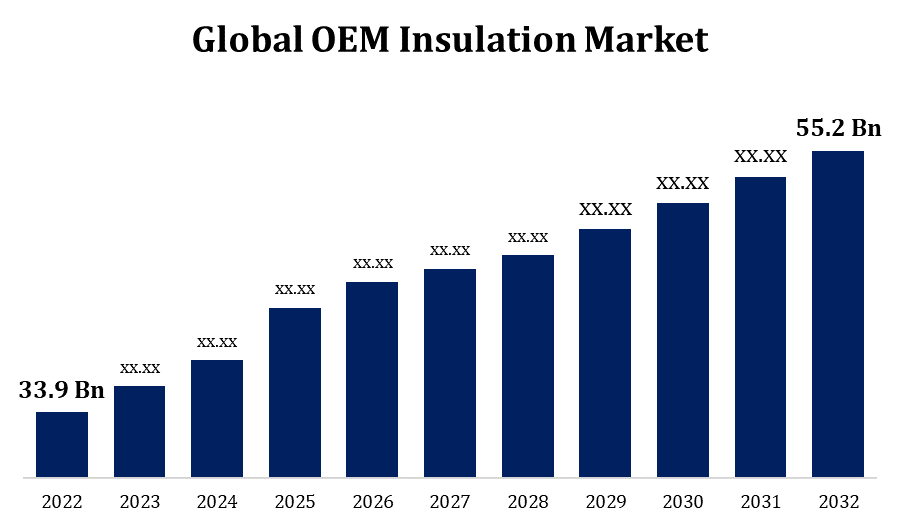

Global OEM Insulation Market Size To Worth USD 55.2 Billion by 2032 | CAGR OF 5.00%

Category: Chemicals & MaterialsGlobal OEM Insulation Market Size To Worth USD 55.2 billion by 2032

According to a research report published by Spherical Insights & Consulting, the Global OEM Insulation Market Size to Grow from USD 33.9 Billion in 2022 to USD 55.2 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.00% during the Forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 100 Market data tables and figures & charts from the report on the "Global OEM Insulation Market Size By Material (Glass Wool, Foamed Plastics, Mineral Wool), By End-Users (Automotive, Marine, Aerospace), By Region, And Segment Forecasts, By Geographic Scope And Forecasts to 2032." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/oem-insulation-market

OEM stands for Original Equipment Manufacturer and refers to insulating materials and solutions that are integrated into goods throughout the manufacturing process. This market is driven by a variety of industries, including automotive, aerospace, electronics, and appliances, where insulation plays a critical role in enhancing energy efficiency, reducing noise, and ensuring proper equipment performance. The demand for lightweight and high-performance insulation materials is growing, particularly in areas where weight reduction is crucial, such as automotive and aerospace.

OEM Insulation Market Value Chain Analysis

The value chain begins with suppliers of raw materials such as fibreglass, foams, and other insulation materials. These vendors are crucial in determining the quality and features of the finished insulating product. Businesses in this step transform raw resources into insulating items. For OEM applications, they may produce fibreglass insulation, foam boards, or specialty coatings. These are the companies that specialise in the development of insulating solutions for Original Equipment Manufacturers. They design and manufacture insulating components or systems that can be easily integrated into the manufacturing processes of many industries. OEMs from diverse industries, such as automotive, aerospace, and electronics, are the next stage in the value chain. They incorporate insulating elements into their products during the manufacturing process. When the insulation components are ready, they must be supplied to the original equipment manufacturers (OEMs). To ensure timely delivery to manufacturing plants, logistics, warehousing, and transportation services are essential. End users are individuals or businesses who purchase and use finished products that use OEM insulation.

OEM Insulation Market Opportunity Analysis

The increased emphasis on energy efficiency and sustainability around the world is driving up demand for high-performance insulating materials. Technical improvements may enable the market to develop innovative insulating materials that are lighter, more durable, and have superior thermal and acoustic qualities. OEM insulation materials that are both lightweight and effective in noise and temperature control are becoming increasingly popular as the automotive industry emphasises lightweighting for fuel efficiency and emissions reduction. The growth of electric vehicles raises new insulating difficulties due to varying thermal and safety requirements. OEM insulation manufacturers may look into solutions tailored to the special needs of electric vehicles. Construction sector growth, particularly in emerging markets, opens up opportunities for OEM insulation materials in building systems and HVAC applications.

Energy-efficient machinery and products save OEMs money over time. Insulation that enhances equipment's energy efficiency, such as minimising heat loss or boosting thermal management, aligns with manufacturers' cost-cutting objectives. Green building methods and sustainable construction are becoming more popular in the construction industry. Insulation is essential in the design of energy-efficient buildings. Manufacturers of OEM insulation can profit on this trend by offering materials that improve structural energy efficiency. The vehicle industry and the quest for energy-efficient solutions both share the goal of lightweighting for fuel economy.

In competitive industries, OEMs may prioritise economic reasons above advanced insulating technology. It may be difficult to persuade manufacturers to invest in more expensive but more effective insulating materials. Global economic uncertainties and market fluctuations might have an impact on total industrial activity. OEM insulation makers may face challenges related to demand instability and financing in such uncertain economic conditions. Because of factors like as temperature range, durability, and safety standards, insulation requirements differ per industry. OEM insulation manufacturers must design their products to meet the specific requirements of each industry, which mandates a diverse range of solutions. The OEM insulation business, like many others, is vulnerable to supply chain disruptions.

Insights by Material

The foamed plastics segment accounted for the largest market share over the forecast period 2023 to 2032. Because of their outstanding thermal insulation properties, foamed plastics are suitable for a wide range of OEM applications. These materials effectively limit heat transmission and contribute to energy efficiency in a range of areas. Foamed plastics can be moulded and shaped to match specific requirements, making them suitable for a variety of OEM applications. They are used in industries such as automotive, appliances, electronics, and construction and provide insulation in a variety of forms such as boards, sheets, and spray foams. The overall market drive for energy-efficient solutions has fueled the growth of the foamed plastics industry. Foamed plastics are becoming a popular alternative as businesses focus energy efficiency to meet regulatory requirements and save operational costs.

Insights by End Users

The automotive segment accounted for the largest market share over the forecast period 2023 to 2032. Lightweighting is becoming increasingly significant in the automotive industry to improve fuel efficiency and reduce pollution. Foamed plastics and other lightweight insulation materials are crucial for lowering weight without losing performance. The increasing popularity of electric and hybrid vehicles presents new insulating challenges. These vehicles have specific thermal and acoustic requirements, and novel insulating materials are necessary to accommodate the unique features of electric drivetrains and battery systems. To meet increased performance and environmental demands, the automotive sector is rapidly adopting enhanced insulation materials and technologies. The rise of Asia-Pacific and emerging market vehicle markets contributes to an increase in demand for OEM insulation.

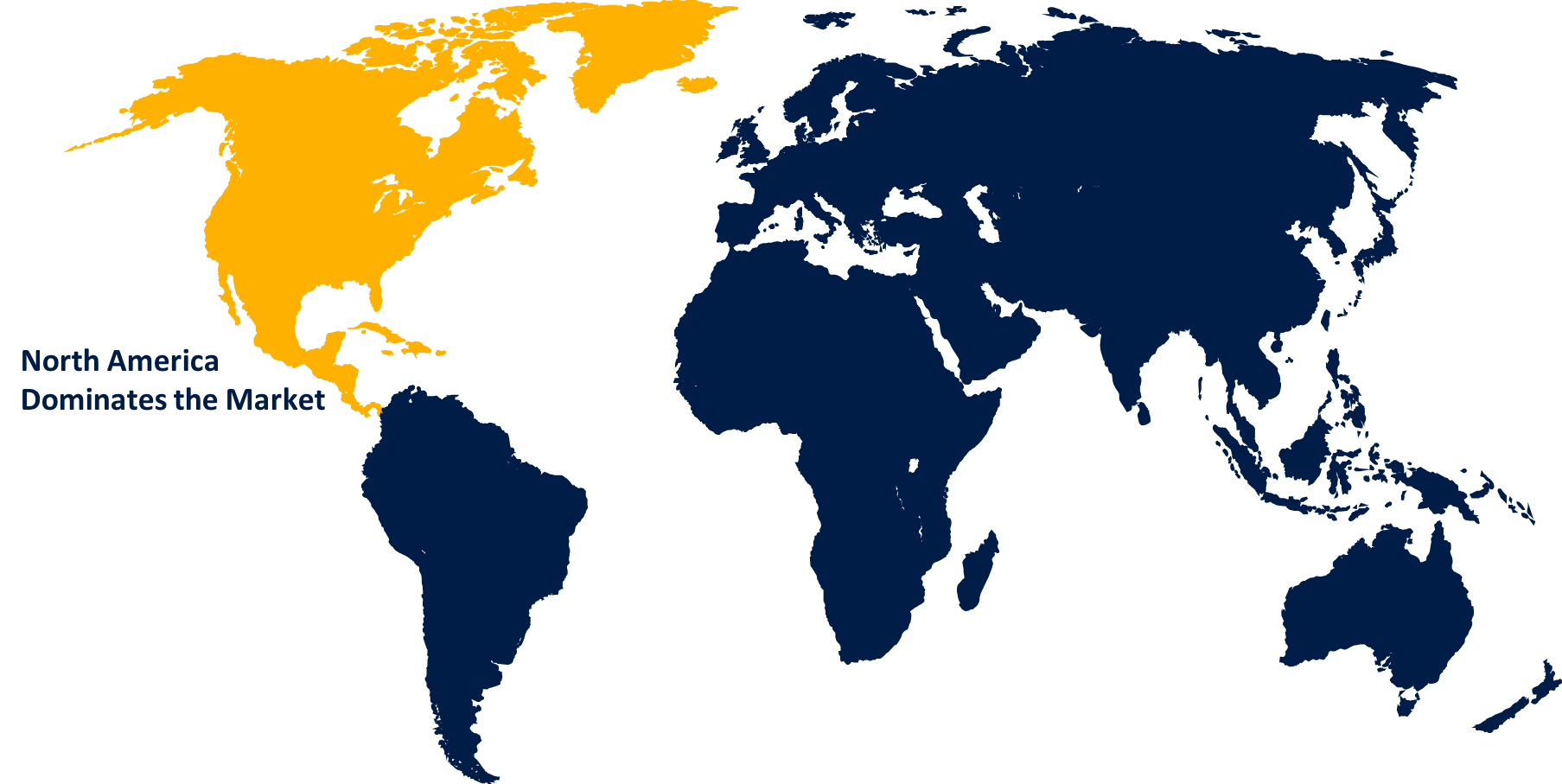

Insights by Region

Get more details on this report -

North America is anticipated to dominate the OEM Insulation Market from 2023 to 2032. OEMs in automotive, aerospace, electronics, and other manufacturing industries have a strong presence in North America. The rising demand for insulating solutions is driven by the need for energy efficiency and compliance with environmental norms. The automotive industry, a major consumer of OEM insulation in North America, wields considerable power. As the industry progresses, there is a greater emphasis on lightweighting, emission reduction, and energy efficiency, which opens the door to creative insulating solutions. The building industry in North America is a big consumer of insulating goods. Increased infrastructure developments and green construction activities drive even more demand for OEM insulation solutions. The OEM insulation industry in North America is competitive, with both domestic and international companies.

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. China, Japan, South Korea, and India are important actors in the Asia-Pacific manufacturing sector. The region's strong industrial base, which includes automotive, electronics, and machinery manufacturing, drives demand for OEM insulation solutions. The automotive and electronics industries are major consumers of OEM insulation in Asia-Pacific. The rise of these businesses, combined with a focus on energy-efficient automobiles and electronics, creates substantial opportunities for insulation manufacturers. Economic growth in the Asia-Pacific area is being matched by an increase in energy demand. As a result, there is a higher emphasis on energy efficiency, which fuels demand for insulating materials in a number of industrial applications to optimise energy usage. The Asia-Pacific region is well-known for its rapid adoption of new technology.

Recent Market Developments

- In April 2022, Kingspan Group is investing USD 27 million to expand its business at 200 Kingspan Way in Frederick County, Maryland.

Major players in the market

- ACH Foam Technologies LLC

- Big Sky Insulations

- Anco Products Inc.

- Johns Manville Corporation

- E.I. du Pont de Nemours and Company

- Armacell International S.A.

- Knauf Insulation, Demilec Inc.

- Autex Industries Ltd.

- Aspen Aerogels Inc.

- Owens Corning Corp.

- Morgan Advanced Materials

- Rockwool International A/S

- Paroc

- Scott Industries LLC

- Saint-Gobain S.A.

- Superglass Insulation Ltd.

- Triumph Group Inc.

- The 3M Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

OEM Insulation Market, Material Analysis

- Glass Wool

- Foamed Plastics

- Mineral Wool

OEM Insulation Market, End Users Analysis

- Automotive

- Marine

- Aerospace

OEM Insulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?