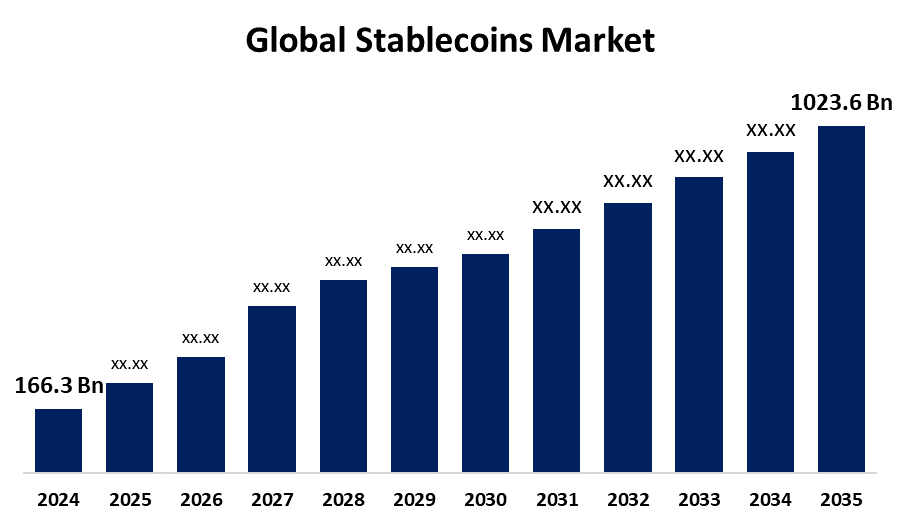

Global Stablecoins Market Size To Exceed USD 1023.6 Billion By 2035 | CAGR of 17.96%

Category: Banking & FinancialGlobal Stablecoins Market Size To Exceed USD 1023.6 Billion By 2035

According to a research report published by Spherical Insights & Consulting, The Global Stablecoins Market Size is expected to grow from USD 166.3 Billion in 2024 to USD 1023.6 Billion by 2035, at a CAGR of 17.96% during the forecast period 2025-2035.

Get more details on this report -

Browse key industry insights spread across 240 pages with 120 Market data tables and figures & charts from the report on the "Global Stablecoins Market Size, Share, and COVID-19 Impact Analysis, By Blockchain (Ethereum-based Stablecoins, Binance Smart Chain (BSC) Stablecoins, Others), By Type of Baking (Fiat-Collateralized Stablecoins, Crypto-Collateralized Stablecoins, and Others), By Use Cases (Payments, Trading and Investment, Lending and borrowing, Remittances), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035" Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/stablecoins-market

Stablecoins are a subset of digital currencies that link to reliable assets like fiat money, commodities, or other cryptocurrencies to steady their value. The capacity of stablecoins to provide cryptocurrency advantages such as speedy international payments while preserving conventional asset stability for trading, DeFi applications, and remittances is the reason for their growing popularity. The growing need for safe digital assets with minimal price volatility, particularly in emerging nations and during uncertain economic times, is driving the market's explosive expansion. The use of stablecoins for cost-effective settlement procedures and international money transfers, as well as cryptocurrency trading pairs, provides further impetus for market expansion. The growing interest from institutional investors as well as fintech businesses accelerates market expansion. The existing state of the market is being significantly altered by the technological developments in the stablecoin sector. While blockchain advancements improve the speed, security, and scalability of transactions for DeFi systems, the development of smart contracts makes programmable finance possible. To improve their usefulness, stablecoins are increasingly included in digital wallets and real-world payment networks. A major driver of this expansion is the growing use of stablecoins for international payments, a market long beset by high fees and inefficiencies. Recent partnerships demonstrate this pattern. However, the market is restrained by the regulatory and institutional challenges, market, financial risk, and security barriers.

The Ethereum-based stablecoins segment accounted for the largest market in 2024 and is projected to grow at a substantial CAGR during the timeframe period.

Based on blockchain type, the global stablecoin market is categorized into Ethereum-based stablecoins, Binance Smart Chain (BSC) stablecoins, and others. Among these, the Ethereum-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The dominance of the market is due to preserving its strong market position. Ethereum's reliable blockchain infrastructure serves as the basis for the most well-known stablecoins, such as USDT (Tether), USDC (USD Coin), and DAI. DeFi integration, developer support, and high liquidity make the Ethereum network the go-to platform for stablecoin issuance and transactions.

The Binance Smart Chain (BSC) stablecoins are expected to expand at the fastest CAGR over the course of the projected year. Because of BSC's short block generation times, low transaction fees, and growing appeal among decentralized finance (DeFi) applications, it allows it to expand the market speedily. As consumers and developers look for scalable, affordable alternatives to Ethereum for implementing DeFi protocols and stablecoins, the platform BSC is becoming more and more popular.

The fiat-collateralized stablecoins segment dominated the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The global stablecoins market is segmented by baking type into fiat-collateralized stablecoins, crypto-collateralized stablecoins, and others. Among these, the fiat-collateralized stablecoins segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market domination is guaranteed by their 1:1 backing with fiat currencies, such as the US dollar and the euro, which provide stability and trust. These coins' consistent worth makes them ideal for store-of-value operations, payments, remittances, and trading.

That crypto-collateralized stablecoins market is expected to expand at the fastest CAGR over the course of the forecast period. Two primary drivers of this industry's expansion are the demand for decentralized solutions within bitcoin networks and the growing acceptance of decentralized finance applications. By operating on smart contract platforms and maintaining cryptocurrency collateralization, crypto-collateralized stablecoins like Dai (DAI) give users more control and transparency.

The payment segment is anticipated to hold the largest market share during the forecast period.

Based on the use cases, the global stablecoins market is segmented into payments, trading and investment, lending and borrowing, and remittances. Among these, the payment segment is anticipated to hold the largest market share during the forecast period. The segment is in a dominant position that is primarily due to the growing use of stablecoins for regular payments, especially in areas where native currencies are volatile and traditional institutions are not accessible. Because stablecoins have lower transaction costs, quicker settlement times, and fewer requirements for middlemen, they are perfect for digital commerce, peer-to-peer payments, and merchant transactions.

The stablecoins market's loan and borrowing sector is projected to expand at the fastest CAGR over the course of the forecast period. The growth of this market is fueled by stablecoins, which give DeFi platforms a stable, low-volatility platform that permits lending and borrowing activities. Bypassing conventional financial institutions, users can earn interest from their assets and obtain quick loans through stablecoins.

North America is anticipated to hold the biggest market share for the stablecoin market during the projected time frame.

Get more details on this report -

In addition to maintaining a robust fintech network and institutional involvement, the US is in a crucial position since it is creating regulations that focus on both consumer safety and stablecoin visibility. As stablecoins become more integrated with traditional payment methods and decentralized finance (DeFi) platforms, their adoption grows.

The Latin American market for Stablecoins is growing faster during the forecast period.

Due to economic instability, high rates of inflation, and currency depreciation, stablecoin usage is growing in Argentina, Venezuela, and Brazil. Because stablecoins are digital assets that retain value and can be used for transactions, more individuals and companies are using them.

Major vendors in the global Stablecoins market are Tether Holdings Ltd., Circle Internet Financial Ltd., Paxos Trust Company, MakerDAO, TrueUSD (TrustToken), PayPal Holdings, Inc., Binance (BUSD – formerly, via Paxos), Ethena Labs, Stably Corporation, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2025, River, a well-known stablecoin abstraction platform in the decentralized finance (DeFi) space, introduced two cutting-edge stablecoin yield products on Base, Coinbase's high-performance Layer 2 network. For institutional and individual investors looking for fresh opportunities for expansion inside the cryptocurrency ecosystem, this move represents a turning point.

In July 2025, Clear Junction, a specialist in global payments and banking infrastructure for regulated financial institutions, launched a new on-chain stablecoin transfer service as part of its fast-growing digital assets division. The service allows clients to send, receive and convert stablecoins – starting with USDC (Circle) and USDT (Tether) – across the Ethereum, Solana, and Tron blockchain networks.

In June 2025, through collaborations with Paxos and Circle, Fiserv's FIUSD will merge with the Solana blockchain. Before the year is up, a stablecoin aimed at financial institutions will be introduced.

In June 2025, Stable, a leader in stablecoin and decentralized finance (DeFi) infrastructure, is introducing a full range of products to assist businesses and financial institutions in issuing stablecoins under their own names. The business offers Stablecoin-as-a-Service (SCaaS) solutions that include integration support with top industry partners like Bridge and Frax, as well as custom development and consultancy services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Stablecoins market based on the below mentioned segments:

Global Stablecoins Market, By Blockchain

- Ethereum-based Stablecoins

- Binance Smart Chain (BSC) Stablecoins

- Others

Global Stablecoins Market, By Type of Baking

- Fiat-Collateralized Stablecoins

- Crypto-Collateralized Stablecoins

- Others

Global Stablecoins Market, By Use Cases

- Payments

- Trading and Investment

- Lending and borrowing

- Remittances

Global Stablecoins Market, by Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?