Global AI Agents In Financial Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Risk Management Agents, Compliance and Regulatory Agents, Fraud Detection Agents, Customer Service Agents, Credit Scoring Agents, and Others), By Institutional Type (Traditional Banks, InsurTech Firms, FinTech Companies, and Others), By Technology (Machine Learning (ML) & Deep Learning, Large Language Models (LLMs), Robotic Process Automation (RPA), Cloud Computing & APIs, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal AI Agents In Financial Services Market Insights Forecasts to 2035

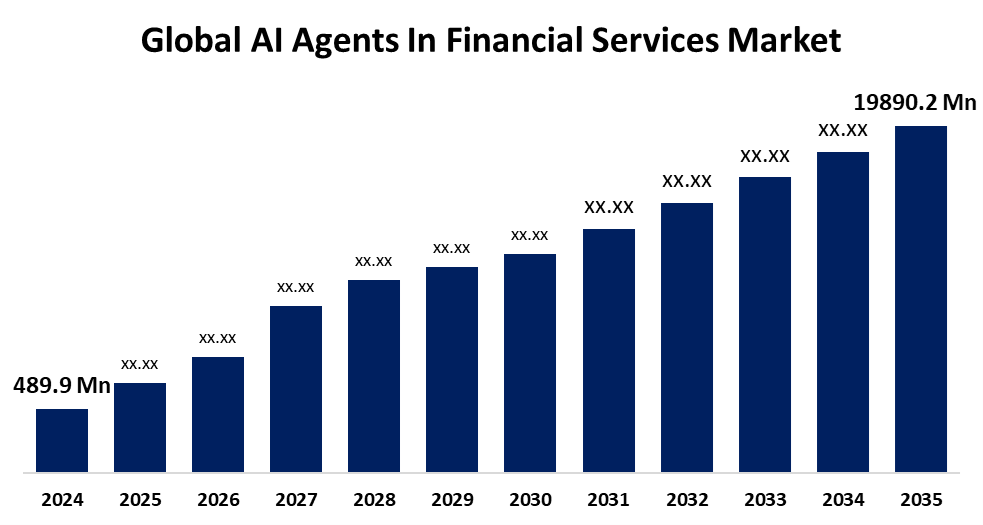

- The Global AI Agents In Financial Services Market Size Was Estimated at USD 489.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 40.03% from 2025 to 2035

- The Worldwide AI Agents In Financial Services Market Size is Expected to Reach USD 19890.2 Million by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global AI Agents In Financial Services Market Size was Worth Around USD 489.9 Million in 2024 and is Predicted to Grow to Around USD 19890.2 Million By 2035 with a Compound Annual Growth Rate (CAGR) of 40.03% from 2025 and 2035. The intelligent agents are reshaping banking by enabling strategic, data-driven operations and personalized customer experiences. As digital demands rise, they empower institutions of all sizes to stay agile and competitive.

Market Overview

The AI agents in the financial services market refer to autonomous artificial intelligence-powered software systems, frequently combined with large language models (LLMs), that can handle a variety of economic functions, from document creation and data analysis to strategic decision-making and operational execution.

Real-time financial forecasting, automated regulatory reporting, and customized wealth management are just a few financial innovations made possible by AI agents. Through data-driven due diligence, they may even support mergers and acquisitions, optimize tax strategies, and help manage ESG (Environmental, Social, and Governance) compliance. Low-code AI agent platforms provide scalable automation for small and mid-sized businesses with little technical know-how, making powerful financial intelligence affordable and available. By automating complex procedures, enhancing decision-making, and providing individualized customer experiences, AI agents are quickly revolutionizing the financial services industry. These intelligent tools make tasks safer and efficient by handling anything from fraud detection and real-time investment management to customer onboarding and round-the-clock support. AI agents save expenses and errors by optimizing portfolios, streamlining compliance, and offering personalized financial advice by utilizing ML and NLP. AI agents are increasingly essential for operational enhancements, fostering innovation, and maintaining competitiveness in a rapidly changing market as financial institutions scramble to implement cutting-edge technologies.

Report Coverage

This research report categorizes the AI agents in financial services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the AI agents in financial services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the AI agents in financial services market.

Global AI Agents In Financial Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 489.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 40.03% |

| 2035 Value Projection: | USD 19890.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Institutional Type, By Technology, By Region. |

| Companies covered:: | Accenture, Zest AI, Amazon Web Services (AWS), WorkFusion, FICO, Upstart, Microsoft, Temenos, NVIDIA, Oracle, Salesforce, SAP, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The improvement in decision-making accuracy and automation of intricate processes, intelligent agents are revolutionizing the banking sector. Through sophisticated data analysis, they lower expenses, simplify operations, and provide flawless client experiences. These solutions help financial institutions remain flexible and competitive in a market that is changing quickly. Businesses are being forced to provide more individualized, responsive services due to changing consumer expectations and digital demands. Smaller businesses now have an even playing field because of the availability of cloud-based tools. With these developments, regular automation gives way to data-driven, strategic financial operations.

Restraining Factors

Data security and privacy are still major issues since organizations have to adhere to stringent laws like the CCPA and GDPR while protecting private and sensitive financial data. Progress is further impeded by regulatory complexity, as the smooth deployment of autonomous systems is complicated by ongoing legislative revisions. Growth is further constrained, particularly for smaller businesses, by high implementation costs and a lack of qualified personnel in AI, cybersecurity, and finance technology.

Market Segmentation

The AI agents in financial services market share is classified into type, institutional type, and technology.

- The fraud detection agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the AI agents in financial services market is divided into risk management agents, compliance and regulatory agents, fraud detection agents, customer service agents, credit scoring agents, and others. Among these, the fraud detection agents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the financial security is being revolutionized by AI fraud detection agents, which make it possible to identify fraudulent actions more quickly and accurately. Their adaptive learning and real-time monitoring enhance risk assessment and lower false positives. These agents provide a proactive defense as fraud tactics become increasingly complex. Their crucial importance in safeguarding contemporary financial systems is indicated by their sustained investment.

- The traditional bank segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the institutional type, the AI agents in financial services market is divided into traditional banks, insurtech firms, fintech companies, and others. Among these, the traditional bank segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the AI agents are being used by traditional banks to increase productivity, cut expenses, and provide more individualized services. Core banking operations are changing as a result of AI integration, from risk management to customer service. Collaborations with AI suppliers promote innovation and fill talent shortages. This change in approach guarantees banks' competitiveness in the digital age.

- The large language models segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the AI agents in financial services market is divided into machine learning (ML) & deep learning, large language models (LLMs), robotic process automation (RPA), cloud computing & apis, and others. Among these, the large language models segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to all industries, as machine learning and optimization are enabling more intelligent, data-driven decisions and efficient operations. With the help of tools like Uptiq's AI Workbench, developers can easily create safe, customized AI agents. These platforms speed up innovation in fields like underwriting and financing. They change the way financial services provide value as adoption increases.

Regional Segment Analysis of the AI Agents In Financial Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the AI agents in financial services market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the AI agents in financial services market over the predicted timeframe. The region’s substantial investment, a thriving tech ecosystem, and early uptake. They improve efficiency and customer experience by automating risk management, fraud detection, customer support, and tailored financial advice. For example, Oracle Financial Services launched AI agents in its Investigation Hub Cloud Service in March 2025 as part of some significant initiatives to automate and speed up financial crime investigations, lowering manual labor and enhancing judgment consistency for financial institutions around the world.

Asia Pacific is expected to grow at a rapid CAGR in the AI agents in financial services market during the forecast period. China, India, and Japan are leading the way in the deployment of AI agents, which are quickly revolutionizing financial services throughout the Asia-Pacific region. These agents are being utilized extensively to improve fraud detection systems, automate back-office tasks, and increase consumer engagement. AI is being seen by financial institutions more and more as a strategic instrument to boost productivity and satisfy growing digital demands. This change is supported by a strong push for innovation and regional government-backed digital financial projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the AI agents in financial services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accenture

- Zest AI

- Amazon Web Services (AWS)

- WorkFusion

- FICO

- Upstart

- Microsoft

- Temenos

- NVIDIA

- Oracle

- Salesforce

- SAP

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Oracle Financial Services added new agentic AI capabilities to its Investigation Hub Cloud Service to assist financial institutions in combating financial crime more efficiently. These AI agents automate investigative processes, identify complicated fraud patterns, and create generative AI-driven narratives, minimizing manual labor and allowing investigators to focus on high-priority leads. The improved technology is now available worldwide, allowing enterprises of all sizes to make financial investigations more predictable, thorough, and efficient.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the AI agents in financial services market based on the below-mentioned segments:

Global AI Agents In Financial Services Market, By Type

- Risk Management Agents

- Compliance and Regulatory Agents

- Fraud Detection Agents

- Customer Service Agents

- Credit Scoring Agents

- Others

Global AI Agents In Financial Services Market, By Institutional Type

- Traditional Banks

- InsurTech Firms

- FinTech Companies

- Others

Global AI Agents In Financial Services Market, By Technology

- Machine Learning (ML) & Deep Learning

- Large Language Models (LLMs)

- Robotic Process Automation (RPA)

- Cloud Computing & APIs

- Others

Global AI Agents In Financial Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the AI agents in financial services market over the forecast period?The global AI agents in financial services market is projected to expand at a CAGR of 40.03% during the forecast period.

-

2. What is the market size of the AI agents in financial services market?The global AI Agents In Financial Services market size is expected to grow from USD 489.9 Million in 2024 to USD 19890.2 Million by 2035, at a CAGR of 40.03% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the AI agents in financial services market?North America is anticipated to hold the largest share of the AI agents in financial services market over the predicted timeframe.

Need help to buy this report?