Global Aerospace 3D Printing Market Size By Technology (FDM, SLS, SLA, PBF, Others), By Platform (Commercial Aircraft, Military Aircraft, UAV, Spacecraft, Printers, Materials), By Application (Structural Components, Engine, Spacecraft Components), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aerospace 3D Printing Market Insights Forecasts to 2033

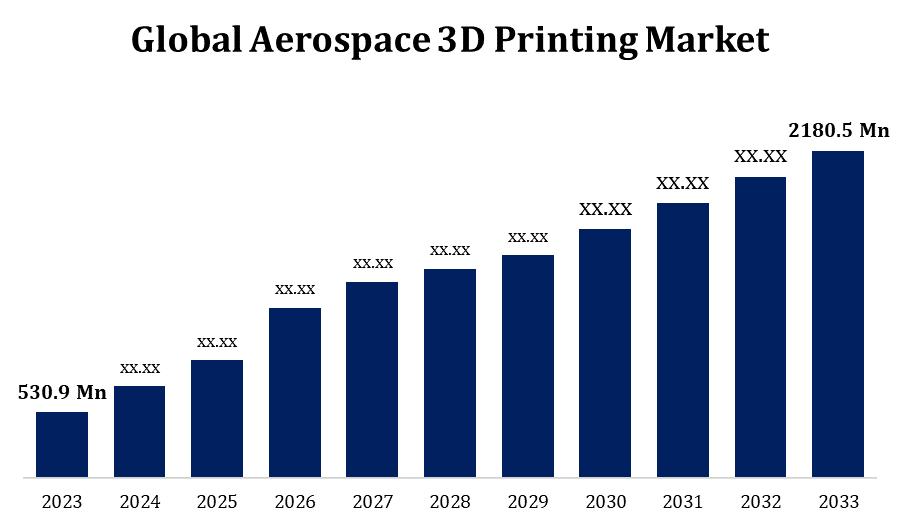

- The Global Aerospace 3D Printing Market Size was valued at USD 530.9 Million in 2023.

- The Market Size is Growing at a CAGR of 15.17% from 2023 to 2033

- The Worldwide Aerospace 3D Printing Market Size is expected to reach USD 2180.5 Million by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aerospace 3D Printing Market Size is expected to reach USD 2180.5 Million by 2033, at a CAGR of 15.17% during the forecast period 2023 to 2033.

3D printing is used by aerospace producers to quickly prototype and iterate designs. Compared to traditional production methods, this technology enables the creation of complex and customised components with shorter lead times. Aircraft weight reduction is facilitated by the ability of 3D printing to produce structurally optimised and lightweight parts. Improving fuel efficiency and cutting operating expenses require this. The fabrication of complicated geometries that would be difficult or impossible to achieve with conventional methods is made achievable via additive manufacturing. Aerospace component performance and efficiency are enhanced by this capability. Through on-site or on-demand component production, aerospace businesses use 3D printing to optimise their supply chains. This can simplify logistics and lessen the need for large stocks.

Aerospace 3D Printing Market Value Chain Analysis

In the aerospace 3D printing value chain, suppliers of 3D printing materials are essential. Specialised metals, polymers, and composites created to satisfy the strict specifications and high performance needs of the aerospace sector can be among these materials. In the value chain, businesses that specialise in producing 3D printing machinery, including as printers and powder bed fusion machines, are crucial. These producers give aircraft firms the hardware they need to start using additive manufacturing. The design and simulation tools required by aerospace engineers to design parts that are appropriate for 3D printing are created by software developers. This include workflow management systems, simulation tools, and CAD (Computer-Aided Design) software. The design and simulation tools required by aerospace engineers to design parts that are appropriate for 3D printing are created by software developers. A crucial component is guaranteeing the calibre and certification of 3D-printed aeronautical parts. Regulatory agencies, quality control experts, and certification bodies set standards, conduct inspections, and attest to the fact that 3D-printed parts satisfy performance and safety criteria. Post-processing and finishing are frequently necessary to satisfy particular aerospace standards after the printing process. To guarantee that 3D-printed parts get to aircraft manufacturers quickly and effectively, logistics and distribution are important.

Aerospace 3D Printing Market Opportunity Analysis

Technologies for additive manufacturing are being used more and more by the aerospace sector to produce intricate parts. Meeting the increasing need for 3D-printed parts in the aerospace and aviation industries presents an opportunity. Opportunities for 3D printing arise from the need for lightweight components that improve overall performance and fuel efficiency. The demand for lightweight, structurally optimised parts in aeronautical applications is an opportunity for manufacturers. Aerospace producers look for ways to use additive manufacturing to streamline their supply chains. Businesses can provide products and services that support on-demand manufacturing, decreased inventory, and optimised logistics. Advanced materials appropriate for aerospace 3D printing have opportunities to be developed and provided. Materials innovations, such as composites, polymers, and high-performance metals, can meet particular aircraft needs.

Global Aerospace 3D Printing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 530.9 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 15.17% |

| 2033 Value Projection: | USD 2180.5 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Platform, By Application, By Region. |

| Companies covered:: | 3D Systems Corporation, ARCAM AB, Aerojet Rocketdyne Holdings Inc, EnvisionTEC GmbH, EOS GmbH, ExOne Co., GE Aviation, Hoganas AB, Materialise NV, Moog Inc., MTU AERO ENGINE, Norsk Titanium, Oerlikon Group, Renishaw plc, Stratasys Ltd., The Trumpf Group, Ultimaker BV, and Others |

| Growth Drivers: | Growing demand for lighter satellites |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace 3D Printing Market Dynamics

Growing demand for lighter satellites

As lighter satellites are lighter, they take less fuel to launch. Launch expenses are frequently based on the payload's weight. Aerospace businesses can save money on launch costs by decreasing the weight of their satellites. Launch vehicles can carry larger payloads thanks to lighter satellites. This maximises the utilisation of the rocket's available space by enabling satellite operators and space agencies to launch numerous satellites on a single mission. The usage of sophisticated lightweight materials, such as composites and high-strength polymers, is made easier by 3D printing. These materials can be used by aerospace manufacturers to create structurally optimised parts that reduce the overall weight of satellites.

Restraints & Challenges

Although materials that are suitable for 3D printing have advanced significantly, there are still difficulties in creating materials that satisfy the particular needs of aeronautical applications. Extremely strong, long-lasting, and condition-resistant materials are required. Purchasing 3D printing equipment can come with a hefty upfront cost, particularly when it comes to metal additive manufacturing. This is a hurdle to the use of 3D printing technologies for some aerospace companies, especially the smaller ones. Variations in quality and consistency may result from the lack of standardised procedures and guidelines for 3D printing in the aerospace industry. The industry must devise and put into effect standardised procedures that guarantee dependability throughout various manufacturing sites.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace 3D Printing Market from 2023 to 2033. Aerospace hubs are located in North America and include places like Seattle, Southern California, and the Space Coast in Florida. These centres serve as focal centres for aerospace 3D printing-related research, development, and manufacturing activities. North American commercial aviation businesses have begun using 3D printed parts in their planes. This covers the manufacturing of lightweight parts, structural parts, and even vital components like engine parts. North America's defence industry has adopted 3D printing as a means of producing parts for space exploration, unmanned aerial vehicles (UAVs), and military aircraft. Additive manufacturing's versatility is very useful for producing customised parts and fast prototyping. Aerospace engineering and additive manufacturing are the subjects of programmes and courses offered by educational institutions in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The aerospace sector in the Asia-Pacific area has grown significantly. A number of nations, including China, Japan, and India, have made significant investments in aircraft production, R&D, and adoption of 3D printing technologies. In the Asia-Pacific area, regional 3D printing enterprises with an emphasis on aerospace applications have surfaced. These businesses offer solutions and services for the manufacture of 3D-printed aeronautical parts. The Asia-Pacific region's commercial aviation industry is expanding quickly, which has increased demand for cutting-edge manufacturing technologies. In response to the region's growing need for air travel, 3D printing is being used for customisation, lightweight component fabrication, and prototyping. The aerospace sector in Asia-Pacific has expressed interest in using metal additive manufacturing to produce robust and long-lasting parts.

Segmentation Analysis

Insights by Technpology

The SLS segment accounted for the largest market share over the forecast period 2023 to 2033. SLS is renowned for its capacity to create intricately geometrized, extremely precise, and complicated parts. The precision that SLS offers is useful in the aerospace industry, where components frequently have complex designs. Since the unsintered powder that surrounds the object provides natural support, SLS does not require support structures to be used during the printing process. This eliminates the need for extra support material and post-processing procedures and enables the creation of intricate, hanging structures. Lightweight components are frequently given priority in aerospace applications in order to increase overall performance and fuel efficiency. Aerospace parts can be made lighter by using SLS, which can create lightweight structures with optimum interior geometry.

Insights by Platform

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Components with optimised geometry that are lightweight can be produced with 3D printing. Reducing component weight is essential for improving fuel efficiency, cutting operating expenses, and complying with strict environmental laws in the commercial aviation industry. The manufacturing of aeroplane parts via 3D printing increases overall fuel economy. The capacity to design complicated geometries, lightweight constructions, and enhanced aerodynamics all contribute to lower emissions and fuel consumption. Complex and detailed designs that would be difficult or impossible to create using traditional manufacturing methods may now be created thanks to 3D printing. Manufacturers of commercial aircraft looking to maximise component functionality and performance benefit from this design flexibility.

Insights by Application

The engine segment accounted for the largest market share over the forecast period 2023 to 2033. Complex and lightweight structures that would be difficult to create with conventional methods may now be produced thanks to 3D printing. These features are essential for optimising the design of internal parts and turbine blades in the engine segment. The engine industry makes extensive use of metal additive manufacturing, a subset of 3D printing, to create high-performance parts. Components with the necessary strength, heat resistance, and longevity are made from materials like titanium and superalloys. Engine parts can have complex interior cooling channels made thanks to 3D printing. This interior structure improves heat management, which prolongs the life and performance of important engine components.

Recent Market Developments

- In November 2020, NASA unveiled two three-dimensional printed rocket engine components: a high-strength alloy nozzle and a combustion chamber made of copper alloy.

Competitive Landscape

Major players in the market

- 3D Systems Corporation

- ARCAM AB

- Aerojet Rocketdyne Holdings Inc

- EnvisionTEC GmbH

- EOS GmbH

- ExOne Co.

- GE Aviation

- Hoganas AB

- Materialise NV

- Moog Inc.

- MTU AERO ENGINE

- Norsk Titanium

- Oerlikon Group

- Renishaw plc

- Stratasys Ltd.

- The Trumpf Group

- Ultimaker BV

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace 3D Printing Market, Technology Analysis

- FDM

- SLS

- SLA

- PBF

- Others

Aerospace 3D Printing Market, Platform Analysis

- Commercial Aircraft

- Military Aircraft

- UAV

- Spacecraft

- Printers

- Materials

Aerospace 3D Printing Market, Application Analysis

- Structural Components

- Engine

- Spacecraft Components

Aerospace 3D Printing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1 What is the market size of the Aerospace 3D Printing Market?The global Aerospace 3D Printing Market is expected to grow from USD 530.9 million in 2023 to USD 2180.5 million by 2033, at a CAGR of 15.17% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace 3D Printing Market?Some of the key market players of the market are 3D Systems Corporation, ARCAM AB, Aerojet Rocketdyne Holdings Inc, EnvisionTEC GmbH, EOS GmbH, ExOne Co., GE Aviation, Hoganas AB, Materialise NV, Moog Inc., MTU AERO ENGINE, Norsk Titanium, Oerlikon Group, Renishaw plc, Stratasys Ltd., The Trumpf Group, Ultimaker BV.

-

3. Which segment holds the largest market share?The engine segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Aerospace 3D Printing Market?North America is dominating the Aerospace 3D Printing Market with the highest market share.

Need help to buy this report?