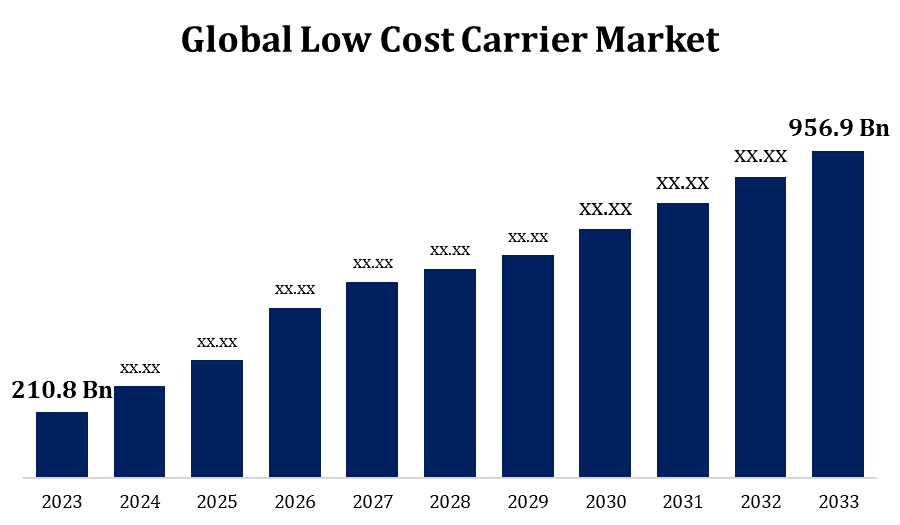

Global Low Cost Carrier Market Size To Worth USD 956.9 Billion By 2033 | CAGR Of 16.33%

Category: Aerospace & DefenseGlobal Low Cost Carrier Market Size To Worth USD 956.9 Billion By 2033 | CAGR Of 16.33%

According to a research report published by Spherical Insights & Consulting, The Global Low Cost Carrier Market Size to grow from USD 210.8 Billion in 2023 to USD 956.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 16.33% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on The 'Global Low Cost Carrier Market Size By Aircraft Type (Narrow Body, Wide Body), By Application (Individual, Commercial), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/low-cost-carrier-market

Low-cost carriers have grown extensively, providing both short- and long-haul flights. Low-cost carriers have captured a sizable portion of the aviation market, posing a challenge to major carriers. The real market share varies by region, with some areas having a higher number of low-cost carriers than others. The low-cost carrier industry is quite competitive. Airlines routinely engage in price wars to attract customers, and this tough competition has led to innovative company structures and cost-cutting measures.

Low Cost Carrier Market Value Chain Analysis

LCCs prioritise purchasing fuel-efficient and cost-effective aircraft, often from a single manufacturer, to simplify maintenance and training. To save money, form agreements with suppliers of petrol, spare parts and other running necessities. Ground procedures are being streamlined to improve operational efficiency, such as faster turnaround times, improved labour scheduling, and less idle time. LCCs frequently use direct flights rather than hub-and-spoke structures to save money on layovers and connecting flights. Using online platforms and direct distribution strategies to cut distribution costs while expanding your consumer base. Using cost-effective marketing methods, often utilising digital media, to promote lower rates and attract budget-conscious passengers. The success of low-cost carriers is contingent on improving each stage of the value chain to create cost reductions.

Low Cost Carrier Market Opportunity Analysis

As the aviation industry recovers from the consequences of the COVID-19 epidemic, low-cost carriers can benefit on pent-up demand and adapt their strategies to the new travel environment. Using digital technology to improve client experiences, such as simplified booking processes, mobile apps, and customised services, can increase customer satisfaction and loyalty. Identifying and entering new markets, particularly in emerging economies with a growing middle class and expanding air travel demand, provides opportunities for expansion. Investing in contemporary, fuel-efficient aircraft can help you save money, increase operational efficiency, and promote environmental sustainability.

Low-cost airlines are well-known for their low costs, which make air travel more accessible to a broader spectrum of individuals. This affordability is particularly enticing for domestic travel, encouraging more people to fly instead of taking other modes of transportation. Economic growth and urbanisation frequently lead to an increase in domestic travel for both business and recreational purposes. As more people move to cities, the demand for air travel within a country grows. Low-cost airlines usually focus on market segmentation, aiming for specific demographics or traveller profiles.

Fuel price variations have a significant impact on airline operating costs. Low-cost carriers, which rely heavily on cost efficiency, may struggle to be viable during periods of high fuel prices. Economic recessions or downturns can lead to a decrease in consumer spending and travel. Low-cost carriers, who usually cater to price-sensitive travellers, may be hit harder during economic downturns. The low-cost carrier industry is very competitive, and price wars among airlines can reduce profit margins. Differentiating from competitors while keeping prices low is an ongoing issue.

Insights by Aircraft Type

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. In general, narrow-body aircraft are less expensive than wide-body aircraft, both in terms of initial and operating expenses. Low-cost carriers prioritise cost-effectiveness, and narrow-body planes' lower operational expenses align with their business model. Low-cost carriers may adopt a point-to-point technique, connecting passengers directly between city pairs rather than through hubs. This idea is best suited to narrow-body aircraft, allowing carriers to efficiently serve a wide range of destinations. Short-haul and regional travel are becoming increasingly popular, especially in densely populated areas and growing economies.

Insights by Application

The individual segment accounted for the largest market share over the forecast period 2023 to 2033. The leisure travel section of the low-cost carrier market is usually populated by cost-conscious travellers looking for low-cost flights for vacations and holidays. This segment's expansion is being driven by increased disposable incomes, a desire for distinctive travel experiences, and the convenience provided by low-cost carriers. Low-cost carriers are increasingly targeting business travellers by offering competitive fares, flexible scheduling, and services tailored to specific business needs. Business travel segment growth is influenced by cost-conscious business travel restrictions, a need for quick and frequent connections, and the expansion of low-cost carrier route networks.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Low Cost Carrier Market from 2023 to 2033. Low-cost carriers now dominate North America's domestic market. They compete with traditional carriers for both leisure and business travellers, offering reasonable fares and a varied selection of destinations. Low-cost airlines in North America have changed their business models throughout time. While some carriers began by focusing on no-frills, point-to-point service, they have now introduced additional services and amenities to appeal to a broader variety of clients.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region has experienced rapid expansion in air travel demand, facilitating the establishment of low-cost carriers. The growth of a thriving middle class, increased urbanisation, and a growing desire to travel all contribute to the demand for low-cost flights. The Asia-Pacific LCC market is diverse, with carriers based in Malaysia, India, Japan, South Korea, Indonesia, and Thailand, among others. Each market has its own distinctive characteristics and challenges. Low-cost carriers have gained market share, particularly in domestic markets.

Recent Market Developments

- In June 2023, Norse Atlantic Airways launched a flight from Rome to New York. The new service offers users a low-cost summer vacation choice. The flights will be operated by a Boeing 787 Dreamliner.

Major players in the market

- Alaska Air Group, Inc.

- Azul S.A.

- Norwegian Air Shuttle ASA

- AirAsia Group Berhad

- easyJet plc

- Qantas Airways Limited

- WestJet Airlines Ltd.

- Air Arabia PJSC

- New World Aviation, Inc.

- Ryanair Holdings Plc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Low Cost Carrier Market, Aircraft Type Analysis

- Narrow Body

- Wide Body

Low Cost Carrier Market, Application Analysis

- Individual

- Commercial

Low Cost Carrier Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?