Global Airborne Surveillance Market Size, By Component (Radars, Sensors, Imaging System, Others), By Technology (Unmanned System, Manned System), By Application (Commercial, Military & Government), By Region, And Segment Forecasts, By Geographic Scope And Forecasts to 2033

Industry: Aerospace & DefenseGlobal Airborne Surveillance Market Insights Forecasts to 2033

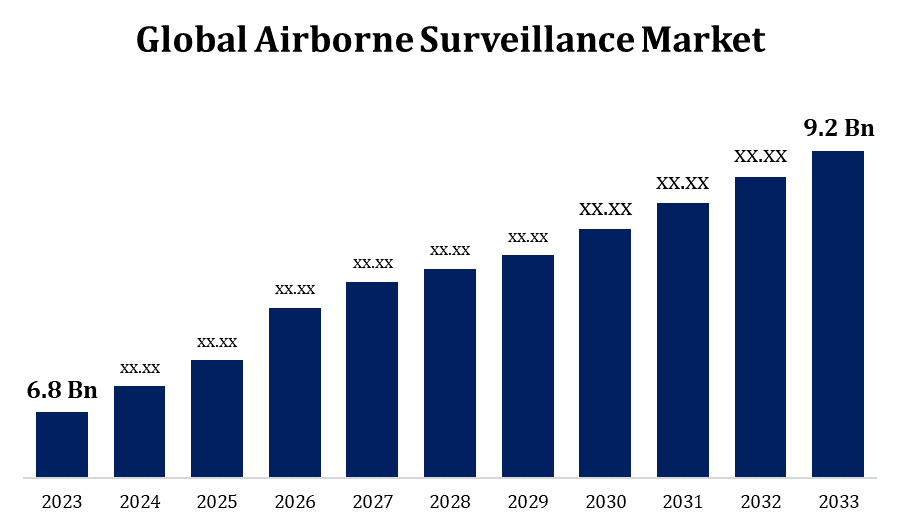

- The Global Airborne Surveillance Market Size was valued at USD 6.8 Billion in 2023.

- The Market is Growing at a CAGR of 3.07% from 2023 to 2033

- The Worldwide Airborne Surveillance Market Size is Expected to reach USD 9.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Airborne Surveillance Market Size is expected to reach USD 9.2 Billion by 2033, at a CAGR of 3.07% during the forecast period 2023 to 2033.

Due to growing security concerns, border threats, territorial conflicts, and the necessity for real-time situational awareness, there has been a notable increase in the market for airborne surveillance in recent years. In order to streamline data processing, improve target identification, and deliver actionable intelligence in real-time, AI and data analytics are being progressively incorporated into airborne surveillance systems. Faster decision-making and more effective use of surveillance resources are made possible by this integration. The development of swarming drones for collective surveillance, the use of satellite-based surveillance systems for wide-area coverage, and the integration of unmanned aerial vehicles into already-existing manned surveillance platforms for enhanced capabilities are some emerging trends in the airborne surveillance market.

Airborne Surveillance Market Value Chain Analysis

The creation of different hardware subsystems and components for airborne surveillance systems is known as component manufacturing. This comprises data processing units, communication systems, sensors (radar, electro-optical/infrared cameras), and other mechanical and electronic parts. Surveillance systems, sensors, communication devices, and other subsystems must be integrated and assembled into the aerial platforms. To make sure the surveillance systems fulfil legal criteria and performance standards, this step also involves software installation, testing, and certification. Marketing and selling airborne surveillance systems to clients, such as defence agencies, governmental bodies, law enforcement agencies, and commercial entities, is done through distribution and sales channels.

Airborne Surveillance Market Opportunity Analysis

The growing use of UAVs for surveillance purposes presents chances for businesses that specialise in software development, sensor integration, and UAV production. Unmanned Aerial Vehicles (UAVs) offer economical and adaptable platforms for various surveillance tasks, such as monitoring infrastructure, border protection, and disaster relief. Advanced airborne surveillance solutions are in demand as worries about border security, illegal immigration, smuggling, and marine threats grow. These prospects can be realised by companies who provide integrated surveillance systems that are able to monitor maritime domains and huge border areas in real-time. Beyond defence and security, commercial applications for airborne surveillance systems include infrastructure inspection, disaster management, agriculture, and environmental monitoring. Improved coverage, persistence, and situational awareness are provided by the combination of satellite-based and airborne surveillance systems.

Global Airborne Surveillance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.07% |

| 2033 Value Projection: | USD 9.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Technology, By Application, By Region. |

| Companies covered:: | Raytheon, Lockheed Martin, Saab, BAE Systems, Safran, Thales, Leica Geosystems, Teledyne Technologies, Leonardo, FLIR Systems, Northrop Grumman, L-3 Wescam, and other key vendors. |

| Growth Drivers: | Growing Usage of Unmanned Aerial Systems (UAS) in Defence Uses to Promote Growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Airborne Surveillance Market Dynamics

Growing Usage of Unmanned Aerial Systems (UAS) in Defence Uses to Promote Growth

Unmanned airborne Systems (UAS) offer armed forces instantaneous airborne surveillance capabilities, enabling them to track enemy movements, carry out reconnaissance operations, and obtain intelligence without endangering crew lives. On the battlefield, the use of UAS enhances situational awareness, facilitating better decision-making and boosting operational efficacy. UAS are available in a variety of shapes and sizes, from compact tactical drones to massive, long-range models. Because of its adaptability, defence forces can use UAS for a variety of surveillance tasks, such as protecting convoys, acquiring targets, assessing battle damage, and gathering intelligence. Unmanned Aerial Systems (UAS) can be easily coordinated with other aerial and terrestrial assets since they are frequently incorporated into larger command and control (C2) systems. Overall situational awareness is improved through data fusion, cooperative mission planning, and real-time information sharing made possible by this integration.

Restraints & Challenges

Significant experience and research and development funding are needed to create and integrate cutting-edge sensors, communication systems, and data analytics capabilities into airborne surveillance aircraft. The complexity of technology can result in longer development cycles, higher development costs, and difficulties guaranteeing compatibility and interoperability across many platforms and systems. Cybersecurity risks to aircraft surveillance systems include signal jamming, hacking, and data leaks. It is essential to guarantee the security and integrity of data transferred between aerial platforms and ground-based command and control centres in order to stop unwanted access and misuse of private data. There are several companies vying for contracts and market share in the increasingly competitive airborne surveillance market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airborne Surveillance Market from 2023 to 2033. The development and acquisition of airborne surveillance systems are funded by significant budgets from the United States and Canada, two of the world's biggest defence spenders. These expenditures bolster defence capabilities against changing threats, improve situational awareness, and assist in modernising the armed forces. Commercial uses such as infrastructure monitoring, environmental evaluation, agriculture, and aerial photography are driving up demand for airborne surveillance systems in addition to defence and security. Drones and other airborne platforms with sophisticated sensors are being used by North American businesses to deliver data-driven solutions to a range of industries.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Geopolitical tensions and a variety of territorial conflicts, especially in the South China Sea and the Korean Peninsula, define the Asia-Pacific area. In order to monitor maritime activity, carry out reconnaissance, and maintain maritime security in disputed areas, airborne surveillance systems are essential. Terrorism, insurgency, and transnational crime pose challenges to numerous countries in the Asia-Pacific area. In order to identify and prevent threats, secure borders, and safeguard vital infrastructure, law enforcement, border surveillance, and counterterrorism operations all make use of aerial surveillance equipment. The Asia-Pacific area is seeing rapid urbanisation and economic development, which is increasing demand for airborne surveillance systems for environmental protection, disaster management, and infrastructure monitoring.

Segmentation Analysis

Insights by Component

The radar segment accounted for the largest market share over the forecast period 2023 to 2033. For the long-range identification of targets, such as cars, ships, aircraft, and other interesting objects, radars are indispensable. The need for radar systems with longer detection ranges and higher sensitivity is rising as security and defence services look to increase their situational awareness and early warning capabilities. In order to provide complementary surveillance capabilities, radar systems are frequently coupled with additional sensors, such as electro-optical/infrared (EO/IR) cameras. By utilising EO/IR sensors for visual identification and radar for initial detection, operators can track targets with integrated sensor suites, which improves situational awareness and mission effectiveness. Radar systems are used by armed forces, homeland security organisations, and border protection authorities for a variety of monitoring and reconnaissance tasks.

Insights by Technology

The unmanned systems segment accounted for the largest market share over the forecast period 2023 to 2033. UAVs have become increasingly popular for surveillance purposes because of their affordability, adaptability, and capacity to operate in areas that manned aircraft may find too dangerous or unfeasible. Unmanned Aerial Vehicles (UAVs) provide an adaptable platform for carrying out diverse surveillance tasks, such as infrastructure monitoring, border patrol, aerial reconnaissance, and disaster relief. Because of their speedy deployment capabilities, unmanned aerial vehicles (UAVs) allow operators to promptly initiate surveillance missions in reaction to events or developing threats. UAVs can also be used in swarms to cover big regions at once, offering scalable surveillance solutions for border security, disaster response, and safeguarding vital infrastructure. Unmanned Aerial Vehicles (UAVs) are finding growing usage in creative surveillance applications such infrastructure inspection, precision agriculture, environmental surveillance, and animal monitoring.

Insights by Platform

The military and government segment accounted for the largest market share over the forecast period 2023 to 2033. In order to improve their monitoring capacities, many nations are investing in defence modernization programmes. To protect national security and improve situational awareness, governments set aside large sums of money for the purchase of sophisticated airborne surveillance equipment, such as drones, unmanned aerial vehicles (UAVs), sensors, and communication systems. To protect sensitive data obtained by airborne surveillance equipment, military and government institutions give cybersecurity and data protection measures top priority. Governments allocate resources towards encryption technology, cybersecurity protocols, and secure communication networks in order to thwart adversaries' attempts to access, intercept, and utilise surveillance data without authorization. Demand for airborne surveillance systems that can seamlessly interact with allied platforms and systems is driven by military alliances, joint operations, and coalition partnerships, which promote cooperation and interoperability among armed forces.

Recent Market Developments

- May 2022, TerraSense Analytics announced that it has been granted a USD 8.976 Million contract under the Department of National Defence's Innovation for Defence Excellence and Security (IDEaS) initiative. IDEaS is a federal funding initiative that assists Canadian innovators in addressing defence and security concerns, and it will help TerraSense advance the development of its unique technology, MIST.

Competitive Landscape

Major players in the market

- Raytheon

- Lockheed Martin

- Saab

- BAE Systems

- Safran

- Thales

- Leica Geosystems

- Teledyne Technologies

- Leonardo

- FLIR Systems

- Northrop Grumman

- L-3 Wescam

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airborne Surveillance Market, Component Analysis

- Radars

- Sensors

- Imaging System

- Others

Airborne Surveillance Market, Technology Analysis

- Unmanned System

- Manned System

Airborne Surveillance Market, Application Analysis

- Commercial

- Military & Government

Airborne Surveillance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Airborne Surveillance Market?The global Airborne Surveillance Market Size is expected to grow from USD 6.8 billion in 2023 to USD 9.2 billion by 2033, at a CAGR of 3.07% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airborne Surveillance Market?Some of the key market players of the market are Raytheon, Lockheed Martin, Saab, BAE Systems, Safran, Thales, Leica Geosystems, Teledyne Technologies, Leonardo, FLIR Systems, Northrop Grumman, L-3 Wescam.

-

3. Which segment holds the largest market share?The military and government segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Airborne Surveillance Market?North America is dominating the Airborne Surveillance Market with the highest market share.

Need help to buy this report?