Global Aircraft De-Icing Market Size, Share, and COVID-19 Impact Analysis, By Fluid Type (Type I, Type II & Others), By Method (Spray, Chemical), By Application (Commercial, Military), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: Aerospace & DefenseGlobal Aircraft De-Icing Market Insights Forecasts to 2033.

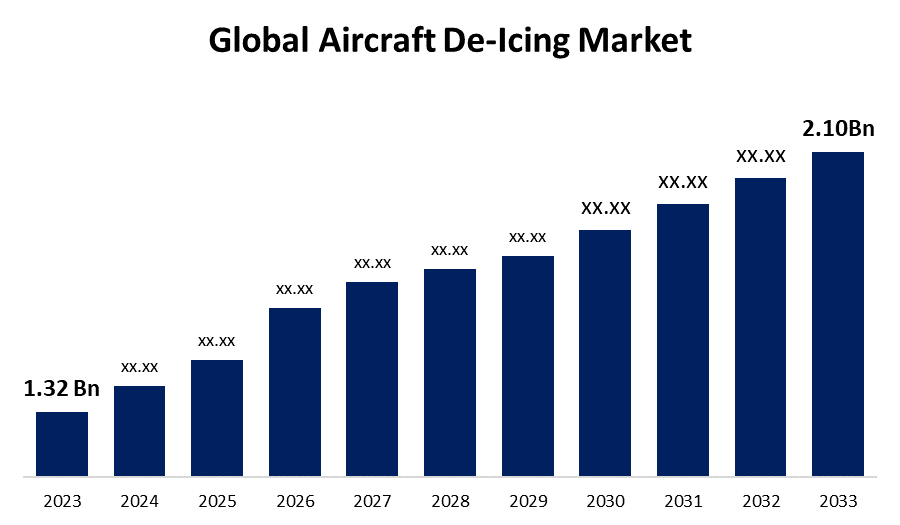

- The Global Aircraft De-Icing Market Size Was Valued at USD 1.32 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.75% from 2023 to 2033.

- The Worldwide Aircraft De-Icing Market Size is Expected to Reach USD 2.10 Billion by 2033.

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft De-Icing Market Size is Anticipated to Exceed USD 2.10 Billion by 2033, Growing at a CAGR of 4.75% from 2023 to 2033.

Market Overview

The aircraft surface, wings, and propellers become saturated with ice due to the low temperature present at high altitudes. The aircraft's water storage and liquid coolants begin to turn into ice when it reaches a height of 6,000 feet. The airplane must always be de-iced in order to prevent any mishaps brought on by the freezing of aircraft machinery. The process of eliminating ice from an aircraft's exterior and interior both during and after the flight is known as "aircraft de-icing." The global market for airplane deicing is expanding as a result of past records of mishaps caused by aircraft components freezing in midair and growing regulatory authorities' concern for employee and passenger safety. The various weather patterns seen in the various regions where airlines operate have an impact on the demand for de-icing services. Snow, freezing rain, and ice are examples of unfavorable winter weather that can have a big impact on an aircraft's performance and safety. Airlines now operate in areas vulnerable to erratic or prolonged winter weather due to the global expansion of commercial aviation, underscoring the critical need for trustworthy de-icing services.

Report Coverage

This research report categorizes the market for the global aircraft de-icing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global aircraft de-icing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global aircraft de-icing market.

Global Aircraft De-Icing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.32 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.75% |

| 2033 Value Projection: | USD 2.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fluid Type, By Method, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Clariant AG, BASF SE, Kilfrost Ltd., Dow Chemical Company, Vestergaard Company, Cryotech, Global Ground Support LLC, Contego De-icing Solutions, Weihai Guangtai Airport Equipment Co., Ltd., Safeaero I Tarmac Aerosave, JBT AeroTech, Kiitokori Oy, GE Aviation, Textron Inc., UTC Climate, Controls & Security, The Dow Chemical Company, 3M Company, UTC Aerospace Systems, Others, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global aircraft de-icing market is driven by various factors, including increased safety awareness. As more people choose to travel by air, especially during the winter, there is a greater need than ever to ensure safe operations by clearing ice and snow from aircraft surfaces. According to data from Airlines for America, the U.S. economy benefited greatly from commercial aviation, which accounted for 5% of the nation's GDP in 2022 and USD 1.25 trillion. As a result, demand for the product in the United States is anticipated to increase throughout the forecast period due to the growing aviation sector. In addition, the United States has a variety of climates, including regions with extremely cold temperatures and heavy snowfall. Because of this variability, de-icing techniques must be used to maintain aircraft performance and safety standards. In addition, the instrumentation that determines the aircraft's height, speed, and vertical speed is partially or completely damaged as a result of the abrupt drop in cabin temperature. Even seasoned pilots are not able to control the situation if this equipment is lost. Aircraft manufacturing has seen a rise in demand for aircraft de-icing due to the need for temperature-resistant equipment assemblies for operating aircraft at high altitudes.

Restraining Factors

One of the very few factors limiting the market for deicing airplanes is that, while time-consuming, the deicing process is not very lengthy. This indicates that, after a brief period of time, de-icing is required. The airplane is out of commission throughout this process, which adds to the expense for airline firms.

Market Segmentation

The Global Aircraft De-Icing Market share is classified into fluid type, method, and application.

- The type II segment is expected to hold the largest share of the global aircraft de-icing market during the forecast period.

Based on the fluid type, the global aircraft de-icing market is divided into type I, type II, and others. Among these, the type II segment is expected to hold the largest share of the global aircraft de-icing market during the forecast period. Because of its immediate qualities, which enable speedy de-icing and turnaround times, this rise is explained. This is especially important at crowded airports where timely aircraft de-icing is necessary to keep flights on schedule. It is a heated fluid with a glycol basis that is sprayed over the aircraft to melt the ice and enable a safe takeoff. These things are used in a variety of weather situations since they are made to function well in a range of temperatures.

- The spray segment is expected to hold the largest share of the global aircraft de-icing market during the forecast period.

Based on the method, the global aircraft de-icing market is divided into spray and chemical. Among these, the spray segment is expected to hold the largest share of the global aircraft de-icing market during the forecast period. This method of de-icing airplanes involves spraying a hot de-icing solution onto the surface to melt ice and frost. The aircraft's wings, tail, and control surfaces is effectively and completely covered by spraying the hot fluid under pressure. It is appropriate for many locations and seasons since it is used in a broad variety of temperatures and climates. This method's increasing popularity in the industry might be attributed to its versatility.

- The commercial segment is expected to hold the largest share of the global aircraft de-icing market during the forecast period.

Based on the application, the global aircraft de-icing market is divided into commercial, and military. Among these, the commercial segment is expected to hold the largest share of the global aircraft de-icing market during the forecast period. This high percentage is explained by the fact that, in order to protect crew and passengers, aviation regulatory organizations like the Federal Aviation Administration (FAA) have put in place highly specific de-icing procedures. These rules must be followed by airlines in order to keep their operating permits and fulfill strict safety requirements. The various weather patterns seen in the various areas where aircraft operate also have a significant role in the rising need for de-icing services.

Regional Segment Analysis of the Global Aircraft De-Icing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global aircraft de-icing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global aircraft de-Icing market over the predicted timeframe. The regions varied and occasionally severe winter weather, which includes snowstorms, freezing rain, and ice formation, is blamed for this expansion. This weather makes it very difficult for airplanes to operate safely, which is why de-icing techniques are so important. Another important element contributing to the high demand for airplane de-icing services is regulatory compliance. Regulation agencies have set certain criteria about aircraft de-icing processes, such as the Federal Aviation Administration (FAA) in the United States. In order to keep their operating permits and maintain safety standards, airlines must abide by these rules. Noncompliance with these laws leads to fines and perhaps aircraft grounding. The demand for prompt and effective de-icing operations grows as the number of aircraft and passengers in the area continues to climb. In 2022, for example, U.S. airlines operated over 25,000 flights, transporting over 2.5 million people from 80 countries and over 59,000 tons of cargo from over 220 nations daily, according to Airlines for America (A4A).

Europe is expected to grow the fastest during the forecast period. Many of Europe's airports are situated in areas that frequently experience winter conditions, including Scandinavia, Russia, and Northern Europe. Due to extreme cold and snowfall throughout the winter, airports in nations like Norway, Sweden, Finland, and Russia have several obstacles that call for intensive de-icing operations. The need for de-icing systems that adhere to regulatory criteria is driven by European aviation authorities such as the European Aviation Safety Agency (EASA), which govern de-icing methods and standards throughout the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global aircraft de-icing along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clariant AG

- BASF SE

- Kilfrost Ltd.

- Dow Chemical Company

- Vestergaard Company

- Cryotech

- Global Ground Support LLC

- Contego De-icing Solutions

- Weihai Guangtai Airport Equipment Co., Ltd.

- Safeaero I Tarmac Aerosave

- JBT AeroTech

- Kiitokori Oy

- GE Aviation

- Textron Inc.

- UTC Climate, Controls & Security

- The Dow Chemical Company

- 3M Company

- UTC Aerospace Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Savage, a seasoned veteran of the aviation business, led NextGen Deicing, a full-service airplane deicing company, was introduced by Salvatore C. Calvino's private investment firm, Equivu Capital Holdings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Aircraft De-Icing Market based on the below-mentioned segments:

Global Aircraft De-Icing Market, By Fluid Type

- Type I

- Type II

- Others

Global Aircraft De-Icing Market, By Method

- Spray

- Chemical

Global Aircraft De-Icing Market, By Application

- Commercial

- Military

Global Aircraft De-Icing Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which market region held the most proportion of the aircraft de-icing market?North America was the leading region aircraft de-icing market.

-

2. What are the various factors that fuel the market for aircraft de-icing?Growing safety concerns are a major driver propelling the market expansion, as snow and ice accumulation on an aircraft's surface is have a major influence on its performance.

-

3. He big is the aircraft de-icing market in 2023?The Global Aircraft De-Icing Market Size was Valued at USD 1.32 Billion in 2023.

-

4. What is the growth of aircraft de-icing market?the global aircraft de-icing market size is anticipated to exceed USD 2.10 billion by 2033, growing at a CAGR of 4.75% from 2023 to 2033.

Need help to buy this report?