Global 2 Piece Packaging Cans Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Aluminum, Steel, and Others), By Application (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal 2 Piece Packaging Cans Market Insights Forecasts to 2035

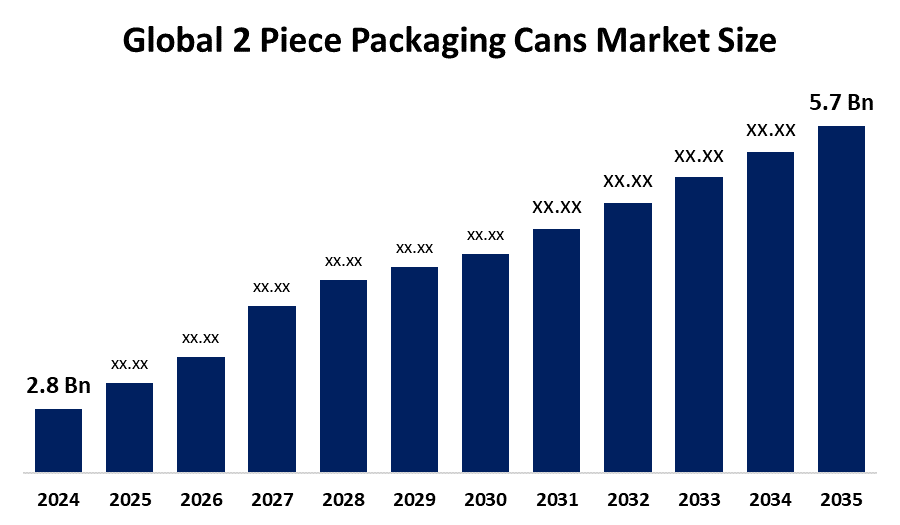

- The Global 2 Piece Packaging Cans Market Size Was Estimated at USD 2.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.68% from 2025 to 2035

- The Worldwide 2 Piece Packaging Cans Market Size is Expected to Reach USD 5.7 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global 2 Piece Packaging Cans Market Size was worth around USD 2.8 Billion in 2024 and is predicted to grow to around USD 5.7 Billion by 2035 with a compound annual growth rate (CAGR) of 6.68% from 2025 and 2035. The market for 2 piece packaging cans has a number of opportunities to grow because of growing consumer demand for lightweight, convenient, and long lasting packaging, growing consumption of packaged goods and beverages ecofriendly recycling trends, and advancements in design and production that extend product shelf life.

Market Overview

2 piece packing cans consist of two primary parts a separate end, or can-lid, that is joined after filling, and a single drawn and formed body, which includes the bottom. The market for two-piece packaging cans is expanding due in large part to consumer preferences for ecofriendly and simple packaging. The modern consumer is actively looking for packaging options that enable recyclability and a lower carbon footprint as they become more conscious of environmental issues. The market is expanding as a result of manufacturers being compelled to develop and create environmentally friendly packaging solutions due to this change in customer behavior. The market for two piece packaging cans is also being driven by the growing demand for ready to consume food and beverages due to hectic lives and urbanization. The market's expansion has also been significantly influenced by technological developments in can manufacturing techniques. Improved manufacturing processes have produced robust, lightweight cans that provide excellent product protection at a reasonable price. The market for two iece packaging cans has seen an increase in players due to innovations like digital printing on cans and the use of bi-metal and hybrid materials, which have created new opportunities for product differentiation and branding. These technical advancements make cans a favored option for a variety of end consumers by improving their visual attractiveness and extending their shelf life.

Governments and regulatory bodies' increasing legal requirements for recycled content in packaging materials have a direct effect on two-piece metal cans. For example, a roadmap released by the Indian Ministry of Environment, Forests, and Climate Change requires that all new products created from non ferrous metals, including aluminum, contain at least 5% recycled content beginning in fiscal year 2028 (FY 28) and 10% by FY 31. Similarly, by 2026, extended producer responsibility rules will require non ferrous metal manufacturers, importers, and producers to register and meet recycling specifications.

Report Coverage

This research report categorizes the 2 piece packaging cans market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 2 piece packaging cans market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the 2 piece packaging cans market.

Global 2 Piece Packaging Cans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.68% |

| 2035 Value Projection: | USD 5.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Material Type, By Application, and By Region |

| Companies covered:: | Ball Corporation, Crown Holdings Inc., Ardagh Group S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., Huber Packaging Group GmbH, Kian Joo Can Factory Berhad, MIVISA Envases S.A.U., CPMC Holdings Limited, Massilly Group, Grupo Zapata, Pacific Can, DS Container, Shengxing Group, Chumboon, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for 2 piece packaging cans has a lot of potential because of the rising demand for ecofriendly packaging options. Demand for ecofriendly substitutes is growing as customers grow more conscious of the harm packaging waste causes to the environment. Cans for two piece packaging, especially those composed of recyclable materials like steel and aluminum, are in a good position to benefit from this trend. Investing in environmentally friendly production methods and materials would probably give manufacturers a competitive advantage, drawing in eco aware customers and propelling market expansion. The growing use of two piece packing cans in new industries presents another market potential. These cans are becoming more and more popular in industries including specialty chemicals, personal care, and pharmaceuticals because of their excellent protective qualities and adaptable design.

Restraining Factors

The 2 piece packaging cans market is restricted by factors like the price fluctuations of raw materials, especially steel and aluminum. Manufacturers' profit margins may be impacted by changes in the cost of producing two piece packaging cans due to price fluctuations for these components.

Market Segmentation

The 2 piece packaging cans market share is classified into material type and application.

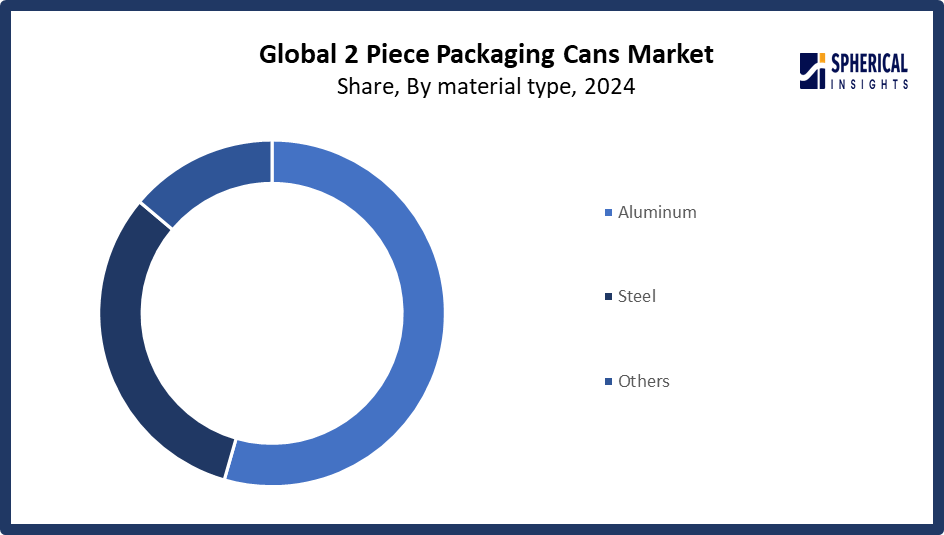

- The aluminum segment dominated the market in 2024, accounting for approximately 54% and is projected to grow at a substantial CAGR during the forecast period.

Based on the material type, the 2 piece packaging cans market is divided into aluminum, steel, and others. Among these, the aluminum segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because of its excellent recyclability, corrosion resistance, and lightweight nature, aluminum has become the most used material. Aluminum production greatly lowers carbon emissions and shipping costs, supporting international sustainability objectives. Aluminum cans also provide superior barrier protection, which prolongs the freshness and quality of the contents. Because of this, they are becoming a popular option for packing food and beverages, especially canned goods and fizzy drinks.

Get more details on this report -

- The food & beverages segment accounted for the largest share in 2024, accounting for approximately 57.4% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the 2 piece packaging cans market is divided into food & beverages, pharmaceuticals, personal care & cosmetics, and others. Among these, the food & beverages segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because cans are widely used to package a wide range of items, including soft drinks, alcoholic beverages, canned vegetables, and ready to eat meals. The food and beverage industry has the highest share. One of the main factors propelling this industry is the demand for packaging solutions that are safe, durable, and easy. One major benefit that increases demand for two piece cans is their capacity to maintain the freshness, flavor, and quality of food and beverages without the need for refrigeration.

Regional Segment Analysis of the 2 Piece Packaging Cans Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 37.5% of the 2 piece packaging cans market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 37.5% of the 2 piece packaging cans market over the predicted timeframe. In the North America market, the demand is rising due to strict packaging waste restrictions and a firmly established food and beverage industry, North America has been a major market for two-piece packaging cans. The region's emphasis on recyclability and sustainability complements the benefits of two piece packaging cans, which helps explain why they are so widely used. The existence of significant manufacturers and creative packaging options further supports the market's expansion in this area.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 7.5% in the 2 piece packaging cans market during the forecast period. The Asia Pacific area has a thriving market for 2 piece packaging cans due to the need for dependable and practical packaging solutions which is being driven in this area by rapid industrialization, growing disposable incomes, and shifting consumer lifestyles. 2 piece packaging cans are becoming more and more popular as a result of the notable expansion in the food and beverage, pharmaceutical, and personal care industries in emerging economies like China, India, and Southeast Asian nations. Market expansion in the Asia Pacific area is also being driven by the growing retail industry and rising urbanization.

Europe, representing nearly 4.8% in the 2 piece packaging cans market during the forecast period, which places a high priority on environmental sustainability and cutting edge packaging technology, is another significant market for two-piece packaging cans. Two-piece packaging cans are in high demand as a result of nations like Germany, France, and the UK leading the way in the adoption of environmentally friendly packaging solutions. Another key growth driver in the area is the strict regulatory environment around packaging waste and recyclability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 2 piece packaging cans market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Group S.A.

- Silgan Holdings Inc.

- Toyo Seikan Group Holdings Ltd.

- Huber Packaging Group GmbH

- Kian Joo Can Factory Berhad

- MIVISA Envases S.A.U.

- CPMC Holdings Limited

- Massilly Group

- Grupo Zapata

- Pacific Can

- DS Container

- Shengxing Group

- Chumboon

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Novelis, a leading sustainable aluminum solutions provider and the world leader in aluminum rolling and recycling, announced that it has entered into a joint development agreement with DRT Holdings, LLC to accelerate the adoption of high recycled content alloys in aluminum beverage can ends. This collaboration aims to improve the manufacturing process for sustainable can ends, ensuring seamless adoption across the global metal packaging industry.

- In December 2024, Ball Corporation also partnered with Dabur India Ltd to launch Real Bites juice in recyclable aluminium 2 piece cans in India.

- In June 2024, Sonoco Products Company, a global leader in high value sustainable packaging, today announced it has agreed to acquire Eviosys, Europe’s leading food cans, ends, and closures manufacturer, from KPS Capital Partners, LP for approximately $3.9 billion.

- In May 2024, Ball Corporation partnered with CavinKare in India to launch retort capable two piece aluminium cans for milkshakes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 2 piece packaging cans market based on the below-mentioned segments:

Global 2 Piece Packaging Cans Market, By Material Type

- Aluminum

- Steel

- Others

Global 2 Piece Packaging Cans Market, By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

Global 2 Piece Packaging Cans Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 2 piece packaging cans market over the forecast period?The global 2 piece packaging cans market is projected to expand at a CAGR of 6.68% during the forecast period.

-

2. What is the market size of the 2 piece packaging cans market?The global 2 piece packaging cans market size is expected to grow from USD 2.8 Billion in 2024 to USD 5.7 Billion by 2035, at a CAGR of 6.68% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the 2 piece packaging cans market?North America is anticipated to hold the largest share of the 2 piece packaging cans market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global 2 piece packaging cans market?Ball Corporation, Crown Holdings Inc., Ardagh Group S.A., Silgan Holdings Inc., Toyo Seikan Group Holdings Ltd., Huber Packaging Group GmbH, Kian Joo Can Factory Berhad, MIVISA Envases S.A.U., CPMC Holdings Limited, Massilly Group, Grupo Zapata, Pacific Can, DS Container, Shengxing Group, Chumboon, and Others.

-

5. What factors are driving the growth of the 2 piece packaging cans market?The 2 piece packaging cans market growth is driven by the food and beverage industry's growing demand, consumers' growing inclination for recyclable and sustainable packaging, urbanization, can manufacturing technology developments, and the robust uptake of ready to drink products by consumers.

-

6. What are market trends in the 2 piece packaging cans market?The 2 piece packaging cans market trends include sustainability and ecofriendly materials, advancements in digital printing and customization, integration of smart packaging technologies, shift towards lightweight and high barrier cans, and automation and high speed manufacturing.

-

7. What are the main challenges restricting wider adoption of the 2 piece packaging cans market?The 2 piece packaging cans market trends include high production costs, fluctuating raw material prices, strict environmental laws, competition from packaging alternatives like plastics and cartons, and logistical challenges with metal can storage and shipping.

Need help to buy this report?