Global Loan Origination and Management Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (On Demand, and On Premise), By Component (Software, and Services), By Application (Mortgage Lenders & Brokers, Banks, Credit Unions, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa), Analysis and Forecast 2021 - 2030

Industry: Information & TechnologyLOAN ORIGINATION AND MANAGEMENT MARKET: OVERVIEW

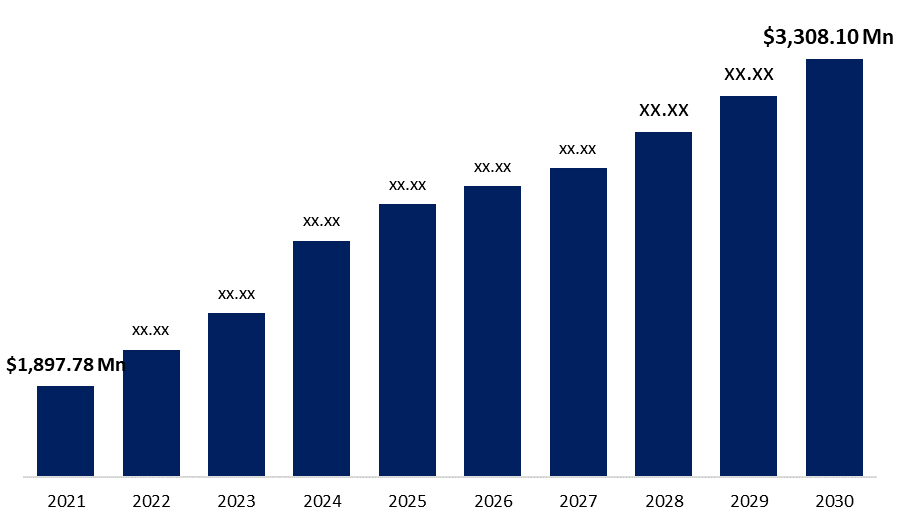

The Global Loan Origination and Management Market Size was valued at USD 1,897.78 million in 2021 and is expected to reach USD 3,308.10 million by 2030, growing at a CAGR of 14.7 % during 2021-2030. Small and medium-sized financial institutions, such as community banks, credit unions, and regional banks, can use Loan Origination and Management to manage the digital lending process. Users can design and manage lending campaigns, loan applications, reviews, and other applications with it. Lending evaluation, automated checks, and underwriting are also included, as well as identification verification, distinct digital loan files for each applicant, and compliance management. It allows businesses to customize, develop, and apply changes to their decision-making processes based on scorecards, data analysis, and market trends. The market is likely to develop as a result of the necessity to automate the entire loan collection, processing, and appraisal process. It's designed for banks, credit unions, and auto lenders, and it lets them set up policies, streamline operations, and boost operational efficiency across the board. As a result, the increased demand for Loan Origination and Management is likely to propel the Loan Origination and Management market forward in the near future.

Get more details on this report -

COVID-19 ANALYSIS

COVID-19 has disrupted business in a variety of industries all around the world. Banks and financial institutions have been hesitant to issue new loans due to heightened regulatory restrictions and an increase in nonperforming assets. Furthermore, due to lockdown and shut-down concerns, banks and financial institutions have been obliged to physically restrict themselves from collecting loans. As a result, a number of financial institutions have begun to process loan applications utilizing computerized platforms. Loan origination software platforms were used at a higher rate than typical due to the conditions.

LOAN ORIGINATION AND MANAGEMENT MARKET: TREND

Growing Demand of loan Origination Software from End use Industries Boost Market Growth

Loan origination software is increasingly being used in the BFSI sector to increase productivity and improve the customer experience. To better understand consumer behavior, it is turning to advanced automation technologies such as artificial intelligence. AI-powered loan origination software assists banks and financial institutions in recognizing customer preferences based on transaction history and current trends, thereby improving customer engagement and trust.

LOAN ORIGINATION AND MANAGEMENT MARKET: DRIVERS

Technological Advancement in the Loan Origination and Management Drive Market Growth

The market is growing due to increased usage of AI, machine learning, and block chain-based technologies, as well as more severe government norms and regulations. Furthermore, the market's growth is fueled by rising usage of Loan Origination and Management across various industrial verticals. A rigorous negative framework that harms lending companies, on the other hand, may stifle the market's expansion. Increased customer demand for convenient banking services, on the other hand, is projected to generate profitable opportunities in the coming years.

Global Loan Origination and Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1,897.78 million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 14.7 % |

| 2030 Value Projection: | USD 3,308.10 million |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | COVID-19 Impact Analysis Report, By Type, By Component, By Application, By Region |

| Companies covered:: | Nelito Systems Ltd, Fiserv Inc, Calyx Software, Bancorp Inc, Wipro, Gallagher Solutions LLC, Tavant Tech, HCL Technologies Limited, Perfios Software Solutions (InteGREAT), Experian Information Solutions Inc, Finflux, Persistent Systems, Nucleus Software Exports Ltd., Habile Technologies, Intellect Design Arena Ltd, 4Finezza. |

| Growth Drivers: | 1)The Global Loan Origination and Management market is segmented based on Type, Application, Components and region 2)Based on the Region, the Loan Origination and Management Market is categorized into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

LOAN ORIGINATION AND MANAGEMENT MARKET: RESTRAINT

Concern About Data Security and Compliance Hamper Market Growth

Cloud computing enables organizations to rapidly expand or reduce their computing facilities. This concept is appealing to public and private companies, as well as SMEs, who see cloud computing as an opportunistic business strategy for remaining competitive and meeting their business needs. Uploading business data from personal devices to personal cloud platforms is causing significant concern due to the risk of data leaks, posing challenges for SMEs and large enterprises.

LOAN ORIGINATION AND MANAGEMENT MARKET: SEGMENTATION

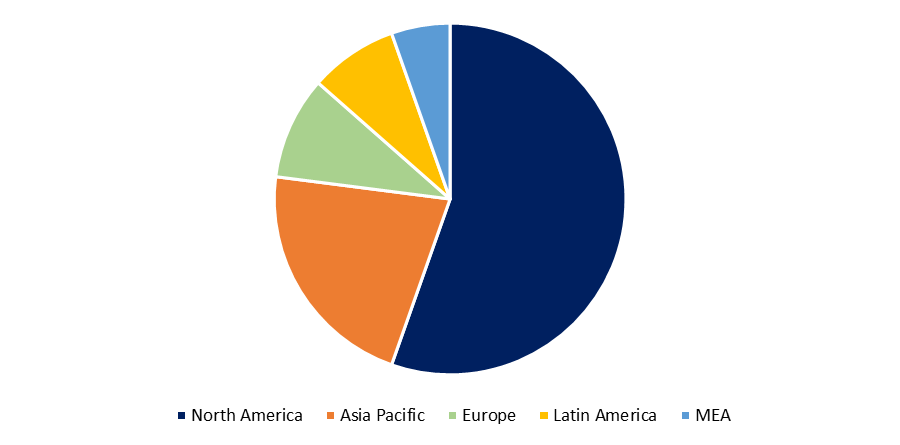

The Global Loan Origination and Management market is segmented based on Type, Application, Components and region. Based on Type, the market is bifurcated as On-demand and On-premise. Based on the Components the market is further classified as software and service based on the Application the market is further classified as Mortgage Lenders & Brokers, Banks, Credit Unions and Others. Based on the Region, the market is categorized into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

LOAN ORIGINATION AND MANAGEMENT MARKET: BY REGION

Based on the Region, the Loan Origination and Management Market is categorized into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

North America is the largest market for loan originated and management during the forecast period due the presence of a large number of leading vendors offering loan origination software. Furthermore, one of the factors driving market growth is early technology adoption among North American enterprises to improve productivity and customer experience. Furthermore, the presence of a large number of SMEs in the United States that opt for loans for initial business investment has led to the development of the loan origination and Management market. According to the U.S. Small Business Administration (SBA), the private sector in the United States accounts for approximately 30.2 million SMEs. This allows financial institutions to use loan origination software to manage loan applications.

Get more details on this report -

LOAN ORIGINATION AND MANAGEMENT MARKET: COMPETITIVE LANDSCAPE

The companies operating in this industry are focusing more on efficient growth, improvement of operational efficiency and productivity, achieving high safety standards, and focus on maintaining sustainable development. The players are focusing on securing a leading position in this industry. They are continuously looking for the opportunity to reinforce their competitive advantage. To meet a higher market share and developing a socially responsible business company is identifying various strategic pillars such as mergers & acquisitions, new product launch, product enhancement, and others.

LOAN ORIGINATION AND MANAGEMENT MARKET: RECENT DEVELOPMENT

- May 2022- Midland States Bancorp, Inc. announced a collaboration with LendingPoint, an AI-driven CreditTech platform that provides consumer financing solutions. Midland will fund consumer loans originated with its underwriting criteria through LendingPoint's national network of point-of-sale retail relationships as part of this partnership.

LOAN ORIGINATION AND MANAGEMENT MARKET: KEY PLAYERS

- Nelito Systems Ltd

- Fiserv, Inc

- Calyx Software

- Bancorp, Inc

- Wipro

- Gallagher Solutions LLC

- Tavant Tech

- HCL Technologies Limited

- Perfios Software Solutions (InteGREAT)

- Experian Information Solutions, Inc

- Finflux

- Persistent Systems

- Nucleus Software Exports Ltd.

- Habile Technologies

- Intellect Design Arena Ltd

- 4Finezza.

SCOPE OF THE REPORT

The reports also assist in understanding the dynamic and structure of the Loan Origination and Management market. The study serves as an investor's guide with its clear representation of competitive analysis of key competitors by product, price, financial condition, product portfolio, growth plans, and regional presence in the market for Loan Origination and Management.

Need help to buy this report?