Global Aircraft Sensors Market Size By Sensor Type (Temperature, Pressure, Position, Flow, Torque, Radar, Accelerometer, Proximity); By Application (Fuel, Hydraulic, & Pneumatic Systems, Engine/Propulsion, Cabin & Cargo Environmental Control, Aerostructures & Flight Control, Landing Gear Systems, Weapon System); By Aircraft Type (Fixed-wing, Rotary-wing, Unmanned Aerial Vehicles, Advanced Air Mobility); By End-Use (OEM, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Sensors Market Insights Forecasts to 2033

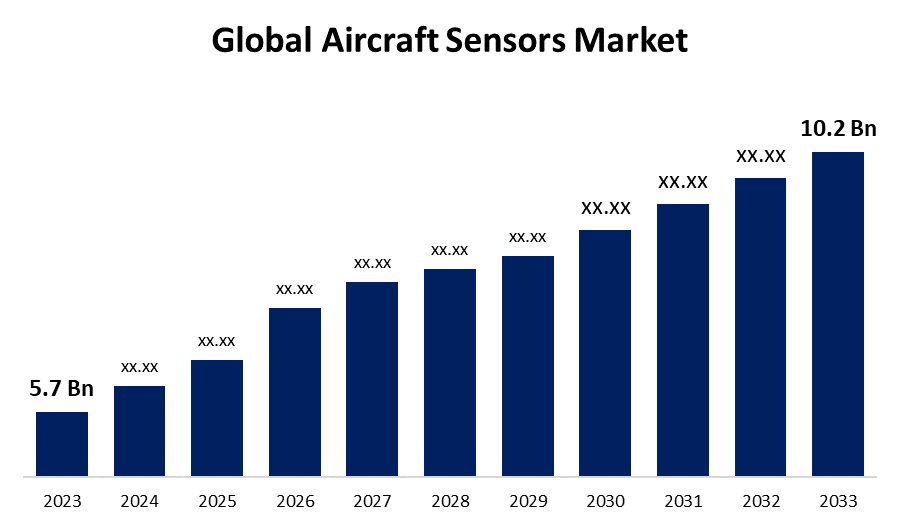

- The Aircraft Sensors Market Size was valued at USD 5.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.99% from 2023 to 2033

- The Worldwide Aircraft Sensors Market Size is expected to reach USD 10.2 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Sensors Market Size is expected to reach USD 10.2 Billion by 2033, at a CAGR of 5.99% during the forecast period 2023 to 2033.

The desire for new military and commercial aircraft, as well as the growth in air travel, were driving the aerospace industry's increase in aircraft manufacturing. As a result, there was an increase in demand for the sensors that are employed in many aircraft systems. Improving aircraft performance, efficiency, and safety was becoming more and more important to aircraft producers and operators. Sensors are essential for monitoring a range of characteristics, including position, speed, pressure, and temperature, which helps to guarantee the safe and efficient operation of aviation systems. There was a growing need for sensors employed in these aircraft due to the growing use of UAVs for both military and commercial purposes. In order to allow autonomous operation, navigation, and payload functionality in UAVs, sensors are necessary.

Aircraft Sensors Market Value Chain Analysis

The value chain for the aircraft sensors market starts with raw material suppliers giving sensor manufacturers access to metals, semiconductors, and electronic components. By producing a range of sensors, these producers guarantee adherence to industry norms. Suppliers of components provide specialty parts. While system integrators make sure the integration is flawless, aircraft OEMs integrate sensors throughout the production process. Distributors handle logistics by supplying sensors to OEMs, airlines, and MRO companies. Airlines deploy sensors to track performance, and maintenance services are provided by MRO companies. Regulations set the bar, and innovation is propelled by research institutions.

Aircraft Sensors Market Opportunity Analysis

Aircraft manufacturers are increasing production in response to the growing demand for air travel, which is driving up the need for sensors in both military and commercial aircraft. Opportunities for sensors that enable real-time data monitoring and analysis to improve safety measures are created by the increased attention on aeroplane safety and the regulatory requirements for advanced monitoring and control systems. There's a rising need for sensors that optimise fuel efficiency, monitor engine performance, and improve overall aircraft performance as airlines look to cut costs and environmental effect. Unmanned aerial vehicles (UAVs) are becoming more and more popular for a variety of uses, such as monitoring, surveillance, and freight delivery. This opens up new markets for sensors designed specifically for UAV use. Rising air travel in developing nations combined with plans for fleet growth and infrastructure improvement.

Global Aircraft Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.99% |

| 2033 Value Projection: | USD 10.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sensor Type, By Application, By Aircraft Type, By End-Use, By Region. |

| Companies covered:: | Aerocontrolex Group, Aerosonic Corporation, AMETEK, Curtiss-Wright Corporation, Dynon Avionics, Esterline Technologies Corporation, Free Flight Systems, Garmin International, General Atomics Corporation, Hindustan Aeronautics, Honeywell Aerospace, Kollsman, Meggitt, Memscap, Pacific Avionics & Instruments, Revue Thommen, Rockwell Collins, Safran Electronic & Defense, Schneider Electric, TE Connectivity, and Others |

| Growth Drivers: | Increasing demand for new aircraft worldwide |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Sensors Market Dynamics

Increasing demand for new aircraft worldwide

The need for additional aircraft to serve the expanding number of travellers is being fueled by the continual expansion in air passenger traffic, especially in emerging nations. In an effort to save operating expenses, cut emissions, and boost overall efficiency, airlines are swapping out their ageing aircraft for newer, more fuel-efficient versions. This pattern adds to the requirement for sophisticated sensors in contemporary aeroplanes. New military aircraft fitted with cutting-edge sensor systems for combat, reconnaissance, and surveillance are in high demand due to military modernization programmes and defence procurement initiatives across the globe. The need for air transport connection and growing globalisation are pushing airlines to grow their fleets in order to service additional routes and destinations, which is increasing demand for new aircraft.

Restraints & Challenges

Cost concerns are a common problem for aircraft operators and manufacturers, which puts pressure on them to lower the total cost of sensors without sacrificing performance, dependability, or quality. Modern aviation systems require the integration of new sensor technologies, which presents design, development, and testing issues requiring knowledge in several disciplines including as engineering, software development, and data analytics. Ensuring data security and cybersecurity measures to guard against cyber attacks and unauthorised access to sensitive information is becoming increasingly difficult as aircraft systems grow more networked and dependent on data interchange. Natural disasters, geopolitical unrest, or material shortages can all disrupt the global supply chain and affect the availability of vital parts and raw materials required for the production of sensors. This can result in production delays and higher prices.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Sensors Market from 2023 to 2033. The United States and other countries in North America are the centre of aerospace innovation and technological advancement. The region's leading research institutes, aerospace businesses, and sensor manufacturers propel the development of sensor technology for aircraft applications. Due to the strong aerospace sector in North America and the presence of major aerospace manufacturers like Boeing and Airbus in the area, there is a high demand for sensors used in the manufacturing of both military and commercial aircraft. One of the biggest markets for commercial aviation is North America, where major airlines consistently engage in fleet expansion and aircraft modernization. This increases the need for sensors in avionics, flight control, and engine health monitoring, among other systems.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area, especially nations like China, India, and Japan, has seen tremendous economic expansion, which has raised demand for air travel. The demand for aircraft sensors is fueled by this expansion, which also drives the need for new aircraft. The aviation industry in the Asia-Pacific area is expanding significantly due to the establishment of new airlines, the growth of their current fleets, and the construction of new airports and aviation infrastructure. Significant opportunities are presented by this expansion for sensor makers serving the region's aircraft OEMs and operators. The growing middle class in Asia-Pacific nations is fueling a rise in demand for both business and leisure air travel. The increasing demand for commercial aeroplanes fitted with cutting-edge sensor systems is partly attributed to this demographic trend.

Segmentation Analysis

Insights by Sensor Type

The proximity sensor segment accounted for the largest market share over the forecast period 2023 to 2033. A key component in improving safety features in aircraft systems is proximity sensors. They are employed in ground operations, parking, and taxiing to help avoid crashes by detecting the presence of surrounding objects or impediments. The need for retrofit solutions is fueled by the opportunity to install contemporary proximity sensor systems on older aircraft to increase safety and comply with new regulations. In-flight entertainment systems, cabin lighting controls, and passenger monitoring are just a few of the non-traditional aviation systems for which proximity sensors find uses. These applications help proximity sensors expand their market share and broaden their range of potential applications.

Insights by Application

The fuel, hydraulic & pneumatic segment accounted for the largest market share over the forecast period 2023 to 2033. Advanced switches to regulate fuel, hydraulic, and pneumatic systems are in high demand as airlines and aircraft operators look to update their fleets. More advanced switching systems are frequently included in newer aircraft types to increase dependability and efficiency. The market for aircraft switches is expanding as a result of the world's growing production of both military and commercial aircraft. Switches for fuel, hydraulic, and pneumatic systems are needed for every new aircraft built. The need for switches to regulate the fuel, hydraulic, and pneumatic systems in these aircraft is fueled by the increasing usage of unmanned aerial vehicles (UAVs) in a variety of tasks, such as freight delivery, surveillance, and reconnaissance.

Insights by Aircraft Type

The fixed wing type segment accounted for the largest market share over the forecast period 2023 to 2033. The fixed-wing type sector of the aircraft switches market is growing due to the increased demand for commercial fixed-wing aircraft, which is being driven by factors including growing air travel demand, airline fleet expansion plans, and the need for more fuel-efficient aircraft. Fly-by-wire systems, which rely on electronic switches and controls for flight control inputs, are becoming more and more common in modern fixed-wing aircraft. As a result of this tendency, traditional mechanical switches are being replaced in many applications by electronic switch technologies, which are growing in the fixed-wing type category.

Insights by End User

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. The OEM industry is expanding as a result of the growing global demand for new aircraft. Switches and other avionics components are in greater demand as a result of aircraft manufacturers building more aircraft to satisfy airlines' expanding demand. Defence industry original equipment manufacturers are funding the development of cutting-edge military aircraft fitted with complex switch and control systems. This includes unmanned aerial vehicles (UAVs), fighter jets, and transport aircraft, which increases the need for switches designed specifically for military use.

Recent Market Developments

- In July 2022, next-generation inertial navigation units for aerospace and military applications were developed by TT Electronics in partnership with Honeywell Aerospace to support navigation and flight control operations.

Competitive Landscape

Major players in the market

- Aerocontrolex Group

- Aerosonic Corporation

- AMETEK

- Curtiss-Wright Corporation

- Dynon Avionics

- Esterline Technologies Corporation

- Free Flight Systems

- Garmin International

- General Atomics Corporation

- Hindustan Aeronautics

- Honeywell Aerospace

- Kollsman

- Meggitt

- Memscap

- Pacific Avionics & Instruments

- Revue Thommen

- Rockwell Collins

- Safran Electronic & Defense

- Schneider Electric

- TE Connectivity

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Sensors Market, Sensor Type Analysis

- Temperature

- Pressure

- Position

- Flow

- Torque

- Radar

- Accelerometer

- Proximity

Aircraft Sensors Market, Application Analysis

- Fuel, Hydraulic, & Pneumatic Systems

- Engine/Propulsion

- Cabin & Cargo Environmental Control

- Aerostructures & Flight Control

- Landing Gear Systems

- Weapon System

Aircraft Sensors Market, Aircraft Type Analysis

- Fixed-wing

- Rotary-wing

- Unmanned Aerial Vehicles

- Advanced Air Mobility

Aircraft Sensors Market, End User Analysis

- OEM

- Aftermarket

Aircraft Sensors Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Sensors Market?The global Aircraft Sensors Market is expected to grow from USD 5.7 billion in 2023 to USD 10.2 billion by 2033, at a CAGR of 5.99% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Sensors Market?Some of the key market players of the market are Aerocontrolex Group, Aerosonic Corporation, AMETEK, Curtiss-Wright Corporation, Dynon Avionics, Esterline Technologies Corporation, Free Flight Systems, Garmin International, General Atomics Corporation, Hindustan Aeronautics, Honeywell Aerospace, Kollsman, Meggitt, Memscap, Pacific Avionics & Instruments, Revue Thommen, Rockwell Collins, Safran Electronic & Defense, Schneider Electric, and TE Connectivity.

-

3. Which segment holds the largest market share?The proximity sensor segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aircraft Sensors Market?North America is dominating the Aircraft Sensors Market with the highest market share.

Need help to buy this report?