Global 5G Satellite Communication Market Size, Share, and COVID-19 Impact Analysis, By Orbit (Geostationary Earth Orbit (GEO), Medium Earth Orbit (MEO), Lower Earth Orbit (LEO), and Others), By Application (Government, Defense, and Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal 5G Satellite Communication Market Insights Forecasts to 2035

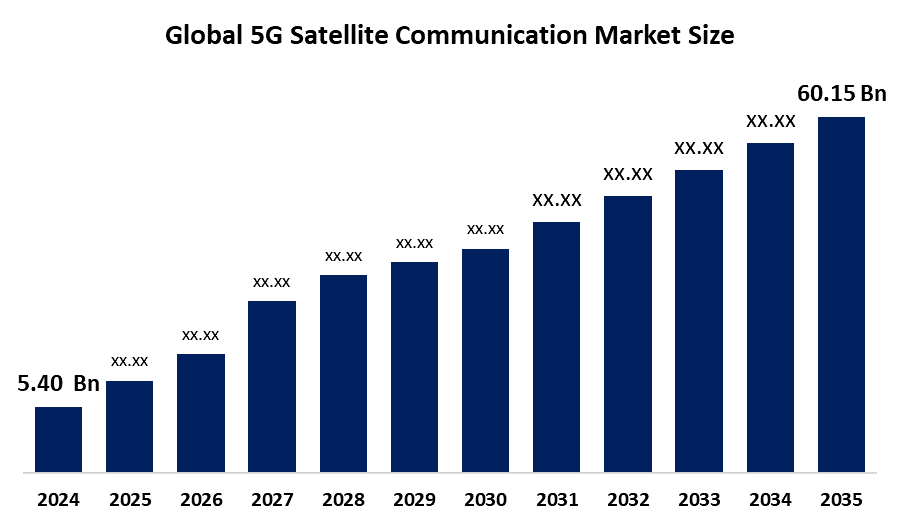

- The Global 5G Satellite Communication Market Size Was Estimated at USD 5.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 24.5 % from 2025 to 2035

- The Worldwide 5G Satellite Communication Market Size is Expected to Reach USD 60.15 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global 5G Satellite Communication Market Size was valued at USD 5.40 Billion in 2024 and is predicted to grow to around USD 60.15 Billion by 2035 with a compound annual growth rate (CAGR) of 24.5 % from 2025 to 2035. Opportunities for increased global connectivity, improved rural coverage, IoT integration, robust networks, defense applications, disaster recovery, and smooth interaction with terrestrial 5G infrastructures are all identified by the 5G satellite communication market.

Market Overview

The global ecosystem of technology, services, infrastructure, and stakeholders engaged in providing fifth-generation (5G) communication capabilities via satellite-based networks is referred to as the 5G satellite communication market. The smooth integration of fifth-generation (5G) cellular networks with satellite systems, which enables non-terrestrial networks (NTN) to provide ubiquitous, high-speed connections beyond conventional terrestrial infrastructure, is included in the 5G satellite communication market. Together with T-Mobile's commercial direct-to-device (D2D) messaging rollout, innovations include 3GPP Release 17 standards for satellite-based 5G New Radio (NR) and narrowband IoT. For instance, in January 2025, ESA and Telesat launched a world-first 5G satellite communication milestone, enabling direct 5G NTN connectivity from ground to LEO spacecraft using Ka-band frequencies, advancing non-geostationary 5G networks globally for the future. Strong government spending in space and defense technologies, rising need for high-speed connectivity in rural and isolated areas, quick adoption of autonomous systems and the Internet of Things (IoT), and substantial research and development (R&D) are the main factors driving the 5G satellite communication market in the region. The growing need for high-speed connectivity in isolated and underserved areas is driving the growth of the global 5G satellite communication market.

Report Coverage

This research report categorizes the 5G satellite communication market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 5G satellite communication market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the 5G satellite communication market.

Global 5G Satellite Communication Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 24.5% |

| 2035 Value Projection: | USD 60.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Orbit, By Application |

| Companies covered:: | Avanti Technology, Clutch Space Systems, Gilat Satellite Networks Ltd., Inmarsat, Intelsat S.A., Kuiper Systems, Myriota, Omnispace LLC, Sateliot, SES S.A., Skyloom, ST Engineering, Starlink (SpaceX), Thales Group and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing defense and military applications, like secure communications and surveillance, are driving investment and market expansion. The market for 5G satellite communication is driven by a number of factors, including defense requirements, low latency services, network resilience, IoT expansion, rural connectivity, global coverage, and integration with terrestrial 5G infrastructures. Due to continuous advancements in satellite technology and increased R&D spending by large corporations, the 5G satellite communication industry is growing. The market is expanding due to the increasing demand for secure military-grade communications, which is driving investments in the defense sector. Additionally, the development of smart cities and autonomous transportation systems calls for reliable satellite-based 5G connections, which are propelling satellite communication market growth.

Restraining Factors

High deployment and launch costs, complicated regulatory frameworks, difficulties allocating spectrum, latency restrictions, difficulties integrating with terrestrial networks, and worries about satellite lifespan, space debris, and long-term sustainability are all factors restricting the 5G satellite communication market.

Market Segmentation

The 5G satellite communication market share is classified into Orbit and end user.

- The lower earth orbit segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the orbit, the 5G satellite communication market is divided into geostationary earth orbit (GEO), medium earth orbit (MEO), lower earth orbit (LEO), and others. Among these, the lower earth orbit segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. LEO satellites are ideal for applications needing lower earth orbit transfer, such as Internet of Things (IoT) networks, broadband services in rural areas, and defense communications, since they provide low-latency, high-speed connectivity. Market adoption has been further strengthened by the growing deployment of LEO satellite constellations by top providers, as well as by falling launch costs and favorable regulatory environments.

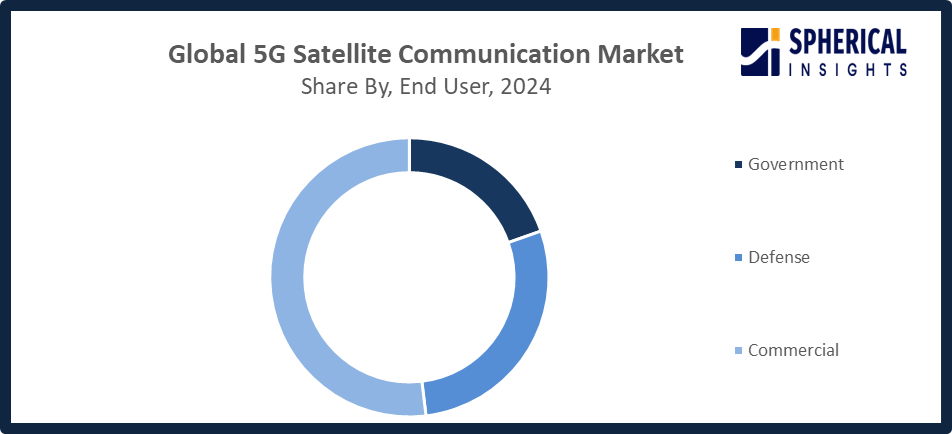

- The commercial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the 5G satellite communication market is divided into government, defense, and commercial. Among these, the commercial segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growing investments from commercial operators, technological developments in satellite networks, and the convergence of satellite and terrestrial 5G infrastructures to provide scalable, dependable, and low-latency communication services all contribute to the commercial segment's expansion.

Get more details on this report -

Regional Segment Analysis of the 5G Satellite Communication Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the 5G satellite communication market over the predicted timeframe.

North America is anticipated to hold the largest share of the 5G satellite communication market over the predicted timeframe. The primary factors driving demand in the region are robust government initiatives, technological developments, and the expanding need for high-speed connectivity. North America is driven by early adoption of state-of-the-art communication technology and large investments in satellite infrastructure and space. The existence of significant satellite operators, telecom corporations, and tech firms actively creating and implementing 5G Non-Terrestrial Network technologies is advantageous to the area. In October 2025, the U.S. Federal Communications Commission (FCC) led significant government initiatives, announcing "Space Month" to update satellite licensing processes, do away with the need for surety bonds for geostationary orbits, and suggest increased mid-band spectrum access for 5G and 6G services, enabling mega-constellations and increased bandwidth.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the 5G satellite communication market during the forecast period. The significant need for satellite-enabled 5G solutions because the region has a number of growing and emerging economies with spotty terrestrial network coverage. Increasing governmental and commercial investment in satellite launches, space programs, and telecommunications infrastructure are important growth driver. The government's efforts to improve broadband accessibility and strengthen national communication capabilities also support market growth. In order to improve Asia-Pacific space cooperation and increase orbital capacity for 5G-enabled internet, Japan and New Zealand launched a communications satellite together in December 2025.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 5G satellite communication market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Avanti Technology

- Clutch Space Systems

- Gilat Satellite Networks Ltd.

- Inmarsat

- Intelsat S.A.

- Kuiper Systems

- Myriota

- Omnispace LLC

- Sateliot

- SES S.A.

- Skyloom

- ST Engineering

- Starlink (SpaceX)

- Thales Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, China announced the launch of a commercial satellite IoT trial to enhance the 5G satellite communication market, supporting emerging industries like commercial aerospace and the low-altitude economy.

- In October 2025, India launched plans to rapidly deploy a nationwide satellite communication network, aiming to match the speed and success of its 5G rollout, announced Union Minister for Communications Jyotiraditya Scindia.

- In September 2025, Capgemini, Thales, and Thales Alenia Space launched an innovative 5G satellite communication project under France 2030, demonstrating direct-to-device (D2D) connectivity as selected by the French Space Agency (CNES).

- In March 2025, Thuraya launched its hybrid 5G-satellite smartphone, Thuraya One, enabling direct-to-device connectivity via 5G, 4G terrestrial networks, and the recently launched Thuraya 4 satellite.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 5G satellite communication market based on the below-mentioned segments:

Global 5G Satellite Communication Market, By Orbit

- Geostationary Earth Orbit (GEO)

- Medium Earth Orbit (MEO)

- Lower Earth Orbit (LEO)

- Others

Global 5G Satellite Communication Market, By End User

- Government

- Defense

- Commercial

Global 5G Satellite Communication Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 5G satellite communication market over the forecast period?The global 5G satellite communication market is projected to expand at a CAGR of 24.5% during the forecast period.

-

2. What is the market size of the 5G satellite communication market?The global 5G satellite communication market size is expected to grow from USD 5.40 billion in 2024 to USD 60.15 billion by 2035, at a CAGR of 24.5 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the 5G satellite communication market?North America is anticipated to hold the largest share of the 5G satellite communication market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global 5G satellite communication market?Avanti Technology, Clutch Space Systems, Gilat Satellite Networks Ltd., Inmarsat, Intelsat S.A., Kuiper Systems, Myriota, Omnispace LLC, Sateliot, SES S.A., Skyloom, ST Engineering, Starlink (SpaceX), Thales Group, and Others.

-

5. What factors are driving the growth of the 5G satellite communication market?The 5G satellite communication market is driven by demand for global connectivity, rural coverage, IoT expansion, low-latency services, network resilience, defense applications, and integration with terrestrial 5G infrastructures.

-

6. What are the market trends in the 5G satellite communication market?Key trends include deployment of low Earth orbit satellite constellations, 5G Non-Terrestrial Network standardization, increasing IoT integration, public-private partnerships, cloud-based services, and convergence of satellite and terrestrial 5G networks.

-

7. What are the main challenges restricting the wider adoption of the 5G satellite communication market?Challenges include high deployment and launch costs, complex regulatory frameworks, spectrum allocation limitations, latency concerns, technical integration difficulties with terrestrial networks, satellite lifespan constraints, and risks related to space debris.

-

1. What is the CAGR of the 5G satellite communication market over the forecast period?The global 5G satellite communication market is projected to expand at a CAGR of 24.5% during the forecast period.

-

2. What is the market size of the 5G satellite communication market?The global 5G satellite communication market size is expected to grow from USD 5.40 billion in 2024 to USD 60.15 billion by 2035, at a CAGR of 24.5 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the 5G satellite communication market?North America is anticipated to hold the largest share of the 5G satellite communication market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global 5G satellite communication market?Avanti Technology, Clutch Space Systems, Gilat Satellite Networks Ltd., Inmarsat, Intelsat S.A., Kuiper Systems, Myriota, Omnispace LLC, Sateliot, SES S.A., Skyloom, ST Engineering, Starlink (SpaceX), Thales Group, and Others.

-

5. What factors are driving the growth of the 5G satellite communication market?The 5G satellite communication market is driven by demand for global connectivity, rural coverage, IoT expansion, low-latency services, network resilience, defense applications, and integration with terrestrial 5G infrastructures.

-

6. What are the market trends in the 5G satellite communication market?Key trends include deployment of low Earth orbit satellite constellations, 5G Non-Terrestrial Network standardization, increasing IoT integration, public-private partnerships, cloud-based services, and convergence of satellite and terrestrial 5G networks.

-

7. What are the main challenges restricting the wider adoption of the 5G satellite communication market?Challenges include high deployment and launch costs, complex regulatory frameworks, spectrum allocation limitations, latency concerns, technical integration difficulties with terrestrial networks, satellite lifespan constraints, and risks related to space debris.

Need help to buy this report?