Global Acetonitrile Market Size By Type (Derivative, Solvent), By Application (Agrochemical, Analytical Industry), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 - 2032

Industry: Chemicals & MaterialsGlobal Acetonitrile Market Insights Forecasts to 2032

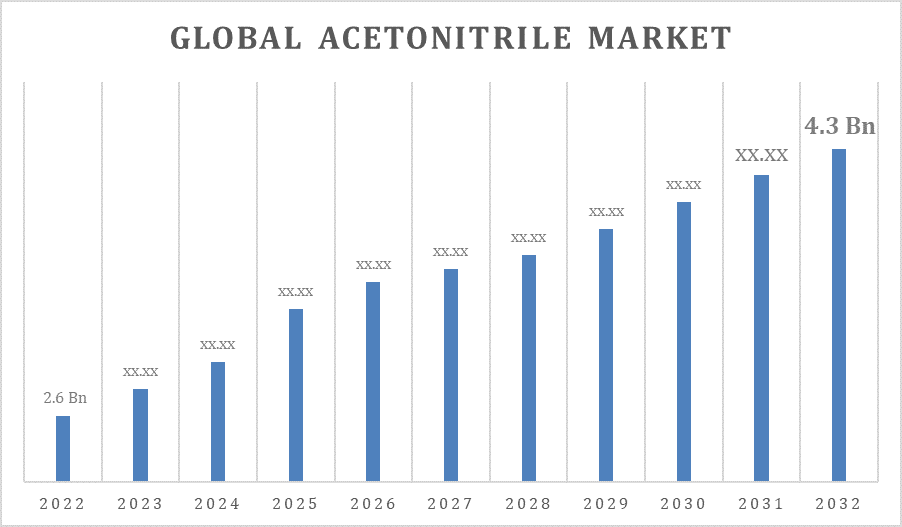

- The Acetonitrile Market Size was valued at USD 2.6 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.2% from 2022 to 2032

- The Global Acetonitrile Market is expected to reach USD 4.3 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Acetonitrile Market Size is expected to reach USD 4.3 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022 to 2032.

In the pharmaceutical industry, acetonitrile is an essential solvent, especially for the synthesis of active pharmaceutical ingredients (APIs). Acetonitrile demand is mostly influenced by the pharmaceutical industry's ongoing expansion, which is fueled by factors such as rising healthcare costs, R&D expenditures, and population increase worldwide. Acetonitrile is also necessary for the agricultural sector, which produces insecticides and herbicides. The desire for high-yield crops and the advancement of agricultural technology lead to a surge in the need for agrochemicals, including acetonitrile. Acetonitrile finds application in diverse chemical procedures, including the synthesis of intermediates and speciality compounds. The need for acetonitrile is increased by the expansion of the chemical manufacturing sector, which is fueled by innovation and industrial development.

Acetonitrile Market Value Chain Analysis

The supply of raw materials needed to produce acetonitrile is the first step in the value chain. Acrylonitrile and hydrogen usually react in the presence of a catalyst to form acetonitrile. The actual process of producing acetonitrile is the following step. This covers the chemical procedures needed to change raw materials into finished goods. At this point, the infrastructure and production units are quite important. Following production, acetonitrile must be supplied to a variety of end customers. Logistics, storage, and transportation are all involved in this. The cost and availability of acetonitrile on the market may be affected by how effectively this stage operates. Utilising acetonitrile by end-user industries is the last step in the value chain.

Acetonitrile Market Opportunity Analysis

The pharmaceutical industry's steady expansion on a global scale presents a chance for acetonitrile demand to rise. The market may be driven by pharmaceutical companies seeking to increase output or create new medications. The creation of novel and cutting-edge agrochemicals is changing the agricultural sector. Manufacturers of acetonitrile have the opportunity to work with agrochemical businesses to produce creative and efficient crop protection solutions. Providing end users with information regarding the distinct qualities and advantages of acetonitrile in various applications can raise awareness and increase demand.

Global Acetonitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 4.3 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | GREENFIELD GLOBAL INC., INEOS, Connect Chemicals, Secco.com.cn, Honeywell International Inc., Robinson Brothers, Hunan Chem. Europe B.V., Mitsubishi Chemical Corporation, Zibo Luzhong Chemical Light Industry Co., Ltd., Formosa Plastics Corp, Nova Molecular Technologies, Biosolve Chimie, Avantor, Inc., Asahi Kasei Corporation, Imperial Chemical Corporation, Alfa Aesar, Thermo Fisher Scientific Inc., GFS Chemicals, Inc., Jilin Provincial Chemicals Import & Export Co.,Ltd., Standard Reagents Pvt.Ltd, Tedia Company, TAEKWANG INDUSTRIAL CO.,LTD., Nantong Acetic Acid Chemical Co., Ltd., PetroChina Company Limited, and Others. |

| Growth Drivers: | Growing demand of acetonitrile from pharmaceutical production |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Acetonitrile Market Dynamics

Growing demand of acetonitrile from pharmaceutical production

Globally, the pharmaceutical industry is expanding quickly due to ageing populations, rising healthcare demands, and improvements in medical research. As more medications are created and introduced to the market, acetonitrile is required increasingly frequently as a vital ingredient in pharmaceutical production procedures. Acetonitrile demand has surged as a result of the trend of contract development and manufacturing organisations (CDMOs) handling pharmaceutical manufacturing outsourcing. These companies frequently work on specialised synthesis projects, and acetonitrile is essential to these operations. The rise in the production of specialty drugs, including biopharmaceuticals and complex molecules, often requires specialized solvents like acetonitrile. The diversification of pharmaceutical products and the trend toward personalized medicine contribute to the growing demand.

Restraints & Challenges

Acrylonitrile is one of the raw ingredients used in the production of acetonitrile; its price is subject to fluctuations. Price fluctuations for raw materials can have an effect on the total cost of manufacturing and, in turn, the dynamics of the market. The demand for acetonitrile from end-user sectors like agrochemicals and pharmaceuticals is strongly linked to the market. The demand for acetonitrile as a whole may change in response to changes in these industries or economic downturns. Acetonitrile is faced with competition from substitute solvents on the market. Competing solvents may influence the decisions made by producers and end users by providing comparable qualities or being more affordable. Like any other market, the acetonitrile industry is vulnerable to interruptions in the supply chain. The manufacturing and distribution of acetonitrile might be impacted by occurrences like natural disasters, geopolitical unrest, or international health crises. In the chemical sector, pricing competitiveness is a critical aspect. It might be difficult for manufacturers to maximise manufacturing costs while upholding quality standards. The prompt and economical supply of acetonitrile depends on good logistics and transportation. The market may be impacted by poor logistics infrastructure or transportation difficulties.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Acetonitrile market from 2023 to 2032. North America has a strong pharmaceutical sector, especially in the US. Acetonitrile is used in pharmaceutical production processes, such as the creation of pharmaceuticals and pharmaceutical intermediates, which drives the need for it in the region. Many different compounds can be produced using acetonitrile. The demand for acetonitrile is influenced by the general expansion and dynamics of the chemical sector in North America. Trade relations between North America and other regions have an impact on the import and export of chemicals, including acetonitrile. Trade agreements and policies may have an effect on acetonitrile's cost and availability. The market for acetonitrile is impacted by healthcare developments, such as the need for medications and biotechnology products. The demand for pharmaceutical-grade acetonitrile is influenced by the area's emphasis on healthcare and medical breakthroughs.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Rapid industrialization, particularly in nations like China and India, is a defining feature of the Asia Pacific area. Because acetonitrile is utilised in many different production processes, its demand is influenced by this increase in the industrial sector. Asia Pacific's chemical and pharmaceutical industries are among the biggest users of acetonitrile. Acetonitrile and other solvents are in high demand due to the region's status as a centre for the production of chemicals and pharmaceuticals. Asia Pacific's agriculture industry is a major market for acetonitrile, which is used in the manufacturing of agrochemicals. The need for fertilisers and crop protection chemicals drives up the demand for acetonitrile overall. The increasing population density in some Asia-Pacific nations raises consumer demand for pharmaceuticals, which in turn raises the need for acetonitrile in the production of drugs.

Segmentation Analysis

Insights by Type

The solvent segment accounted for the largest market share over the forecast period 2023 to 2032. In the pharmaceutical sector, acetonitrile is frequently employed as a solvent for the production of medications and pharmaceutical intermediates. The need for acetonitrile as a solvent is largely driven by the pharmaceutical industry's ongoing expansion, which is fueled by rising healthcare costs and drug discovery efforts. Acetonitrile is a multipurpose solvent that is used in many different chemical reactions, such as those that produce intermediates and speciality compounds. Acetonitrile's growth as a solvent is fueled by the expansion of the chemical industry and the need for solvents with certain qualities. Acetonitrile is used in extraction procedures, especially when different chemicals need to be separated and purified. Acetonitrile is a solvent that is used in petrochemical and natural product extraction industries. The acetonitrile market's solvent segment may expand due to developments in solvent technology and creative processes that call for particular solvents.

Insights by Application

Pharmaceutical segment is witnessing the fastest market growth over the forecast period 2023 to 2032. Acetonitrile is an essential solvent in the production of pharmaceuticals, especially when it comes to the formulation of pharmacological products and the synthesis of active pharmaceutical ingredients (APIs). Acetonitrile is essential to the pharmaceutical industry's ability to produce a large variety of medications effectively and efficiently. The ageing population, rising rates of chronic illnesses, and improvements in medical research have all contributed to the pharmaceutical industry's consistent expansion on a global scale. The increasing need for acetonitrile is directly correlated with the growth of the pharmaceutical industry. Pharmaceutical manufacture is increasingly being outsourced to custom synthesis suppliers and contract development and manufacturing organisations (CDMOs). Many of these organisations use acetonitrile in their operations, which adds to the market for pharmaceuticals.

Recent Market Developments

- In July 2019, with an installed capacity of 9,000 tonnes annually, Balaji Amines Limited commenced manufacture of acetonitrile.

Competitive Landscape

Major players in the market

- GREENFIELD GLOBAL INC.

- INEOS

- Connect Chemicals

- Secco.com.cn

- Honeywell International Inc.

- Robinson Brothers

- Hunan Chem. Europe B.V.

- Mitsubishi Chemical Corporation

- Zibo Luzhong Chemical Light Industry Co., Ltd.

- Formosa Plastics Corp

- Nova Molecular Technologies

- Biosolve Chimie

- Avantor, Inc.

- Asahi Kasei Corporation

- Imperial Chemical Corporation

- Alfa Aesar

- Thermo Fisher Scientific Inc.

- GFS Chemicals, Inc.

- Jilin Provincial Chemicals Import & Export Co.,Ltd.

- Standard Reagents Pvt.Ltd

- Tedia Company

- TAEKWANG INDUSTRIAL CO.,LTD.

- Nantong Acetic Acid Chemical Co., Ltd.

- PetroChina Company Limited

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Acetonitrile Market, Type Analysis

- Derivative

- Solvent

Acetonitrile Market, Application Analysis

- Agrochemical

- Analytical Industry

Acetonitrile Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Acetonitrile Market?The global Acetonitrile Market is expected to grow from USD 2.6 Billion in 2023 to USD 4.3 Billion by 2032, at a CAGR of 6.2% during the forecast period 2023-2032.

-

2.Who are the key market players of the Acetonitrile Market?Some of the key market players of market are GREENFIELD GLOBAL INC., INEOS, Connect Chemicals, secco.com.cn, Honeywell International Inc., Robinson Brothers, Hunan Chem. Europe B.V., Mitsubishi Chemical Corporation, Zibo Luzhong Chemical Light Industry Co., Ltd., Formosa Plastics Corp, Nova Molecular Technologies, Biosolve Chimie, Avantor, Inc., Asahi Kasei Corporation, Imperial Chemical Corporation, Alfa Aesar, Thermo Fisher Scientific Inc., GFS Chemicals, Inc., Jilin Provincial Chemicals Import & Export Co.,Ltd., Standard Reagents Pvt.Ltd, Tedia Company, TAEKWANG INDUSTRIAL CO.,LTD., Nantong Acetic Acid Chemical Co., Ltd. and PetroChina Company Limited.

-

3.Which segment holds the largest market share?Solvent segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Acetonitrile Market?North America is dominating the Acetonitrile Market with the highest market share.

Need help to buy this report?