Global Aircraft Recycling Market Size By Aircraft (Narrow-Body, Wide-Body, Regional), By Component (Engines, Landing Gear, Avionics), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Recycling Market Insights Forecasts to 2033

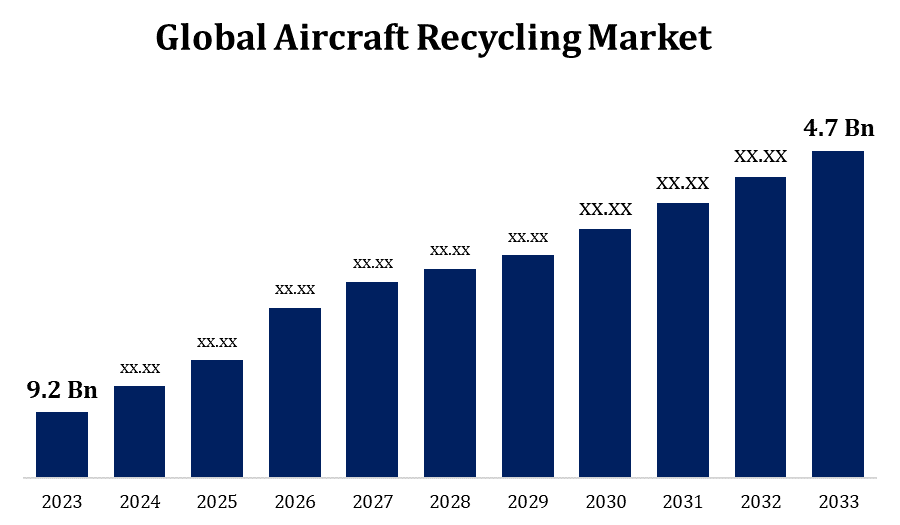

- The Aircraft Recycling Market Size was valued at USD 4.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.95% from 2023 to 2033

- The Worldwide Aircraft Recycling Market Size is expected to reach USD 9.2 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Recycling Market Size is expected to reach USD 9.2 Billion by 2033, at a CAGR of 6.95% during the forecast period 2023 to 2033.

The global number of retired aircraft has increased in recent years, which has led to a major growth in the aircraft recycling market. The need for aircraft recycling services is anticipated to rise as aircraft fleets continue to grow, particularly with the expansion of the commercial aviation industry. Regulations and worries about the environment are the main forces behind aircraft recycling. Valuable resources like titanium, aluminium, and other recyclable metals can be found in end-of-life aircraft. Furthermore, to avoid contaminating the environment, hazardous items like as chemicals, hydraulic fluids, and lubricants must be disposed of properly. The aerospace manufacturers, parts brokers, and specialised recycling firms are some of the players in the aircraft recycling market. These businesses provide a variety of services, such as material recycling, component repair, disassembly, and parts resale.

Aircraft Recycling Market Value Chain Analysis

The aircraft recycling market value chain involves a series of interconnected processes starting from the retirement and decommissioning of aircraft by owners and operators, facilitated by maintenance, repair, and overhaul (MRO) providers. Aircraft recycling companies and salvage operators then undertake dismantling and component removal, recovering reusable parts such as engines, avionics, and interiors. Following this, metal recyclers and composite material processors handle the recycling of recovered materials, including metals like aluminum and titanium, as well as composite materials such as carbon fiber reinforced polymers (CFRP). Hazardous waste management companies ensure the safe disposal of fluids and chemicals removed from retired aircraft. Parts brokers, distributors, and aftermarket service providers handle the resale and refurbishment of salvaged components, ensuring they meet safety standards for reuse in active aircraft. Environmental regulatory agencies and certification bodies oversee compliance with environmental and safety standards throughout the process. Aerospace manufacturers and research institutions also contribute to the value chain through research and development initiatives focused on sustainable aircraft design and recycling technologies, ultimately ensuring the responsible disposal and recycling of retired aircraft while maximizing the recovery of valuable materials and components. Collaboration and coordination among stakeholders are essential to the efficiency, safety, and environmental sustainability of the aircraft recycling process.

Aircraft Recycling Market Opportunity Analysis

The growing demand for air travel is fueling the expansion of the global aircraft fleet. The need for aircraft recycling services is growing as more aircraft approach the end of their operating lifespan, which presents potential for businesses that specialise in this market. Important materials used in aircraft, such as electronics, metals, and composites, can be recycled and utilised again in a variety of industries. Innovative recycling businesses have the chance to collect and resell materials from decommissioned aeroplanes, generating value as we move towards a circular economy that prioritises resource reuse and recycling. Owners and operators of aircraft can generate income and save money by recycling their aircraft. Operators can offset decommissioning costs and create other revenue streams by selling reusable components and materials salvaged from retired aircraft, making aircraft recycling a desirable alternative.

Global Aircraft Recycling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.95% |

| 2033 Value Projection: | USD 9.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft, By Component, By Region. |

| Companies covered:: | TARMAC Aerosave, Airbus, Air Salvage International, Total Technic, Vallair, CAVU Aerospace, ComAv Technical Services, Sycamore Aviation, Falcon Aircraft Recycling, VAS Aero Services, Aviation Internation Recyling, ADI-Aircraft Demolition & Recyling, KLM UK Engineering, AELS, Aerocycle, Aircraft Recycling International, ROTH International, Aircraft Solutions ME, AJ Walter Aviation, and Other |

| Growth Drivers: | Increasing awareness for aircraft recycling |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Recycling Market Dynamics

Increasing awareness for aircraft recycling

Operators may be encouraged to explore recycling as a financially viable substitute for conventional disposal techniques if they are aware of the economic advantages of aircraft recycling. Owners of aeroplanes can collect and resale valuable materials and components to partially offset decommissioning costs and even make additional cash. By encouraging cooperation among stakeholders, such as aircraft owners, recycling businesses, government agencies, and academic institutions, increased awareness can promote market development. This partnership may result in the creation of best practices, standardised procedures, and technical advancements that boost productivity and competitiveness in the aircraft recycling industry. Companies can improve their reputation and public image by showcasing their dedication to sustainable development and ethical business practices. Operators and recyclers can gain customers' trust by highlighting their participation in aircraft recycling programmes.

Restraints & Challenges

Aircraft recycling businesses face difficulties in adhering to several rules pertaining to safety, hazardous material management, and environmental preservation. It takes knowledge and resources to navigate these restrictions, which can change depending on the jurisdiction or region. An aircraft recycling factory needs to be established with a substantial upfront investment in trained labour, equipment, and infrastructure. The substantial initial outlay could prevent new competitors from entering the market and discourage current operators from growing or improving their facilities. Aircraft owners, operators, maintenance providers, recyclers, and parts brokers are some of the many supply chain participants in the aircraft recycling process. It can be difficult to manage logistics and coordinate these stakeholders, particularly when there are several planes involved in large-scale recycling activities.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Recycling Market from 2023 to 2033. A sizable fraction of the world's fleet of aircraft, comprising private jets, military aircraft, and commercial airliners, is based in North America. The need for aircraft recycling services is rising as these aircraft approach the end of their useful lifespan. Technological innovation in the recycling and aerospace industries is centred in North America. To increase the effectiveness and sustainability of aircraft recycling operations, businesses in the area are investing in cutting-edge recycling technology like automated dismantling systems and composite material recycling procedures. Because of the size of the fleet and the financial advantages of employing refurbished parts, the North American aviation sector has a high demand for recycled aeroplane parts.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The demand for air travel is growing quickly in Asia-Pacific, which is increasing the size of the aircraft fleet. In order to manage the retirement and disposal of end-of-life aircraft, there is an increasing need for aircraft recycling services. Asia-Pacific's emerging economies, including China, India, and the nations of Southeast Asia, are making significant investments in aviation infrastructure and growing their fleets of commercial aircraft. In order to address the increasing demand for aircraft decommissioning and recycling, this offers chances for aircraft recycling businesses to establish a presence in these markets and offer their services.

Segmentation Analysis

Insights by Aircraft

The narrow-minded segment accounted for the largest market share over the forecast period 2023 to 2033. A emphasis on recycling particular aircraft types, like commercial airliners, while ignoring other segments, like military or general aviation aircraft, could be one cause of sector expansion that is narrow-minded. Recycling businesses risk missing out on or underutilizing growth prospects in other market segments if they concentrate on just one. Disparities in industry innovation and technology adoption can also lead to narrow-minded sector growth. Businesses that invest in cutting-edge recycling technology and procedures might expand more quickly than those that stick with antiquated practices, which could result in market segmentation based on technological prowess. Variations in consumer preferences and market demand within the aircraft recycling industry could lead to narrow-minded segment growth. Due to fleet size and turnover rates, some segments like commercial airplanes may have a higher demand for recycling services, while other segments might have a lesser demand or require specialisation.

Insights by Component

The engine segment is dominating the market with the largest market share over the forecast period 2023 to 2033. The need for engine overhauls, repairs, and refurbishments is rising as aircraft engines approach the end of their useful lifespan. The market for recycling engines is growing as a result of aircraft operators looking for economical ways to prolong the life of their engines. Particularly for older aircraft models and in growing economies, there is an increasing demand in the aftermarket for used aircraft engines. Used engines are more affordable than brand-new equivalents, which attracts MRO companies and aircraft operators. The engine segment of the recycling industry is growing as a result of consumer demand. Engine recycling businesses can now focus on the disassembly and recycling of more recent engine models due to emerging trends in engine design, such as the creation of engines that are more ecologically friendly and fuel-efficient.

Recent Market Developments

- In October 2023, a partnership was announced between Air France-KLM and Safran Landing Systems to create and carry out a closed-loop recycling programme for landing gear components. By 2030, the programme wants to recycle all landing gear components to 100%.

Competitive Landscape

Major players in the market

- TARMAC Aerosave

- Airbus

- Air Salvage International

- Total Technic

- Vallair

- CAVU Aerospace

- ComAv Technical Services

- Sycamore Aviation

- Falcon Aircraft Recycling

- VAS Aero Services

- Aviation Internation Recyling

- ADI-Aircraft Demolition & Recyling

- KLM UK Engineering

- AELS

- Aerocycle

- Aircraft Recycling International

- ROTH International

- Aircraft Solutions ME

- AJ Walter Aviation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Recycling Market, Aircraft Analysis

- Narrow-Body

- Wide-Body

- Regional

Aircraft Recycling Market, Component Analysis

- Engines

- Landing Gear

- Avionics

Aircraft Recycling Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Recycling Market?The global Aircraft Recycling Market is expected to grow from USD 4.7 billion in 2023 to USD 9.2 billion by 2033, at a CAGR of 6.95% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Recycling Market?Some of the key market players of the market are TARMAC Aerosave, Airbus, Air Salvage International, Total Technic, Vallair, CAVU Aerospace, ComAv Technical Services, Sycamore Aviation, Falcon Aircraft Recycling, VAS Aero Services, Aviation Internation Recyling, ADI-Aircraft Demolition & Recyling, KLM UK Engineering, AELS, Aerocycle, Aircraft Recycling International, ROTH International, Aircraft Solutions ME, AJ Walter Aviation.

-

3. Which segment holds the largest market share?The engine segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aircraft Recycling Market?North America is dominating the Aircraft Recycling Market with the highest market share.

Need help to buy this report?