Global Packaging Resins Market Size, Share, and COVID-19 Impact Analysis, By Type (HDPE, LDPE, PET, Polypropylene, Polystyrene, PVC, and Others), By Application (Food & Beverages, Consumer Goods, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Packaging Resins Market Size Insights Forecasts to 2035

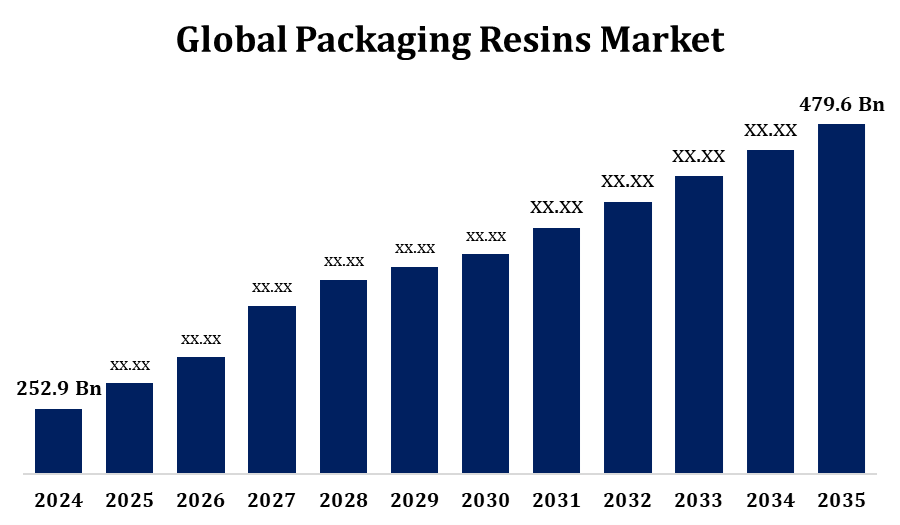

- The Global Packaging Resins Market Size was valued at USD 252.9 Billion in 2024.

- The market is growing at a CAGR of 6.61% from 2025 to 2035.

- The Worldwide Packaging Resins Market Size is Expected to reach USD 479.6 Billion by 2035.

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Packaging Resins Market Size is experiencing robust growth driven by rising demand for durable, lightweight, and cost-effective materials across food, beverage, healthcare, and consumer goods sectors. Increasing urbanization, changing lifestyles, and the boom in e-commerce are fueling the need for flexible and rigid packaging solutions. Polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS) are among the most widely used resins due to their versatility, barrier properties, and recyclability. Sustainability trends are prompting innovation in bio-based and recyclable resin options. Moreover, emerging economies are witnessing rapid industrialization and retail expansion, further supporting market growth. However, environmental concerns and regulatory pressures related to plastic waste are encouraging shifts toward circular economy practices and sustainable packaging alternatives.

Packaging Resins Market Value Chain Analysis

The value chain of the packaging resins market comprises several key stages, beginning with raw material suppliers who provide feedstocks such as naphtha and natural gas for resin production. Resin manufacturers convert these feedstocks into base polymers like polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). These polymers are then processed by compounders and converters to produce films, sheets, containers, and other packaging formats. Packaging product manufacturers use these semi-finished goods to create final packaging solutions tailored to various industries, including food & beverage, pharmaceuticals, and personal care. Distributors and retailers ensure the availability of these products to end users. Finally, waste collection and recycling firms manage post-consumer packaging waste, promoting sustainability. Innovation, cost-efficiency, and regulatory compliance influence each stage of the value chain.

Packaging Resins Market Opportunity Analysis

The packaging resins market presents significant growth opportunities across multiple fronts. The rising demand for bio-based and biodegradable resins is creating avenues for innovation, as consumers and regulatory bodies push for more sustainable packaging alternatives. Advancements in high-performance resins, such as high-barrier multilayer films and smart packaging materials, are enabling enhanced functionality for food, pharmaceutical, and e-commerce packaging. The rapid expansion of e-commerce is further driving demand for lightweight, durable resins that offer protection during transit. Additionally, emerging economies in Asia-Pacific and Latin America are witnessing increased consumption due to growing urbanization, rising disposable incomes, and a booming retail sector. Companies focusing on sustainable solutions, technological upgrades, and regional expansion are well-positioned to capitalize on these evolving market dynamics.

Global Packaging Resins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 252.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.61% |

| 2035 Value Projection: | USD 479.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Reliance Industries Limited, Borealis AG., BASF SE, Mitsubishi Chemical Corporation, LyondellBasell Industries Holdings B.V., Braskem, INEOS, China Petrochemical Corporation, SABIC, Exxon Mobil Corporation, and Other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Packaging Resins Market Dynamics

Rising Demand from the Food and Beverage Sector to Drive Market Expansion

The food and beverage sector is a major driver of growth in the packaging resins market, owing to increasing demand for safe, durable, and cost-effective packaging solutions. With changing consumer lifestyles, rising urbanization, and growing consumption of packaged and processed foods, manufacturers are turning to high-performance resins such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) for their excellent barrier properties and flexibility. These materials help extend shelf life, preserve freshness, and ensure product safety during transportation and storage. Additionally, the rise in online food delivery and ready-to-eat meals is accelerating the need for lightweight, hygienic, and recyclable packaging options. The shift toward sustainable and eco-friendly packaging is also encouraging innovation in bio-based resins, offering further opportunities for market expansion in this segment.

Restraints & Challenges

One of the primary concerns is the increasing environmental impact of plastic waste, which has led to stricter government regulations and rising consumer demand for sustainable alternatives. This is pressuring manufacturers to invest in costly research and development for recyclable or bio-based resins. Additionally, volatility in raw material prices, particularly crude oil and natural gas, can significantly affect production costs and profit margins. Supply chain disruptions, especially in global markets, further complicate material availability and pricing stability. Moreover, competition from alternative packaging materials such as paper, glass, and biodegradable composites is intensifying. Addressing these challenges requires innovation, investment in circular economy practices, and strong compliance with evolving environmental standards and regulatory frameworks.

Regional Forecasts

Get more details on this report -

North America Market Statistics

North America is anticipated to dominate the Packaging Resins Market from 2025 to 2035. The packaging resins market in North America is witnessing steady growth, fueled by rising demand from key sectors such as food and beverage, healthcare, and personal care. The increasing consumption of ready-to-eat and processed foods, along with the surge in e-commerce and food delivery services, is driving the need for lightweight, durable, and safe packaging. This trend supports the widespread use of resins like polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET). Strict food safety standards and heightened consumer focus on hygiene further contribute to market expansion. Additionally, growing environmental concerns and regulatory pressures around plastic waste are pushing companies to invest in recyclable and bio-based resin technologies. North America continues to lead in innovation, with advancements in smart and high-barrier packaging materials enhancing both functionality and sustainability.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The growth is driven by rapid urbanization, industrialization, and increasing demand for packaged food, beverages, and pharmaceuticals across countries like China, India, Japan, and South Korea. The booming e-commerce sector is further accelerating the need for flexible, durable, and lightweight packaging solutions such as films, pouches, and containers. Growing awareness about environmental sustainability is encouraging the adoption of recyclable and bio-based resins, including PET, HDPE, PP, and biodegradable alternatives like PLA. Additionally, rising demand for high-barrier and specialty resins is being fueled by the need for extended shelf life and enhanced food safety.

Segmentation Analysis

Insights by Type

The polypropylene segment accounted for the largest market share over the forecast period 2025 to 2035. Polypropylene is widely used in both rigid and flexible packaging formats, particularly in food, beverage, and personal care applications, thanks to its excellent chemical resistance and moisture barrier properties. The rise of e-commerce has further boosted demand for flexible packaging solutions made from PP, which offer lightweight yet durable protection. Rapid industrialization and increasing consumption in emerging economies, especially across Asia-Pacific, are also driving regional demand. Moreover, growing emphasis on sustainable packaging is promoting the use of recyclable PP and supporting advancements in recycling technologies. These factors collectively position polypropylene as a key material in the evolving landscape of modern and eco-conscious packaging solutions.

Insights by Application

The food & beverages segment accounted for the largest market share over the forecast period 2025 to 2035. Materials such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are widely used in bottles, containers, films, and pouches due to their excellent barrier properties and durability. Urbanization, rising disposable incomes, and the rapid growth of e-commerce and food delivery services are further accelerating the need for safe, convenient, and long-lasting packaging. Additionally, strict food safety and hygiene regulations are pushing manufacturers to adopt advanced resin-based packaging that protects against moisture, oxygen, and contaminants. Innovations in recyclable, biodegradable, and active packaging technologies are also gaining traction, offering sustainable solutions while enhancing shelf life and maintaining product quality.

Recent Market Developments

- In October 2020, LyondellBasell and Sasol entered into an agreement to acquire a 50% stake in Sasol’s assets, which include a 0.9 billion ton per year low and linear low-density polyethylene plant, a 1.5 billion ton per year ethane cracker, and associated infrastructure. The deal, valued at approximately USD 2 billion, will be operated under the newly formed joint venture named Louisiana Integrated PolyEthylene JV LLC.

Competitive Landscape

Major players in the market

- Reliance Industries Limited

- Borealis AG.

- BASF SE

- Mitsubishi Chemical Corporation

- LyondellBasell Industries Holdings B.V.

- Braskem

- INEOS

- China Petrochemical Corporation

- SABIC

- Exxon Mobil Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Packaging Resins Market, Type Analysis

- HDPE

- LDPE

- PET

- Polypropylene

- Polystyrene

- PVC

- Others

Packaging Resins Market, Application Analysis

- Food & Beverages

- Consumer Goods

- Healthcare

- Others

Packaging Resins Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?