Global Aircraft Cargo Systems Market Size, Share, and COVID-19 Impact Analysis, By Type of Aircraft (Commercial Aircraft, Military Aircraft, Freighters and Regional Aircraft), By Component (Cargo Handling System, Cargo Control System, Cargo Monitoring System), By End User (Airlines, Freight Forwarders, Military), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Aircraft Cargo Systems Market Insights Forecasts to 2035

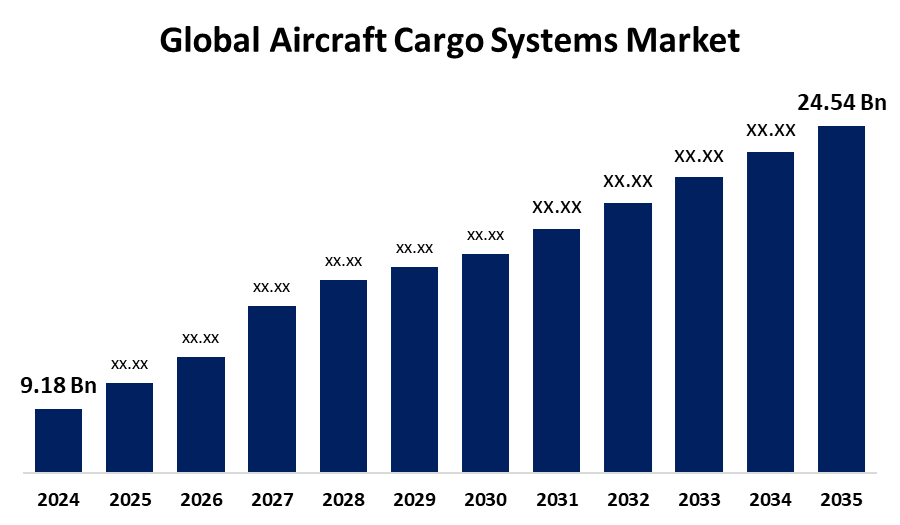

- The Global Aircraft Cargo Systems Market Size Was Estimated at USD 9.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.35% from 2025 to 2035

- The Worldwide Aircraft Cargo Systems Market Size is Expected to Reach USD 24.54 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Aircraft Cargo Systems Market Size was Worth around USD 9.18 Billion in 2024 and is predicted to Grow to around USD 24.54 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 9.35% from 2025 and 2035. The aircraft cargo systems market size is fueled by surging demand for e-commerce, growing international trade, ongoing fleet modernization, and innovations in automation and intelligent monitoring technologies that increase efficiency in cargo handling, and security, and lower operational expenses globally.

Market Overview

The Aircraft Cargo Systems Market Size involves the international industry specializing in the creation, production, installation, and servicing of systems that provide for effective cargo handling, control, and monitoring in many forms of aircraft, which include commercial, military, freighters, and regional planes. The systems play an important role in the management of safe loading, securing, and tracing of goods transported by air, which is underpinning the rapidly increasing demand for air freight services globally. The core objective of the aircraft cargo systems market is to advance the efficiency, safety, and reliability of freight operations. Through innovations in sophisticated cargo handling mechanisms, controls, and monitoring technologies, the industry seeks to minimize turnaround times, maximize cargo space utilization, and maintain compliance with stringent international safety standards. This leads to quicker delivery of cargo, reduced cargo damage, and enhanced operational efficiency for airlines and freight carriers. Additionally, sophisticated robotic loaders, automated tracking systems, and real-time data analysis enhance cargo flow and security. These technologies are reshaping aircraft cargo systems into more intelligent, efficient, and cost-reductive solutions in response to changing global air logistics needs.

Report Coverage

This research report categorizes the aircraft cargo systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aircraft cargo systems market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aircraft cargo systems market.

Global Aircraft Cargo Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.18 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.35% |

| 2035 Value Projection: | USD 24.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type of Aircraft, By Component, By End User, By Region |

| Companies covered:: | Boeing, Airbus, Honeywell International Inc., Collins Aerospace, Zodiac Aerospace, Lufthansa Technik, Safran S.A., SITA, Unilode Aviation Solutions, Cargo Systems Inc., Telair International GmbH, Ancra International LLC, DHL Aviation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The exponential growth in e-commerce has seen the demand for fast, secure air cargo services grow. The trend compels airlines and logistics operators to invest in effective cargo systems capable of transporting large volumes of packages efficiently, delivering goods faster, and keeping customers satisfied. Growing international trade augments, the demand for air freight to move goods quickly across borders. Aircraft cargo systems that provide safe, efficient loading and unloading are essential to facilitate this growth, prompting airlines to upgrade their systems to accommodate various types of cargo. Additionally, airlines are in constant replacement of older aircraft with newer ones fitted with modern cargo systems. These advanced systems enhance efficiency in cargo handling, decrease turnaround time, and increase safety, propelling market growth as airlines embrace new technology.

Restraining Factors

Increased deployment of sophisticated aircraft cargo systems involves huge initial investment in technology, equipment, and installation. Budget constraints amongst many airlines, particularly smaller carriers, hinder the utilization of cutting-edge cargo handling and monitoring systems. The high initial investment delays market expansion and adoption levels. Additionally, strict aviation regulations and safety standards are not constant across different countries and regions. Following these intricate regulations involves ongoing system upgrades and certifications, which are time-consuming and can be expensive. This regulation can slow down deployment and limit market expansion, especially in developing economies.

Market Segmentation

The aircraft cargo systems market share is classified into type of aircraft, component, and end user.

- The commercial aircraft segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type of aircraft, the aircraft cargo systems market is divided into commercial aircraft, military aircraft, freighters, and regional aircraft. Among these, the commercial aircraft segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by commercial flights transporting passengers and cargo in tandem, leveraging belly cargo capacity. This dual-purpose strategy boosts airlines' revenues and creates demand for reliable cargo systems capable of transporting mixed loads securely and efficiently, which stimulates investment in sophisticated cargo handling technologies.

- The cargo handling system segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the component, the aircraft cargo systems market is divided into cargo handling system, cargo control system, and cargo monitoring system. Among these, the cargo handling system segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to cargo handling systems are crucial for the safe and efficient transportation of goods in aircraft. They comprise rollers, locks, and tracks that facilitate rapid loading and unloading. Airlines spend heavily on these systems to minimize turnaround time and enhance operational effectiveness, thereby making this segment the largest in the market.

- The airline segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end user, the aircraft cargo systems market is divided into airlines, freight forwarders, and military. Among these, the airline segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to airlines having extensive networks of global routes and thus are critical to global cargo transportation. Their capability to rapidly transport goods across continents enhances the need for efficient and high-capacity cargo systems. As international trade grows, airlines enhance systems to address global logistics needs, further solidifying their dominance in the cargo systems industry.

Regional Segment Analysis of the Aircraft Cargo Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the aircraft cargo systems market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the aircraft cargo systems market over the predicted timeframe. North America boasts prominent aerospace organizations such as Boeing and Lockheed Martin, two of the world's largest aircraft manufacturers. These organizations play significant roles in the need for cutting-edge cargo systems, both commercial and defense. Their ongoing development, mass production capacity, and government contracts sustain a strong supply chain for cargo system parts, providing North America with competitive advantages and controlling market share.

Asia Pacific is expected to grow at a rapid CAGR in the aircraft cargo systems market during the forecast period. Asian-Pacific governments are investing significantly in air transport infrastructure, such as the modernization of airports and the construction of cargo-specific terminals. China and India have initiated national plans to increase air cargo capacities. Some of these include the upgrade of aircraft fleets with more advanced, efficient cargo systems. Direct investment in logistics and airport development on this scale supports quicker deployment of advanced cargo technologies, making the region the fastest-growing market in this category.

Europe is predicted to hold a significant share of the aircraft cargo systems market throughout the estimated period. Europe boasts prime aerospace manufacturers like Airbus, Safran, and Liebherr that are pivotal in the production of commercial and military aircraft. These firms fuel demand for sophisticated aircraft cargo systems via integration into new aircraft and retrofits. Their rigorous emphasis on quality, innovation, and global collaboration positions Europe to provide globally competitive cargo technologies, making the region hold a substantial share of the global aircraft cargo systems market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aircraft cargo systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boeing

- Airbus

- Honeywell International Inc.

- Collins Aerospace

- Zodiac Aerospace

- Lufthansa Technik

- Safran S.A.

- SITA

- Unilode Aviation Solutions

- Cargo Systems Inc.

- Telair International GmbH

- Ancra International LLC

- DHL Aviation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Textron Aviation delivered the first Cessna SkyCourier Combi, a twin-engine turboprop aircraft with a new interior conversion option. This Combi configuration enables operators to carry nine passengers and cargo at the same time, increasing operational flexibility. The plane was delivered to Everts Air, an Alaskan-based operator meeting passenger and cargo requirements throughout Alaska and beyond.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aircraft cargo systems market based on the below-mentioned segments:

Global Aircraft Cargo Systems Market, By Type of Aircraft

- Commercial Aircraft

- Military Aircraft Freighters

- Regional Aircraft

Global Aircraft Cargo Systems Market, By Component

- Cargo Handling System

- Cargo Control System

- Cargo Monitoring System

Global Aircraft Cargo Systems Market, By End User

- Airlines

- Freight Forwarders

- Military

Global Aircraft Cargo Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aircraft cargo systems market over the forecast period?The global aircraft cargo systems market is projected to expand at a CAGR of 9.35% during the forecast period.

-

2. What is the market size of the aircraft cargo systems market?The global aircraft cargo systems market size is expected to grow from USD 9.18 Billion in 2024 to USD 24.54 Billion by 2035, at a CAGR of 9.35% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the aircraft cargo systems market?Asia Pacific is anticipated to hold the largest share of the aircraft cargo systems market over the predicted timeframe.

Need help to buy this report?