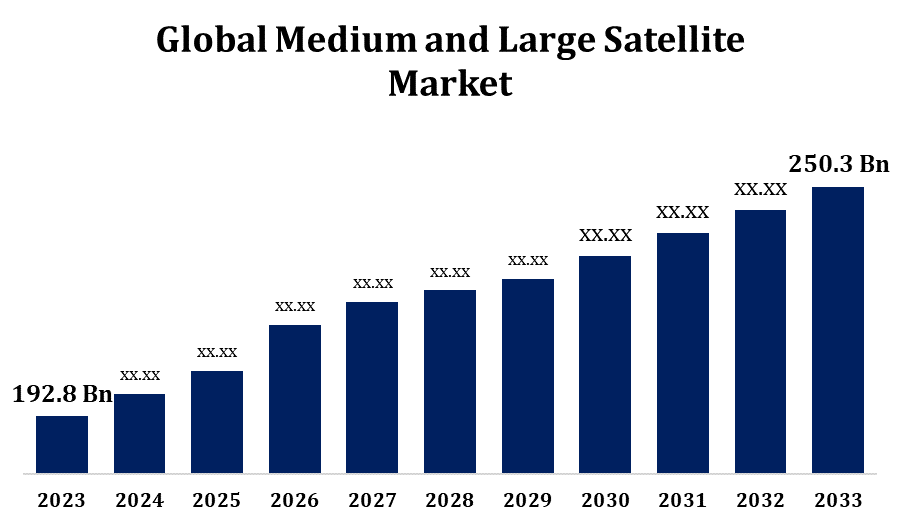

Global Medium And Large Satellite Market Size To Worth USD 250.3 Billion by 2033 | CAGR Of 2.64%

Category: Aerospace & DefenseGlobal Medium And Large Satellite Market Size To Worth USD 250.3 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Medium And Large Satellite Market Size to grow from USD 192.8 Billion in 2023 to USD 250.3 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 2.64% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 market data tables and figures & charts from the report on The "Global Medium And Large Satellite Market Size By Mass (500 kg -1000 kg (Medium satellites), and >1000 kg ( Large Satellites)), By Application (Navigation and Mapping, Communication, Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/medium-and-large-satellite-market

Medium and large satellites are crucial parts of global communication networks because they carry phone, data, and multimedia services to government agencies, telecommunications companies, and internet service providers. Geostationary communication satellites and high-throughput satellites (HTS) are two prominent examples in this field. By providing communication, reconnaissance, intelligence, surveillance, and reconnaissance (ISR), and reconnaissance capabilities, medium and large satellites support defence and surveillance operations. These satellites provide situational awareness in addition to monitoring key locations and hotspots and assisting with military operations. Among the commercial services that medium and large satellites may offer are satellite broadcasting, geospatial analytics, satellite imaging, and remote sensing data services.

Medium And Large Satellite Market Value Chain Analysis

Satellite manufacturers and space agencies invest in research and development to build new technologies, materials, and systems for satellites. The purpose of R&D is to improve satellite performance, cost-effectiveness, and reliability in response to shifting market demands. Satellite engineering and design include conceptualization, design, and system optimisation. Together, scientists and engineers design satellite designs, subsystems, and components that meet mission-specific requirements while taking payload capacity, power generation, communication capabilities, and thermal control into consideration. Satellite components and subsystems include solar panels, batteries, propulsion systems, communication antennae, payload instrumentation, and onboard computers, to name a few. Spacecraft assembly and integration facilities assemble and integrate separate satellite components to form complete spacecraft. Satellite operators supervise mission operations to ensure the effective utilisation and operation of their fleets of satellites. End users utilise satellite services and data for a wide range of purposes, including national security, agriculture, weather forecasting, broadcasting, telecommunications, Earth observation, and environmental monitoring.

Medium And Large Satellite Market Opportunity Analysis

The need for high-speed internet connectivity is growing in remote and underserved areas of the world. Large and medium-sized satellites can play a major role in expanding broadband access by providing satellite internet services to regions without terrestrial infrastructure. Satellite operators may capitalise on this market by offering high-throughput, stable, and cost-effective satellite broadband solutions. Strong backhaul infrastructure is required for 5G network implementation in order to connect cell towers and enable high-bandwidth data transport. Medium- and large-sized satellites can be extremely important in 5G backhaul networks to connect remote or rural areas where terrestrial backhaul is either impractical or prohibitively expensive. Satellite operators can work with telecom companies to offer satellite-based 5G backhaul solutions.

Increasing production volume can lower manufacturing costs per unit through economies of scale. Manufacturers of satellites may decide to standardise parts, improve production procedures, and streamline supply chains in order to reduce costs and boost output. Manufacturers enable the reuse of similar components and subsystems across several satellite missions through the standardisation of satellite platforms and the application of modular design concepts. This approach minimises design complexity, shortens development cycles, and lowers manufacturing costs by eliminating customisation and rework. Supply chain disruptions can be minimised and procurement costs can be cut by streamlining the satellite supply chain through the procurement of components from reliable vendors, favourable contract negotiations, and inventory control. Just-in-time manufacturing strategies and astute supplier relationships can lower costs and streamline procedures.

The substantial initial outlay necessary for the design, production, and deployment of medium- and large-sized satellites may restrict the scalability of satellite programmes and act as a barrier to entry for new rivals. When developing medium- and large-sized satellites, sophisticated systems and state-of-the-art technology—such as propulsion systems, communication payloads, and high-resolution image sensors—must be combined. Maintaining technical complexity and ensuring system compatibility could be challenging, especially for multi-mission satellites. Launch delays, failures, and disruptions can affect deployment schedules and increase costs for satellite operators. The planning and execution of satellite launches can be made more uncertain and risky by geopolitical concerns, legal limitations, and a shortage of launch vehicles.

Insights by Mass

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. Medium-sized satellites, which have payload capacities ranging from several metric tonnes to 500 kg, are perfect for a number of applications, including communication, Earth observation, scientific research, and navigation. The growing need for medium-capacity satellites, particularly in emerging countries, is driving the market's expansion. Emerging industries including satellite broadband, Internet of Things (IoT) connectivity, and Earth observation analytics are driving the need for medium satellites. Satellite operators are creating opportunities for the industry by putting medium satellites into service to suit the expanding needs of applications such as precision agriculture, environmental monitoring, disaster monitoring, and rural connectivity.

Insights by Application

The communication segment accounted for the largest market share over the forecast period 2023 to 2033. The need for high-speed broadband access is rising worldwide, particularly in remote and developing areas with inadequate or nonexistent terrestrial infrastructure. Large and medium-sized satellites make it easier for household, business, and industrial clients to access broadband internet, which in turn spurs growth in the communication market. Medium- and large-sized satellites are essential backhaul lines for mobile and cellular networks, bringing coverage to remote and rural areas where using terrestrial backhaul would be prohibitively expensive. The ability of mobile operators to reach more consumers, improve the quality of their services, and expand their networks through satellite-based backhaul solutions is what drives the demand for communication satellite capacity.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Medium And Large Satellite Market from 2023 to 2033. Prominent multinational commercial satellite providers, such Intelsat, SES, and ViaSat, are headquartered in North America and provide broadband internet access, satellite communication services, and Earth observation data. These operators serve a variety of markets and industries with excellent services by utilising medium- and large-sized satellites. Numerous businesses in North America, including national security, broadcasting, telecommunications, navigation, and Earth observation, have considerable demand for satellite services. The region's complex infrastructure, varied economy, and extensive terrain necessitate the use of satellite-based systems for communication, networking, and surveillance. Space travel, lunar exploration, satellite servicing, and on-orbit assembly are among the new satellite market segments that are becoming available for venture capital in North America.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Startups and satellite operators in the Asia-Pacific area are providing investment for satellite constellation projects in order to provide broadband internet coverage globally, remote sensing services, and networking solutions. Businesses such as SpaceX, OneWeb, and Starlink are attempting to bridge the digital divide by deploying large and medium-sized satellite constellations to underserved areas. Environmental problems, such as natural disasters, urbanisation, and climate change, are driving demand for satellite-based Earth observation data and analytics in the Asia-Pacific region. Governments, educational institutions, and private companies all employ medium and large satellites to monitor environmental changes, manage natural resources, and support disaster relief efforts.

Recent Market Developments

- In May 2023, the first satellite of the international ViaSat-3 constellation was successfully launched by NASA's Kennedy Space Centre in Florida.

Major players in the market

- EchoStar Corporation

- Airbus D&S

- Lockheed Martin Corporation

- Space Exploration Technologies Corp.

- Inmarsat PLC

- AMOS Spacecom

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Medium And Large Satellite Market, Mass Analysis

- 500 kg -1000 kg (Medium satellites),

- >1000 kg ( Large Satellites)

Medium And Large Satellite Market, Application Analysis

- Navigation and Mapping

- Communication

- Others

Medium And Large Satellite Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?