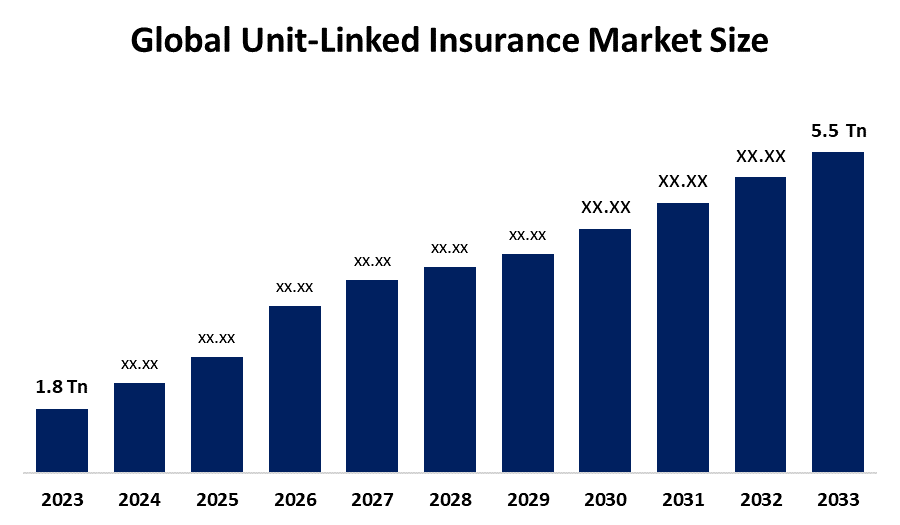

Global Unit-Linked Insurance Market Size To Exceed USD 5.5 Trillion By 2035 | CAGR of 10.69%

Category: Banking & FinancialGlobal Unit-Linked Insurance Market Size To Exceed USD 5.5 Trillion By 2035

According to a research report published by Spherical Insights & Consulting, The Global Unit-Linked Insurance Market Size is expected to Grow from USD 1.1 Trillion in 2024 to USD 5.5 Trillion by 2035, at a CAGR of 10.69% during the forecast period 2025-2035.

Get more details on this report -

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the" Global Unit-Linked Insurance Market Size, Share, and COVID-19 Impact Analysis, By Mode (Online and Offline), By Distribution Channel (Direct from Insurers, Insurance Brokers and Agencies, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/unit-linked-insurance-market

A unit-linked insurance is a type of life insurance contract where a portion of the money is invested in assets and the remaining portion is utilized for life insurance. The shift to more individualized plans is one of the main trends in unit-linked insurance. Consumers are requesting more flexible policies that allow them to change their investment decisions while the policy is in effect. Particularly among younger, tech-savvy consumers, digital advisory platforms that provide automated and personalized financial advice are becoming more and more popular. Customers can more easily investigate, purchase, and manage their insurance plans online due to this digital change, which also improves convenience in general. The emphasis on retirement planning in unit-linked insurance products is another significant development. Bundled options, which combine life insurance with long-term investing methods targeted at retirement savings, are being developed by insurers. Growing financial literacy is contributing to this trend, as more than half of policyholders increasingly prioritize asset accumulation in addition to protection. However, the unit-linked insurance product complexity & transparency are likely going to restrict market expansion.

The online segment dominated the market in 2024 with 35% and is projected to grow at a substantial CAGR during the forecast period.

Based on the mode, the unit-linked insurance market is divided into online and offline. Among these, the online segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment's development is stimulated due to increased internet and smartphone penetration, growing consumer preference for digital channels, the ease of online plan comparison and purchase, and the pace of digital transformation from the pandemic period.

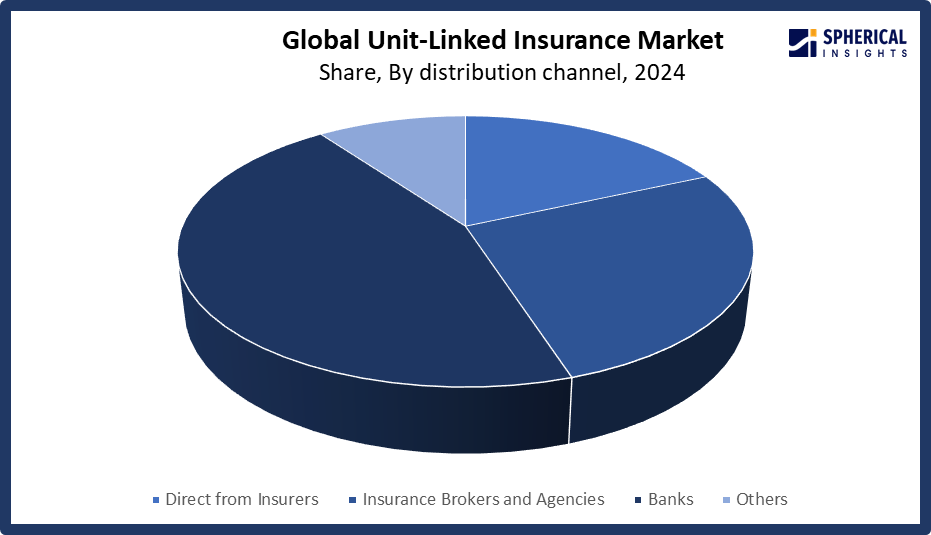

The banks segment accounted for the largest share in 2024 with 45% and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the distribution channel, the Unit-Linked Insurance market is divided into direct from insurers, insurance brokers and agencies, banks, and others. Among these, the banks segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment's increase is prompted because of their existing wide branch networks and strong client relationships, banks are able to successfully cross-sell ULIPs. Furthermore, banks sometimes package insurance with other financial products and offer advisory services, which makes purchasing ULIPs more convenient and reliable.

Get more details on this report -

North America is expected to hold the majority share with 40% of the global unit-linked insurance market during the forecast period.

North America is expected to hold the majority share of the global unit-linked insurance market during the forecast period. The unit-linked insurance market in the Asia Pacific is driven by high consumer awareness of investment linked life products, a well established insurance infrastructure, sophisticated digital distribution channels, and robust regulatory frameworks that encourage product innovation.

Get more details on this report -

Asia Pacific is anticipated to grow at the fastest pace, with 25% in the global unit-linked insurance market during the forecast period. The unit-linked insurance market in the Asia Pacific is bolstered by growing middle-class incomes, underserved insurance markets, extensive digital and mobile distribution, and growing demand for investment linked life insurance products that provide protection and asset growth.

Major vendors in the global unit-linked insurance market are Life Insurance Corporation of India, HDFC Life Insurance, ICICI Prudential Life Insurance, SBI Life Insurance, Max Life Insurance, Aviva plc, Allianz SE, Prudential plc, AIA Group Limited, MetLife, Inc., AXA SA, Zurich Insurance Group, Nippon Life Insurance Company, Sun Life Financial Inc., Manulife Financial Corporation, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In July 2025, Policybazaar reported that ULIP plans are gaining popularity among serious investors due to reforms that enhanced transparency, reduced costs, and increased fund options. The insurance platform emphasized the recent trend of ULIPs offering zero premium allocation charges and broader asset coverage, including ESG and foreign funds, making them more attractive for long-term wealth creation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the unit-linked insurance market based on the below-mentioned segments:

Global Unit-Linked Insurance Market, By Mode

- Online

- Offline

Global Unit-Linked Insurance Market, By Distribution Channel

- Direct from Insurers

- Insurance Brokers and Agencies

- Banks

- Others

Global Unit-Linked Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?