Global Airport Information Systems Market Size, By System (Airport Operation Control Center, and Departure Control System), By Type (Airside, and Terminal Side), By Investment (Brownfield, and Greenfield), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Airport Information Systems Market Insights Forecasts to 2033

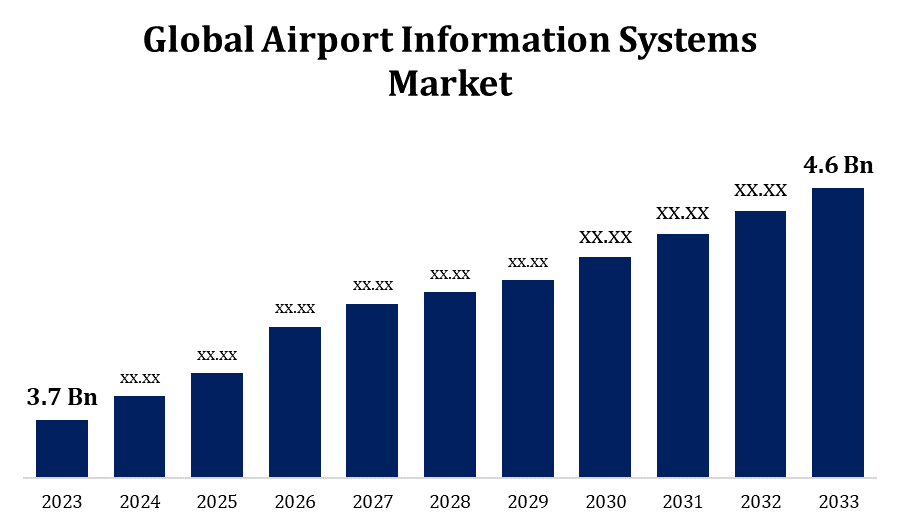

- The Airport Information Systems Market Size was valued at USD 3.7 Billion in 2023.

- The Market is Growing at a CAGR of 2.20% from 2023 to 2033

- The Worldwide Airport Information Systems Market Size is expected to reach USD 4.6 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Airport Information Systems Market Size is expected to reach USD 4.6 Billion by 2033, at a CAGR of 2.20% during the forecast period 2023 to 2033.

Due to the rising need for air travel around the world, the AIS market has been growing steadily. The demand for cutting-edge information systems is being driven by significant investments made in airport infrastructure, particularly by emerging nations. In order to establish a smooth airport environment, there is an increasing focus on combining different AIS components. Better data exchange and coordination amongst many stakeholders, including as airlines, airport authorities, and security agencies, are made possible by interoperability across different systems. Passenger experience is becoming a top priority for airports, which is why passenger-centric AIS solutions are being used. Technologies geared towards enhancing the traveller experience include self-service kiosks, biometric authentication systems, and smartphone apps for navigation and flight updates.

Airport Information Systems Market Value Chain Analysis

Suppliers of components offer the hardware and software required to construct AIS solutions. This comprises the servers, networking hardware, software platforms, sensors, displays, and other IT infrastructure needed for airport operations. In order to combine different AIS components into cohesive solutions that are suited to the unique requirements of airports, system integrators are essential. They create, set up, set up, and manage intricate systems that handle luggage, process passengers, conduct security checks, and perform other vital tasks. These are businesses that focus on creating and offering AIS solutions. Airport management software, flight information display systems, passenger processing systems, and baggage handling solutions are just a few of the goods and services they provide. The ultimate consumers of AIS solutions are airport operators. For the continuous functioning and maintenance of AIS solutions, maintenance and support services are necessary. To guarantee the best possible performance and dependability of airport systems, this includes routine maintenance, troubleshooting, software upgrades, and technical support offered by suppliers or independent service providers. As they move through the airport, end users such as travellers, airlines, and ground handlers engage either directly or indirectly with AIS systems.

Airport Information Systems Market Opportunity Analysis

There are opportunities to expand AIS solutions into emerging economies where the demand for air travel is rising due to increasing urbanisation and economic expansion. The construction of airport infrastructure has substantial growth potential in the Asia-Pacific, Latin American, and African regions, which will increase need for sophisticated information systems. The aviation industry is seeing an increasing trend towards digital transformation as a result of the demand for increased productivity, cost savings, and better passenger experiences. There are opportunities for AIS providers to improve service delivery and optimise airport operations by providing cutting-edge digital solutions like cloud-based platforms, data analytics, and IoT-enabled devices. Enhancing the traveller experience is a top concern for airports across the globe. AIS providers can take advantage of this by creating passenger-focused solutions like mobile apps for wayfinding, self-service check-in, and customised alerts.

Global Airport Information Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.20% |

| 2033 Value Projection: | USD 4.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By System, By Type, By Investment, By Region. |

| Companies covered:: | Amadeus IT Group SA, SITA, Thales Group, RTX Corporation (formerly Raytheon Technologies Corporation), Honeywell International Inc., and other key vendors. |

| Growth Drivers: | Growing air passenger traffic to drive the market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Airport Information Systems Market Dynamics

Growing air passenger traffic to drive the market growth

More people are choosing to travel by air for business, pleasure, and other reasons as the world's economies expand and people's disposable incomes rise. Due to the rising demand, airport operations must become more effective, which will enhance the adoption of AIS solutions to handle security, baggage handling, passenger flow, and other crucial tasks. Airports are developing new terminals, runways, and facilities in order to handle the increasing volume of travellers. Opportunities to supply systems supporting the effective functioning of these facilities, such as baggage handling, flight information display, and passenger processing, are created by this growth for AIS providers. In order to stay competitive and draw in more passengers, airports are putting more and more emphasis on improving the passenger experience.

Restraints & Challenges

Cybersecurity risks are a major concern because airport operations are becoming more digital and because AIS systems are integrated. Cyberattacks that try to disrupt operations, steal confidential data, or result in financial loss frequently target airports. It is essential to have strong cybersecurity safeguards in place to guard against ransomware, malware, data breaches, and other online dangers. It is still difficult to integrate and make different AIS systems and components work together, especially in contexts with several vendors. Proprietary formats, incompatible legacy systems, and inconsistent data standards might impede smooth communication and cooperation among airport stakeholders. A lot of data is produced by AIS systems, including as operating data, flight schedules, and passenger information. Maintaining passenger confidence and adhering to data protection laws depend on the security and privacy of this data.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airport Information Systems Market from 2023 to 2033. North America's vast air travel network, crowded airports, and sophisticated infrastructure make it one of the world's biggest markets for AIS. A vast array of AIS solutions are available on the market, such as airport management software, flight information display systems, luggage handling systems, passenger processing systems, and security screening systems. The market is still expanding thanks to elements like rising air traveller traffic, airport expansions, and technology developments. North American airports are expanding and modernising to meet the rising demand for travel, boost operational effectiveness, and provide a better overall travel experience. Through these projects, AIS providers may help digital transformation efforts, sustainability initiatives, and airport infrastructure upgrades by offering cutting-edge technology solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The need for air travel is being driven by the region's fast urbanisation and economic growth, which is causing airports to expand and upgrade in order to handle the increasing volume of passenger traffic. It is anticipated that this growth trajectory will continue, increasing demand for AIS solutions to assist airport operations and improve passenger experiences. Airports in the Asia-Pacific region are progressively implementing cutting-edge technologies to boost security, streamline operations, and offer flawless passenger experiences. Technologies like automation, AI, biometrics, and the Internet of Things are becoming more and more popular as a way to improve overall service quality, expedite airport operations, and lessen traffic.

Segmentation Analysis

Insights by System

The airport operational control center segment accounted for the largest market share over the forecast period 2023 to 2033. Flight information systems, baggage handling systems, security screening systems, and passenger processing systems are just a few of the AIS components that AOCC solutions interact with. Better coordination and decision-making inside the AOCC environment are made possible by this integration, which allows for smooth data sharing and communication between various airport systems. In the face of a growing number of interruptions, including pandemics, extreme weather, and security concerns, AOCC solutions are essential for bolstering airport resilience and assisting with contingency planning. Airports can respond to unforeseen events and preserve operational continuity more effectively by utilising the scenario modelling, risk assessment, and adaptive decision-making capabilities that advanced AOCC systems offer.

Insights by Type

The airside segment accounted for the largest market share over the forecast period 2023 to 2033. The rising demand for air travel around the world is causing airports to handle more aircraft movements, which puts more strain on airside operations. The need for sophisticated AIS solutions to control aircraft movements, maximise runway utilisation, and improve airside safety and efficiency is being driven by the increase in air traffic. Runway and apron management systems are included in AIS solutions for the airside segment. These systems are essential for facilitating efficient and safe aircraft operations. These technologies optimise runway capacity utilisation, minimise delays, and reduce taxi times by facilitating automated aircraft sequencing, scheduling, and routing. For aircraft docking, turnaround, and gate assignments to be optimised, gate management systems are necessary.

Insights by Investment

The brownfield investment segment accounted for the largest market share over the forecast period 2023 to 2033. The ageing infrastructure of many airports throughout the world has to be updated or replaced in order to comply with modern operating standards, safety requirements, and passenger expectations. In order to extend the lifespan of airport infrastructure, improve operating efficiency, and modernise existing facilities, brownfield investments are necessary. The capacity of current airport infrastructure is frequently exceeded by the growing demand for air travel, resulting in traffic jams, delays, and a decline in service quality. By building more terminals, gates, runways, and other infrastructure, brownfield investments help airports increase their capacity and handle growing passenger and aircraft flows. Because brownfield developments make use of pre-existing infrastructure and assets while minimising the expenses associated with land acquisition and construction, they are frequently more affordable than greenfield constructions.

Recent Market Developments

- In September 2020, Enterprise Engineering Services LLC (EES) and the Federal Aviation Administration (FAA) Airport Technology Research and Development Branch inked a 2.4 million dollar deal. System development, software development, and system

Competitive Landscape

Major players in the market

- Amadeus IT Group SA

- SITA

- Thales Group

- RTX Corporation (formerly Raytheon Technologies Corporation)

- Honeywell International Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airport Information Systems Market, System Analysis

- Airport Operation Control Center

- Departure Control System

Airport Information Systems Market, Type Analysis

- Airside

- Terminal Side

Airport Information Systems Market, Investment Analysis

- Brownfield

- Greenfield

Airport Information Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Airport Information Systems Market?The global Airport Information Systems Market is expected to grow from USD 3.7 billion in 2023 to USD 4.6 billion by 2033, at a CAGR of 2.20% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airport Information Systems Market?Some of the key market players of the market are Amadeus IT Group SA, SITA, Thales Group, RTX Corporation (formerly Raytheon Technologies Corporation), Honeywell International Inc. and others.

-

3. Which segment holds the largest market share?The brownfield segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Airport Information Systems Market?North America is dominating the Airport Information Systems Market with the highest market share.

Need help to buy this report?