Global 4-Octylphenol Market Size, Share, and COVID-19 Impact Analysis, By Type (99% Purity, and 99.5% Purity), By Application (Resin, Surfactant, Chemical Intermediate, Pesticides, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal 4-Octylphenol Market Insights Forecasts to 2035

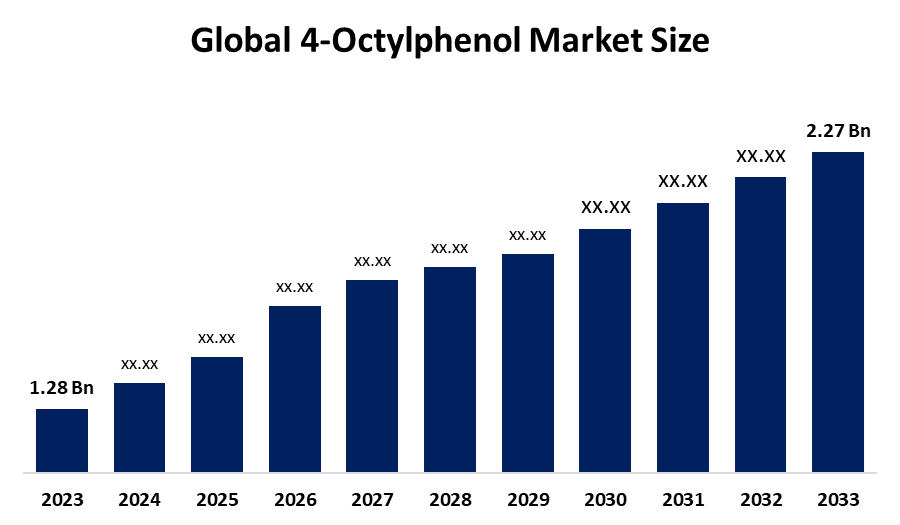

- The Global 4-Octylphenol Market Size Was Estimated at USD 1.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.35 % from 2025 to 2035

- The Worldwide 4-Octylphenol Market Size is Expected to Reach USD 2.27 Billion by 2035

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global 4-Octylphenol Market Size was valued at around USD 1.28 Billion in 2024 and is Predicted to Grow to around USD 2.27 Billion by 2035 with a compound annual growth rate (CAGR) of 5.35 % from 2025 to 2035. The growing need for specialty chemicals and environmentally friendly manufacturing methods, the 4-Octylphenol market offers opportunities in industrial applications such as the production of resin and plastic, coatings, and adhesives.

Market Overview

The commerce, manufacturing, and consumption of 4-Octylphenol, a chemical substance mostly utilized as an intermediary in the production of phenolic resins, detergents, coatings, adhesives, and plastic stabilizers, are together referred to as the 4-Octylphenol market. Its characteristics of being hydrophobic and wetting make it a crucial ingredient to be used in formulation for detergents, industrial cleaners, plastic stabilizers, agrochemicals, and personal care products. By para-substituting phenol with a 1,1,3,3-tetramethylbutyl group, 4-Octylphenol is produced. The entire process of obtaining raw materials, chemical synthesis, formulation, distribution, and marketing of 4-Octylphenol to several businesses with diverse applications is limited to this market. A finalized Toxic Substances Control Act (TSCA) Section 8(d) rule was announced by the U.S. Environmental Protection Agency (EPA) and will go into effect after 2024. This rule requires the submission of unpublished health and safety data for 4-tert-octylphenol, one of 16 priority chemicals, by March 18. The rule addresses endocrine-disrupting potentials such as kidney inflammation and reproductive toxicity. The growing use of 4-Octylphenol as an intermediate in the manufacturing of phenolic resins, adhesives, coatings, and plastic stabilizers, all of which are crucial for the consumer goods, construction, and automotive industries, is one of the main factors driving the market.

Report Coverage

This research report categorizes the 4-Octylphenol market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 4-Octylphenol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the 4-Octylphenol market.

Global 4-Octylphenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.35% |

| 2035 Value Projection: | USD 1.28 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type |

| Companies covered:: | Solvay S.A., Sasol Limited, PCC Group, Mitsui Chemicals Inc., Leap Chem Co. Ltd., LG Chem Ltd., Kumho P&B Chemicals Inc., INEOS Group Holdings S.A., ExxonMobil Chemical Company, DIC Corporation, Dow Chemical Company, Chevron Phillips Chemical Company, BASF SE, SI Group, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing consumption of 4-Octylphenol in phenolic resins, stabilizers, and modifiers for polymers in industries like coatings, adhesives, and plastics is one of the main factors driving the market. New inventions in chemical synthesis and formulation methods give more power to the existing products while cutting down the cost of production which in turn helps to expand the market. Stricter regulatory frameworks that emphasize the use of sustainable and eco-friendly chemicals have made it easier for manufacturers to switch to new production technologies, thereby accelerating the use of 4-Octylphenol in eco-friendly applications. Besides, the demand from the industry, the upcoming technology, and the sustainability are the powerful drivers supporting the 4-Octylphenol market.

Restraining Factors

Strict environmental restrictions, growing concerns about chemical toxicity, high production costs, and the availability of safer, eco-friendly alternatives all provide challenges to the 4-Octylphenol market, limiting its adoption and impeding its expansion across a variety of industries.

Market Segmentation

The 4-Octylphenol market share is classified into type and application.

- The 99% purity segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the 4-Octylphenol market is divided into 99% purity and 99.5% purity. Among these, the 99% purity segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Manufacturers choose the 99% purity sector because it is widely used in the manufacturing of phenolic resins, adhesives, coatings, and plastic stabilizers. Its adoption is also anticipated to be fueled by rising demand in the consumer products, construction, and automotive industries.

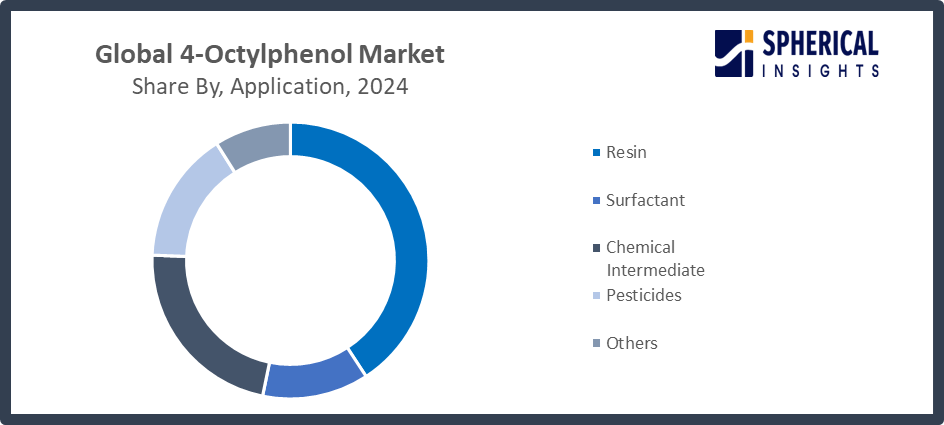

- The resin segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the 4-Octylphenol market is divided into resin, surfactant, chemical intermediate, pesticides, and others. Among these, the resin segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The crucial function it plays in creating high-performance phenolic resins and coatings is what propels the resin industry. Key drivers of market expansion include growing industrialization, increase in end-use industries such consumer products, construction, and automobiles, and rising demand for long-lasting, premium resins.

Get more details on this report -

Regional Segment Analysis of the 4-Octylphenol Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the 4-Octylphenol market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the 4-Octylphenol market over the predicted timeframe. 4-Octylphenol is used extensively in the manufacturing of phenolic resins, adhesives, coatings, and plastic stabilizers in end-use sectors like consumer goods, automotive, construction, and plastics in nations like China, India, and Japan. In January 2025, China's Ministry of Ecology and Environment (MoE) introduced a simplified registration exemption for low-tonnage novel chemicals (0.1–1 ton), reducing compliance costs and promoting chemical processing innovation. Simultaneously, in March 2025, Japan's Ministry of Health, Labour and Welfare (MHLW) announced that 157 compounds had been added to the New Compounds List, improving safety procedures and promoting sustainable formulations in the 4-Octylphenol market.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the 4-Octylphenol market during the forecast period. The development of cutting-edge chemical manufacturing technologies and the growing demand from end-use industries are the main drivers in North America. Innovation and sustainable chemical production are encouraged by the region's robust research and development skills, well-established industrial infrastructure, and supportive regulatory frameworks. Important advancements include the introduction of affordable, high-performance rubber processing grades by Prasol Chemicals Ltd. in 2025 and the industry-wide implementation of Industry 4.0 technology, such as AI-optimized reactors to reduce emissions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 4-Octylphenol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay S.A.

- Sasol Limited

- PCC Group

- Mitsui Chemicals Inc.

- Leap Chem Co. Ltd.

- LG Chem Ltd.

- Kumho P&B Chemicals Inc.

- INEOS Group Holdings S.A.

- ExxonMobil Chemical Company

- DIC Corporation

- Dow Chemical Company

- Chevron Phillips Chemical Company

- BASF SE

- SI Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 4-Octylphenol market based on the below-mentioned segments:

Global 4-Octylphenol Market, By Type

- 99% Purity

- 99.5% Purity

Global 4-Octylphenol Market, By Application

- Resin

- Surfactant

- Chemical Intermediate

- Pesticides

- Others

Global 4-Octylphenol Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 4-Octylphenol market over the forecast period?The global 4-Octylphenol market is projected to expand at a CAGR of 5.35% during the forecast period

-

2. What is the market size of the 4-Octylphenol market?The global 4-Octylphenol market size is expected to grow from USD 1.28 billion in 2024 to USD 2.27 billion by 2035, at a CAGR of 5.35 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the 4-Octylphenol market?Asia Pacific is anticipated to hold the largest share of the 4-Octylphenol market over the predicted timeframe

-

4. Who are the top companies operating in the global 4-Octylphenol market?Solvay S.A., Sasol Limited, PCC Group, Mitsui Chemicals Inc., Leap Chem Co. Ltd., LG Chem Ltd., Kumho P&B Chemicals Inc., INEOS Group Holdings S.A., ExxonMobil Chemical Company, DIC Corporation, Dow Chemical Company, Chevron Phillips Chemical Company, BASF SE, SI Group, and Others

-

5. What factors are driving the growth of the 4-Octylphenol market?Growing industrial applications in resins, adhesives, coatings, and plastics, as well as growing demand for specialty chemicals, technological improvements, and an increasing emphasis on sustainable manufacturing solutions, are driving the 4-Octylphenol market.

-

6. What are the market trends in the 4-Octylphenol market?Adoption of environmentally acceptable chemical substitutes, greater use in high-performance industrial applications, regional production growth, and strategic partnerships among international chemical producers are some of the major trends in the 4-Octylphenol market.

-

7. What are the main challenges restricting the wider adoption of the 4-Octylphenol market?Strict environmental restrictions, worries about chemical toxicity, expensive production costs, and the availability of safer, sustainable alternatives all limit market growth and prevent widespread adoption across many industrial sectors.

Need help to buy this report?