Global Acrylonitrile Styrene Acrylate Market Size, Share, and COVID-19 Impact Analysis, By Manufacturing Process (3D Printing, Thermoforming, Injection Moulding, and Others), By Application (Car Exterior Panels, Side View Mirror Housing, Commercial Sliding, Electrical Housing, Furniture, Medical Devices, Garden Equipment, and Others), By End-Use (Automotive, Electronics, Consumer Goods, Construction, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Acrylonitrile Styrene Acrylate Market Size Insights Forecasts to 2035

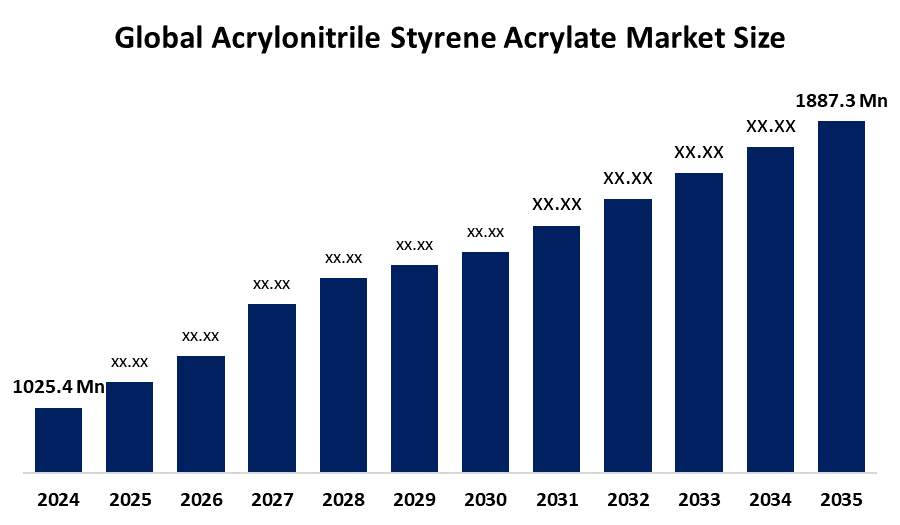

- The Global Acrylonitrile Styrene Acrylate Market Size Was Estimated at USD 1025.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The Worldwide Acrylonitrile Styrene Acrylate Market Size is Expected to Reach USD 1887.3 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Acrylonitrile Styrene Acrylate Market Size was worth around USD 1025.4 Million in 2024 and is predicted to Grow to around USD 1887.3 Million by 2035 with a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035. The acrylonitrile styrene acrylate market is experiencing growth because automotive exterior parts and construction projects require materials with durability, UV protection and weatherproofing capabilities. The demand for sustainable, eco-friendly polymer solutions and 3D printing applications drives the market further.

Market Overview

Acrylonitrile styrene acrylate (ASA) exists as a high-performance thermoplastic terpolymer that combines three different polymer components to create a material with superior UV protection, weather resistance, and impact resistance, which makes it suitable for outdoor use. The automotive industry uses it to manufacture exterior mirror housings, grilles and pillar covers, while the construction industry uses it for siding, roofing and window profiles, and the consumer goods sector uses it for garden furniture and appliance housings. The market experiences development through urbanization trends in emerging markets, the growing need for long-lasting materials that maintain their color and the increasing use of lightweight materials in electric vehicles.

The EU Packaging and Packaging Waste Regulation (PPWR) will implement its complete legal requirements in February 2025, with full enforcement starting in mid-2026 to establish standards for plastic materials that require better recycling and recycled content and waste reduction. The initiative focuses on packaging materials, but it creates better business incentives for companies to switch to sustainable packaging solutions that require long-lasting, recyclable materials such as acrylonitrile styrene acrylate (ASA). The market presents substantial business potential through its development of 3D printing and sustainable bio-based ASA resin production, and adoption of high-gloss, eco-friendly products. LG Chem and INEOS Styrolution, Chi Mei Corporation, SABIC and BASF SE operate as key global market players who concentrate their efforts on developing new products and expanding their production facilities throughout Asia-Pacific while implementing sustainability programs.

Report Coverage

This research report categorizes the acrylonitrile styrene acrylate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the acrylonitrile styrene acrylate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the acrylonitrile styrene acrylate market.

Global Acrylonitrile Styrene Acrylate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1025.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.7% |

| 2035 Value Projection: | USD 1887.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 91 |

| Segments covered: | By Manufacturing Process, By Application and COVID-19 Impact Analysis |

| Companies covered:: | INEOS Styrolution Group GmbH, Chi Mei Corporation, BASF SE, LG Chem Ltd., Trinseo S.A., Formosa Plastics Corporation, SABIC, Kumho Petrochemical, Mitsubishi Chemical Corporation, Asahi Kasei Corporation, Sinopec, Techno-UMG Co., Ltd., Eni S.p.A., Toray Industries, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global acrylonitrile styrene acrylate (ASA) market experiences its main growth because the automotive and construction sectors need materials that possess both high-performance capabilities and weather-resistance. The material exists as a better option for exterior applications because it maintains its color through UV radiation and outdoor conditions. The growing transition to electric vehicles (EVs) produces a strong market demand for lightweight and durable plastic components. The market demand in the Asia-Pacific region experiences acceleration through two main factors, which include 3D printing adoption for outdoor-grade functional prototypes and the increasing interest in sustainable, recyclable polymer materials.

Restraining Factors

The global acrylonitrile styrene acrylate (ASA) market faces its main barriers through two factors, which include the fluctuating costs of acrylonitrile and styrene and acrylate raw materials that make production more expensive. The high production expenses, together with the presence of cheaper alternatives such as ABS and polycarbonate and the limited recycling capacity, create obstacles that prevent cost-sensitive sectors from adopting these materials at scale.

Market Segmentation

The acrylonitrile styrene acrylate market share is classified into manufacturing process, application, and end-use.

- The injection moulding segment dominated the market in 2024, approximately 58% and is projected to grow at a substantial CAGR during the forecast period.

Based on the manufacturing process, the acrylonitrile styrene acrylate market is divided into 3D printing, thermoforming, injection moulding, and others. Among these, the injection moulding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market growth in the injection moulding segment is driven by its high production efficiency and cost-effective nature, and the capacity to manufacture complex and precise ASA components in large quantities. The automotive industry, electronics market, and consumer goods production systems widely adopted the technology because it produced products with excellent surface finish and consistent quality, which led to higher demand.

- The car exterior panels segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the acrylonitrile styrene acrylate market is divided into car exterior panels, side view mirror housing, commercial sliding, electrical housing, furniture, medical devices, garden equipment, and others. Among these, the car exterior panels segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The car exterior panels segment is growing owing to increasing automotive production and rising electric vehicle adoption, and the growing need for lightweight materials that can withstand various weather conditions. The automotive industry uses ASA because its UV stability, impact strength, and color retention make it suitable for outdoor use in both passenger and commercial vehicle production.

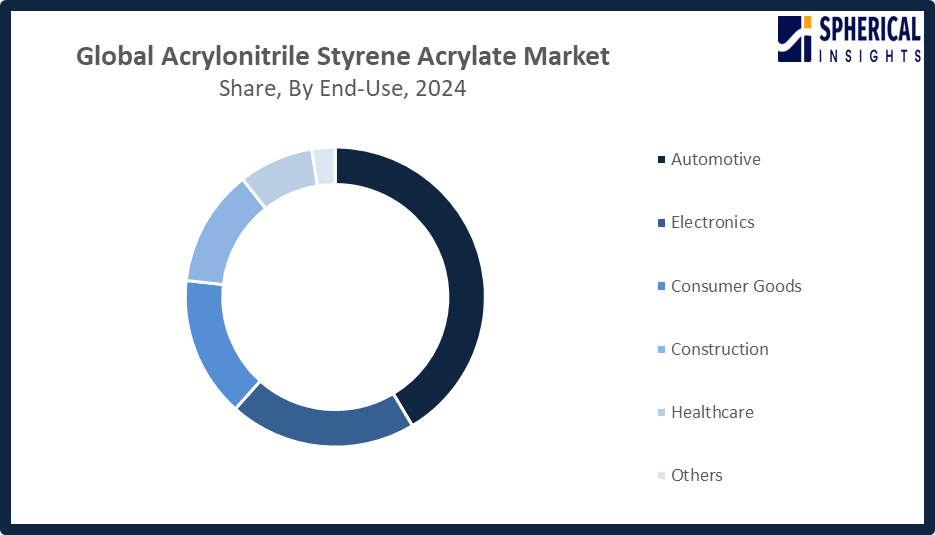

- The automotive segment accounted for the highest market revenue in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the acrylonitrile styrene acrylate market is divided into automotive, electronics, consumer goods, construction, healthcare, and others. Among these, the automotive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The automotive segment generated the most market growth due to rising vehicle production and fast electric vehicle adoption, and increasing demand for lightweight materials that maintain durability. ASA provides excellent weather protection, impact resistance and design flexibility, which makes it ideal for automotive exterior parts and functional components.

Get more details on this report -

Regional Segment Analysis of the Acrylonitrile Styrene Acrylate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the acrylonitrile styrene acrylate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the acrylonitrile styrene acrylate market over the predicted timeframe. Asia Pacific will become the major region for acrylonitrile styrene acrylate (ASA) market, 45% share due to fast industrial growth, rising automotive manufacturing and increasing need for long-lasting plastics used in building projects and consumer products. China possesses the strongest manufacturing capacity, which enables it to produce electric vehicles while developing recycling programs that support advanced polymer technologies. The automotive industry, infrastructure projects, and government initiatives to boost local production are driving India's growth. Japan and South Korea advance their economies through technological progress and the production of premium automotive and electronic components. The NDRC of China established action plans in January 2026 to promote recycled material usage and green packaging practices and chemical recycling methods, which will increase capacity and improve circular economy operations.

North America is expected to grow at a rapid CAGR in the acrylonitrile styrene acrylate market during the forecast period. North America will experience a 20% share of rapid market expansion through acrylonitrile styrene acrylate (ASA) market growth owing to increasing needs from the automotive, electronics and construction industries, which will drive up demand for durable weatherproof plastics. The United States leads growth, driven by electric vehicle production, infrastructure modernization, and technological innovation in polymer applications. The automotive manufacturing and industrial growth in Canada and Mexico create a combined effect that supports the rapid increase of the ASA market development across the region.

The European acrylonitrile styrene acrylate (ASA) market expands due to three factors, which include environmental regulations and circular economy policies, together with high demand from both the automotive and construction industries. Germany dominates the automotive sector through its advanced manufacturing capabilities and sustainable polymer technologies, while the countries of France, Italy and the UK support their economies through electronics and consumer products and infrastructure development. The European Commission started pilot programs for plastic recycling and circularity improvements in December 2025, which receive funding for new ideas and development work, while the 2026 Circular Economy Act will enhance the EU Single Market for secondary raw materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the acrylonitrile styrene acrylate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Styrolution Group GmbH

- Chi Mei Corporation

- BASF SE

- LG Chem Ltd.

- Trinseo S.A.

- Formosa Plastics Corporation

- SABIC

- Kumho Petrochemical

- Mitsubishi Chemical Corporation

- Asahi Kasei Corporation

- Sinopec

- Techno-UMG Co., Ltd.

- Eni S.p.A.

- Toray Industries, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Trinseo began receiving chemically recycled styrene monomer (rSM) from Indaver's new Antwerp plant, using polystyrene household waste. The rSM enables production of STYRON, MAGNUM, and TYRIL resins as drop-in, sustainable alternatives, including for food-contact applications, supporting the circular economy and reducing reliance on fossil-based feedstocks.

- In April 2025, Trinseo launched LIGOS A 9210, an all-acrylic latex binder for flexible flooring adhesives. Designed for demanding applications like LVT, it offers excellent peel strength, plasticizer resistance, dimensional stability, and rapid adhesion, enhancing long-term durability and faster-ready flooring installations in commercial and residential projects.

- In February 2025, LG Chem announced it would begin producing bio-acrylic acid from vegetable oils, with an annual prototype capacity of 100 MT. This eco-friendly material, suitable for cosmetics, SAP, adhesives, coatings, and paints, marks the company's first commercial-scale entry into sustainable acrylic raw materials.

- In August 2023, INEOS Styrolution introduced Luran S MED 7975 SPF30, a new acrylonitrile styrene acrylate (ASA) material designed for healthcare applications, particularly small medical device housings and casings. Part of the Luran S family, it offers excellent chemical resistance, UV stability, impact strength, and flowability for injection moulding

- In January 2022, Asahi Kasei announced that Tongsuh Petrochemical (TSPC) received ISCC PLUS certification for sustainable acrylonitrile (AN). Production using biomass propylene began in February 2022. AN, a key raw material for ABS, acrylics, carbon fiber, and nitrile rubber, meets growing demand in wind turbines and medical gloves.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the acrylonitrile styrene acrylate market based on the below-mentioned segments:

Global Acrylonitrile Styrene Acrylate Market, By Manufacturing Process

- 3D Printing

- Thermoforming

- Injection Moulding

- Others

Global Acrylonitrile Styrene Acrylate Market, By Application

- Car Exterior Panels

- Side View Mirror Housing

- Commercial Sliding

- Electrical Housing

- Furniture

- Medical Devices

- Garden Equipment

- Others

Global Acrylonitrile Styrene Acrylate Market, By End-Use

- Automotive

- Electronics

- Consumer Goods

- Construction

- Healthcare

- Others

Global Acrylonitrile Styrene Acrylate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the acrylonitrile styrene acrylate market over the forecast period?The global acrylonitrile styrene acrylate market is projected to expand at a CAGR of 5.7% during the forecast period.

-

2. What is the market size of the acrylonitrile styrene acrylate market?The global acrylonitrile styrene acrylate market size is expected to grow from USD 1025.4 million in 2024 to USD 1887.3 million by 2035, at a CAGR of 5.7% during the forecast period 2025-2035.

-

3. What is the global acrylonitrile styrene acrylate market?The global acrylonitrile styrene acrylate (ASA) market refers to the production, demand, and applications of durable, weather-resistant thermoplastics worldwide.

-

4. Which region holds the largest share of the acrylonitrile styrene acrylate market?Asia Pacific is anticipated to hold the largest share of the acrylonitrile styrene acrylate market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global acrylonitrile styrene acrylate market?INEOS Styrolution Group GmbH, Chi Mei Corporation, BASF SE, LG Chem Ltd., Trinseo S.A., Formosa Plastics Corporation, SABIC, Kumho Petrochemical, Mitsubishi Chemical Corporation, Asahi Kasei Corporation, and Others.

-

6. What factors are driving the growth of the acrylonitrile styrene acrylate market?The factors driving the acrylonitrile styrene acrylate (ASA) market include rising demand for UV-resistant/durable exterior automotive parts, increased construction activity requiring weatherable materials, growing adoption in 3D printing, and sustainability initiatives.

-

7. What are the market trends in the acrylonitrile styrene acrylate market?Key trends include rising demand for UV-resistant exterior auto/construction parts, EV component adoption, sustainability, and increased 3D printing applications.

-

8. What are the main challenges restricting wider adoption of the acrylonitrile styrene acrylate market?The challenges restricting wider adoption of acrylonitrile styrene acrylate (ASA) include high production costs compared to ABS, raw material price volatility (petroleum dependency), intense competition from cheaper alternatives, and limited recycling infrastructure.

Need help to buy this report?