Global Stablecoins Market Size, Share, and COVID-19 Impact Analysis, By Blockchain (Ethereum-based Stablecoins, Binance Smart Chain (BSC) Stablecoins, Others), By Type of Baking (Fiat-Collateralized Stablecoins, Crypto-Collateralized Stablecoins, Others), By Use Cases (Payments, Trading and Investment, Lending and borrowing, Remittances) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Banking & FinancialStablecoins Market Summary

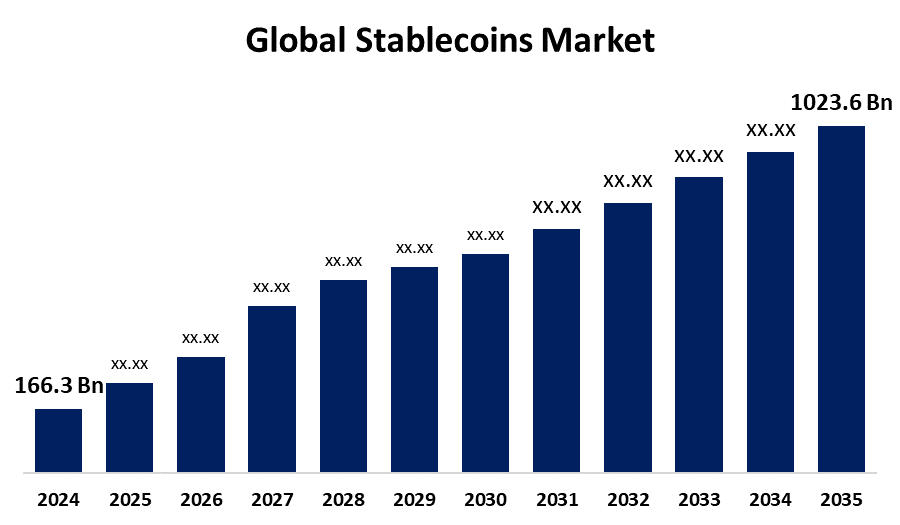

The Global Stablecoins Market Size Was Estimated at USD 166.3 Billion in 2024 and is Projected to Reach USD 1023.6 Billion by 2035, Growing at a CAGR of 17.96% from 2025 to 2035. Rising demand for price-stable digital assets, more cross-border transactions, growing institutional interest in blockchain-based finance, and greater DeFi acceptance are all driving growth in the global stablecoins market.

Get more details on this report -

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 37.8% and dominated the market globally.

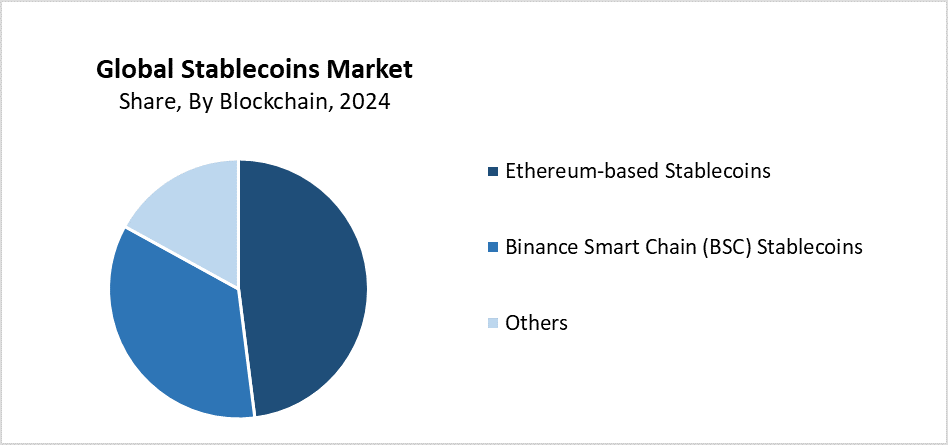

- In 2024, the Ethereum-based stablecoins segment had the highest market share by blockchain, accounting for 48.4%.

- In 2024, the fiat-collateralized stablecoins segment had the biggest market share by type of baking.

- In 2024, the Payments segment had the highest market share by use cases, accounting for 39.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 166.3 Billion

- 2035 Projected Market Size: USD 1023.6 Billion

- CAGR (2025-2035): 17.96%

- North America: Largest market in 2024

Global Stablecoins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 166.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.96% |

| 2035 Value Projection: | USD 1023.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Blockchain, By Type of Baking, By Use Cases and By Region |

| Companies covered:: | Tether Holdings Ltd., Circle Internet Financial Ltd., Paxos Trust Company, MakerDAO, TrueUSD (TrustToken), PayPal Holdings, Inc., Binance (BUSD - formerly, via Paxos), Ethena Labs, Stably Corporation, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

The stablecoins market represents a segment of digital currencies that stabilizes their value by linking to dependable assets such as commodities, fiat money, or other cryptocurrencies. The rising popularity of stablecoins results from their ability to deliver cryptocurrency benefits such as quick international payments, while maintaining traditional asset stability for trading, DeFi applications, and remittances. The market experiences rapid growth because of increasing requirements for secure digital assets, which have low price fluctuations, especially in developing countries and during unstable economic periods. The market growth receives additional momentum from stablecoins being used for international money transfers and cost-effective settlement operations, as well as cryptocurrency trading pairs. The market growth receives an extra boost through the expanding interest from both fintech companies and institutional investors.

The technological advancements in the stablecoin industry are drastically transforming the current market environment. The progress of smart contracts enables programmable finance while blockchain innovations enhance transaction speed, security, and scalability for DeFi systems. Real-world payment networks and digital wallets now incorporate stablecoins to enhance their practical applications. Worldwide governments and financial authorities examine new regulatory frameworks for handling risks while enhancing transparency measures. The market achieves greater legitimacy through initiatives such as central bank digital currencies (CBDCs) and stablecoin reserve and audit regulations.

Blockchain Insights

Get more details on this report -

What Factors Enabled the Ethereum-Based Stablecoins Segment to Capture the Largest Revenue Share of 48.4% in the Stablecoins Market in 2024?

The Ethereum-based stablecoins segment led the stablecoins market by capturing the largest revenue share of 48.4% in 2024. Ethereum's dependable blockchain platform provides the foundation for the most popular stablecoins, including USDT (Tether), USDC (USD Coin), and DAI, thus maintaining its strong market standing. Through its high liquidity and developer support, along with DeFi integration, the Ethereum network stands as the preferred platform for stablecoin issuance and transactions. The widespread adoption of Ethereum-based stablecoins continues to grow because the platform hosts numerous decentralized applications and exchanges. The steady transition to Ethereum 2.0 strengthens the platform's leadership in stablecoin ecosystems because it delivers improved scalability along with energy efficiency benefits.

The Binance Smart Chain (BSC) stablecoins segment is anticipated to grow at the fastest CAGR throughout the forecasted period. BSC achieves rapid market expansion because of its low transaction fees, brief block generation periods, and its increasing popularity among decentralized finance (DeFi) applications. The platform BSC gains popularity as developers and users seek cost-effective, scalable solutions instead of Ethereum for deploying stablecoins and DeFi protocols. The rapid growth of BSC is driven by its growing ecosystem, together with Ethereum cross-chain bridges and Binance's support as one of the leading global cryptocurrency exchanges. The combination of these factors enables BSC stablecoins to experience faster market adoption during the coming years.

Type of Baking Insights

Why Did the Fiat-Collateralized Stablecoins Segment Dominate the Stablecoins Market in 2024?

The fiat-collateralized stablecoins segment dominated the stablecoins market, accounting for the largest revenue share. The 1:1 backing of these coins with fiat currencies, including the US dollar and euro, ensures their market dominance because they deliver trust alongside stability. Their uniform value makes these coins perfect for trading, remittances, payments, and store-of-value functions. The group contains popular stablecoins that find broad usage throughout both centralized exchanges and DeFi systems, including USDT (Tether), USDC (USD Coin), and TUSD (TrueUSD). The digital asset ecosystem sees fiat-collateralized stablecoins as its preferred option because they maintain transparency and undergo regular audits and follow regulatory standards, which boost user trust.

During the forecast period, the crypto-collateralized stablecoins segment is anticipated to grow at the fastest CAGR. The growth of this sector stems from two main factors: the push for decentralized solutions within bitcoin networks and the rising popularity of decentralized finance applications. Users gain enhanced power and transparency through the operation of crypto-collateralized stablecoins such as Dai (DAI), which function on smart contract platforms and maintain cryptocurrency collateralization. The DeFi industry's expected expansion will drive significant growth in the demand for crypto-collateralized stablecoins, which will lead to their rapid market expansion in the future.

Use Cases Insights

What Factors Enabled the Payments Segment to Capture the Largest Revenue Share of 39.4% in the Stablecoins Market in 2024?

The Payments segment led the stablecoins market by generating the largest revenue share of 39.4% in 2024. The main reason for this dominant position is the expanding use of stablecoins for everyday payments, particularly in regions where traditional banks are inaccessible and local currencies show volatility. The benefits of stablecoins as payment solutions include reduced transaction costs and faster settlement periods, plus lower requirements for intermediaries, which makes them ideal for peer-to-peer payments, merchant transactions, and digital commerce. USDT and USDC serve as common stablecoins that developers integrate into their fintech applications, mobile wallets, and payment processing networks. The Payments segment dominates stablecoin adoption because international remittances and cross-border e-commerce continue to expand.

The lending and borrowing segment of the stablecoins market is anticipated to grow at the fastest CAGR throughout the forecast period. Stablecoins provide DeFi platforms with a solid, low-volatility platform that enables lending and borrowing operations, thus driving this segment's expansion. Through stablecoins, users can receive fast loans and generate interest from their holdings while bypassing traditional financial institutions. Smart contract technology developments have both enhanced transaction security and transparency, together with efficiency, while increasing user participation. The demand for financial inclusion in underbanked regions has driven the rising popularity of stablecoin-based loan solutions. The lending and borrowing application will serve as a fundamental element to expand stablecoin market penetration while driving growth throughout the DeFi ecosystem.

Regional Insights

North America Stablecoins Market Trends

Get more details on this report -

The stablecoin market in North America held the largest revenue share of 37.8% and led the market globally in 2024. The market supremacy of North America results mainly from the widespread use of Tether (USDT) and USD Coin (USDC), together with its developed digital infrastructure and blockchain adoption history. The United States holds a vital position because it maintains a strong fintech network and institutional engagement alongside developing regulatory measures that target both consumer safety and stablecoin visibility. Stablecoins gain broader acceptance through their growing connections with decentralized finance (DeFi) platforms and conventional payment systems. The market's faith in digital assets, together with North America's established regulatory framework, enables it to lead the market.

Latin America Stablecoins Market Trends

During the forecast period, the Latin America stablecoins market is anticipated to grow at the fastest CAGR. The increasing stablecoin adoption in Argentina, Venezuela, and Brazil results from economic instability and high inflation rates, together with currency depreciation. As a result, more people and businesses are turning to stablecoins for transactional purposes and as digital assets that maintain value. The region experiences strong demand for economical remittance services; thus, stablecoins enable faster and more affordable cross-border payments. The adoption of stablecoins expands as people adopt digital wallets and as internet connectivity improves and fintech services become more prevalent. Legal frameworks in Latin America, combined with growing cryptocurrency popularity, position the region to lead the stablecoin financial revolution among developing nations.

Key Stablecoins Companies:

The following are the leading companies in the stablecoin market. These companies collectively hold the largest market share and dictate industry trends.

- Tether Holdings Ltd.

- Circle Internet Financial Ltd.

- Paxos Trust Company

- MakerDAO

- TrueUSD (TrustToken)

- PayPal Holdings, Inc.

- Binance (BUSD – formerly, via Paxos)

- Ethena Labs

- Stably Corporation

- Others

Recent Developments

- In June 2024, the major Japanese financial services firm Nomura Holdings has teamed up with the GMO Internet Group to look at stablecoins that are backed by both the Japanese yen and the US dollar. The cooperation will also include Laser Digital, a subsidiary of Nomura that specializes in digital assets.

- In June 2024, Datachain and Progmat collaborated to increase the AUM (Assets Under Management) of stablecoins produced through Progmat's "Progmat Coin" stablecoin issuance and management platform. Along with their current multi-chain/cross-chain expansion, the partnership will see Datachain and Progmat work together to advance the creation of stablecoin contracts and the growth of international markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the stablecoins market based on the below-mentioned segments:

Global Stablecoins Market, By Blockchain

- Ethereum-based Stablecoins

- Binance Smart Chain (BSC) Stablecoins

- Others

Global Stablecoins Market, By Type of Baking

- Fiat-Collateralized Stablecoins

- Crypto-Collateralized Stablecoins

- Others

Global Stablecoins Market, By Use Cases

- Payments

- Trading and Investment

- Lending and borrowing

- Remittances

Global Stablecoins Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?