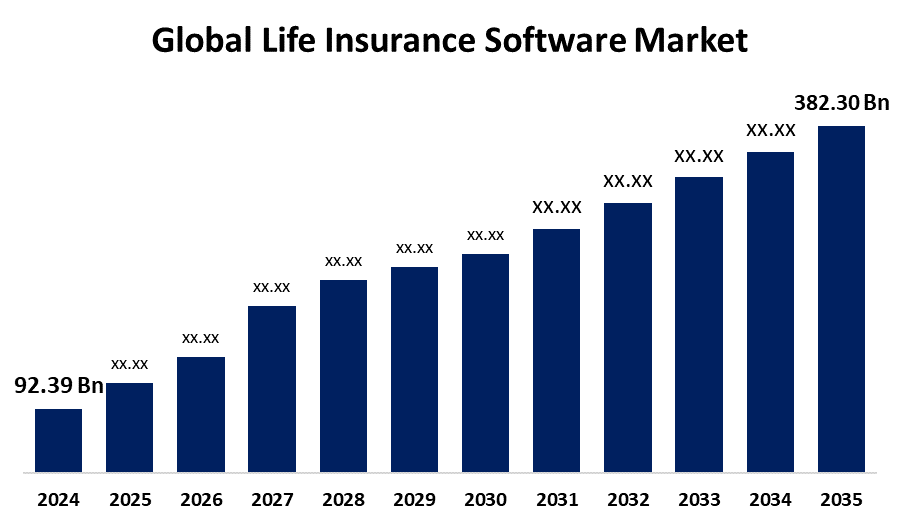

Global Life Insurance Software Market Size to Exceed USD 382.30 Billion by 2035 | CAGR Of 13.78%

Category: Information & TechnologyGlobal Life Insurance Software Market Size to Exceed USD 382.30 Billion by 2035

According to a research report published by Spherical Insights & Consulting, The Global Life Insurance Software Market is expected to grow from USD 92.39 Billion in 2024 to USD 382.30 Billion by 2035, at a CAGR of 13.78% during the forecast period 2025-2035.

Get more details on this report -

Browse key industry insights spread across 246 pages with 109 Market data tables and figures & charts from the report on the “Global Life Insurance Software Market Size, Share, and COVID-19 Impact Analysis, By Type (On-Premise and Cloud-Based), By Application (Term Life, Annuity, Whole Life, Group Life and Unit-linked), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 – 2035. Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/life-insurance-software-market

The life insurance software industry is the business that deals with offering technology solutions that are tailored for life insurance firms to automate their operations, improve customer service, and meet regulatory requirements. Moreover, the life insurance sector is moving towards digital platforms to automate operations and improve customer experience. The implementation of life insurance software is necessary to automate processes like policy administration, claims handling, and underwriting, resulting in greater operational efficiency, lower costs, and enhanced customer satisfaction. Life insurance software enables insurers to remain compliant with regulations like Solvency II and GDPR by automating compliance processes, ensuring proper data management, and producing timely reports. This minimizes the possibility of legal fines and facilitates the smooth operations of insurers across several jurisdictions. However, insurance is a highly regulated industry with variation in regulations by geography. Complying with different regulatory requirements for life insurance software can be expensive and time-consuming, serving as a hurdle to adoption, particularly for the smaller players.

The on-premise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the life insurance software market is divided into on-premise and cloud-based. Among these, the on-premise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to on-premises deployments provide more flexibility, enabling insurers to customize software solutions to suit their unique requirements. Such customization accommodates intricate business needs and ensures the software complies fully with the company's operational procedures and specialized workflows.

The term life segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the life insurance software market is divided into term life, annuity, whole life, group life, and unit-linked. Among these, the term life segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to younger and middle-aged buyers usually prefer term insurance due to the lower premiums it offers and proper coverage during earnings years. These steady demands persuade insurers to increase operations through platforms of software with the ability to process large amounts of short- to medium-duration policies with very little customization.

North America is expected to hold the majority share of the global life insurance software market during the forecast period.

Get more details on this report -

North America is expected to hold the majority share of the global life insurance software market during the forecast period. Most of the top life insurance software vendors are based in or have significant operations in North America. This closeness enables quicker adoption of new technologies, direct customer interaction, and tailored solutions. The presence of these major players creates a competitive and innovative climate, which fuels market growth and improves service delivery for insurers.

Asia Pacific is anticipated to grow at the fastest pace in the global life insurance software market during the forecast period. The life insurance industry in nations such as China, India, and Southeast Asia is growing rapidly with increasing incomes, urbanization, and financial protection awareness. This growth in the market translates to a high demand for advanced software solutions that can facilitate digital policy issuance, customer service, and claims management, enabling insurers to keep up with increasing customer expectations.

Europe is predicted to hold a significant share of the life insurance software market throughout the estimated period. European insurers have a comparatively mature stage of digital uptake, facilitated by established IT infrastructure. Such maturity enables the smoother embedding of sophisticated life insurance platforms that leverage AI, automation, and analytics. Insurers use these platforms to automate claims handling, enhance customer service, and manage policies more efficiently, enhancing the region's strong market standing.

Major vendors in the global life insurance software market are Accenture, Infosys, Cognizant, Wipro, TCS, IBM, Oracle, Microsoft, SAP, Pegasystems, FSS, Sopra Steria, Vertafore, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In June 2023, InsurTech Company’s, insurance software automation announced the release of Best Plan Pro 2.0, an artificial intelligence-driven underwriting software that helps automate the life insurance application process. The new version further simplifies the user experience through its improved user interface and enhanced data entry system, which allows agents to pre-qualify clients for final expense, term life, and Medicare supplement products in mere seconds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the life insurance software market based on the below-mentioned segments:

Global Life Insurance Software Market, By Type

- On-Premise

- Cloud-Based

Global Life Insurance Software Market, By Application

- Term Life

- Annuity

- Whole Life

- Group Life

- Unit-linked

Global Life Insurance Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?