Global Alkylamines Market Size, Share, and COVID-19 Impact Analysis, By Type (Methylamines, Ethylamines, Propylamines, Butylamines, and Cyclohexylamines), By Application (Solvents, Agrochemicals, Rubber Processing, Water Treatment, Feed Additives, Pharmaceuticals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Alkylamines Market Insights Forecasts to 2035

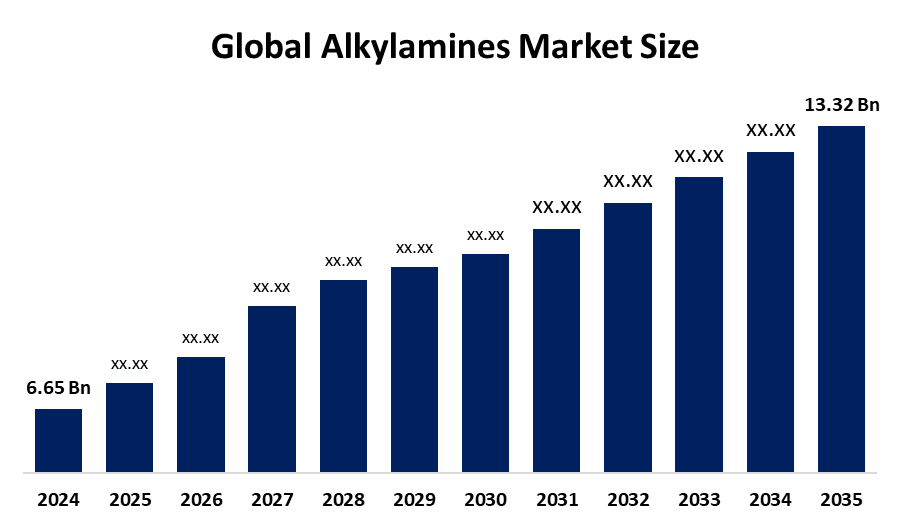

- The Global Alkylamines Market Size Was Estimated at USD 6.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.52% from 2025 to 2035

- The Worldwide Alkylamines Market Size is Expected to Reach USD 13.32 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global alkylamines market size was worth around USD 6.65 Billion in 2024 and is predicted to Grow to around USD 13.32 Billion by 2035 with a compound annual growth rate (CAGR) of 6.52% from 2025 to 2035. The rise of the alkylamine market is growing due to the increasing usage of the chemical in key markets such as the agricultural, pharmaceutical, and wastewater treatment industries. The chemical acts as a solvent and a chemical intermediate.

Market Overview

The global market for alkylamines refers to a group of organic amine compounds. They are used as flexible intermediates in other industries owing to their reactivity and functionality characteristics. They are extremely important in the manufacture of drugs, agrochemicals, water treatment chemicals, surfactants, solvents, and specialty chemicals. The demand is primarily driven by the expanding usage of alkylamines in the manufacture of drugs and agro compounds as a major raw material. They are equally important owing to the rapidly expanding industries and developments in water treatment and chemicals.

In April 2024, the USEPA strengthened air toxics regulations affecting SOCMI and polymer and resin facilities. This is specifically affecting alkylamine manufacturers. To reduce emissions of ethylene oxide and chloroprene by up to 96%, attenuated cancer risks throughout their lifetimes, with capital and operating expenses of $1-$2 billion over 10 years. Technology and the use of environmentally responsible production technologies are significant opportunities for growth in the industry, and are largely noticeable in developing nations. The industry is fiercely competitive, and the challenge is posed by leading chemical manufacturers such as BASF SE, Eastman Chemical Company, Dow Inc., Huntsman Corporation, Alkyl Amines Chemicals Ltd., and others who are working on inventions and using environmentally responsible technologies to meet the demands triggered by globalization.

Report Coverage

This research report categorizes the alkylamines market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the alkylamines market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the alkylamines market.

Global Alkylamines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.65 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.52% |

| 2035 Value Projection: | USD 13.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Eastman Chemical Company, Dow Inc., Huntsman Corporation, BASF SE, Evonik Industries AG, Arkema S.A., Alkyl Amines Chemicals Ltd, Daicel Corporation, Albemarle Corporation, Solvay S.A., Akzo Nobel N.V., LUXI GROUP, Kao Corporation, Mitsubishi Gas Chemical Company, Inc., and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for alkylamines is driven by the rise in demand within the major end-use markets such as the pharmaceutical industry, agrochemical industry, water and wastewater treatment industry, and cosmetics industry, where alkylamines act as an intermediate and functional chemical ingredient. Their wide-spectrum use in pharmaceutical manufacture, agrochemicals like herbicides and pesticides, and surfactants drives up the demand in the market. Technological developments in the manufacturing process and the increasing use of eco-friendly preparations of alkylamines accelerate the growth of the alkylamines market. Furthermore, extensive industrialization in the Asia-Pacific region increases the demand, thereby fueling the alkylamines market growth.

Restraining Factors

The market restraints for the global alkylamines market include strict environmental and safety regulations, which make the cost of compliance high. In addition to this, the raw material price variations and the dangerousness of alkylamines make production costly. Another market restraint includes the competition posed by other chemicals, including bio-based chemicals.

Market Segmentation

The alkylamines market share is classified into type and application.

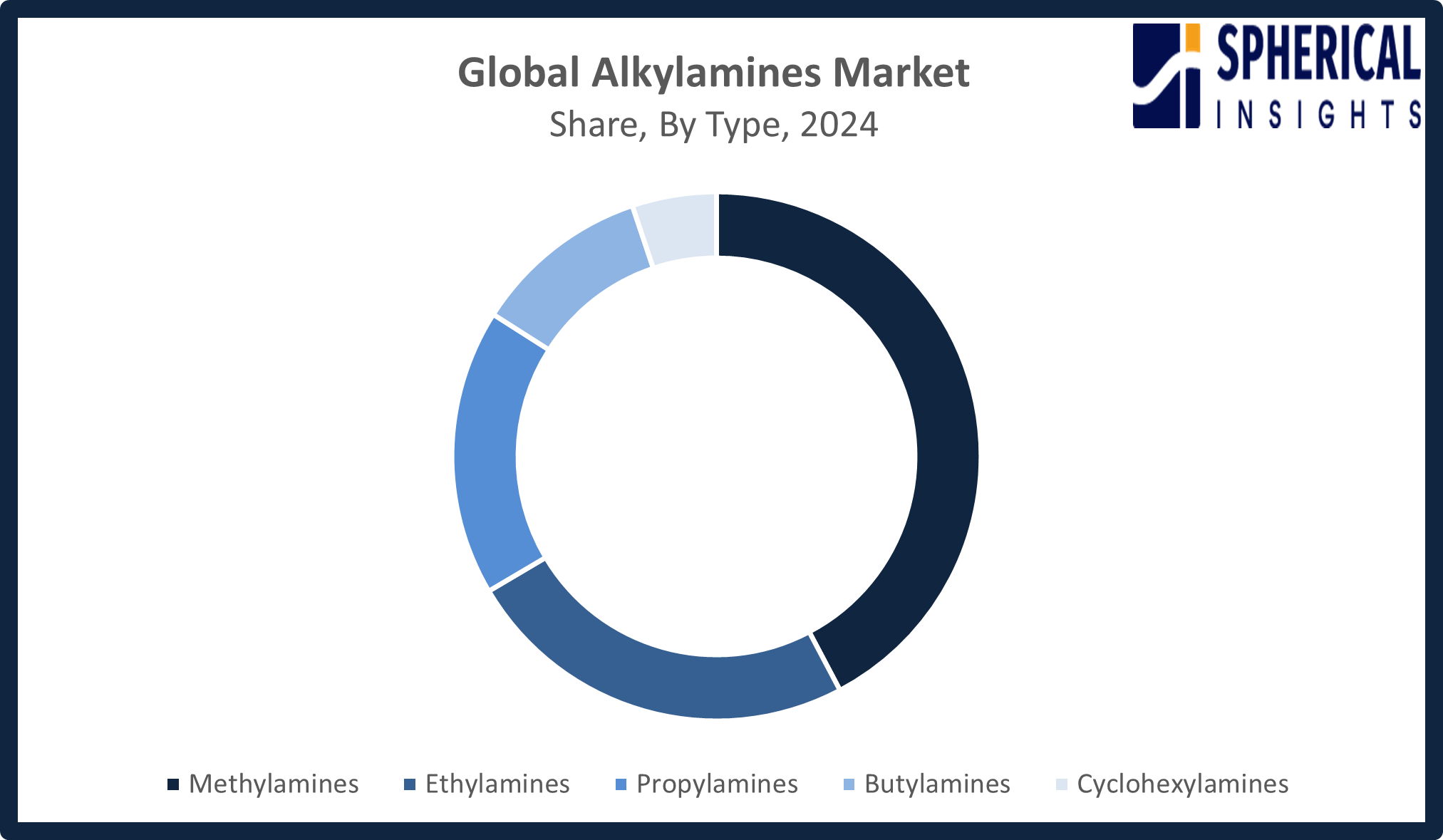

- The methylamines segment dominated the market in 2024, approximately 42% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the alkylamines market is divided into methylamines, ethylamines, propylamines, butylamines, and cyclohexylamines. Among these, the methylamines segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The methylamines market growth is due to the usage of methylamines as an intermediate compound in the manufacturing of life-saving drugs and agrochemicals, and also as a final compound in the treatment of water. Therefore, methylamines are recognized as the major contributing factor towards the growth of the alkylamines market.

Get more details on this report -

- The agrochemicals segment accounted for the highest market revenue in 2024, approximately 38% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the alkylamines market is divided into solvents, agrochemicals, rubber processing, water treatment, feed additives, pharmaceuticals, and others. Among these, the agrochemicals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The agrochemicals industry is growing in terms of market due to the growing usage of pesticides, herbicides, and agrochemicals that protect crops from damage that could reduce agricultural production around the world. Alkylamines are essential intermediates used for such purposes. The ever-increasing global population, increase in agricultural lands, and development plans for a greener farming approach have pushed alkylamine agrochemical products to record the sharpest growth in this market.

Regional Segment Analysis of the Alkylamines Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the alkylamines market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the alkylamines market over the predicted timeframe. The Asia Pacific market is expected to account for the 48% market share in the alkylamines market due to the increasing pace of industrialization, the growing pharmaceutical and agrochemical industries, and the development of the water treatment market. The countries that contribute to this demand are China, India, and Japan. The leading country in the region due to its large manufacturing capacity in chemicals is China, whereas in India, the country encourages the production of alkyl amines through the Atmanirbhar Bharat initiative and the New Scheme of Petrochemicals to start the 10 Plastic Parks, 18 Centres of Excellence, and an innovation award program. The PLI Scheme provides subsidies and support from 100% FDI. The region’s market leadership will be due to capacity and demand, along with the input of Japan in the form of high-end specialty chemicals.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the alkylamines market during the forecast period. The market in North America is projected to have a 24% market share in the alkylamines market due to the rising demand from the pharmaceutical industry and agrochemicals, and the need to meet strict environmental regulations by using environmentally safe chemical intermediates. The USA leads the market with the most developed infrastructure for the production of chemicals and the enforcement of regulations by the Environmental Protection Agency to favor eco-friendly manufacturing processes. Its contribution is supplemented by that of Canada, which already produces specialty chemicals.

The alkylamines industry in Europe is expanding steadily owing to increased use in pharmaceuticals, agrochemicals, and speciality chemicals, facilitated by REACH regulations. Germany, France, and the UK are leaders, with Germany setting a pace through advanced production processes. The EU’s Chemicals Strategy for Sustainability, adopted in 2024, targeted non-essential uses of hazardous alkylamines, facilitated safer alternatives, simplified REACH registration, while 2025 plans will focus on assuring home production comparable to imports, as well as research and development of non-toxic alkylamines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the alkylamines market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eastman Chemical Company

- Dow Inc.

- Huntsman Corporation

- BASF SE

- Evonik Industries AG

- Arkema S.A.

- Alkyl Amines Chemicals Ltd

- Daicel Corporation

- Albemarle Corporation

- Solvay S.A.

- Akzo Nobel N.V.

- LUXI GROUP

- Kao Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, BASF’s Intermediates division announced that its standard grade amine portfolio at the Geismar, Louisiana Verbund site will transition to 100% renewable electricity. Beginning in Q4 2025 and continuing through 2026, the move uses solar and wind credits, complementing BASF’s ongoing European transition.

- In November 2024, Evonik broke ground on a specialty amines plant expansion in Nanjing, China, attended by local government officials. The project supports growing polyurethane and epoxy curing agent markets and reinforces Evonik’s manufacturing footprint in China, a key region for its global operations.

- In February 2022, Eastman’s Care Additives business announced the completion of a major expansion of its tertiary amine capacity, mainly DIMLA 1214, at its Ghent, Belgium, and Pace, Florida sites. The upgrades increased capacity and efficiency, making Pace the world’s largest tertiary amine production unit.

- In November 2019, Eastman Chemical Co. announced multiple debottlenecking projects to expand alkyl amines capacity and meet rising global demand. These projects span Eastman’s integrated sites in North America, Europe, and Asia, with one completed in Q3 2019 and another planned for 2020 to further boost production capacity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the alkylamines market based on the below-mentioned segments:

Global Alkylamines Market, By Type

- Methylamines

- Ethylamines

- Propylamines

- Butylamines

- Cyclohexylamines

Global Alkylamines Market, By Application

- Solvents

- Agrochemicals

- Rubber Processing

- Water Treatment

- Feed Additives

- Pharmaceuticals

- Others

Global Alkylamines Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the alkylamines market over the forecast period?The global alkylamines market is projected to expand at a CAGR of 6.52% during the forecast period

-

2. What is the market size of the alkylamines market?The global alkylamines market size is expected to grow from USD 6.65 billion in 2024 to USD 13.32 billion by 2035, at a CAGR of 6.52% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the alkylamines market?Asia Pacific is anticipated to hold the largest share of the alkylamines market over the predicted timeframe

-

4. What is the alkylamines market?The alkylamines market involves production and sale of organic amines used in pharmaceuticals, agrochemicals, solvents, water treatment, and industrial applications

-

5. Who are the top 10 companies operating in the global alkylamines market?Eastman Chemical Company, Dow Inc., Huntsman Corporation, BASF SE, Evonik Industries AG, Arkema S.A., Alkyl Amines Chemicals Ltd, Daicel Corporation, Albemarle Corporation, Solvay S.A., and Others

-

6. What factors are driving the growth of the alkylamines market?The alkylamines market is driven by rising demand in agrochemicals, pharmaceuticals, and water treatment, expanding industrial applications, technological advancements, sustainable production methods, and increasing global chemical and specialty manufacturing activities

-

7. What are the market trends in the alkylamines market?Key trends include rising eco‑friendly production, specialty alkylamine formulations, capacity expansions, technological innovations, and growing demand from agrochemical, pharmaceutical, and water treatment sectors

-

8. What are the main challenges restricting wider adoption of the alkylamines market?The main challenges restricting the wider adoption and growth of the alkylamines market include stringent government regulations, the hazardous nature of the chemicals, fluctuating raw material prices, and intense market competition

Need help to buy this report?