propelling the market's expansion. The United States is dominating the North America aluminium alloy ingot market with the largest share, driven by the expanding electric vehicle industry, innovations like development in alloy formulas, and smelting technologies for enhancing production efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aluminium alloy ingot market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pooja Steel & Alloys

- Vedanta Aluminium Ltd.

- JM Aluminium

- Indo Alusys Industries Limited

- Global Aluminium Private Limited

- Alcoa

- Rio Tinto Group

- Norsk Hydro ASA

- Aluminum Corporation of China (Chalco)

- Rusal (UC Rusal)

- China Hongqiao Group

- Hindalco Industries

- Chalco

- Rio Tinto

- Hongqiaqo Group

- Alva Aluminium Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Nupur Recycling Ltd., a leader in metal scrap processing and recycling, based in New Delhi, acquired Tycod Autotech Pvt. Ltd., a manufacturer of high-pressure die-cast and machined aluminium alloy components for automotive applications, which is located in Haryana.

- In June 2025, National Aluminium Company Limited (NALCO), a Navratna CPSE under the Ministry of Mines, expanded its product line with the launch of the IA90 grade aluminium alloy ingot, developed to cater to the evolving requirements of the automobile industry.

- In May 2025, Aluminium Dunkerque, a leading producer of primary aluminium in Europe, has taken a bold step toward greener metal production with the launch of its new Furnace 8, a state-of-the-art melting furnace dedicated to aluminium recycling. This innovation would enable the plant to recycle 7,000 tonnes of aluminium scrap annually, boosting output by 20,000 tonnes of low-carbon aluminium each year.

- In February 2024, the Surface Treatment global business unit within BASF’s Coatings division, operating under the renowned Chematall brand, marked a significant milestone with the inauguration of its latest endeavour.

- In February 2021, Vedanta Limited, India’s foremost producer of metals and oil & gas, announced the formal launch of its newest product, the Cylinder Head Alloy, a critical raw material for manufacturing cylinder heads and other automotive components.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aluminium alloy ingot market based on the below-mentioned segments:

Global Aluminium Alloy Ingot Market, By Application

- Aircraft Components

- Automotive Parts

- Building Structures

- Electric Conductors

- Machinery Components

Global Aluminium Alloy Ingot Market, By End-Use

- Automotive & Construction

- Packaging

- High-Tech Engineering

- Others

Global Aluminium Alloy Ingot Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the aluminium alloy ingot market?Asia Pacific is anticipated to hold the largest share of the aluminium alloy ingot market over the predicted timeframe.

-

2. What is the forecasted CAGR of the Global Aluminium Alloy Ingot Market from 2024 to 2035?The market is expected to grow at a CAGR of around 3.04% during the period 2024–2035.

-

3. Who are the top companies operating in the Global Aluminium Alloy Ingot Market?Key players include Pooja Steel & Alloys, Vedanta Aluminium Ltd., JM Aluminium, Indo Alusys Industries Limited, Global Aluminium Private Limited, Alcoa, Rio Tinto Group, Norsk Hydro ASA, Aluminum Corporation of China (Chalco), Rusal (UC Rusal), and China Hongqiao Group.

-

4. Can you provide company profiles for the leading aluminium alloy ingot manufacturers?Yes. For example, Vedanta Aluminium Ltd. is India’s largest aluminium producer and a leading global producer of wire rods, billets and alloys, serving industries with sustainable, high-quality aluminium solutions. JM Aluminium is a leading aluminium fabrication company that offers its customers high-quality and custom-made, and standard aluminum extrusion profiles.

-

5. What are the main drivers of growth in the aluminium alloy ingot market?The widespread application of aluminium alloy ingot in the construction & transportation sectors, along with the growing investment in low-carbon technologies, are major market growth drivers of the aluminium alloy ingot market.

-

6. What challenges are limiting the aluminium alloy ingot market?Complex environmental regulations and high production prices remain key restraints in the aluminium alloy ingot market.

Need help to buy this report?