Global 3D Printing Service Bureau Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Prototyping, Production, Design, and Others), By Technology (Fused Deposition Modeling, Stereolithography, Selective Laser Sintering, PolyJet, and Others), By Application (Aerospace & Defense, Automotive, Healthcare, Consumer Products, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal 3D Printing Service Bureau Market Insights Forecasts to 2035

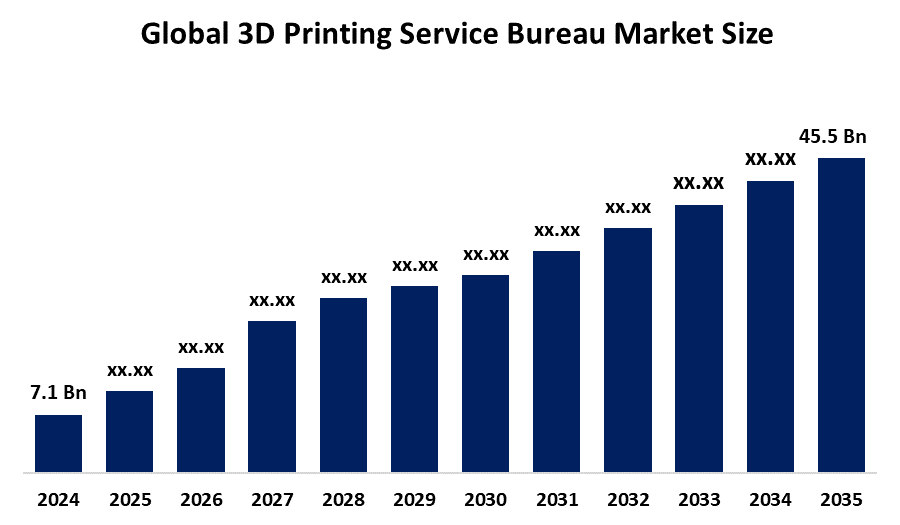

- The Global 3D Printing Service Bureau Market Size Was Estimated at USD 7.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.4% from 2025 to 2035

- The Worldwide 3D Printing Service Bureau Market Size is Expected to Reach USD 45.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global 3D printing service bureau market size was worth around USD 7.1 billion in 2024 and is predicted to grow to around USD 45.5 billion by 2035 with a compound annual growth rate (CAGR) of 18.4% from 2025 to 2035. The 3D printing service bureau sector expands due to increased demand for prototyping, personalized and small-batch production, innovations in printing technology, integration of Industry 4.0 and the requirement for economical, adaptable and eco-friendly manufacturing options across various industries.

Market Overview

The worldwide 3D printing service bureau market defines the sector offering additive manufacturing services, allowing companies to create prototypes, tailor-made parts and limited production batches without the need to invest in their own 3D printing facilities. These service providers cater to sectors such as automotive, aerospace, healthcare, consumer products and industrial machinery, providing access to innovative technologies such as polymer, metal and composite 3D printing. Market expansion is fueled by the rising need for prototyping, personalized products, faster market entry and minimized material wastage. Progress in printing technologies, the growing uptake of Industry 4.0 and the increasing demand for adaptable and eco-friendly manufacturing options create substantial prospects for service providers.

Emerging markets present growth opportunities as companies relocate manufacturing to lower investment costs. Key players such as 3D Systems, Stratasys, Materialise, Protolabs, Sculpteo and Shapeways are enhancing technologies and fostering innovations to address increasing needs. In November 2025, the European Union committed than €600 million via Horizon Europe to back printing research and development. The UK’s £38 million DECSAM initiative, in collaboration with ASTM and Airbus, is improving metal L-PBF processes for eco-aircraft components. ASTM presented this, along with six international additive manufacturing projects, at Formnext 2025.

Report Coverage

This research report categorizes the 3D printing service bureau market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 3D printing service bureau market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the 3D printing service bureau market.

3D Printing Service Bureau Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.1 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 18.4% |

| 2035 Value Projection: | USD 45.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Technology ,By Region |

| Companies covered:: | 3D Systems, Materialise, Protolabs, Stratasys, EOS GmbH, HP Inc, Formlabs, Sculpteo, Voxeljet, Markforged, SLM Solutions, Xometry, GE Additive, Shapeways, Others, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for printing service bureaus is propelled by increasing needs for fast prototyping, tailor-made manufacturing and affordable small-scale production in sectors like automotive, aerospace, healthcare and consumer products. Progress in printing technology involving metal, polymer and composite materials allows for highly accurate, intricate designs that shorten time to market and minimize material waste. The move toward fabrication and the embrace of Industry 4.0 continue to drive market expansion with businesses opting to outsource printing services to cut down on capital costs tied to in-house machinery. Growing recognition of sustainability advantages, production adaptability and the surge in on-demand manufacturing options also play roles in boosting growth in this industry.

Restraining Factors

The 3D printing service bureau market faces restraints from high equipment and material costs, limited awareness of advanced printing capabilities, and technical challenges in scaling production for large volumes. Additionally, intellectual property concerns, inconsistent quality standards, and post-processing requirements can hinder widespread adoption and market growth.

Market Segmentation

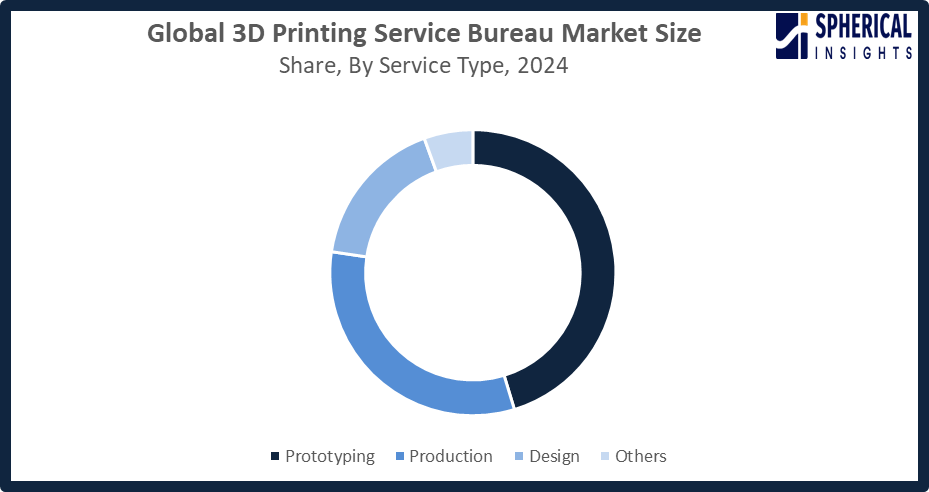

The 3D printing service bureau market share is classified into service type, technology, and application.

- The prototyping segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the service type, the 3D printing service bureau market is divided into prototyping, production, design, and others. Among these, the prototyping segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Prototyping serves as the step for companies embracing manufacturing, allowing for quick iterations, design verification and economic development. This need is particularly pronounced in the aerospace and consumer electronics sectors, where swift innovation is crucial. Service bureaus are broadening their range of materials. Enhancing design, to-print processes to address the increasing complexity of prototyping demands.

Get more details on this report -

- The fused deposition modeling segment accounted for the largest share in 2024, approximately 32% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the 3D printing service bureau market is divided into fused deposition modeling, stereolithography, selective laser sintering, polyJet, and others. Among these, the fused deposition modeling segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Fused Deposition Modeling (FDM) is a 3D printing technique due to its cost-effectiveness, flexibility and ability to handle diverse thermoplastic materials. Commonly used for prototyping and functional testing, FDM offers production times and economical use of materials. Its widespread availability makes it an essential offering for agencies catering to clients.

- The aerospace & defense segment accounted for the highest market revenue in 2024, approximately 27% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the 3D printing service bureau market is divided into aerospace & defense, automotive, healthcare, consumer products, industrial, and others. Among these, the aerospace & defense segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Aerospace manufacturers depend on service bureaus for lightweight, high-performance parts, rapid prototyping, and tooling, with strict quality and regulatory standards driving demand for advanced materials and precision. In automotive, 3D printing supports prototyping, functional testing, and the growing production of end-use components, including brackets, housings, and interior parts.

Regional Segment Analysis of the 3D Printing Service Bureau Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the 3D printing service bureau market over the predicted timeframe.

North America is anticipated to hold the largest share of the 3D printing service bureau market over the predicted timeframe. North America is projected to have a 38% market share of the printing service bureau market, fueled by substantial industrial uptake, sophisticated manufacturing facilities and significant research and development funding. The U.S. Spearheads this with aerospace, automotive and healthcare industries applying 3D printing for prototypes, tooling and final parts. Canada plays a role through research projects and government-supported additive manufacturing initiatives. Favourable regulations, established service bureaus and technical know-how boost the market's expansion. In June 2024, America Makes initiated its Open Project Call, providing $2.1 million from the U.S. Department of Defense to boost manufacturing for defense and commercial uses across the country.

Asia Pacific is expected to grow at a rapid CAGR in the 3D printing service bureau market during the forecast period. The region is projected to account for a 27% share of market growth, driven by fast industrial expansion, growing production industries, and increasing adoption of innovative manufacturing technologies. China leads the region with strong investments in additive manufacturing across the automotive, aerospace, and healthcare sectors. Japan and South Korea further contribute through technological advancements and high-quality manufacturing, while India’s expanding industrial base and government support for digital manufacturing accelerate market growth. Rising demand for cost-effective prototyping and production continues to drive the market across APAC.

The 3D printing service bureau market in Europe is also expanding steadily, supported by a well-established industrial foundation, strong automotive, aerospace, and healthcare industries, and a focus on quality and sustainability. Germany stands out for its advanced manufacturing systems and significant adoption of additive manufacturing, while the UK and France promote growth through research, innovation, and government initiatives. Increasing demand for prototyping, tooling, and end-use parts is strengthening the market. In December 2023, the UK Atomic Energy Authority awarded £1.5 million for the FATHOM2 project at the University of Birmingham to scale 3D printing and hot isostatic pressing for advanced tungsten components used in nuclear fusion reactors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 3D printing service bureau market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3D Systems

- Materialise

- Protolabs

- Stratasys

- EOS GmbH

- HP Inc

- Formlabs

- Sculpteo

- Voxeljet

- Markforged

- SLM Solutions

- Xometry

- GE Additive

- Shapeways

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, at Formnext 2025, HP Additive Manufacturing Solutions unveiled innovations and collaborations to advance additive manufacturing adoption. The initiatives aim to simplify design complexity, empower engineers and creators, and enable efficient, high-quality production across industries worldwide.

- In September 2025, Formlabs launched Form Now, an on-demand 3D printing service allowing users to upload designs, choose professional-grade materials, and receive printed parts directly. Offering turnaround times as fast as two days, the service delivers unmatched speed, convenience, and accessibility for businesses and professionals worldwide.

- In September 2024, Stratasys, in collaboration with Materialise, launched the Stratasys Neo Build Processor for Investment Casting, compatible with Neo 450 and Neo 800 SLA printers. The solution accelerates file processing by up to 50% and boosts print speeds, streamlining 3D printing workflows for aerospace and other demanding industries.

- In June 2024, Protolabs released its 3D Printing Trend Report, highlighting strong confidence in the global additive manufacturing market. The report indicates growth potential beyond prototyping, with expanding micro and large-format applications, signaling opportunities for production-level 3D printing across diverse industries.

- In April 2024, Formlabs launched the Form 4 and Form 4B resin 3D printers, featuring the new Low Force Display (LFD) print engine. With print speeds up to five times faster, these models enhance productivity, enabling professionals to innovate and accelerate time-to-market.

In February 2022, 3D Systems announced acquisitions of medical 3D printing specialist Kumovis and pellet extrusion firm Titan Robotics, enhancing its extrusion capabilities. The moves expand its market in personalized healthcare and enable better service for consumer, automotive, aerospace, defense, and service bureau clients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 3D printing service bureau market based on the below-mentioned segments:

Global 3D Printing Service Bureau Market, By Service Type

- Prototyping

- Production

- Design

- Others

Global 3D Printing Service Bureau Market, By Technology

- Fused Deposition Modeling

- Stereolithography

- Selective Laser Sintering

- PolyJet

- Others

Global 3D Printing Service Bureau Market, By Application

- Aerospace & Defense

- Automotive

- Healthcare

- Consumer Products

- Industrial

- Others

Global 3D Printing Service Bureau Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 3D printing service bureau market over the forecast period?The global 3D printing service bureau market is projected to expand at a CAGR of 18.4% during the forecast period

-

2. What is the market size of the 3D printing service bureau market?The global 3D printing service bureau market size is expected to grow from USD 7.1 billion in 2024 to USD 45.5 billion by 2035, at a CAGR of 18.4% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the 3D printing service bureau market?North America is anticipated to hold the largest share of the 3D printing service bureau market over the predicted timeframe.

-

4. What is the 3D printing service bureau market?The 3D printing service bureau market provides on-demand additive manufacturing services for prototyping, tooling, and production across various industries.

-

5. Who are the top 10 companies operating in the global 3D printing service bureau market?3D Systems, Materialise, Protolabs, Stratasys, EOS GmbH, HP Inc., Formlabs, Sculpteo, Voxeljet, Markforged, and Others

-

6. What factors are driving the growth of the 3D printing service bureau market?Growth is driven by rising demand for rapid prototyping, customized production, industrial adoption, advanced materials, cost-effective manufacturing, and government support for additive manufacturing and digitalization initiatives worldwide

-

7. What are the market trends in the 3D printing service bureau market?Key trends include rising adoption for prototyping, advanced materials, industrial applications, on-demand production, and integration of digital manufacturing technologies

-

8. What are the main challenges restricting wider adoption of the 3D printing service bureau market?The main challenges restricting the wider adoption of the 3D printing service bureau market stem primarily from cost considerations, technological limitations related to speed, materials, and quality, and a significant lack of a skilled workforce and standardization.

Need help to buy this report?