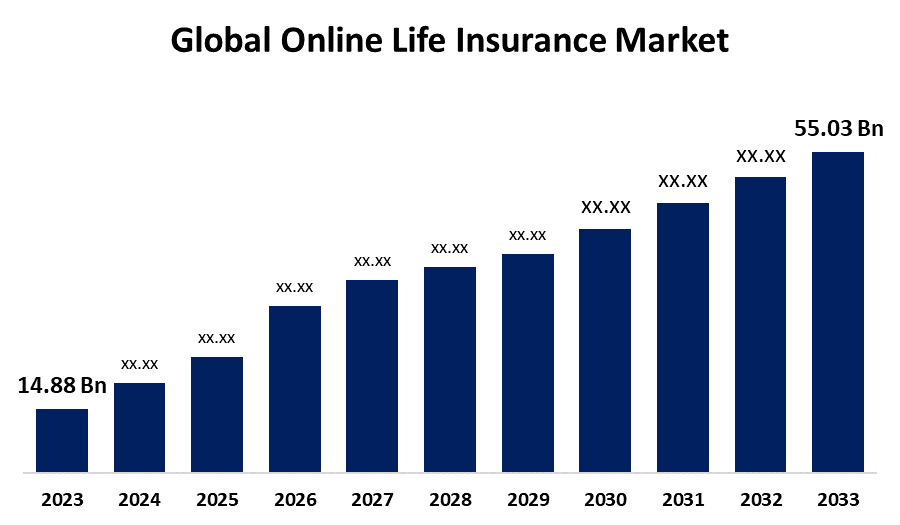

Global Online Life Insurance Market Size To Exceed USD 55.03 Billion By 2033 | CAGR Of 13.97%

Category: Banking & FinancialGlobal Online Life Insurance Market Size To Exceed USD 55.03 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Online Life Insurance Market Size is Expected to Grow from USD 14.88 Billion in 2023 to USD 55.03 Billion by 2033, at a CAGR of 13.97% during the forecast period 2023-2033.

Get more details on this report -

Browse key industry insights spread across 210 pages with 100 Market data tables and figures & charts from the report on the “Global Online Life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Policy Type (Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Variable Life Insurance and Others), By Age Group (Minors, Adults and Seniors), By Distribution Channel (Direct Sales, Insurance Aggregators, Brokers and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.” Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/online-life-insurance-market

The digital life insurance market is the portion of the insurance sector in which life insurance policies are distributed, sold, and administered online through websites, smartphone apps, and online aggregators. It allows policyholders to compare products, obtain quotes, and buy policies without going through intermediaries. Moreover, ubiquitous internet penetration, smartphone use, and electronic payment systems have facilitated consumers to compare, research, and buy insurance online. The comfort of 24/7 accessibility and ease of apps is changing the way consumers buy by tilting towards digital-first insurance. Online platforms minimize the necessity for physical branches and agents, reducing acquisition and operational expenses. Insurers are now moving to direct-to-consumer models where they can own pricing, customer experience, and retention through personalized, data-driven interaction. However, life insurance policies, particularly those involving investment components, are complex and difficult to understand without personalized advice. The absence of human advisers in online channels restricts consumers from understanding policy nuances, thus making them apprehensive about finalizing a purchase.

The term life insurance segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the policy type, the online life insurance market is divided into term life insurance, whole life insurance, universal life insurance, variable life insurance, and others. Among these, the term life insurance segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by term life insurance provides low premiums for high coverage relative to whole or universal life policies. This renders it particularly appealing to price-conscious consumers like young adults and families seeking financial security without a heavy monthly cost.

The adults segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the age group, the online life insurance market is divided into minors, adults, and seniors. Among these, the adults segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to this group usually having stable employment and disposable income, with the ability to pay premiums and purchase long-term financial planning instruments such as life insurance. Insurers also aim for this group as it provides an adequate balance between affordability and insurability as a result of their reduced health risk as compared to seniors.

The direct sales segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the online life insurance market is divided into direct sales, insurance aggregators, brokers, and others. Among these, the direct sales segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to life insurers have significantly invested in their own websites and mobile applications through which they have been selling policies directly to customers. Such platforms provide brand control, price control, as well as control over the customer experience, hence becoming the channel of choice for insurers to issue, renew, and service policies digitally.

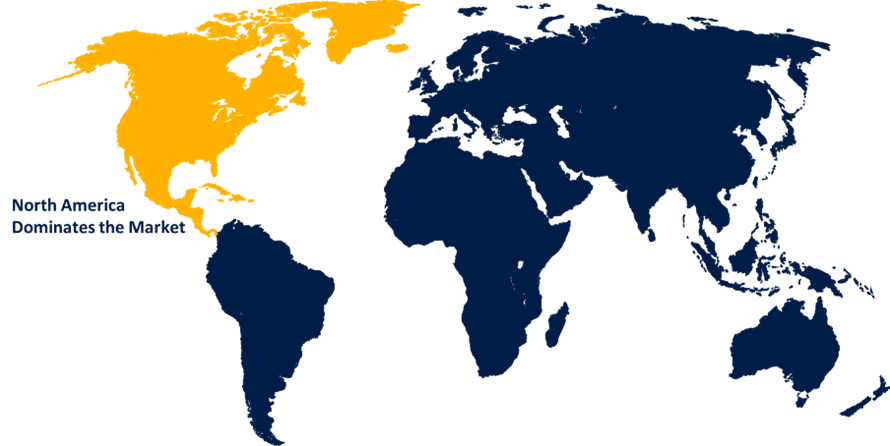

North America is expected to hold the majority share of the global online life insurance market during the forecast period.

Get more details on this report -

North America is expected to hold the majority share of the global online life insurance market during the forecast period. North America is where prominent insurtechs like Haven Life, Ethos, and Ladder operate. They simplify buying life insurance using AI-based underwriting and immediate approval. Their technology-driven model is attractive to young, digitally native buyers, further increasing online market share.

Asia Pacific is anticipated to grow at the fastest pace in the global online life insurance market during the forecast period. Governments in nations such as India and China are actively encouraging financial inclusion by digital means such as Aadhaar, e-KYC, and digital wallets. All these have facilitated insurers to reach distant and underserved communities through online channels, increasing the customer base significantly.

Major vendors in the global online life insurance market are MetLife, Prudential Financial, AXA, Allianz, China Life Insurance, Berkshire Hathaway, Manulife Financial, AIA Group, Zurich Insurance Group, Generali Group, New York Life Insurance, Nippon Life Insurance, Ping An Insurance, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In December 2024, ICICI Prudential Life Insurance launched 'ICICI Pru Wish', a pioneering health product in the life insurance sector, targeting women-specific critical illnesses and surgeries. ICICI Prudential Life Insurance has designed this product in association with Reinsurance Group of America, Incorporated (RGA), one of the world's leading global life and health reinsurers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the online life insurance market based on the below-mentioned segments:

Global Online Life Insurance Market, By Policy Type

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

- Others

Global Online Life Insurance Market, By Age Group

- Minors

- Adults

- Seniors

Global Online Life Insurance Market, By Distribution Channel

- Direct Sales

- Insurance Aggregators

- Brokers

- Others

Global Online Life Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?