Global 2 Ethylhexyl Nitrate Market Size, Share, and COVID-19 Impact Analysis, By Sales Channel (Direct and Indirect), By End User (Fuel Additive, Solvent, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal 2 Ethylhexyl Nitrate Market Size Insights Forecasts to 2035

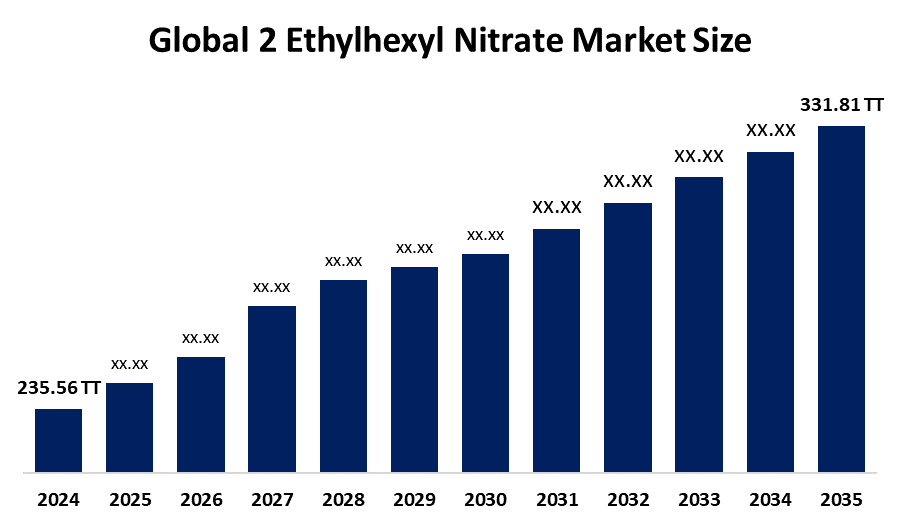

- The Global 2 Ethylhexyl Nitrate Market Size Was Valued at 235.56 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.16 % from 2025 to 2035

- The Worldwide 2 Ethylhexyl Nitrate Market Size is Expected to Reach 331.81 Thousand Tonnes by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global 2 Ethylhexyl Nitrate Market Size was worth around 235.56 Thousand Tonnes in 2024 and is predicted to Grow to around 331.81 Thousand Tonnes by 2035 with a compound annual growth rate (CAGR) of 3.16% from 2025 to 2035. The 2-ethylhexyl nitrate market offers strong future opportunities driven by rising diesel fuel demand, stricter emission norms, growing fuel additive usage, and expanding transportation and industrial activities across emerging economies worldwide.

Market Overview

The 2-ethylhexyl nitrate market refers to the global industry involved in the production and distribution of this chemical compound, primarily used as a cetane improver in diesel fuels to enhance combustion efficiency. The increasing demand for premium diesel fuels with higher cetane values, which enhance combustion efficiency and reduce emissions, the market for 2-Ethylhexyl Nitrate. In addition, governments across regions are implementing cleaner fuel standards, such as Bharat Stage VI norms in India and Euro VI regulations in Europe, encouraging the use of fuel additives to meet emission targets. Supportive policies promoting low-emission fuels and improved engine performance are expected to create sustained growth opportunities. Market growth is driven by increasing diesel consumption, rising demand for fuel efficiency, and stringent emission regulations aimed at reducing pollutants. The expanding transportation, logistics, and industrial sectors further support demand.

Report Coverage

This research report categorizes the 2 ethylhexyl nitrate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 2 ethylhexyl nitrate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the 2 ethylhexyl nitrate market.

Global 2 Ethylhexyl Nitrate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 235.56 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.16% |

| 2035 Value Projection: | 331.81 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Sales Channel, By End User and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Afton Chemical Corporation, The Lubrizol Corporation, Innospec Inc., Evonik Industries AG, Lanxess AG, Chevron Oronite Company LLC, Infineum International Limited, Clariant AG, Eurenco (EURENCO Group), Deepak Nitrite Limited, Dorf Ketal Chemicals India Private Limited, JX Nippon Oil & Energy Corporation, NITROERG SA, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key driving factors of the 2-ethylhexyl nitrate market include the growing demand for diesel fuel additives to improve cetane numbers and combustion efficiency. Rising global transportation, logistics, and construction activities are increasing diesel consumption. Stringent emission regulations are encouraging the use of performance-enhancing additives to reduce engine emissions. Additionally, expanding industrialization in emerging economies, increasing focus on fuel economy, and advancements in fuel formulation technologies are further supporting market growth and adoption across automotive and heavy-duty engine sectors.

Restraining Factors

Market growth is restrained by volatility in raw material prices, stringent chemical handling regulations, health and safety concerns, and the gradual shift toward electric vehicles reducing long-term diesel demand.

Market Segmentation

The 2 ethylhexyl nitrate market share is classified into sales channel and end user.

- The direct segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the 2 ethylhexyl nitrate market is divided into direct and indirect. Among these, the direct segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Direct segment is attributed to strong manufacturer-to-end-user relationships, long-term supply agreements with fuel producers, and cost advantages. The direct segment is driven by increasing demand from large industrial and automotive fuel additive consumers seeking customized supply and technical support.

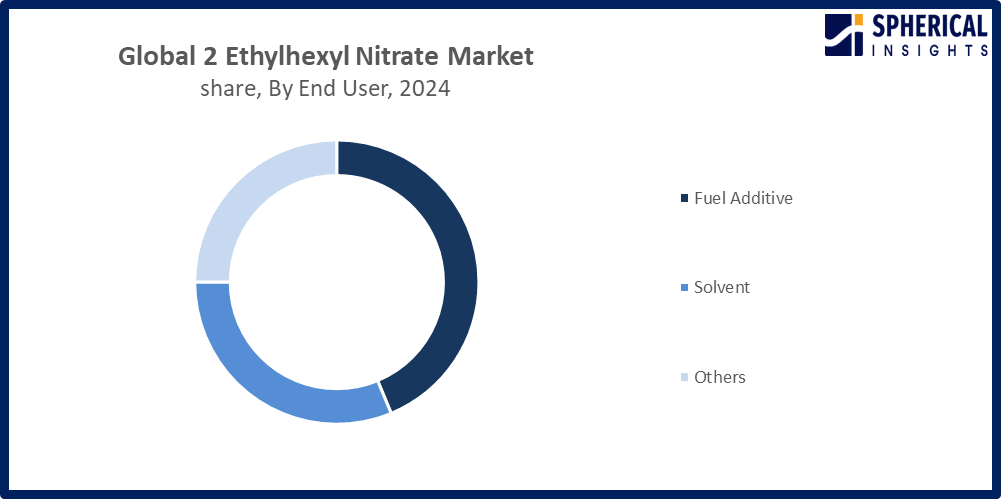

- The fuel additive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the 2 ethylhexyl nitrate market is divided into fuel additive, solvent, and others. Among these, the fuel additive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Fuel additive is due to its widespread use in improving diesel cetane numbers, rising demand for cleaner and more efficient fuels, and stringent emission regulations that encourage adoption of fuel additives in transportation and industrial sectors worldwide.

Get more details on this report -

Regional Segment Analysis of the 2 Ethylhexyl Nitrate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the 2 ethylhexyl nitrate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the 2 ethylhexyl nitrate market over the predicted timeframe. This leadership is driven by rapid industrialization, increasing diesel consumption in transportation and construction, growing automotive and heavy-equipment industries, and supportive government emission norms in countries such as China and India. Expansion of fuel additive production facilities and rising demand for cleaner fuels across the region further bolster market growth. India's Bharat Stage VI regulations, which have been in full effect since 2020, require higher cetane compliance and 10 ppm sulfur limitations. As a result, 2-EHN must be widely adopted for efficient combustion and regulatory compliance.

North America is expected to grow at a rapid CAGR in the 2 ethylhexyl nitrate market during the forecast period. North America’s rapid CAGR is driven by stringent emission regulations, rising adoption of advanced fuel additives, strong diesel consumption in logistics and agriculture, technological advancements in fuel formulation, and increasing focus on improving engine efficiency and reducing environmental impact. The November 2025 launch of PETRONAX's INTRON cTane 2EHN, a high-purity cetane improver for post-refinery blending, expands bulk/IBC availability FOB Houston and CIF deliveries across North America to support ignition performance and regulatory compliance in diesel blends.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the 2 ethylhexyl nitrate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Afton Chemical Corporation

- The Lubrizol Corporation

- Innospec Inc.

- Evonik Industries AG

- Lanxess AG

- Chevron Oronite Company LLC

- Infineum International Limited

- Clariant AG

- Eurenco (EURENCO Group)

- Deepak Nitrite Limited

- Dorf Ketal Chemicals India Private Limited

- JX Nippon Oil & Energy Corporation

- NITROERG SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 2 ethylhexyl nitrate market based on the below-mentioned segments:

Global 2 Ethylhexyl Nitrate Market, By Sales Channel

- Direct

- Indirect

Global 2 Ethylhexyl Nitrate Market, By End User

- Fuel Additive

- Solvent

- Others

Global 2 Ethylhexyl Nitrate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the 2 ethylhexyl nitrate market over the forecast period?The global 2 ethylhexyl nitrate market is projected to expand at a CAGR of 3.16% during the forecast period.

-

2. What is the market size of the 2 ethylhexyl nitrate market?The global 2 ethylhexyl nitrate market size is expected to grow from 235.56 Thousand Tonnes in 2024 to 331.81 Thousand Tonnes by 2035, at a CAGR of 3.16 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the 2 ethylhexyl nitrate market?Asia Pacific is anticipated to hold the largest share of the 2 ethylhexyl nitrate market over the predicted timeframe.

-

4. Who are the top companies operating in the global 2 ethylhexyl nitrate market?BASF SE, Afton Chemical Corporation, The Lubrizol Corporation, Innospec Inc., Evonik Industries AG, Lanxess AG, Chevron Oronite Company LLC, Infineum International Limited, Clariant AG, Eurenco (EURENCO Group), Deepak Nitrite Limited, Dorf Ketal Chemicals India Private Limited, JX Nippon Oil & Energy Corporation, and NITROERG SA., and others.

Need help to buy this report?