Global 3D Printed Maxillofacial Implant Market Size, Share, and COVID-19 Impact Analysis, By Material (Titanium, POM, Polyether Ether Ketone, and Glass Ceramics), By Technology (Stereolithography, Selective Laser Sintering, Fused Deposition Modeling, and Computer-Aided Design), By Application (Craniomaxillofacial Reconstruction, Dental Implants, Orthognathic Surgery, and Trauma Reconstruction), By End-Use (Hospitals, Dental Clinics, and Ambulatory Surgical Centers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal 3D Printed Maxillofacial Implant Market Insights Forecasts to 2035

- The Global 3D Printed Maxillofacial Implant Market Size Was Estimated at USD 2.251 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.61% from 2025 to 2035

- The Worldwide 3D Printed Maxillofacial Implant Market Size is Expected to Reach USD 4.102 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global 3D printed maxillofacial implant market size was worth around USD 2.251 billion in 2024 and is predicted to grow to around USD 4.102 billion by 2035 with a compound annual growth rate (CAGR) of 5.61% from 2025 to 2035. The market also continues to grow owing to the increasing demand for patient-specific facial reconstruction, advancements in 3D printing material and technology, and enhanced precision of surgery. It is also driven by increasing cases of trauma, growing dental and craniofacial applications, and quicker, cost-efficient customization that enhances global adoption.

Market Overview

The Global 3D-printed Maxillofacial Implant Market Size refers to the making and application of patient-specific implants manufactured by additive manufacturing for reconstructive purposes or replacement of injury to facial structures such as the mandible, zygomatic bones, orbital walls, and cranial segments. Applications include trauma reconstruction, correction of congenital deformity, orthognathic surgery, dental rehabilitation, and oncology-related facial reconstruction. The global growth is driven by an increase in trauma cases, increased demand for customized treatment, improvements in biomaterials at a rapid pace, and the integration of digital surgical planning with the latest imaging and AI-powered design. Porous titanium structures, bioresorbable polymers, new hybrid materials, and fully customized geometries of implants are the latest innovations that are helping in improving implant integration and reducing surgical time. Advancement of point-of-care 3D printing within hospitals and increased use of surgical robotics are further accelerating the adoption.

With the improvement in healthcare infrastructure, government support for medical device manufacturing, and increasing investments in bioprinting and regenerative medicine, opportunities are emerging in developing regions. Minimally invasive procedures are increasingly performed, while improvements in reimbursement pathways further encourage market growth. Key market players include Materialise, Stryker, Zimmer Biomet, Medtronic, Renishaw, KLS Martin Group, DePuy Synthes, B. Braun, and Medartis, with several emerging companies that specialize in patient-specific surgical solutions. On September 6, 2024, India’s Department of Pharmaceuticals introduced the UCMPMD with an aim to regulate marketing practices for medical devices, replacing the less suitable UCPMP. It expands the role of medical representatives, allows evaluation and demonstration samples with strict documentation, and allows overseas clinical training with DoP approval, thus providing clearer and more practical guidance for device companies.

Report Coverage

This research report categorizes the 3D printed maxillofacial implant market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 3D printed maxillofacial implant market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the 3D printed maxillofacial implant market.

Driving Factors

The rise in trauma cases, congenital deformities, and demand for personalized and patient-specific implants is supporting the growth of the global 3D-printed maxillofacial implant market. Improved available biocompatible materials, speed of production, and precision of 3D printing technologies favour better surgical outcomes and shorter operative times. Additionally, the increasing use of digital dentistry, surgical planning software, and AI-assisted design accelerates clinical acceptance. This, along with an increase in the elderly population, higher healthcare spending, and easy access to minimally invasive reconstruction procedures, drives the market. Supporting regulatory policies, allowing for the customization of medical devices, and higher awareness among surgeons are thus driving the demand globally.

Restraining Factors

High production and implementation costs, limited reimbursement, and strict regulatory requirements for customized implants are the restraints that the 3D-printed maxillofacial implant market. There are material limitations, quality-control concerns, and a lack of standardization in technical challenges, which further slow down the adoption. Further, specialized expertise and limited awareness act as additional deterrents to the market's expansion in developing regions.

Market Segmentation

The 3D printed maxillofacial implant market share is classified into material, technology, application, and end-use.

- The titanium segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the material, the 3D printed maxillofacial implant market is divided into titanium, POM, polyether ether ketone, and glass ceramics. Among these, the titanium segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The dominance of the titanium segment in the 3D-printed maxillofacial implants market is due to it possesses excellent biocompatibility, high strength-to-weight ratio, resistance to corrosion, and the ability to merge with bone tissue. Mechanical stability, durability, and ease of customization for patient-specific implants through 3D printing make it an ideal choice. Additionally, widespread clinical adoption and regulatory familiarity with titanium implants further drive market growth in this segment globally.

Get more details on this report -

- The stereolithography segment accounted for the largest share in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the 3D printed maxillofacial implant market is divided into stereolithography, selective laser sintering, fused deposition modeling, and computer-aided design. Among these, the stereolithography segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The high precision, smooth surface finish, and possibility of creating complex, patient-specific geometries drive growth in the stereolithography segment. SLA allows for precise modelling of complex facial structures, minimizes post-processing needs, and, in turn, improves surgical outcomes. Its wide adoption for presurgical planning, prototyping, and the fabrication of customized implants leads to high growth and preference over other 3D printing technologies.

- The craniomaxillofacial reconstruction segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the 3D printed maxillofacial implant market is divided into craniomaxillofacial reconstruction, dental implants, orthognathic surgery, and trauma reconstruction. Among these, the craniomaxillofacial reconstruction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The craniofacial reconstruction segment is growing due to the high prevalence of craniofacial trauma, congenital deformities, and tumor-related defects. The growth was also driven by the demand for precise implants that are patient-specific and improve the functional and aesthetic outcomes. Further, support for market dominance of the segment is coming from advancements in 3D printing technology, improved biocompatible materials, and increasing adoption of minimally invasive surgical procedures.

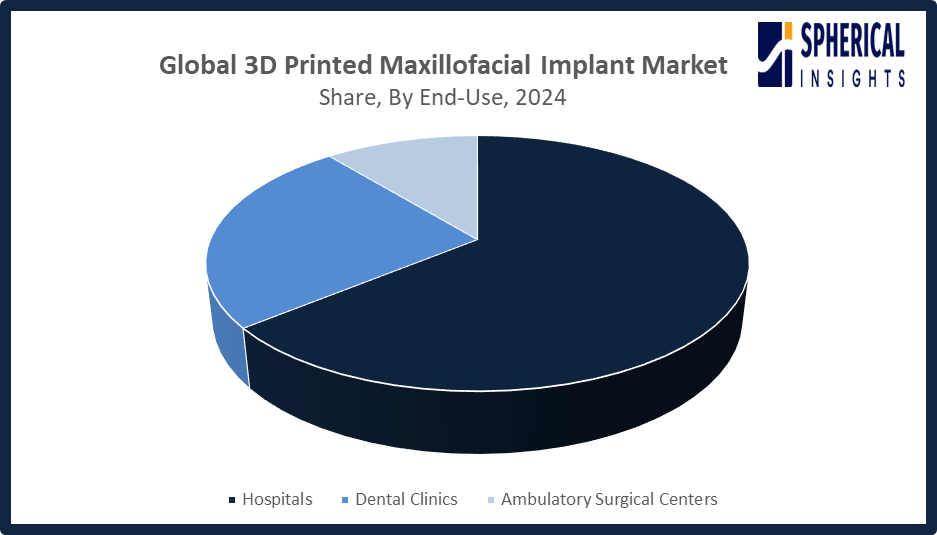

- The hospitals segment accounted for the highest market revenue in 2024, approximately 64% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the 3D printed maxillofacial implant market is divided into hospitals, dental clinics, and ambulatory surgical centers. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Some of the factors that contribute to market growth in the segment of 3D-printed maxillofacial implants include the rising number of complex surgical procedures, availability of advanced medical infrastructure, and skilled multidisciplinary teams within hospitals. Hospitals adopt patient-specific implants for trauma, craniofacial reconstruction, and oncology surgeries, supported by in-house 3D printing facilities and digital surgical planning. Rising healthcare investments and focus on improved surgical outcomes further drive the segment's rapid growth globally.

Regional Segment Analysis of the 3D Printed Maxillofacial Implant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the 3D printed maxillofacial implant market over the predicted timeframe.

North America is anticipated to hold the largest share of the 3D printed maxillofacial implant market over the predicted timeframe. North America is expected to constitute 42% share of the market for 3D-printed maxillofacial implants due to its well-developed healthcare infrastructure, high expenditure on healthcare, and increasing adoption of innovative medical technologies. The United States captures the majority share in the region, driven by the presence of key medical device companies, favorable regulatory policy adopted by the FDA with respect to personalized and 3D-printed implants, and a high prevalence of trauma, congenital deformities, and cancer-related reconstructive surgeries. Canada also plays its role in the high adoption of 3D printing in hospitals for surgical planning and implant manufacturing. These factors drive significant growth in the regional market.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the 3D printed maxillofacial implant market during the forecast period. The 3D-printed maxillofacial implants market in the Asia Pacific is expected to have a 20% market share, owing to increasing healthcare investments, growing medical tourism, and increased awareness of personalized treatment options. The regional market is dominated by China, with a large patient pool, significant penetration of advanced medical technologies, and supportive government policies toward manufacturing devices locally. India also contributes to this segment due to the availability of low-cost healthcare, expanding infrastructure in hospitals, and increased usage of 3D printing for custom-designed implants, thereby driving overall market growth within the region.

On July 3, 2025, China’s National Medical Products Administration (NMPA) released its Whole Life Cycle Regulation announcement, outlining 10 measures aimed at accelerating the development and approval of high-end medical devices. The policy focuses on innovative, domestically developed, and globally competitive technologies—such as AI-driven devices, advanced implants, and medical robots—to strengthen China’s MedTech innovation ecosystem and enhance regulatory efficiency.

In Europe, the 3D-printed maxillofacial implant market is projected to grow steadily, supported by the stringent regulatory framework of the EU Medical Device Regulation (MDR), which boosts confidence in patient-specific solutions. Germany leads this market, driven by its strong engineering capabilities, mature additive-manufacturing infrastructure, and robust collaboration among hospitals, industry, and research institutions. Its well-developed healthcare system and substantial public and private investment in personalized medicine further encourage the widespread adoption of complex, customized implants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 3D printed maxillofacial implant market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Materialise

- 3D Systems

- Stratasys

- EOS

- Renishaw plc

- EnvisionTEC

- Medtronic Plc.

- Johnson & Johnson

- Dentsply Sirona

- Zimmer Biomet

- Stryker Corporation

- Boston Medical Products

- Formlabs

- KLS Martin

- Oxford Performance Materials

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, SprintRay acquired EnvisionTEC/ETEC’s dental portfolio, including patents, trademarks, inventory, and related IP. This strategic move strengthens SprintRay’s focus on dentistry, enhancing its commitment to delivering advanced, reliable 3D printing hardware and regulatory-compliant resins to dental professionals worldwide.

- In April 2025, 3D Systems announced that, in collaboration with University Hospital Basel, it designed and produced the world’s first MDR-compliant 3D printed PEEK facial implant using VESTAKEEP i4 3DF PEEK on EXT 220 MED. Prof. Thieringer, Dr Sharma, and their team successfully customized the implant for a patient, used in a successful surgery on March 18, 2025.

- In February 2025, Boston Micro Fabrication (BMF) reported 2024 growth driven by strong use of its high-precision Projection Micro Stereolithography (PμSL) 3D printing technology. BMF’s platforms support prototyping, development, and short-run production across industries, including medical devices, electronics, optics, photonics, and life sciences.

- In April 2024, 3D Systems announced FDA 510(k) clearance for its patient-specific VSP PEEK Cranial Implant. The solution features a complete FDA-cleared workflow, including segmentation and 3D modeling software, the EXT 220 MED 3D printer, Evonik VESTAKEEP i4 3DF PEEK, and a predefined production process.

- In June 2024, Stratasys launched the DentaJet XL, a high-speed dental 3D printer. Featuring larger resin cartridges, a big print tray, Super High-Speed mode, and minimal post-processing, it enhances dental lab productivity, reduces costs, and represents the latest innovation in the DentaJet series.

- In June 2022, Formlabs launched Formlabs Dental Academy, an educational platform promoting 3D printing in dentistry. Offering free and paid courses, webinars, guides, and in-person training, it helps dental professionals, including lab technicians, orthodontists, and clinicians, learn and implement 3D printing technology effectively in their practices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 3D printed maxillofacial implant market based on the below-mentioned segments:

Global 3D Printed Maxillofacial Implant Market, By Material

- Titanium

- POM

- Polyether Ether Ketone

- Glass Ceramics

Global 3D Printed Maxillofacial Implant Market, By Technology

- Stereolithography

- Selective Laser Sintering

- Fused Deposition Modeling

- Computer-Aided Design

Global 3D Printed Maxillofacial Implant Market, By Application

- Craniomaxillofacial Reconstruction

- Dental Implants

- Orthognathic Surgery

- Trauma Reconstruction

Global 3D Printed Maxillofacial Implant Market, By End-Use

- Hospitals

- Dental Clinics

- Ambulatory Surgical Centers

Global 3D Printed Maxillofacial Implant Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 3D printed maxillofacial implant market over the forecast period?The global 3D printed maxillofacial implant market is projected to expand at a CAGR of 5.61% during the forecast period.

-

2. What is the 3D printed maxillofacial implant market?The 3D printed maxillofacial implant market is a sector focused on the design and production of patient-specific implants for the face and jaw using 3D printing technology.

-

3. What is the market size of the 3D printed maxillofacial implant market?The global 3D printed maxillofacial implant market size is expected to grow from USD 2.251 Billion in 2024 to USD 4.102 billion by 2035, at a CAGR of 5.61% during the forecast period 2025-2035.

-

The global 3D printed maxillofacial implant market size is expected to grow from USD 2.251 Billion in 2024 to USD 4.102 billion by 2035, at a CAGR of 5.61% during the forecast period 2025-2035.North America is anticipated to hold the largest share of the 3D printed maxillofacial implant market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global 3D printed maxillofacial implant market?Materialise, 3D Systems, Stratasys, EOS, Renishaw plc, EnvisionTEC, Medtronic Plc., Johnson & Johnson, Dentsply Sirona, Zimmer Biomet, Stryker Corporation, Boston Medical Products, Formlabs, KLS Martin, Oxford Performance Materials, and Others.

-

6. What factors are driving the growth of the 3D printed maxillofacial implant market?The growth of the 3D-printed maxillofacial implant market is driven by the increasing demand for customized and personalized implants, advancements in 3D printing technology, and a rising incidence of maxillofacial trauma and congenital deformities.

-

7. What are the market trends in the 3D printed maxillofacial implant market?Key trends in the 3D printed maxillofacial implant market include a strong growth trajectory driven by the demand for personalized implants, advancements in 3D printing technology, and a rising number of maxillofacial trauma cases and congenital deformities.

-

8. What are the main challenges restricting wider adoption of the 3D printed maxillofacial implant market?The main challenges restricting the wider adoption of the 3D-printed maxillofacial implant market include material limitations, high costs, complex regulatory hurdles and a lack of specialized knowledge and training among medical professionals.

Need help to buy this report?