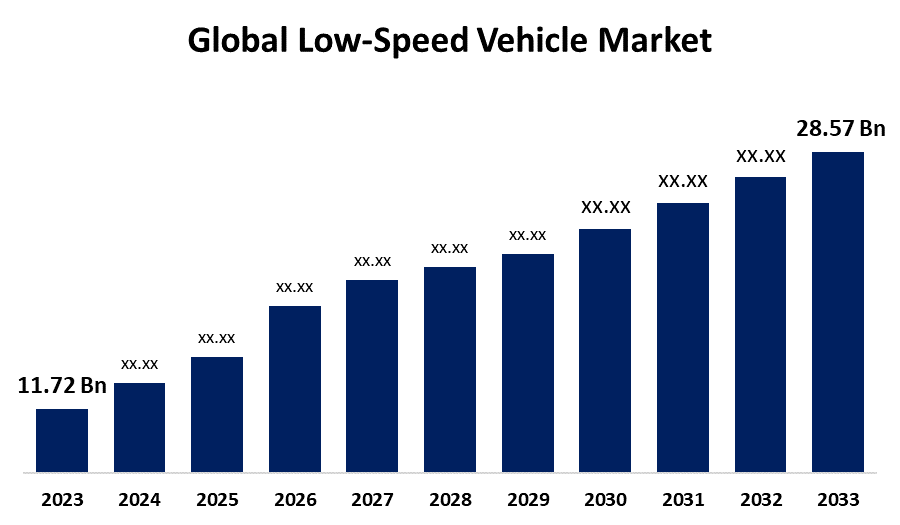

Global Low-Speed Vehicle Market Size To Exceed USD 28.57 Billion By 2033 | CAGR of 9.32%

Category: Automotive & TransportationGlobal Low-Speed Vehicle Market Size To Exceed USD 28.57 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Low-Speed Vehicle Market Size is to Grow from USD 11.72 Billion in 2023 to USD 28.57 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 9.32% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Low-Speed Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Type (Golf Cart, Commercial Utility Vehicle, Industrial Utility Vehicle, Personal Mobility Vehicle), By Power Output (<8, 8-15KW, >15 KW), By Propulsion Type (Electric Vehicle, ICE), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/low-speed-vehicle-market

The low-speed vehicle (LSV) industry refers to cars built for travel at low speeds, typically between 20 and 25 mph (32 and 40 kph). LSVs are widely utilized for short-distance transportation in residential neighbourhoods’, schools, resorts, and other regulated areas. These electric vehicles offer a feasible and ecologically friendly means of transportation. Leading governments are working together to minimize emissions and impose strict emission restrictions to tackle climate change, which is mostly driven by transportation emissions. These vehicles are projected to contribute to reduced vehicular pollution. As a result, these cars are likely to gain popularity in towns and cities for short-distance trips and campus rides to companies, hospitals, universities, golf courses, colleges, residential flats, and other locations. Thus, this factor is projected to boost the market. Providing rapid and effective transportation over short distances is the main purpose of LSVs. Governments have enacted stringent automotive pollution laws and restrictions, boosting industry growth. However, the high cost of EVs, a lack of enough infrastructure for charging, and the fact that technology for them is still in its early stages are hindering the growth of the low-speed electric vehicle market share worldwide.

The commercial utility vehicle segment is expected to hold the largest share of the global low-speed vehicle market during the anticipation timeframe.

Based on the type, the global low-speed vehicle market is categorized into golf cart, commercial utility vehicle, industrial utility vehicle, and personal mobility vehicle. Among these, the commercial utility vehicle segment is expected to hold the largest share of the global low-speed vehicle market during the anticipation timeframe. The transportation of these vehicles between plants is becoming increasingly crucial in the business. The main competitors are focusing on commercial vehicles. For instance, in December 2021, Deere & Company agreed to buy Krisel Electric's majority stake. Kreisel produces high-density, long-lasting electric battery modules and packs. John Deere has seen a rise in demand for batteries as a solo or hybrid vehicle propulsion system. Turf equipment, compact utility tractors, miniature tractors, compact construction, and road-building equipment are all examples of Deere goods that can be powered solely by batteries.

The 8-15KW segment is expected to grow at the fastest CAGR during the anticipation timeframe.

Based on the power output, the global low-speed vehicle market is categorized into <8, 8-15KW, >15 KW. Among these, the 8-15KW segment is expected to grow at the fastest CAGR during the anticipation timeframe. 8-15KW LSVs can be more powerful and have more range per charge than LSVs with a maximum power output of 8KW or less. These vehicles are mostly used for private use and include small electric cars and golf carts.

The electric vehicle segment is expected to hold a significant share of the global low-speed vehicle market during the anticipation timeframe.

Based on the propulsion type, the global low-speed vehicle market is categorized into electric vehicle, and ICE. Among these, the electric vehicle segment is expected to hold a significant share of the global low-speed vehicle market during the anticipation timeframe. The growing number of golf courses, as well as the government's efforts to limit carbon emissions to comply with pollution control regulations, will boost the automobile sector.

Asia Pacific is anticipated to hold the largest share of the global low-speed vehicle market over the anticipation timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global low-speed vehicle market over the anticipation timeframe. Countries such as India, South Korea, and Thailand have been experiencing increased demand in recent years. Golf's popularity is growing throughout Asia, with 5,000 courses planned by 2021 and numerous new clubs slated to open. In addition, tourism, product manufacturing, IT hubs, and warehousing have all expanded dramatically in recent years. Low-speed vehicles can be useful in these applications for transferring people to particular areas and conveying medium to big items. All of these variables are expected to boost the growth of low-speed cars in the region.

North America is expected to grow at the fastest CAGR growth of the global Low-Speed Vehicle market during the anticipation timeframe. For instance, in February 2022, the US Department of Transportation announced intentions to invest USD 5 billion over the next few years through the National Electrical Vehicle Infrastructure (NEVI) Formula. This program was launched by the president to assist in the development of a national network of electric vehicle charging stations. To combat pollution, there is an increase in global demand for low-emission, ecologically friendly automobiles. To address the negative consequences of deforestation, governments in the US are promoting electric vehicles and low-emission fuel sources.

Major vendors in the global low-speed vehicle market are ICON Electric Vehicles, AGT Electric Cars, KUBOTA Corporation, Moto Electric Vehicles, Motrec International Inc., Star EV Corporation, CLUB CAR, Columbia Vehicle Group Inc., Deere & Company, Evolution Electric Vehicles, Garia, American Landmaster, Bradshaw, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, United Rentals, Inc. has partnered with Polaris Commercial, a Polaris division, to supply more all-electric utility vehicles, which will help make job sites cleaner, more environmentally friendly, and quieter. This will also help users accomplish their sustainability goals while decreasing maintenance requirements. The Polaris RANGER XP Kinetic, an all-new electric utility vehicle, boasts more features and the most horsepower and torque ever seen in a utility side-by-side.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global low-speed vehicle market based on the below-mentioned segments:

Global Low-Speed Vehicle Market, By Type

- Golf Cart

- Commercial Utility Vehicle

- Industrial Utility Vehicle

- Personal Mobility Vehicle

Global Low-Speed Vehicle Market, By Power Output

- <8

- 8-15KW

- >15 KW

Global Low-Speed Vehicle Market, By Propulsion Type

- Electric Vehicle

- ICE

Global Low-Speed Vehicle Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?