Global Polyphenylene Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyphenylene Ether (PPE), Polyphenylene Sulfide (PPS)), Application (Automotive, Electrical & Electronics, Industrial, Aerospace, Coatings, Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Polyphenylene Market Size Insights Forecasts to 2035

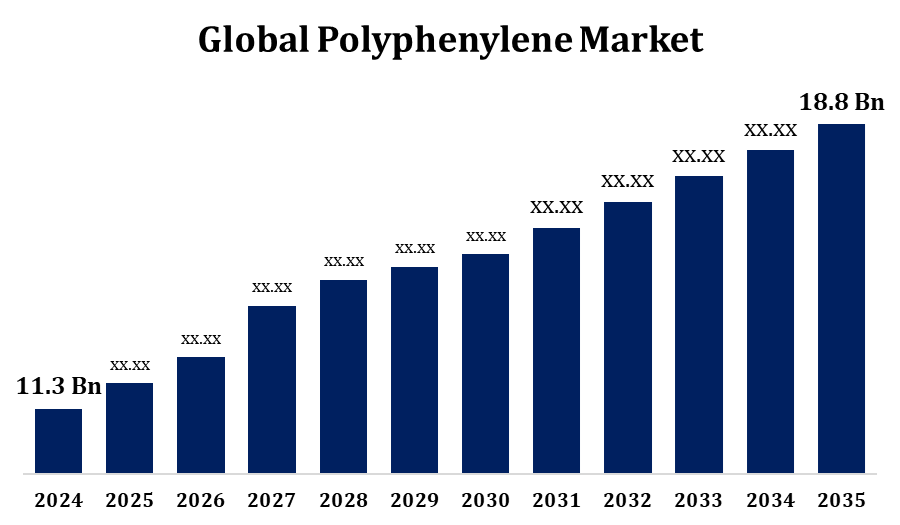

- The Global Polyphenylene Market Size was valued at USD 11.3 Billion in 2024.

- The Market is Growing at a CAGR of 5.22% from 2025 to 2035.

- The Worldwide Polyphenylene Market Size is Expected to reach USD 18.8 Billion by 2035.

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Polyphenylene Market Size is experiencing significant growth, driven by rising demand for high-performance engineering plastics across various industries. Polyphenylene compounds, known for their exceptional thermal stability, chemical resistance, and mechanical strength, are increasingly used in automotive, electronics, aerospace, and industrial applications. The automotive sector, in particular, is a major contributor, leveraging polyphenylene for lightweight components that enhance fuel efficiency and reduce emissions. Additionally, growing adoption in electrical and electronic devices such as connectors, circuit boards, and housings further fuels market expansion. The shift toward miniaturization and high-heat applications in electronics amplifies this demand. Asia-Pacific dominates the market due to robust manufacturing activities, favorable government initiatives, and rising investments in the automotive and electronics sectors. Technological advancements and product innovations also support market growth.

Polyphenylene Market Value Chain Analysis

The polyphenylene market value chain encompasses raw material sourcing, polymer production, compounding, component manufacturing, and end-use applications. It begins with the procurement of key raw materials such as benzene derivatives and other aromatic compounds, followed by polymerization processes to produce polyphenylene variants like polyphenylene ether (PPE) and polyphenylene sulfide (PPS). These base resins are then compounded with fillers, reinforcements, and additives to enhance performance characteristics. Component manufacturers convert these compounds into molded or extruded parts used across automotive, electrical, electronics, and industrial sectors. OEMs integrate these components into final products. Distributors and suppliers facilitate material flow across the chain. Key players often engage in backward or forward integration to optimize costs and quality control. R&D and innovation play a vital role in sustaining competitiveness across the value chain.

Polyphenylene Market Opportunity Analysis

The polyphenylene market offers strong growth opportunities fueled by advancements in technology and evolving industry needs. The rising adoption of electric vehicles (EVs) is a key driver, as polyphenylene is used in lightweight, heat-resistant components essential for EV systems. Increasing demand for advanced electronics and IoT devices further boosts market potential, given the material’s excellent thermal and electrical insulation properties. Emerging applications in aerospace, defense, medical devices, and 3D printing also contribute to expanding opportunities due to polyphenylene’s chemical resistance and mechanical strength. Additionally, growing interest in sustainable materials is driving research into recyclable and bio-based polyphenylene alternatives. Asia-Pacific stands out as a high-potential region, supported by rapid industrial growth, favorable government policies, and a strong presence in automotive and electronics manufacturing, making it a critical hub for future expansion.

Global Polyphenylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.22% |

| 2035 Value Projection: | USD 18.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 253 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | SABIC, Ensinger, Celanese Corporation, DIC Corporation, Solvay, Tosoh Corporation, Kureha Corporation, LG Chem, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Market Dynamics

Polyphenylene Market Dynamics

Growing progress in manufacturing technologies to propel the market growth

Advancements in manufacturing technologies are poised to significantly propel the growth of the polyphenylene market. Innovations such as precision molding, high-temperature processing, and automated compounding systems have enhanced the efficiency, consistency, and scalability of polyphenylene production. These improvements enable manufacturers to develop complex, high-performance components with greater dimensional stability and reduced material waste. As a result, polyphenylene is gaining traction in industries demanding lightweight, durable, and heat-resistant materials, such as automotive, aerospace, and electronics. Additionally, new production methods are helping lower costs and expand customization, encouraging wider adoption across emerging applications. The integration of Industry 4.0 practices, including smart manufacturing and real-time process monitoring, further supports quality control and product innovation. Collectively, these technological advancements are reinforcing the market’s competitiveness and unlocking new growth opportunities worldwide.

Restraints & Challenges

High production costs, primarily due to complex synthesis processes and the use of expensive raw materials, limit broader adoption across cost-sensitive applications. Additionally, processing polyphenylene requires specialized equipment and conditions, posing a barrier for small and mid-sized manufacturers. Environmental concerns related to recyclability and the disposal of high-performance thermoplastics also present regulatory challenges, especially in regions with strict sustainability norms. Market competition from alternative engineering plastics, such as PEEK and polyamide, adds further pressure. Supply chain disruptions and fluctuations in raw material availability can lead to volatility in pricing and production schedules. Moreover, limited awareness and technical expertise in developing regions may restrict market penetration, especially in emerging end-use sectors.

Regional Forecasts

Get more details on this report -

North America Market Statistics

North America is anticipated to dominate the Polyphenylene Market from 2025 to 2035. The region's strong focus on lightweight and high-performance materials, particularly in electric vehicles and aircraft components, is boosting the adoption of polyphenylene compounds due to their excellent thermal stability and mechanical strength. In the electronics sector, the rise in high-frequency devices and miniaturization trends is further encouraging the use of polyphenylene for insulation and structural applications. The United States remains a dominant contributor, supported by advanced manufacturing infrastructure and ongoing technological innovation. Additionally, Mexico is emerging as a key player due to expanding automotive production and supportive government initiatives. Overall, North America's emphasis on sustainability, emissions reduction, and advanced materials is expected to fuel continued growth in the polyphenylene market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The Asia-Pacific polyphenylene market is witnessing strong growth, driven by expanding automotive, electronics, and industrial sectors. Polyphenylene oxide (PPO) is widely utilized in electrical and electronic applications, while polyphenylene sulfide (PPS) is increasingly adopted in high-temperature automotive parts due to its durability and heat resistance. Countries such as China, Japan, South Korea, and India are key contributors, supported by favorable government initiatives promoting electric vehicles and local manufacturing. China leads in consumption and production, while India is rapidly emerging as a growth hotspot due to its booming electronics and appliance industries. The region benefits from cost-effective manufacturing capabilities, a robust supply chain, and rising demand for lightweight, high-performance materials.

Segmentation Analysis

Insights by Type

The Polyphenylene Sulfide (PPS) segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is driven by its superior thermal stability, chemical resistance, and mechanical strength. Linear PPS, in particular, is widely used due to its enhanced toughness and processability, making it ideal for demanding applications. The automotive sector is the primary driver of PPS demand, especially for components exposed to high temperatures such as fuel systems, connectors, and engine parts. The growing shift toward electric and hybrid vehicles further boosts its usage in lightweight, heat-resistant components. Additionally, the electrical and electronics industry is increasingly adopting PPS for high-performance insulation and miniaturized circuit components. Asia-Pacific leads the segment’s growth, supported by large-scale manufacturing and favorable EV policies, while North America and Europe also contribute through advancements in aerospace and electronics applications.

Insights by Application

The Automotive segment accounted for the largest market share over the forecast period 2025 to 2035. Automakers are replacing traditional metals and standard plastics with polyphenylene compounds in components like under-the-hood parts, ignition connectors, fuel systems, and lighting assemblies due to their superior heat resistance, chemical stability, and lightweight nature. This shift is gaining momentum with the rising production of electric and hybrid vehicles, which require durable materials that can withstand high temperatures and reduce overall vehicle weight. Additionally, the global push for fuel efficiency and lower emissions is encouraging the adoption of polyphenylene in lightweight automotive designs. Collaborations between chemical companies and automotive manufacturers are also advancing material innovation, supporting broader application in next-generation vehicle platforms.

Recent Market Developments

- In April 2024, Toray Industries has introduced a new Polyphenylene Ether (PPE) composite material that offers enhanced mechanical strength and improved thermal stability. Engineered for high-performance use, the material is well-suited for demanding applications in automotive components and industrial machinery.

Competitive Landscape

Major players in the market

- SABIC

- Ensinger

- Celanese Corporation

- DIC Corporation

- Solvay

- Tosoh Corporation

- Kureha Corporation

- LG Chem

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Polyphenylene Market, Type Analysis

- Polyphenylene Ether (PPE)

- Polyphenylene Sulfide (PPS)

Polyphenylene Market, Application Analysis

- Automotive

- Electrical & Electronics

- Industrial

- Aerospace

- Coatings

- Healthcare

Polyphenylene Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?