Global Aircraft Micro Turbine Market Size By Engine Type (Turbojet, Turboshaft), By Platform (General Aviation, Commercial Aviation, Military Aviation, Advanced Air Mobility), By End-Use (Propulsion, Auxiliary Power), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Micro Turbine Market Insights Forecasts to 2033

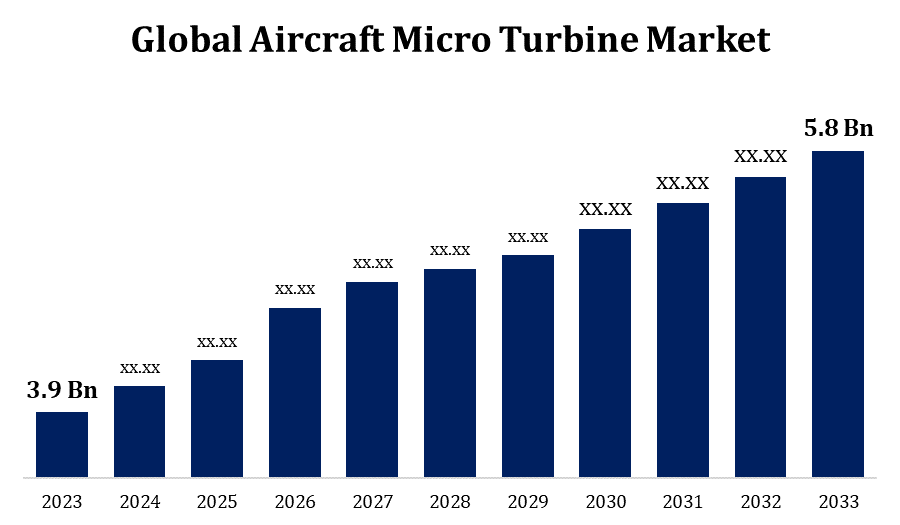

- The Aircraft Micro Turbine Market Size was valued at USD 3.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.05% from 2023 to 2033

- The Worldwide Aircraft Micro Turbine Market Size is expected to reach USD 5.8 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Micro Turbine Market Size is expected to reach USD 5.8 Billion by 2033, at a CAGR of 4.05% during the forecast period 2023 to 2033.

Micro turbines have been adopted as a result of the increased demand for UAVs in military, commercial, and civilian applications. This demand has also increased the need for lightweight, efficient power sources. Micro turbines can be used to expand the range of hybrid-electric aircraft and burn biofuels in addition to hydrocarbon fuels, which is in line with the increasing interest in electric propulsion systems. The development of micro turbine technology for aviation applications is receiving increasing funding from both public and private sources, which is driving up demand for aircraft micro turbine engines. Beyond conventional aircraft propulsion, micro turbines are finding use in auxiliary power units (APUs) for larger aircraft, opening up new market prospects.

Aircraft Micro Turbine Market Value Chain Analysis

The providers of raw materials, such as metals (steel, titanium, and aluminium), composites, and other materials needed to make microturbines, are at the start of the value chain. These vendors supply the necessary parts needed to fabricate turbines. Microturbines must be designed, engineered, and produced by manufacturers. This covers putting parts together, integrating control systems, and carrying out testing for quality control. Specialised parts and subsystems required in the production of micro turbines are supplied by component suppliers. This covers parts such as electrical components, combustion chambers, fuel delivery systems, and bearings. Manufacturers of aircraft incorporate microturbines into their aircraft systems. They might create their own models of aircraft or modify existing airframes to include microturbines for use in UAVs, general aviation aircraft, or specialty platforms. Microturbine-equipped aircraft are used by operators and end users for a variety of purposes.

Aircraft Micro Turbine Market Opportunity Analysis

For producers of microturbines, the growing usage of unmanned aerial vehicles (UAVs) in military, commercial, and civilian contexts offers a substantial opportunity. Micro turbines are ideally suited for UAV propulsion systems because to their high power-to-weight ratio and long endurance, which are attributes that UAVs require in their power sources. Micro turbine-powered aircraft have prospects as urban air mobility services such as drone delivery systems and air taxis gain popularity. Vertical take-off and landing (VTOL) capabilities can be made possible by micro turbines, opening up effective and environmentally friendly urban transportation options. The aviation industry's shift to hybrid-electric propulsion systems offers micro turbines the chance to function as auxiliary power units (APUs) or range extenders. Micro turbines can provide onboard power generation to electric propulsion systems, thereby complementing them.

Global Aircraft Micro Turbine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.9 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.05% |

| 2033 Value Projection: | USD 5.8 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Engine Type, By Platform, By End-Use, By Region. |

| Companies covered:: | AeroDesignWorks GmbH, Elliott Company, General Electric Company, Honeywell International Inc., Kratos Defense & Security Solutions, Inc., Micro Turbine Technology B.V., PBS Group. A.s., Sentient Blue Technologies, Turbotech SAS, Williams International, and Others |

| Growth Drivers: | Increasing demand of micro turbine for military light weight UAVs |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Micro Turbine Market Dynamics

Increasing demand of micro turbine for military light weight UAVs

A lot of nations are concentrating on updating their armed forces, which includes incorporating cutting-edge unmanned aerial vehicles (UAVs) for intelligence collection, reconnaissance, and surveillance. Due to the excellent power-to-weight ratios and energy density of micro turbines, lightweight UAVs are able to carry larger payloads, including armament systems, cameras, sensors, and communication devices. Microturbine-powered military lightweight UAVs provide greater operational flexibility by enabling them to function in adverse weather, at high altitudes, and at extremely high and low temperatures. When compared to electric motors or piston engines, micro turbines generate less noise and vibration, which makes them appropriate for operations that require stealth and covertness. Microturbine producers may adjust the power output of their products to match the unique specifications of various UAV models, giving military clients flexibility and customizability.

Restraints & Challenges

Purchasing and installing micro turbine power systems into an aeroplane might have significant up-front expenditures. This can discourage potential buyers from purchasing micro turbine-powered aircraft, particularly smaller operators or those with tighter budgets. Alternative propulsion methods include electric motors, hybrid electric systems, and piston engines compete with micro turbines. Although diesel, biofuels, and synthetic fuels are all theoretically compatible with micro turbines, their availability and compatibility may be restricted. Micro turbines can still generate a lot of noise and pollutants even with improvements in noise reduction and emissions control technologies, especially when operating at higher power levels. Especially for smaller businesses or startups, achieving economies of scale and increasing production volume can be difficult for micro turbine makers.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Micro Turbine Market from 2023 to 2033. Due to its many uses in the general aviation, commercial, and military aviation sectors, North America is a major market for aircraft micro turbines. The strong aerospace sector in the area, along with the rising need for specialised aircraft platforms, urban air mobility solutions, and unmanned aerial vehicles (UAVs), all support market expansion and business prospects for microturbine producers. Utilised in lightweight UAVs, reconnaissance aircraft, surveillance platforms, and other military applications, aircraft micro turbines are widely consumed by the North American defence industry. Along with their military uses, aircraft micro turbines are becoming more and more common in North American general and commercial aviation markets.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The fast economic growth in the Asia-Pacific area is fueling the rise of commercial aviation, defence spending, and aerospace technology investments. Opportunities for the use of aircraft microturbines in general aviation, military platforms, and unmanned aerial vehicles (UAVs) are created by this growth. Unmanned aerial vehicles (UAVs) are in high demand in the military, commercial, and civilian sectors in the Asia-Pacific area. Micro turbines are a great choice for UAV propulsion systems in surveillance, reconnaissance, and border security applications because of their high power-to-weight ratio, extended endurance, and dependability. In order to address transport issues in rapidly expanding metropolitan centres, a number of Asia-Pacific nations are investigating urban air mobility alternatives.

Segmentation Analysis

Insights by Engine Type

The turbojet segment accounted for the largest market share over the forecast period 2023 to 2033. Military aircraft frequently use turbojet engines because of their high thrust-to-weight ratio and fast operating speeds. The need for military aircraft powered by turbojets is rising due to the modernization of military fleets, rising defence budgets across the globe, and the development of fighter jets and unmanned aerial vehicles (UAVs). Despite being less popular in commercial aviation than turbofans, turbojets are nonetheless used in specialised markets including supersonic transports, executive aircraft, and private jets. This market has room to grow as turbojets become increasingly appealing for use in specific commercial aviation applications due to their increased fuel efficiency and lower emissions.

Insights by Platform

The advanced air mobility segment accounted for the largest market share over the forecast period 2023 to 2033. Micro turbines are especially appealing for AAM applications that need longer flying capabilities since they have higher endurance and better range than battery-electric propulsion systems. This is essential to minimising the need for regular refuelling or charging and to provide feasible transport services over greater distances. AAM services are becoming more and more in demand from a variety of stakeholders, such as investors, technology businesses, transit authorities, and urban planners. Interest in and investment in AAM technologies are fueled by the broad range of applications that the prospective market for AAM spans, such as aerial surveys, medical evacuation, freight drones, air taxis, and emergency response.

Insights by End Use

The auxiliary power segment accounted for the largest market share over the forecast period 2023 to 2033. When the primary engines of an aeroplane are not operating, air conditioning, electrical power, and other crucial operations are provided by APUs. The need for dependable and effective APUs is rising as the world's aviation sector expands and more sophisticated aircraft types are introduced. APUs are essential to the commercial aviation industry because they power emergency systems, in-flight amenities, and ground operations for airlines, charter companies, and air freight carriers. APUs are also used by military aircraft for a variety of tasks, such as providing ground power, starting auxiliary engines, and powering onboard systems while on mission.

Recent Market Developments

- In October 2018, according to information published by the International Air Transport Association (IATA), passenger numbers could double to 8.2 billion by 2037 as a result of current advancements in air travel.

Competitive Landscape

Major players in the market

- AeroDesignWorks GmbH

- Elliott Company

- General Electric Company

- Honeywell International Inc.

- Kratos Defense & Security Solutions, Inc.

- Micro Turbine Technology B.V.

- PBS Group. A.s.

- Sentient Blue Technologies

- Turbotech SAS

- Williams International

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Micro Turbine Market, Engine Type Analysis

- Turbojet

- Turboshaft

Aircraft Micro Turbine Market, Platform Analysis

- General Aviation

- Commercial Aviation

- Military Aviation

- Advanced Air Mobility

Aircraft Micro Turbine Market, End Use Analysis

- Propulsion

- Auxiliary Power

Aircraft Micro Turbine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Micro Turbine Market?The global Aircraft Micro Turbine Market is expected to grow from USD 3.9 billion in 2023 to USD 5.8 billion by 2033, at a CAGR of 4.05% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Micro Turbine Market?Some of the key market players of the market are AeroDesignWorks GmbH, Elliott Company, General Electric Company, Honeywell International Inc., Kratos Defense & Security Solutions, Inc., Micro Turbine Technology B.V., PBS Group. a.s., Sentient Blue Technologies, Turbotech SAS, Williams International.

-

3. Which segment holds the largest market share?The turbojet segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aircraft Micro Turbine Market?North America is dominating the Aircraft Micro Turbine Market with the highest market share.

Need help to buy this report?