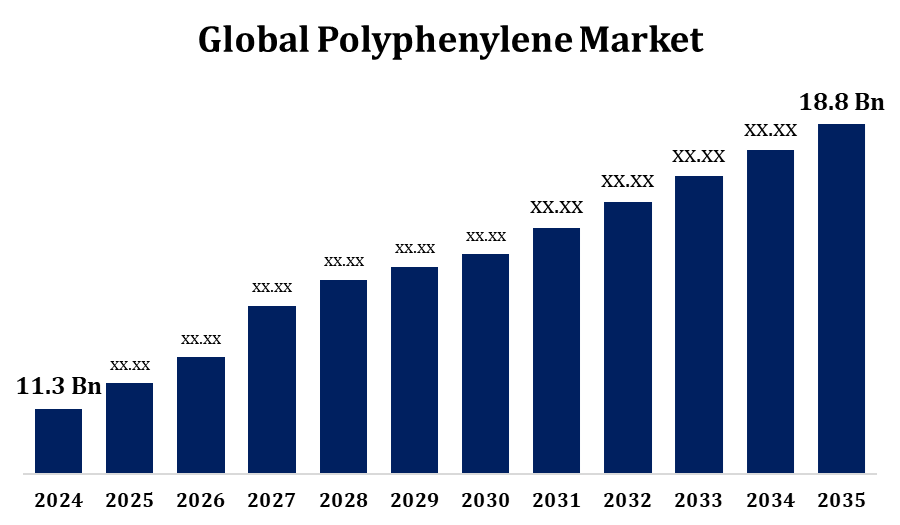

Global Polyphenylene Market Size To Worth USD 18.8 Billion By 2035 | CAGR of 5.22%

Category: Chemicals & MaterialsGlobal Polyphenylene Market Size To Worth USD 18.8 Billion By 2035

According to a Research Report Published by Spherical Insights & Consulting, the Global Polyphenylene Market Size to Grow from USD 11.3 Billion in 2024 to USD 18.8 Billion by 2035, at a Compound Annual Growth Rate (CAGR) of 5.22% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 253 pages with 125 Market data tables and figures & charts from the report on “Global Polyphenylene Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyphenylene Ether (PPE), Polyphenylene Sulfide (PPS)), Application (Automotive, Electrical & Electronics, Industrial, Aerospace, Coatings, Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035.” Get Detailed Report Description:https://www.sphericalinsights.com/reports/polyphenylene-market

The Global Polyphenylene Market Size is witnessing strong growth, fueled by the increasing demand for high-performance engineering plastics across diverse industries. Renowned for their excellent thermal stability, chemical resistance, and mechanical strength, polyphenylene compounds are widely utilized in automotive, electronics, aerospace, and industrial applications. The automotive industry remains a key driver, using polyphenylene to produce lightweight parts that improve fuel efficiency and lower emissions. In the electronics sector, its use in components like connectors, circuit boards, and housings is expanding rapidly, especially with the growing trend toward miniaturization and high-temperature performance. The Asia-Pacific region leads the market, supported by strong manufacturing capabilities, government support, and significant investments in automotive and electronics production. Continuous technological innovation and new product development further enhance the market’s growth prospects.

Polyphenylene Market Value Chain Analysis

The Polyphenylene Market Size value chain involves several key stages, including raw material sourcing, polymer synthesis, compounding, component manufacturing, and end-use integration. It starts with the acquisition of essential raw materials like benzene derivatives and other aromatic compounds, which are then used in polymerization processes to create polyphenylene types such as polyphenylene ether (PPE) and polyphenylene sulfide (PPS). These base polymers are compounded with reinforcements, fillers, and additives to improve their performance attributes. The enhanced materials are molded or extruded by component manufacturers into parts for use in automotive, electrical, electronics, and industrial applications. Original equipment manufacturers (OEMs) incorporate these parts into finished products. Distributors and suppliers support the seamless flow of materials along the chain. To improve efficiency and maintain quality, companies often pursue backward or forward integration. Research and development remain essential for innovation and long-term competitiveness.

Polyphenylene Market Opportunity Analysis

The Polyphenylene Market Size presents significant growth prospects, driven by technological advancements and shifting industry demands. A major growth catalyst is the increasing adoption of electric vehicles (EVs), where polyphenylene is valued for its lightweight, heat-resistant properties crucial to EV components. The surge in demand for advanced electronics and IoT devices further enhances market potential, thanks to polyphenylene’s superior thermal and electrical insulation capabilities. Additionally, the material is finding new applications in aerospace, defense, medical devices, and 3D printing, owing to its strong chemical resistance and mechanical durability. The push for environmentally friendly materials is also encouraging the development of recyclable and bio-based polyphenylene options. Asia-Pacific emerges as a key growth region, backed by rapid industrialization, supportive government policies, and a robust automotive and electronics manufacturing base.

Advancements in manufacturing technologies are set to drive substantial growth in the polyphenylene market. Innovations such as precision molding, high-temperature processing, and automated compounding have significantly improved production efficiency, consistency, and scalability. These advancements allow manufacturers to create complex, high-performance components with enhanced dimensional accuracy and reduced material waste. As a result, polyphenylene is increasingly being adopted in sectors like automotive, aerospace, and electronics, where lightweight, durable, and heat-resistant materials are essential. Moreover, modern production techniques are lowering manufacturing costs and enabling greater customization, expanding the material’s use in emerging applications. The adoption of Industry 4.0 technologies such as smart manufacturing and real-time monitoring is further enhancing quality control and fostering innovation. Together, these technological improvements are strengthening the market’s competitiveness and opening new avenues for global expansion.

High production costs driven by complex synthesis methods and the reliance on costly raw materials pose a significant barrier to the widespread use of polyphenylene in price-sensitive markets. The need for specialized equipment and processing conditions further limits accessibility, particularly for small and mid-sized manufacturers. Environmental concerns around the recyclability and disposal of high-performance thermoplastics add regulatory pressure, especially in regions with stringent sustainability standards. The market also faces intense competition from alternative engineering plastics like PEEK and polyamide, which offer comparable performance in some applications. Additionally, disruptions in the supply chain and fluctuations in raw material availability contribute to pricing instability and manufacturing delays. In developing regions, limited awareness and insufficient technical know-how further hinder market penetration, particularly in emerging applications and industries.

Insights by Type

The Polyphenylene Sulfide (PPS) segment accounted for the largest market share over the forecast period 2025 to 2035. The growth of the PPS segment is largely attributed to its outstanding thermal stability, chemical resistance, and mechanical strength. Linear PPS is especially favored for its improved toughness and ease of processing, making it well-suited for high-performance and demanding applications. The automotive industry remains the dominant driver of PPS demand, particularly for high-temperature components like fuel systems, connectors, and engine parts. The ongoing transition to electric and hybrid vehicles further accelerates the use of PPS in lightweight, heat-resistant parts. Moreover, the electrical and electronics sector is increasingly utilizing PPS for miniaturized components and advanced insulation solutions. Asia-Pacific leads this growth, thanks to its robust manufacturing base and supportive EV policies, while North America and Europe also see steady expansion, particularly in aerospace and electronics sectors.

Insights by Application

The Automotive segment accounted for the largest market share over the forecast period 2025 to 2035. Automakers are increasingly turning to polyphenylene compounds to replace conventional metals and standard plastics in critical components such as under-the-hood parts, ignition connectors, fuel systems, and lighting assemblies. This shift is driven by polyphenylene’s exceptional heat resistance, chemical stability, and lightweight properties. The trend is accelerating with the growing production of electric and hybrid vehicles, which demand materials that can endure high temperatures while contributing to overall weight reduction. In addition, the global emphasis on improving fuel efficiency and reducing emissions is further promoting the use of lightweight materials like polyphenylene in automotive design. Collaborative efforts between chemical manufacturers and automotive companies are also driving innovation, enabling the development of advanced materials for broader use in next-generation vehicle technologies.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Polyphenylene Market from 2025 to 2035. North America's growing emphasis on lightweight, high-performance materials especially in electric vehicles and aerospace applications is driving the increased use of polyphenylene compounds, valued for their superior thermal stability and mechanical strength. In the electronics industry, the rise of high-frequency devices and ongoing miniaturization trends are further boosting demand for polyphenylene in insulation and structural components. The United States leads regional growth, backed by a strong manufacturing base and continuous technological advancements. Meanwhile, Mexico is emerging as a significant contributor, supported by expanding automotive manufacturing and favorable government policies. With a regional focus on sustainability, emission reduction, and innovation in advanced materials, North America is poised to remain a key growth market for polyphenylene in the years ahead.

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The Asia-Pacific polyphenylene market is experiencing rapid growth, fueled by the expansion of the automotive, electronics, and industrial sectors. Polyphenylene oxide (PPO) finds extensive use in electrical and electronic applications, while polyphenylene sulfide (PPS) is increasingly favoured for high-temperature automotive components due to its strength and thermal stability. Key markets such as China, Japan, South Korea, and India are driving this growth, supported by government policies that encourage electric vehicle adoption and boost domestic manufacturing. China remains the leading producer and consumer, while India is emerging as a key growth market, thanks to its rapidly expanding electronics and appliance industries. The region’s advantages such as low-cost manufacturing, a strong supply chain network, and growing demand for lightweight, high-performance materials, continue to support its market leadership.

Recent Market Developments

- In April 2024, Toray Industries has launched a new Polyphenylene Ether (PPE) composite featuring superior mechanical strength and enhanced thermal stability. Designed for high-performance applications, this advanced material is ideal for use in demanding environments such as automotive parts and industrial equipment.

Major players in the market

- SABIC

- Ensinger

- Celanese Corporation

- DIC Corporation

- Solvay

- Tosoh Corporation

- Kureha Corporation

- LG Chem

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Polyphenylene Market, Type Analysis

- Polyphenylene Ether (PPE)

- Polyphenylene Sulfide (PPS)

Polyphenylene Market, Application Analysis

- Automotive

- Electrical & Electronics

- Industrial

- Aerospace

- Coatings

- Healthcare

Polyphenylene Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?