Global Aircraft Fairings Market Size, By Aircraft Type (Narrow-Body, Wide-Body, Very Large, Regional, General Aviation), By Application (Wing-to-Body, Engine Cowling, Vertical Fin Fairing, Flap Track, Others), By Material Type (Composites, Metals), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Fairings Market Insights Forecasts to 2033

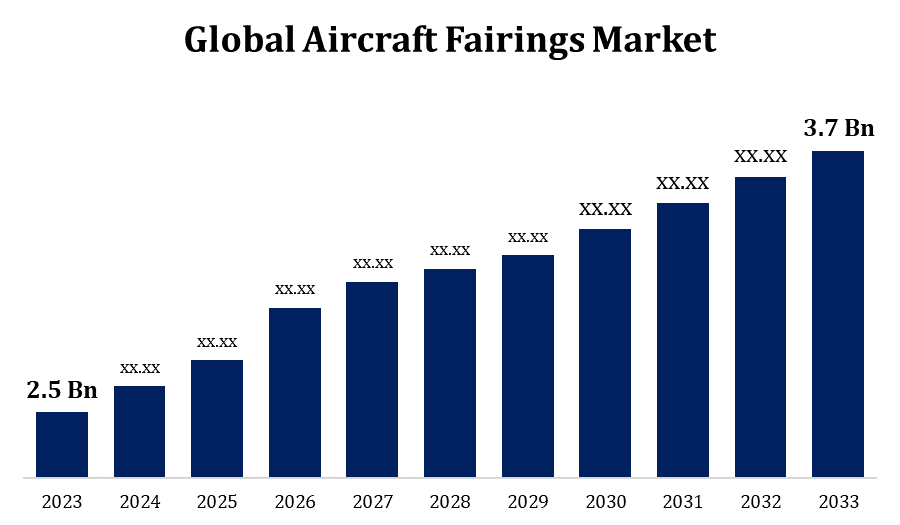

- The Global Aircraft Fairings Market Size was valued at USD 2.5 Billion in 2023.

- The Market is Growing at a CAGR of 4% from 2023 to 2033

- The Worldwide Aircraft Fairings Market Size is expected to reach USD 3.7 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Fairings Market Size is expected to reach USD 3.7 Billion by 2033, at a CAGR of 4% during the forecast period 2023 to 2033.

The need for aircraft Fairings is directly correlated with the rate of aircraft production. The market for Fairings expands in tandem with the production increases made by commercial and military aircraft manufacturers to fulfil the expanding demand. Technological developments in materials science, manufacturing processes, and aerodynamic design lead to the creation of lighter, more effective Fairings, which in turn spur market expansion. Globally, airlines and armed forces are constantly updating their fleets with newer, more fuel-efficient aircraft. The desire for sophisticated Fairings, which can further improve fuel efficiency and lower operating costs, is being driven by this trend. Fairings are also used by military aircraft to improve aerodynamics. A rise in demand for military aircraft and related parts, such as Fairings, may result from increases in defence spending, especially in countries like the US, China, and India.

Aircraft Fairings Market Value Chain Analysis

Suppliers of raw materials, such as composites, metals, polymers, and other materials required in the production of aircraft Fairings, are at the start of the value chain. Businesses specialise in manufacturing particular aircraft Fairings parts, including panels, brackets, fasteners, and attachment hardware. After that, these parts are put together to create finished Fairings structures. These businesses use suppliers' components and raw materials to design, engineer, and build entire aircraft Fairings. Manufacturers of aircraft incorporate Fairings into the entire design and production process. They have the option of hiring specialised Fairings manufacturers to handle the production or designing the Fairings internally. Businesses that specialise in aftermarket services include aircraft Fairings replacement, maintenance, and repair.

Aircraft Fairings Market Opportunity Analysis

Analyse the aviation industry's total growth trajectory, taking into account the general, military, and commercial aviation sectors. The need for new aircraft and the retrofitting of existing ones with sophisticated Fairings is driven by factors such the growing demand for air travel, fleet expansion, and technological improvements. Determine which new technologies have the potential to upend the market for conventional aircraft Fairings. Aerodynamic simulations, additive manufacturing (3D printing), lightweight material developments, and smart materials for improved efficiency and performance are a few examples of this. Enhancing aviation fuel efficiency and cutting emissions is becoming more and more important as environmental concerns and laws develop. Companies providing replacement, maintenance, and repair services for ageing aircraft fleets have a lot of opportunity in the aftermarket sector.

Global Aircraft Fairings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2033 |

| Market Size in 2033: | USD 2.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4% |

| 2033 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Aircraft Type, By Application, By Material Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Composite Technology Research Malaysia (CTRM Aerocomposites Sdn Bhd), FACC AG, Finmeccanica-Alenia Aermacchi S.p.A., KAMAN CORPORATION, Korean Air Aerospace Division, Malibu Aerospace LLC, Royal Engineered Composites, ShinMaywa Industries Ltd., Spirit AeroSystems Inc., Strata Manufacturing (a Mubadala Investment Company), Triumph Group, Collins Aerospace (UTC Aerospace Systems) and Other key Vendors. |

| Growth Drivers: | Introduction of new generation airplanes |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Fairings Market Dynamics

Introduction of new generation airplanes

Lightweight materials like carbon fibre reinforced polymers (CFRP), sophisticated metals, and composite materials are being used more and more in the production of new generation aircraft. Fuel economy and structural integrity are two advantages of lightweight materials; therefore, aerodynamic Fairings that complement these materials and reduce weight are required. Modern aircraft are designed with increased aerodynamic efficiency in mind to cut emissions and fuel usage. Aerodynamic Fairings are essential for improving overall aerodynamic performance and fuel efficiency by reducing drag and smoothing the airflow around the engine nacelles, wings, and fuselage of the aircraft. Modern aircraft frequently have more streamlined fuselage designs with less surface irregularities and smoother curves. Because of its streamlined design, which lowers aerodynamic drag, the aircraft needs Fairings that blend in perfectly with the fuselage.

Restraints & Challenges

Aircraft Fairings must be economical while also adhering to strict quality and safety regulations. Manufacturers are under pressure to strike a balance between cost and performance when using sophisticated materials and manufacturing techniques to maximise aerodynamics and reduce weight. The use of cutting-edge technologies into aircraft Fairings, like active flow management, morphing structures, and adaptable materials, adds complexity to the design, production, and maintenance processes. Smaller suppliers and manufacturers face difficulties in developing and adopting these technologies since they demand specialised knowledge, infrastructure, and resources. Manufacturers of aircraft Fairings are exposed to risks such as supply shortages, price fluctuations, geopolitical tensions, and interruptions from natural catastrophes other global events due to their reliance on worldwide supply chains for raw materials, components, and production processes.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Fairings Market from 2023 to 2033. The market for aircraft Fairings is mostly driven by the commercial aviation industry in North America. The region's airlines are always updating their fleets to save expenses, increase passenger satisfaction, and improve fuel efficiency. Consequently, there is a constant need for new aircraft with cutting-edge fairing technology. With many corporate jets and private aircraft flown by enterprises, wealthy individuals, and charter firms, North America has a substantial market for business aviation. In business aviation, the need for aerodynamic Fairings stems from the need for speed, range, and fuel efficiency.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The aviation industry in Asia-Pacific is expanding rapidly due to factors such as urbanisation, rising disposable incomes, and growing demand for air travel. Consequently, there is a notable requirement for aircraft Fairings in the area due to the increased need for new aircraft deliveries. The fastest-growing economies in the world are found in this region, which has led to a sharp increase in demand for air travel. In order to meet the increasing demand, airlines in China, India, and Southeast Asia are boosting their fleets, which presents a market opportunity for suppliers and manufacturers of aircraft Fairings. The Asia-Pacific region has become a major global centre for the manufacturing of aircraft Fairings and other aerospace components. China, Japan, and South Korea are among the nations with a significant aerospace manufacturing industry.

Segmentation Analysis

Insights by Aircraft Type

The wide-planes segment accounted for the largest market share over the forecast period 2023 to 2033. In comparison to narrow-body aircraft, wide-body aircraft usually have bigger fuselages, wings, and engine nacelles. Because of this, they need more Fairings in order to maximise aerodynamics, minimise drag, and improve airflow across the bigger surface area. Advanced aerodynamic designs on wide-body aircraft are intended to improve performance, range, and fuel efficiency. Because they minimise drag, lessen turbulence, and smooth the airflow over the aircraft surfaces, Fairings are essential to these designs. Wide-body aircraft are becoming more and more expensive for airlines and leasing companies to purchase as part of their long-term fleet development ambitions. This entails increasing capacity to accommodate projected passenger demand and swapping out outdated planes for more fuel-efficient versions.

Insights by Application

The wing-to-body segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines and aircraft manufacturers place a high premium on fuel efficiency, especially in light of growing fuel prices and environmental concerns. Wing-to-body Fairings reduce aerodynamic drag, which lowers fuel consumption and operational expenses over the aircraft's lifetime. This helps save fuel. Many different kinds of aircraft, such as regional carriers, business jets, commercial airliners, and military transports, use wing-to-body Fairings. They are essential components of many different aircraft platforms because to their adaptability and significance in maximising aerodynamic performance, which fuels ongoing market demand. Wing-to-body Fairings are frequently added to an airline's or operator's current fleet of aircraft in an effort to enhance performance, fuel economy, and operational capabilities.

Insights by Material

The composites segment accounted for the largest market share over the forecast period 2023 to 2033. Lightweight composites contribute to an aircraft's total weight reduction, which lowers emissions and fuel use while in flight. Composite-based fairing solutions are becoming more and more popular as aircraft manufacturers try to meet strict fuel efficiency requirements and environmental laws. These solutions aim to maximise aircraft performance. Compared to metallic materials, composites provide more design flexibility, enabling the creation of intricate shapes, curves, and aerodynamic profiles for fairing designs. Because of its adaptability, streamlined Fairings have been developed to reduce aerodynamic drag and increase airflow around the aircraft, improving both performance and fuel efficiency. In order to take use of the advantages of lightweight materials, aircraft original equipment manufacturers are increasingly using composites in their designs. when manufacturers release new models and variations of aeroplanes that have composite construction.

Recent Market Developments

- In March 2023, Travis Air Force Base modified the aerodynamic fairing of a C-5M Super Galaxy with new printed 3D pieces in collaboration with engineering and engineering support contractors.

Competitive Landscape

Major players in the market

- Composite Technology Research Malaysia (CTRM Aerocomposites Sdn Bhd)

- FACC AG

- Finmeccanica-Alenia Aermacchi S.p.A.

- KAMAN CORPORATION

- Korean Air Aerospace Division

- Malibu Aerospace LLC

- Royal Engineered Composites

- ShinMaywa Industries Ltd.

- Spirit AeroSystems Inc.

- Strata Manufacturing (a Mubadala Investment Company)

- Triumph Group

- Collins Aerospace (UTC Aerospace Systems)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Fairing Market, Aircraft Type Analysis

- Narrow-Body

- Wide-Body

- Very Large

- Regional

- General Aviation

Aircraft Fairing Market, Application Analysis

- Wing-to-Body

- Engine Cowling

- Vertical Fin Fairing

- Flap Track

- Others

Aircraft Fairing Market, Material Analysis

- Composites

- Metals

Aircraft Fairing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Fairing Market?The global Aircraft Fairing Market is expected to grow from USD 2.5 billion in 2023 to USD 3.7 billion by 2033, at a CAGR of 4% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Fairing Market?Some of the key market players of the market are Composite Technology Research Malaysia (CTRM Aerocomposites Sdn Bhd), FACC AG, Finmeccanica-Alenia Aermacchi S.p.A., KAMAN CORPORATION, Korean Air Aerospace Division, Malibu Aerospace LLC, Royal Engineered Composites, ShinMaywa Industries Ltd., Spirit AeroSystems Inc., Strata Manufacturing (a Mubadala Investment Company), Triumph Group, Collins Aerospace (UTC Aerospace Systems).

-

3. Which segment holds the largest market share?The composites segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aircraft Fairing Market?North America is dominating the Aircraft Fairing Market with the highest market share.

Need help to buy this report?