Global Acid Resistant Adhesive Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Epoxy, Silicone, Polyurethane, Acrylic, and Others), By Application (Automotive, Construction, Electronics, Aerospace, and Others), By End-User (Industrial, Commercial, Residential, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Acid Resistant Adhesive Market Insights Forecasts to 2035

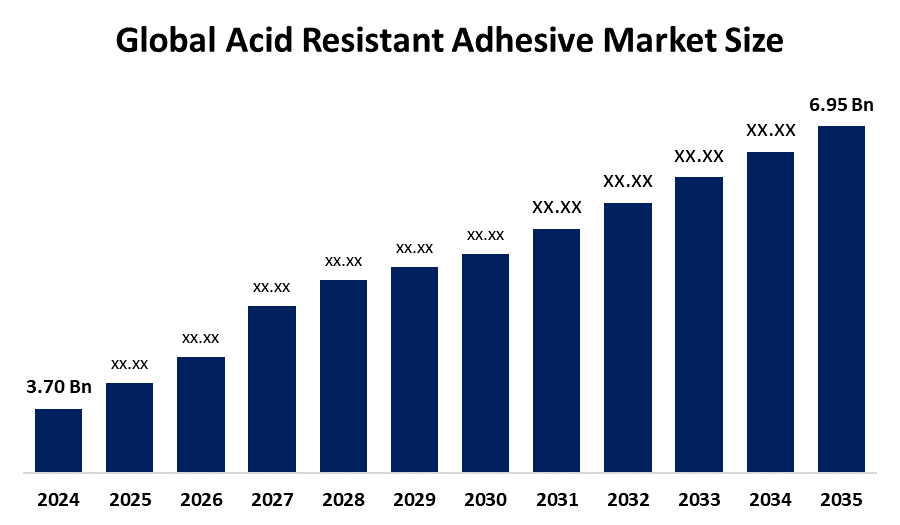

- The Global Acid Resistant Adhesive Market Size Was Estimated at USD 3.70 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.9% from 2025 to 2035

- The Worldwide Acid Resistant Adhesive Market Size is Expected to Reach USD 6.95 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global acid resistant adhesive market size was worth around USD 3.70 billion in 2024 and is predicted to grow to around USD 6.95 billion by 2035 with a compound annual growth rate (CAGR) of 5.9% from 2025 to 2035. Growth in industrialization, increasing demand for chemical-resistant bonding in harsh environments, inroads into sectors such as construction and automotive, along with evolving adhesive technologies offering better durability, resistance to temperature, and performance over a long time, all combine to make the acid resistant adhesive market grow.

Market Overview

The Global Acid-Resistant Adhesive Market Size refers to those adhesives that are specifically designed to operate in extremely corrosive and acidic environments, providing durability in bonding and protection across different industry sectors. These adhesives find broad applications in chemical processing plants, construction, the automotive and electronic industries, and even marine applications, where materials are continually subjected to strong acids, alkalis, or extreme temperatures. Their primary functions include structural reinforcement, preventing chemical deterioration, and minimizing maintenance costs, thus becoming a vital industrial component in manufacturing processes and structure development. The demands for chemical resistance, stringent safety, and durable or maintenance-free adhesives, solved by increased industrialization, ensure continuous growth within this segment. Advances in technology have seen the formulation of advanced products with increased thermal stability, higher bonding strength, and compatibility on a wide range of substrates, including metals, plastics, and composites.

Opportunities are emerging in developing regions, where expanding industrial infrastructure, chemical processing facilities, and construction projects are boosting the demand for high-performance adhesives. Additionally, the adoption of environmentally friendly, low-VOC, and solvent-free acid-resistant adhesives has opened new avenues for sustainable growth. Key market participants are strengthening their presence by developing innovative products, forming strategic partnerships, and expanding their regional footprint. Some of the major players in the market include Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, and Permabond LLC, among others. These companies are investing significantly in research and development to introduce high-performance solutions that meet evolving industrial requirements. On March 12, 2024, China’s National Health Commission published new Food Safety National Standards, including GB 4806.15-2024, which regulates adhesives used in food-contact materials. This standard, developed as part of the 2014 Food Safety National Standards Plan, will come into effect on February 8, 2025.

Report Coverage

This research report categorizes the acid resistant adhesive market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the acid resistant adhesive market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the acid resistant adhesive market.

Global Acid Resistant Adhesive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.70 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 5.9% |

| 024 – 2035 Value Projection: | USD 6.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | 3M Company, Henkel AG & Co. KGaA, Arkema S.A., H.B. Fuller, Sika AG, Huntsman Corporation, Illinois Tool Works Inc., Dow, Master Bond, Pelseal Technologies, Saint-Gobain, Wacker Chemie AG, Delo Industrial Adhesives, Avery Dennison Corporation, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand in industries that require durable and chemical-resistant bonding solutions, such as chemical processing, construction, automotive, and electronics, is driving the growth in the global acid resistant adhesive market. Industrial infrastructure growth, particularly in developing areas, bolsters demand for adhesives capable of withstanding corrosive environments. Growing usage of new materials and composites, coupled with demanding safety and durability regulations, drives the use of acid-resistant adhesives forward. Additionally, the demand for maintenance-free, long-lasting joints in pipelines, storage tanks, and industrial equipment further propels market growth. Technological enhancements of performance, including improved adhesion, temperature stability, and chemical resistance, have been a key factor in the market's growth.

Restraining Factors

High costs of production and the use of special raw materials restrain the growth rate in the acid resistant adhesives market. Lower awareness in small-scale industries, environmental regulations concerning chemical usage, and the availability of other bonding methods further limit its adoption. There may also be a slowdown in market growth since, in some extreme conditions, it may be difficult to obtain optimum performance.

Market Segmentation

The acid resistant adhesive market share is classified into product type, application, and end-user.

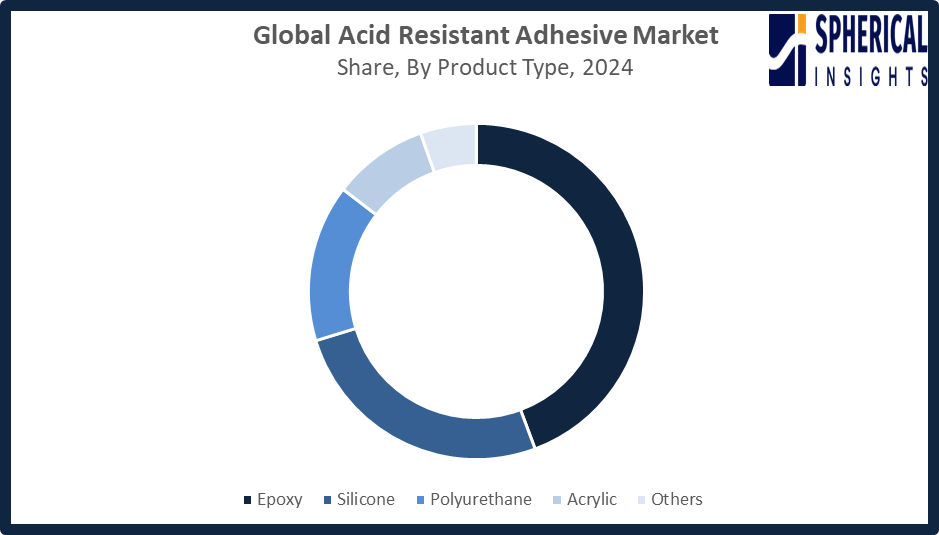

- The epoxy segment dominated the market in 2024, approximately 44% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the acid resistant adhesive market is divided into epoxy, silicone, polyurethane, acrylic, and others. Among these, the epoxy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Epoxy dominated due to its superior mechanical strength, greater chemical and acid resistance, and its ability to adhere to a wide range of substrates, including metals, concrete, and composites. Extensive use in construction, automotive, electrical, and industrial applications reinforces its leading position. Furthermore, ongoing improvements in epoxy formulations to enhance durability, thermal stability, and environmental compliance continue to drive strong demand in both developed and emerging markets.

Get more details on this report -

- The construction segment accounted for the largest share in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the acid resistant adhesive market is divided into automotive, construction, electronics, aerospace, and others. Among these, the construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction segment growth is attributed to the growing demand for durable and chemical-resistant adhesives in infrastructure, industrial facilities, and commercial buildings. Acid-resistant adhesives have a crucial role in bonding the materials that are exposed to rigorous conditions, such as flooring, pipelines, and storage structures. Rapid urbanization, increasing government investments in infrastructure, and stricter safety regulations advance the pace of demand. In addition, the growth of industrial construction and renovation projects supports the dominant position of this segment in the market.

- The industrial segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the acid resistant adhesive market is divided into industrial, commercial, residential, and others. Among these, the industrial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth in the industrial segment is owing to strong, durable, and chemically resistant bonding solutions that are highly required in manufacturing, chemical processing, and heavy-duty equipment applications. Acid-resistant adhesives find extensive use in pipelines, reactors, storage tanks, and machinery operating under corrosive environments. Greater industrialization, stricter safety legislation, and continuing modernization of production facilities further promote demand. Furthermore, the trend toward high-performance materials and long-lasting maintenance solutions further bolster its leading position within the market.

Regional Segment Analysis of the Acid Resistant Adhesive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the acid resistant adhesive market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the acid resistant adhesive market over the predicted timeframe. The Asia Pacific is expected to account for a 36% share of the acid-resistant adhesive market, considering its rapid industrialization, expansion in construction activities, and strong growth in chemical processing, especially in China, India, and Southeast Asia. China dominates the regional market, as it has a huge manufacturing base, increased infrastructure investments, and stringent regulations on the application of high-performance, chemical-resistant materials in various end-user industries. India follows it with respectable growth, as the nation witnesses expansion in the construction sector and increased utilization of adhesive solutions that are durable in nature for the maintenance of equipment and facilities. Government initiatives and the availability of cost-effective production capacities further enhance regional dominance.

North America is expected to grow at a rapid CAGR in the acid resistant adhesive market during the forecast period. North America is rapidly growing in the acid-resistant adhesive market, with a 27% market share, due to strong demand from advanced industries such as automotive, aerospace, chemical processing, and electronics. The United States propels regional growth owing to increasing demand for high-performance bonding solutions, along with strict enforcement of safety regulations and continuous technological innovation. Moreover, the regional presence of significant adhesive players, along with growing investments in industrial modernization and the increasing adoption of corrosion-resistant materials, creates favourability for market growth. Canada will also contribute steadily to the market due to infrastructural development and growth in manufacturing and energy-related applications.

Europe witnesses steady growth in the acid-resistant adhesive market, attributed to the strong demand emanating from the automotive and construction industries, combined with chemical processing. A diversified manufacturing base and high acceptance of long-lasting and high-performance adhesives prop up Germany to take the lead. Furthermore, stringent EU environmental and safety laws promote low-VOC, chemical-resistant formulations. Other contributors to this region include France and the U.K., owing to continuous infrastructure renewals and increasing usage of specialty adhesives in industrial maintenance and equipment protection.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the acid resistant adhesive market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Henkel AG & Co. KGaA

- Arkema S.A.

- H.B. Fuller

- Sika AG

- Huntsman Corporation

- Illinois Tool Works Inc.

- Dow

- Master Bond

- Pelseal Technologies

- Saint-Gobain

- Wacker Chemie AG

- Delo Industrial Adhesives

- Avery Dennison Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Huntsman Advanced Materials launched a reformulated ARALDITE epoxy adhesive range, free from intentionally added BPA and CMR substances, complying with the EU’s CLP regulation, offering safer, high-performance adhesive solutions for industrial applications.

- In July 2025, Henkel Adhesive Technologies will launch Loctite Liofol LA 7837/LA 6265, a solvent-free aliphatic adhesive for high-thermal-stress applications, especially pet food retort packaging. It ensures top food safety, reliable processing, and reduces carbon dioxide emissions by minimizing material use and eliminating energy-intensive solvent drying steps.

- In October 2024, 3M introduced Fastbond Pressure Sensitive Adhesive 1049, offering builders and industrial designers a sustainable, high-performance bonding solution. Delivered via a new portable, ergonomically engineered cylinder system from Worthington Enterprises, it enhances productivity while maintaining the quality that 3M customers expect.

- In September 2024, DELO developed DUALBOND EG4797, a microelectronics adhesive enabling ultra-fine structures within seconds. It supports heterogeneous integration, optical packaging, virtually any free-form structure, and the finest optical barriers, addressing the ongoing trend toward miniaturization in advanced device design

• In August 2024, Master Bond launched EP21ARHTND-2, a two-part epoxy adhesive designed to withstand prolonged chemical exposure. It cures at room temperature, with an optional post-cure at 150–200 °F, and provides excellent acid resistance, electrical insulation, high volume resistivity (>10 ohm-cm), and a dielectric strength of 440 V/mil.

- In June 2024, Avery Dennison launched new pressure-sensitive adhesive tapes for EV battery cell wrapping. Part of its EV battery functional tape portfolio, the products are engineered to address arcing challenges, enhancing safety and performance in electric vehicle battery packs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the acid resistant adhesive market based on the below-mentioned segments:

Global Acid Resistant Adhesive Market, By Product Type

- Epoxy

- Silicone

- Polyurethane

- Acrylic

- Others

Global Acid Resistant Adhesive Market, By Application

- Automotive

- Construction

- Electronics

- Aerospace

- Others

Global Acid Resistant Adhesive Market, By End-User

- Industrial

- Commercial

- Residential

- Others

Global Acid Resistant Adhesive Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the acid resistant adhesive market over the forecast period?The global acid resistant adhesive market is projected to expand at a CAGR of 5.9% during the forecast period.

-

2. What is the market size of the acid resistant adhesive market?The global acid resistant adhesive market size is expected to grow from USD 3.70 billion in 2024 to USD 6.95 billion by 2035, at a CAGR of 5.9% during the forecast period 2025-2035.

-

3. What is the acid resistant adhesive market?The acid resistant adhesive market is the global industry for specialized adhesives designed to withstand exposure to acids and other harsh chemicals.

-

4. Which region holds the largest share of the acid resistant adhesive market?Asia Pacific is anticipated to hold the largest share of the acid resistant adhesive market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global acid resistant adhesive market?3M Company, Henkel AG & Co. KGaA, Arkema S.A., H.B. Fuller, Sika AG, Huntsman Corporation, Illinois Tool Works Inc., Dow, Master Bond, Pelseal Technologies, and Others.

-

6. What factors are driving the growth of the acid resistant adhesive market?The growth of the acid-resistant adhesive market is driven by the expanding construction industry, increasing demand from the automotive sector for light weighting and improved performance, and a general shift towards advanced adhesives as replacements for mechanical fasteners.

-

7. What are the market trends in the acid resistant adhesive market?Market trends in acid-resistant adhesives include a shift towards eco-friendly and high-performance formulations, driven by stricter environmental regulations and demand from key industries such as chemical processing, construction, and automotive.

-

8. What are the main challenges restricting wider adoption of the acid resistant adhesive market?The main challenges restricting the wider adoption of the acid-resistant adhesive market include strict environmental regulations, high production costs, performance limitations under extreme conditions (especially high temperatures), the need for meticulous surface preparation, and volatility in the price and supply of raw materials.

Need help to buy this report?