Global 2D Materials Beyond Graphene Market Size, Share, and COVID-19 Impact Analysis, By Material (Transition Metal Dichalcogenides, Hexagonal Boron Nitride, MXenes, and Others), By End Use (Electronics & Electrical, Energy & Power, Aerospace & Defense, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal 2D Materials Beyond Graphene Market Insights Forecasts to 2035

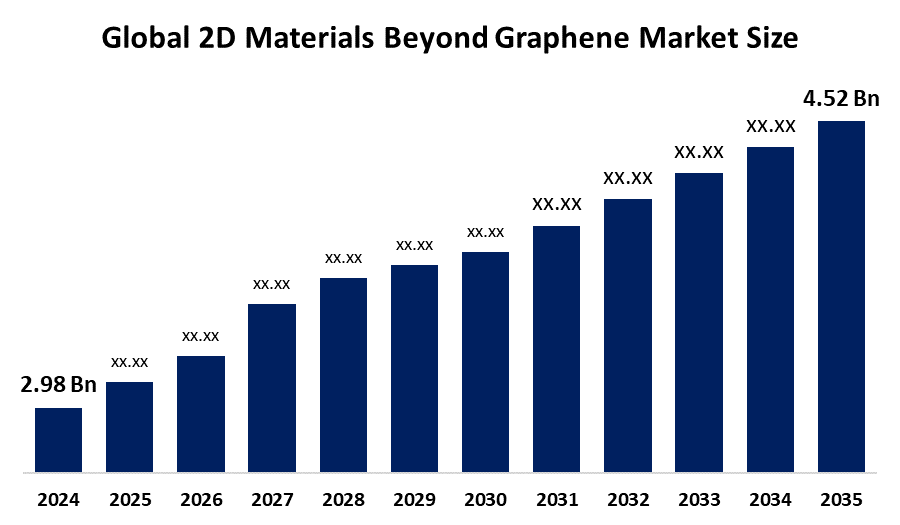

- The Global 2D Materials Beyond Graphene Market Size Was Estimated at USD 2.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.86% from 2025 to 2035

- The Worldwide 2D Materials Beyond Graphene Market Size is Expected to Reach USD 4.52 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

Market Overview

The global 2D materials beyond graphene market encompasses the production, development, and application of advanced two-dimensional materials with superior electrical, optical, and mechanical properties for use in electronics, energy, and nanotechnology applications. Increased investments in nanotechnology research and the growing need for smaller, more energy-efficient electronics are driving the rapid rise of the worldwide market for 2D materials beyond graphene. These materials are ideal for use in fuel cells, supercapacitors, and energy storage applications due to their remarkable electrical, mechanical, and thermal properties. Through increased catalytic performance and charge efficiency, they are playing an increasingly important role in improving renewable energy systems. Furthermore, because of their high reactivity, tunable optical characteristics, and biocompatibility, 2D materials exhibit great promise in biomedical and sensing applications, opening up new avenues for drug administration, environmental monitoring, and biosensing. New commercialisation prospects are being made possible by the convergence of materials science, biotechnology, and nanotechnology. The market is anticipated to see significant long-term growth across a number of industries, including energy, healthcare, and environmental applications, as a result of increased industry focus on scalable manufacturing and sustainable technology.

Report Coverage

This research report categorizes the 2D materials beyond graphene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 2D materials beyond graphene market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the 2D materials beyond graphene market.

Global 2D Materials Beyond Graphene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.86% |

| 2035 Value Projection: | USD 2.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Material, By End Use and By Region |

| Companies covered:: | 2D Semiconductors Inc., Graphenea S.A., NanoXplore Inc., Sixth Element Materials Technology Co., Ltd., Versarien plc, 2D Layer Materials Pte. Ltd., XG Sciences, Inc., ACS Material, LLC, Thomas Swan & Co. Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for innovative materials in flexible electronics, energy storage, and semiconductors is propelling the global market for 2D materials beyond graphene. Innovation and commercialisation are being accelerated by government support, industry-academia partnerships, and growing investments in nanoscale research. These materials are perfect for next-generation devices because of their exceptional mechanical, electrical, and thermal qualities. Market expansion is further fuelled by growing attention to sustainable manufacturing, miniaturized electronics, and renewable energy. Growing end-use applications and improvements in scalable synthesis methods keep boosting market expansion and industrial adoption.

Restraining Factors

High production costs, intricate synthesis procedures, and difficulties in obtaining large-scale, flawless material creation are the main obstacles facing the worldwide market for 2D materials beyond graphene. Widespread adoption is hampered by a lack of standardised manufacturing techniques and limited commercialisation. Furthermore, industrial deployment and market expansion are further slowed by regulatory concerns about the safety, environmental impact, and management of nanomaterials.

Market Segmentation

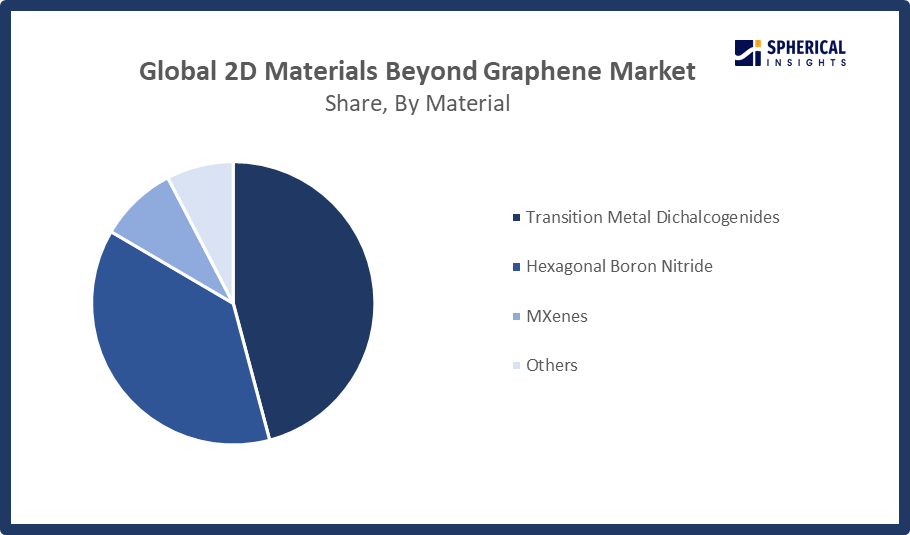

The 2D Materials Beyond Graphene market share is classified into material and end use.

- The transition metal dichalcogenides segment dominated the market in 2024, approximately 46% and is projected to grow at a substantial CAGR during the forecast period.

Based on the material, the 2D materials beyond graphene market is divided into transition metal dichalcogenides, hexagonal boron nitride, mxenes, and others. Among these, the transition metal dichalcogenides segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Driven by special mechanical, optical, and electrical characteristics of materials like WSe2, MoS2, and WS2. For improved performance, these materials are frequently used in photodetectors, transistors, and flexible electronic devices. TMDs high carrier mobility and adjustable band gaps are what are driving their growing use in nanoelectronics and optoelectronics. Improved scalable production techniques and research developments are increasing industrial end uses. Cooperation between manufacturers and research organisations lowers entry barriers and speeds up commercialisation in this market.

Get more details on this report -

- The electronics & electrical segment accounted for the largest share in 2024, approximately 40.6% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the 2D materials beyond graphene market is divided into electronics & electrical, energy & power, aerospace & defense, automotive, and others. Among these, the electronics & electrical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Driven by the growing need for high-performance, compact electronic gadgets. Materials like MoS2 and h BN are being investigated for transistors, photodetectors, and flexible screens because of their exceptional electrical conductivity and adjustable band gaps. Adoption is being accelerated by the quick development of wearable technology, consumer gadgets, and next-generation computer systems. Furthermore, continued research into incorporating 2D materials into semiconductors improves the performance and efficiency of devices. Commercialisation in this market is also being accelerated by industrial partnerships and pilot-scale manufacturing.

Regional Segment Analysis of the 2D Materials Beyond Graphene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 33.4% of the 2D Materials Beyond Graphene market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the 2D materials beyond graphene market over the predicted timeframe. Strong R&D spending, government assistance, and cooperation between universities, startups, and large semiconductor companies are all contributing to the rapid expansion of the U.S. market for 2D materials beyond graphene. Innovation in electronics, energy, and photonics is fuelled by federal initiatives such as the National Nanotechnology Initiative (NNI). The market potential is increased by the increasing use of sensors, transistors, and defence applications. Commercialisation is further aided by growing demand for supercapacitors, hydrogen production, renewable energy solutions, and flexible electronics. Large-scale production and integration into energy storage, next-generation computer, and aerospace technologies are being accelerated via strategic alliances.

Asia Pacific is expected to grow the fastest market share with approximately 28% at a rapid CAGR in the 2D materials beyond graphene market during the forecast period. With robust manufacturing bases and investments in semiconductors and electronics, China, Japan, and South Korea are leading the fast expanding Asia 2D materials beyond graphene sector. Developments in TMDs and boron nitride are propelled by government-supported programs and scholarly partnerships. Through significant investment under "Made in China 2025," China controls the region and promotes extensive research, synthesis, and commercialisation. The demand for flexible electronics, sustainable energy innovation, and expanding pilot production all contribute to the growth and competitiveness of the regional market.

Europe is expected to grow at a rapid CAGR in the 2D materials beyond graphene market during the forecast period. The European Commission, such Horizon Europe, promote cooperative research on innovative 2D materials and how they might be incorporated into green and energy-efficient products. Innovation is aided by the existence of specialised research facilities and cutting-edge semiconductor infrastructure. 2D materials are being investigated by European companies for applications in energy storage, biosensing, and quantum computing. Nanomaterials are produced and used responsibly due to stringent safety and environmental standards. The regional market's trajectory is still being shaped by the growing demand for high-performance and environmentally friendly materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 2D materials beyond graphene market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 2D Semiconductors Inc.

- Graphenea S.A.

- NanoXplore Inc.

- Sixth Element Materials Technology Co., Ltd.

- Versarien plc

- 2D Layer Materials Pte. Ltd.

- XG Sciences, Inc.

- ACS Material, LLC

- Thomas Swan & Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 2D materials beyond graphene market based on the below-mentioned segments:

Global 2D Materials Beyond Graphene Market, By Material

- Transition Metal Dichalcogenides

- Hexagonal Boron Nitride

- MXenes

- Others

Global 2D Materials Beyond Graphene Market, By End Use

- Electronics & Electrical

- Energy & Power

- Aerospace & Defense

- Automotive

- Others

Global 2D Materials Beyond Graphene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 2D Materials Beyond Graphene market over the forecast period?The global 2D Materials Beyond Graphene market is projected to expand at a CAGR of 3.86% during the forecast period.

-

2. What is the market size of the 2D Materials Beyond Graphene market?The global 2D Materials Beyond Graphene market size is expected to grow from USD 2.98 Billion in 2024 to USD 4.52 Billion by 2035, at a CAGR of 3.86% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the 2D Materials Beyond Graphene market?North America is anticipated to hold the largest share of the 2D Materials Beyond Graphene market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global 2D Materials Beyond Graphene market?2D Semiconductors Inc., Graphenea S.A., NanoXplore Inc., Sixth Element Materials Technology Co., Ltd., Versarien plc, 2D Layer Materials Pte. Ltd., XG Sciences, Inc., ACS Material, LLC, Thomas Swan & Co. Ltd., and Others.

-

5. What factors are driving the growth of the 2D Materials Beyond Graphene market?The growth of the 2D materials beyond graphene market is driven by rising demand for miniaturized and energy-efficient electronics, expanding nanotechnology research, government funding, advancements in material synthesis, and increasing applications in semiconductors, energy storage, sensors, flexible electronics, and renewable energy technologies.

-

6. What are the market trends in the 2D Materials Beyond Graphene market?Growing commercialization of TMDs, more R&D partnerships, improvements in scalable synthesis, growing use in flexible and wearable electronics, growing energy storage applications, and integration into quantum computing, photonics, and clean energy technologies are some of the major trends in the market for 2D materials beyond graphene.

-

7. What are the main challenges restricting wider adoption of the 2D Materials Beyond Graphene market?Key challenges include high production costs, scalability issues, material defects, lack of standardized manufacturing processes, and regulatory concerns related to nanomaterial safety, environmental impact, and commercialization barriers limiting widespread adoption.

Need help to buy this report?