Global Acetic Anhydride Market Size, Share, and COVID-19 Impact Analysis, By Application (Cellulose Acetate, Coating Materials, Plasticizers, Dyes & Pigments, Medicine Manufacturing, Agrochemicals, Flavors & Fragrances, and Others), By End User (Chemicals, Pharmaceuticals, Paints & Inks, Textiles, Agriculture, Food & Beverage, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Acetic Anhydride Market Size Insights Forecasts to 2035

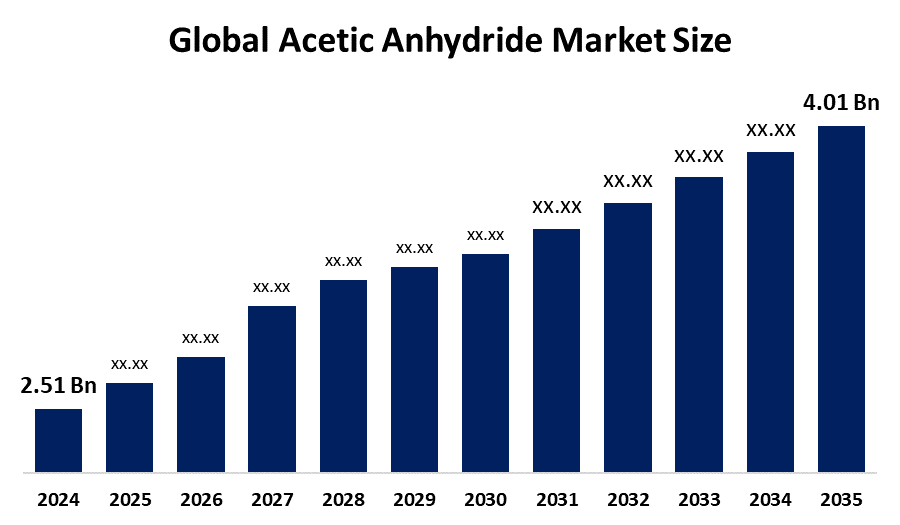

- The Global Acetic Anhydride Market Size Was Estimated at USD 2.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.35% from 2025 to 2035

- The Worldwide Acetic Anhydride Market Size is Expected to Reach USD 4.01 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Acetic Anhydride Market Size was worth around USD 2.51 Billion in 2024 and is predicted to Grow to around USD 4.01 Billion by 2035 with a compound annual growth rate (CAGR) of 4.35 % from 2025 to 2035. The market for acetic anhydride offers opportunities in the manufacturing of chemical intermediates, cellulose acetate, and pharmaceutical synthesis. Growth is driven by rising demand for adhesives, coatings, and expanding economies, as well as advancements in green chemistry and environmentally friendly production techniques.

Global Acetic Anhydride Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.51 Billion

- 2035 Projected Market Size: USD 4.01 Billion

- CAGR (2025-2035): 4.35%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The manufacture, distribution, and commercialization of acetic anhydride ((CH3CO)20), a crucial organic molecule used as an acetylation agent in chemical synthesis, are all included in the global ecosystem known as the acetic anhydride market. Mostly used to make cellulose acetate for films, textiles, and cigarette filters, acetylsalicylic acid (aspirin) and other active pharmaceutical ingredients (APIs); dyes, fragrances, and agrochemicals, and coatings and polymers, it supports a variety of industries, including plastics, textiles, and pharmaceuticals. According to Jubilant Ingrevia announced its 2023 launch of a 60,000 MT capacity plant in Gujarat, India, increasing output to 210,000 MT annually, while KBR announced acquiring Acetica technology for CO2 efficient, greener acetic acid production. The market for acetic anhydride is expanding rapidly due to its vital function as a bridge in numerous chemical synthesis procedures. The market for acetic anhydride has been driven by the increasing use of TAED in the laundry detergent sector. The market for acetic anhydride is mostly driven by the expanding demand from a variety of end-use sectors, such as chemical intermediates, cellulose acetate, and medicines.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the acetic anhydride market during the forecast period.

- In terms of application, the cellulose acetate segment is projected to lead the acetic anhydride market throughout the forecast period

- In terms of end user, the pharmaceuticals segment captured the largest portion of the market

Acetic Anhydride Market Trends

- The growing need for acetylation applications from the textile and pharmaceutical industries.

- Increasing focus on sustainable and eco-friendly production methods to lessen their negative effects on the environment.

- Product consumption is being driven by the growth of the chemical and agrochemical industries.

- Technological developments in production increase productivity and efficiency.

- Major firms can increase their market presence through strategic alliances and mergers.

- The growing use in the production of fragrances and food additives.

Report Coverage

This research report categorizes the acetic anhydride market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the acetic anhydride market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the acetic anhydride market.

Global Acetic Anhydride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.35% |

| 2035 Value Projection: | USD 4.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | SABIC, DuPont, Rhodia, BASF SE, Sipchem, BP Chemicals, Sasol Limited, PetroChina Ltd, Daicel Corporation, Jubilant Life Sciences, Celanese Corporation, Eastman Chemical Company, Luna Chemical Industries Pvt. Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The market for cellulose acetate is being fueled by increased use of acetic anhydride in its production, particularly in textile and filtering applications. Increased urbanization and industrialization, especially in Asia-Pacific rising nations, are driving up demand for specialized chemicals and high-performance materials, which in turn is driving up consumption of acetic anhydride. Through the manufacturing of cellulose acetate fibers, photographic films, and coatings, where acetic anhydride is used as a crucial acetylating agent, the textile and plastics sectors also support market expansion. Technological developments that facilitate increased production volumes and cost-effective operations, such as ongoing process enhancements and capacity expansions, further support market growth.

Restraining Factor

The market for acetic anhydride is limited by stringent environmental laws, concerns about handling hazardous chemicals, and high production costs. Furthermore, market expansion and industrial adoption are constrained by changes in the cost of raw materials and the availability of safer alternatives.

Market Segmentation

The global acetic anhydride market is divided into application and end user.

Global Acetic Anhydride Market, By Application:

- The cellulose acetate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the global acetic anhydride market is segmented into cellulose acetate, coating materials, plasticizers, dyes & pigments, medicine manufacturing, agrochemicals, flavors & fragrances, and others. Among these, the cellulose acetate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The widespread usage of cellulose acetate in the manufacture of textiles, photographic films, and cigarette filters is the main reason for the cellulose acetate segment. Developments in acetate fiber technologies and growing demand from emerging nations both contribute to the segment's expansion.

The medicine manufacturing segment in the acetic anhydride market is expected to grow at the fastest CAGR over the forecast period. The growing need for acetic anhydride, a crucial reagent in the synthesis of active pharmaceutical ingredients (APIs) and intermediates, is the main driver of the medicine manufacturing segment. Market demand has been further increased by growing pharmaceutical production, rising healthcare costs, and an increase in the prevalence of chronic illnesses.

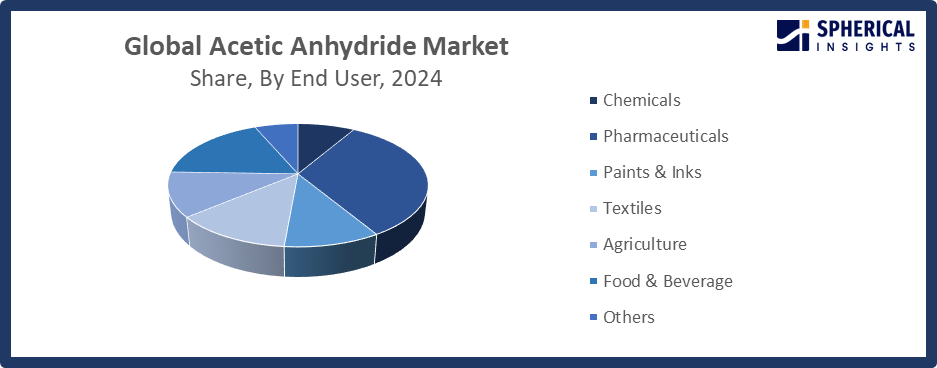

Global Acetic Anhydride Market, By End User:

- The pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end user, the global acetic anhydride market is segmented into chemicals, pharmaceuticals, paints & inks, textiles, agriculture, food & beverage, and others. Among these, the pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The compound's widespread use in the synthesis of active pharmaceutical ingredients (APIs) and intermediates, which are crucial for medication formulation and manufacture, is the main reason for the pharmaceuticals segment. The segment's position has been further reinforced by the ongoing growth of the global healthcare industry, rising demand for generic medications, and improvements in pharmaceutical production techniques.

Get more details on this report -

The food & beverage segment in the acetic anhydride market is expected to grow at the fastest CAGR over the forecast period. The growing use of acetic anhydride in the production of flavoring agents, preservatives, and other food additives that improve product quality and shelf life is the main factor driving the expansion of the Food & Beverage segment.

Regional Segment Analysis of the Global Acetic Anhydride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Acetic Anhydride Market Trends

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global acetic anhydride market over the forecast period.

Due to the pollution levels from industrial activity, the region has seen an increase in health problems, such as fever, cough and cold, body aches, nausea, etc. The region's market dynamics are being improved by an increase in investment in chemical manufacturing. Haldia Petrochemicals Ltd. declared in 2023 that it will invest US$359.0 million to establish new units in West Bengal, India. Additionally, the Asia-Pacific laundry and cleaning industry has grown as a result of growing concerns about cleanliness and hygiene, which is expected to promote the expansion of the acetic anhydride market over the projection period.

China Acetic Anhydride Market Trends

The nation is a global provider of acetyl derivatives due to its interconnected chemical clusters, which allow for economical production. While excess production is being exported, increased output in high-performance coatings and pharmaceuticals is increasing local use. Operating efficiency are increasing as a result of strategic investments in waste reduction and process automation. Competitiveness is further enhanced by government initiatives promoting the modernization of the chemical industry.

India Acetic Anhydride Market Trends

The nation has become a key hub for the production of APIs (active pharmaceutical ingredients), of which acetic anhydride is an essential step. The textile sector is also seeing a rise in demand for acetate fibers for usage in clothing and film packaging. In order to comply with safety regulations, businesses are investing in specialized facilities for prohibited chemicals. Value-added chemical exports are growing due to government incentives.

North America Acetic Anhydride Market Trends

North America is expected to grow at the fastest CAGR in the acetic anhydride market during the forecast period.

The region enjoys the advantages of a strong infrastructure for chemical manufacture that is backed by cutting-edge technological capabilities and active R&D projects. The market demand is also greatly influenced by North America's robust presence in the textile, coating, and plastics sectors, where acetic anhydride is used for the synthesis of cellulose acetate and other chemical processes. Carbon footprints are decreased and operational efficiency is increased when government assistance for chemical manufacture is combined with investments in environmentally friendly and sustainable production methods.

U.S Acetic Anhydride Market Trends

The market for acetic anhydride in the United States is undergoing significant changes due to improvements in production methods, new regulations, and changing industrial uses. The requirement for cellulose acetate, a crucial use of acetic anhydride, is increasing due to the desire for eco-friendly materials and biodegradable polymers. Cellulose acetate is being used more and more by the packaging, textile, and filter industries as a result of pressure to reduce plastic waste.

Canada Acetic Anhydride Market Trends

Industry diversification, regulatory frameworks, and environmental measures are all having a significant on the Canadian acetic anhydride market. Since acetic anhydride is a regulated chemical precursor, Canadian authorities have tightened their supervision over it. Tighter supply chain security, documentation, and monitoring are required by new compliance frameworks. As a regulated chemical precursor, acetic anhydride has been subject to increased regulation by Canadian authorities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global acetic anhydride market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Acetic Anhydride Market Include

- SABIC

- DuPont

- Rhodia

- BASF SE

- Sipchem

- BP Chemicals

- Sasol Limited

- PetroChina Ltd

- Daicel Corporation

- Jubilant Life Sciences

- Celanese Corporation

- Eastman Chemical Company

- Luna Chemical Industries Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In April 2024, Eastman Chemical Company announced an off-list price increase of $0.05 per pound (approximately $0.11 per kilogram) for its acetic anhydride (Sales Grade) across North and Latin America. The company stated the adjustment reflects rising input costs and market conditions, ensuring continued alignment with industry pricing and supply dynamics.

- In March 2024, Celanese Corporation launched a new 1.3 million-ton per year acetic acid plant at its Clear Lake, Texas facility, enhancing its acetyl chain operations while establishing one of the lowest-cost, lowest-carbon footprint acetic acid plants globally.

- In February 2024, Celanese Corporation launches ECO-CC low-carbon acetic acid after approval as a U.S. DOE UPGrants vendor, positioning the company to provide sustainable, circular solutions and support municipalities in meeting growing demand for environmentally responsible chemical products.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the acetic anhydride market based on the following segments:

Global Acetic Anhydride Market, By Application

- Cellulose Acetate

- Coating Materials

- Plasticizers

- Dyes & Pigments

- Medicine Manufacturing

- Agrochemicals

- Flavors & Fragrances

- Others

Global Acetic Anhydride Market, By End User

- Chemicals

- Pharmaceuticals

- Paints & Inks

- Textiles

- Agriculture

- Food & Beverage

- Others

Global Acetic Anhydride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the acetic anhydride market over the forecast period?The global acetic anhydride market is projected to expand at a CAGR of 4.35% during the forecast period.

-

2. What is the market size of the acetic anhydride market?The global acetic anhydride market size is expected to grow from USD 2.51 billion in 2024 to USD 4.01 billion by 2035, at a CAGR 4.35% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the acetic anhydride market?Asia Pacific is anticipated to hold the largest share of the acetic anhydride market over the predicted timeframe.

-

4. Who are the top companies operating in the global acetic anhydride market?SABIC, DuPont, Rhodia, BASF SE, Sipchem, BP Chemicals, Sasol Limited, PetroChina Ltd, Daicel Corporation, Jubilant Life Sciences, Celanese Corporation, Eastman Chemical Company, Luna Chemical Industries Pvt. Ltd., and Others.

-

5. What factors are driving the growth of the acetic anhydride market?The acetic anhydride market growth is driven by rising demand in pharmaceuticals, cellulose acetate production, agrochemicals, and polymers, alongside increasing industrialization and expanding applications in emerging economies.

-

6. What are market trends in the acetic anhydride market?Technological developments, environmentally friendly production techniques, rising demand for high-purity grades, strategic mergers and acquisitions, and expanding use in the pharmaceutical and food additive manufacturing industries are some of the market trends.

-

7. What are the main challenges restricting wider adoption of the acetic anhydride market?Strict environmental laws, health and safety issues, high production costs, volatile raw material prices, and the scarcity of sustainable feedstocks limiting wider market acceptance are some of the main challenges.

Need help to buy this report?