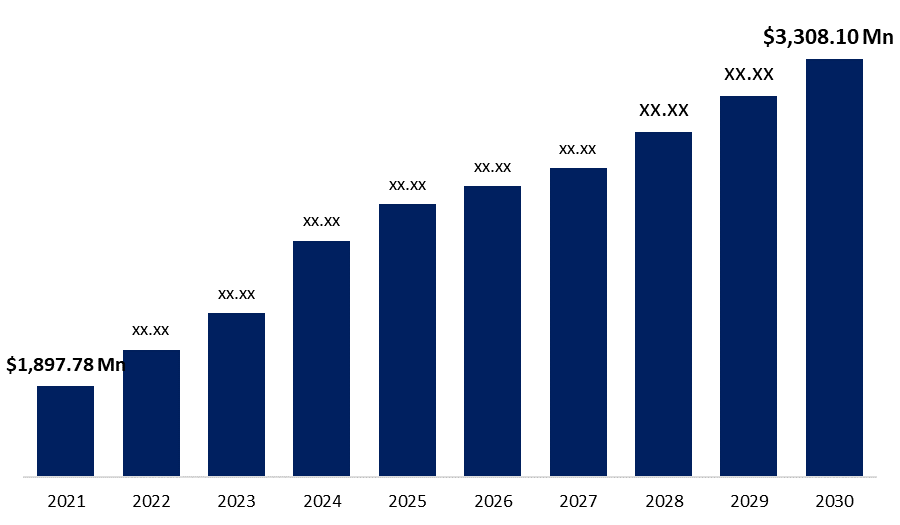

Global Loan Origination and Management Market Size to Grow USD 3308.1 Million By 2030 | CAGR of 14.7%

Category: Information & TechnologyGlobal Loan Origination and Management Market Size to Grow USD 3308.1 Million By 2030

The Global Loan Origination and Management Market Size was valued at USD 1,897.78 million in 2021 and is expected to reach USD 3,308.10 million by 2030, growing at a CAGR of 14.7 % during 2021-2030. as per the latest research report by Spherical Insights & Consulting.

Get more details on this report -

Many software tools fulfil the loan origination and credit assessment needs of traditional and non-traditional lenders in today's commercial lending market. Financial institutions are becoming increasingly conscious of the need to improve their operations in various areas in order to increase efficiency, decision speed, and production, as well as to improve the client experience.

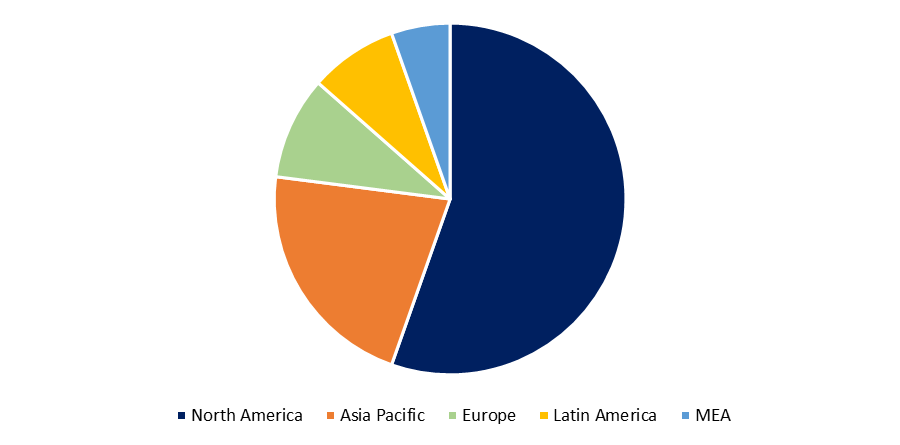

Browse key industry insights spread across 215 pages with 115 market data tables and figures & charts from the report "Global Loan Origination and Management Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (On Demand, and On Premise), By Component (Software, and Services), By Application (Mortgage Lenders & Brokers, Banks, Credit Unions, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa), Analysis and Forecast 2021 – 2030 "in detail along with the table of contents https://www.sphericalinsights.com/reports/loan-origination-and-management-market

Financial organizations utilize Loan Origination Systems to automate the loan transaction process. For loans initiated through several channels, such as branch, call center, or online portal, the system provides credit scoring, offer management, and customer relationship management (CRM) features. Loan origination systems, commonly referred to as digital mortgage solutions, allow lenders to communicate with clients through many channels. The Benefits such as Automate the application and origination process, Configurable approvals enabling no-touch/low-touch processing, Reduced Turn-Around Time (TAT) and Others.

Banks and lending institutions are diversifying their financial offerings to include lending options and conditions that may be tailored to the specific needs of each borrower. This is in reaction to the growing number of ways that customers and businesses want to borrow money for specialized products, but these institutions are running into difficulties with their current lending technologies. Legacy loan origination and loan management system (LOS/LMS) software is designed to handle specific use cases and guide loan origination and administration through stringent protocols that were developed to support traditional lending practices.

When lenders work with unusual borrowers seeking customized financing, or even shops using a direct-to-consumer approach that doesn't cleanly tick all of the boxes necessary in typical LOS, this technology becomes a pain point. Integrating these LOS and LMS solutions with a business process management solution that can easily include business rules and deaccessioning tools into these workflows is the best method to overcome these flaws. Here are some of the primary advantages that this integrated approach should provide to lenders.

Loan origination and administration software is designed specifically to help banks and financial institutions with their loan application and processing needs. It employs workflow technology to track and control the many labor phases involved in loan processing, as well as digital imaging technology to reduce delays and inefficiencies associated with handling paper documents. From underwriting to financial clearances to operational processes, from pre-application to application, from systems check to deviations, this program automates the whole loan origination process. Calculating interests, managing to bill and pay off statements, and being highly integrative with the system are some of the factors driving the market's growth. It also includes mortgages.

Get more details on this report -

Furthermore, it is straightforward to use, has a short learning curve, and can quickly manage bills and amortization schedules, all of which are anticipated to drive market expansion. The global Loan origination & management software market would benefit from an increase in demand for advanced digital lending solutions for retail banking, as well as an increase in the usage of artificial intelligence, machine learning, and Block chain.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?