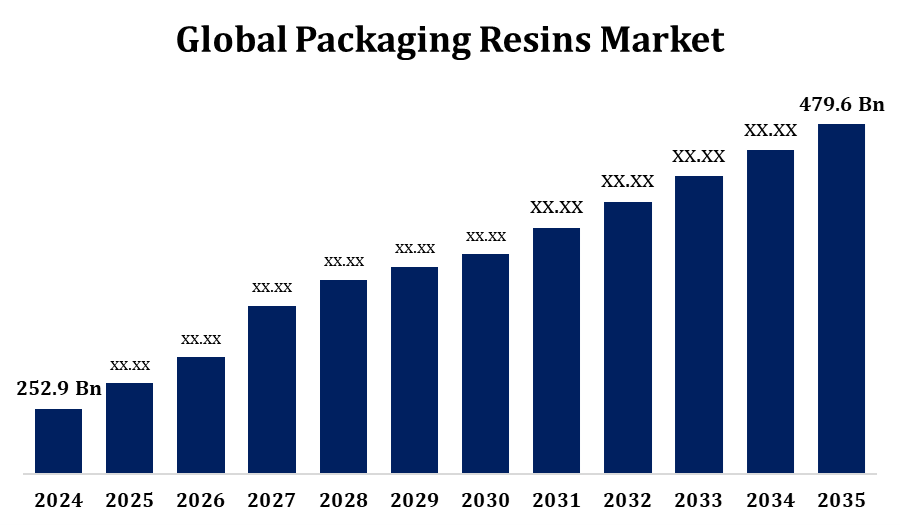

Global Packaging Resins Market Size To Worth USD 479.6 Billion By 2035 | CAGR of 6.61%

Category: Chemicals & MaterialsGlobal Packaging Resins Market Size To Worth USD 479.6 Billion By 2035

According to a Research Report Published by Spherical Insights & Consulting, the Global Packaging Resins Market Size to Grow from USD 252.9 Billion in 2024 to USD 479.6 Billion by 2035, at a Compound Annual Growth Rate (CAGR) of 6.61% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 250 pages with 130 Market data tables and figures & charts from the report on “Global Packaging Resins Market Size, Share, and COVID-19 Impact Analysis, By Type (HDPE, LDPE, PET, Polypropylene, Polystyrene, PVC, and Others), By Application (Food & Beverages, Consumer Goods, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035.” Get Detailed Report Description: https://www.sphericalinsights.com/reports/packaging-resins-market

The Packaging Resins Market Size is witnessing strong growth, driven by the rising demand for lightweight, durable, and cost-effective materials across industries such as food and beverage, healthcare, and consumer goods. The surge in e-commerce, coupled with urbanization and evolving consumer lifestyles, is boosting the need for both flexible and rigid packaging solutions. Commonly used resins like polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS) are favored for their adaptability, protective qualities, and recyclability. Growing emphasis on sustainability is also driving innovation in recyclable and bio-based resin alternatives. Additionally, rapid industrialization and retail sector growth in emerging markets are contributing to market expansion. Nonetheless, concerns over plastic waste and tightening environmental regulations are pushing the industry toward circular economy models and more sustainable packaging options.

Packaging Resins Market Value Chain Analysis

The Packaging Resins Market Size value chain involves several critical stages, starting with raw material suppliers who provide feedstocks like naphtha and natural gas used in resin production. Resin producers transform these inputs into base polymers such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). These polymers are then processed by compounders and converters into various semi-finished products, including films, sheets, and containers. Packaging manufacturers utilize these materials to develop end-use packaging solutions suited for sectors like food and beverage, pharmaceuticals, and personal care. Distributors and retailers facilitate the delivery of these products to consumers. At the final stage, waste management and recycling companies handle post-consumer packaging, supporting environmental sustainability. Each step in the chain is shaped by innovation, cost-effectiveness, and adherence to regulatory standards.

Packaging Resins Market Opportunity Analysis

The Packaging Resins Market Size offers considerable growth potential across various areas. Growing interest in bio-based and biodegradable resins is opening new paths for innovation, as both consumers and regulators increasingly priorities sustainable packaging options. Technological progress in high-performance resins such as high-barrier multilayer films and smart packaging solutions is enhancing the functionality of packaging in industries like food, pharmaceuticals, and e-commerce. The continued growth of online retail is also boosting demand for lightweight and durable resins that ensure product protection during shipping. Moreover, rising urbanisation, higher disposable incomes, and expanding retail activity in emerging regions such as Asia-Pacific and Latin America are further accelerating market demand. Companies that invest in sustainable practices, advanced technologies, and geographic expansion are well-positioned to benefit from these shifting market trends.

The food and beverage industry plays a pivotal role in driving growth within the packaging resins market, fueled by the rising need for safe, durable, and cost-efficient packaging solutions. As consumer lifestyles evolve and urbanization accelerates, the demand for packaged and processed foods continues to grow. In response, manufacturers are increasingly adopting high-performance resins like polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), valued for their strong barrier properties and adaptability. These materials enhance shelf life, maintain product freshness, and provide reliable protection during transport and storage. Moreover, the surge in online food delivery and convenience foods is boosting the demand for lightweight, hygienic, and recyclable packaging formats. The growing emphasis on sustainability is also spurring innovation in bio-based resins, further supporting growth in this segment.

A key challenge facing the packaging resins market is the growing environmental impact of plastic waste, which has triggered stricter government regulations a nd heightened consumer demand for eco-friendly alternatives. This shift is compelling manufacturers to invest heavily in research and development of recyclable and bio-based resins, often at significant cost. In addition, fluctuations in raw material prices particularly crude oil and natural gas can disrupt production economics and impact profit margins. Global supply chain disruptions also add complexity, affecting both material availability and price stability. The market is further pressured by rising competition from alternative materials like paper, glass, and biodegradable composites. Overcoming these obstacles calls for continuous innovation, adoption of circular economy strategies, and strict adherence to evolving environmental regulations and sustainability goals.

Insights by Type

The Polypropylene Segment accounted for the largest market share over the forecast period 2025 to 2035. Polypropylene is extensively utilized in both rigid and flexible packaging applications, especially within the food, beverage, and personal care sectors, due to its strong chemical resistance and effective moisture barrier properties. The growing popularity of e-commerce has amplified the need for flexible packaging made from polypropylene, valued for its lightweight yet durable characteristics. In emerging markets, particularly in the Asia-Pacific region, rapid industrial growth and rising consumer demand are further propelling the use of PP. Additionally, the increasing focus on environmentally friendly packaging solutions is encouraging the adoption of recyclable polypropylene and driving innovation in recycling technologies. Together, these trends solidify polypropylene’s role as a vital material in the transition toward more modern, efficient, and sustainable packaging systems.

Insights by Application

The food & beverages segment accounted for the largest market share over the forecast period 2025 to 2035. Polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are commonly used in the production of bottles, containers, films, and pouches due to their strong barrier capabilities and durability. The growing pace of urbanization, increasing disposable incomes, and the expansion of e-commerce and food delivery services are intensifying the demand for packaging that is safe, convenient, and long-lasting. In response to strict food safety and hygiene standards, manufacturers are turning to advanced resin-based packaging that effectively shields products from moisture, oxygen, and other contaminants. At the same time, innovations in recyclable, biodegradable, and active packaging technologies are gaining momentum, offering eco-friendly alternatives that help preserve shelf life and maintain product integrity.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Packaging Resins Market from 2025 to 2035. The packaging resins market in North America is experiencing consistent growth, driven by increasing demand across key industries such as food and beverage, healthcare, and personal care. The rising consumption of processed and ready-to-eat foods, coupled with the rapid expansion of e-commerce and food delivery services, is boosting the need for lightweight, durable, and secure packaging solutions. This demand is encouraging the widespread use of resins like polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). Strict regulations on food safety and a growing emphasis on hygiene are further supporting market growth. At the same time, environmental concerns and regulatory pressures regarding plastic waste are prompting manufacturers to invest in recyclable and bio-based resins. North America remains at the forefront of innovation, with ongoing advancements in smart and high-barrier packaging technologies improving performance and sustainability.

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The packaging resins market in Asia Pacific is expanding rapidly, driven by swift urbanization, industrial growth, and rising demand for packaged food, beverages, and pharmaceuticals in countries such as China, India, Japan, and South Korea. The surge in e-commerce is further boosting the need for lightweight, durable, and flexible packaging formats like films, pouches, and containers. Increasing environmental awareness is prompting the use of recyclable and bio-based resins such as PET, HDPE, PP, and biodegradable options like PLA. Additionally, the growing emphasis on food safety and extended shelf life is driving demand for high-barrier and specialty resins.

Recent Market Developments

- In October 2020, LyondellBasell and Sasol have signed an agreement under which LyondellBasell will acquire a 50% stake in Sasol’s key assets, including a low and linear low-density polyethylene plant with a capacity of 0.9 million tons per year, a 1.5 million ton per year ethane cracker, and related infrastructure. Valued at around USD 2 billion, the transaction will result in the formation of a new joint venture, named Louisiana Integrated PolyEthylene JV LLC, which will manage the operations of these facilities.

Major players in the market

- Reliance Industries Limited

- Borealis AG.

- BASF SE

- Mitsubishi Chemical Corporation

- LyondellBasell Industries Holdings B.V.

- Braskem

- INEOS

- China Petrochemical Corporation

- SABIC

- Exxon Mobil Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Packaging Resins Market, Type Analysis

- HDPE

- LDPE

- PET

- Polypropylene

- Polystyrene

- PVC

- Others

Packaging Resins Market, Application Analysis

- Food & Beverages

- Consumer Goods

- Healthcare

- Others

Packaging Resins Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?