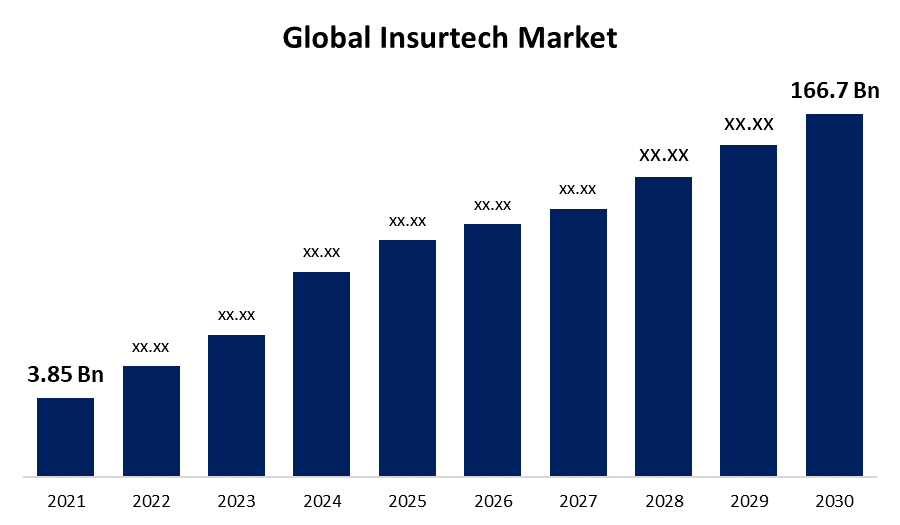

Global Insurtech Market Size to Grow USD 166.7 Billion by 2030 | CAGR of 52%

Category: Information & TechnologyGlobal Insurtech Market Size To Worth USD 166.7 Billion By 2030

According to a research report published by Spherical Insights & Consulting, the Global Insurtech Market Size to Grow from USD 3.85 Billion in 2021 to USD 166.7 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 52% during the forecast period. Over the next few years, the global insurtech market is Expected to grow significantly. This is because the claims process is getting easier, communication with customers is getting better, and automation is getting easier to use.

Get more details on this report -

Browse key industry insights spread across 200 pages with 182 market data tables and figures & charts from the report "Global Insurtech Market Size, Share, and COVID-19 Impact Analysis By Type (Auto, Business, Health, Home, Specialty, Travel, and Others), By Service ( Consulting, Support & Maintenance, and Managed Services), By Technology (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others), By End- User (Automotive, BFSI, Government, Healthcare, Manufacturing, Retail, Transportation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030. ” in detail along with the table of contents. https://www.sphericalinsights.com/reports/insurtech-market

The COVID-19 pandemic has made an adverse impact on credit portfolios. There has been an unprecedented rise in unemployment and disruption in economic activity, putting a strain on the solvency of customers and companies. Central banks have taken a proactive approach by injecting liquidity into the market by lowering interest rates and asset purchase programs. Managing and monitoring credit, market, liquidity, and operational risk across financial markets were hard enough with ongoing geopolitical tensions, international trade wars, and the occasional hurricanes and earthquakes. The current pandemic has forced chief risk officers and their teams to recalibrate old assumptions and models used to manage and monitor risk. COVID-19’s global impact has shown that interconnectedness plays an important role in international cooperation. As a result, many governments started rushing toward identifying, evaluating, and procuring reliable solutions powered by AI.

The health segment to account for the largest market size during the forecast period

Based on the type, the insurtech market is categorized into Auto, Business, Health, Home, Specialty, Travel, and Others. The health segment to account for the largest market size during the forecast period. The growing need for digital platforms in the health insurance industry is expected to boost demand for the health sector. These platforms link health insurance exchanges, brokers, providers, and carriers. Using advanced analytics is becoming more and more important for the success of life and health insurers who want to better serve and understand their clients. More and more health insurance companies are using different insurtech solutions to make the steps involved in processing claims easier. Insurance companies are also trying to combine their health insurance services with mobility features to make things easier for their customers.

The managed services segment to hold a higher CAGR during the forecast period

Based on the services, the insurtech market is categorized into Consulting, Support & Maintenance, and Managed Services. The managed services segment to hold a higher CAGR during the forecast period. Managed service providers can help insurance companies transition to digital by giving them a step-by-step plan based on the knowledge and skills of experienced professionals and the latest tools. The managed service providers can also advise insurers on the best procedures, policies, and regulatory considerations. At the same time, managed services give insurers the ability to solve IT and operations problems and take advantage of opportunities. Recently, the insurance industry has started to understand and value the benefits of improved business models. This has opened up new growth opportunities for the managed services sector.

The cloud computing segment is to hold a higher CAGR during the forecast period.

Based on the technology the insurtech market is categorized into Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory and Others. The cloud computing segment is to hold a higher CAGR during the forecast period. Cloud computing has completely changed the insurance industry because it is flexible, easy to set up, and uses many different resources. It is expected that the growth will be fueled by the popularity of Bring Your Own Device (BYOD) policies and the fact that insurance companies are collecting more and more data. Cloud computing solutions are becoming increasingly popular with insurance companies because they have so many benefits, such as being easy to set up, less expensive, and easier to scale.

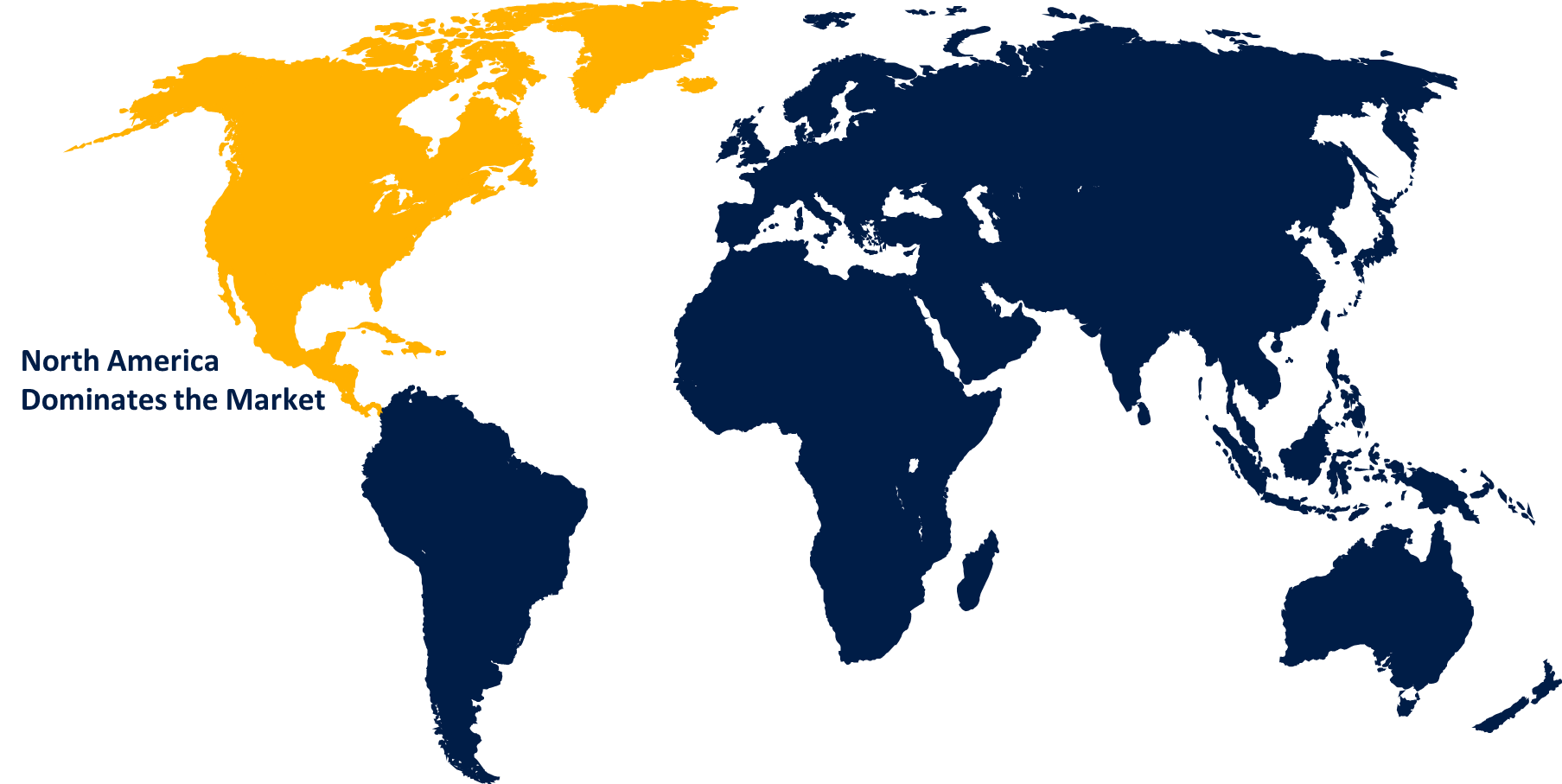

North America is estimated to account for the highest market share in 2022.

Get more details on this report -

The Global Insurtech Market has been segmented into five major regions: North America,

Europe, Asia-Pacific, South America, The Middle East and Africa. North America is estimated to account for the highest market share in 2022. Because people are spending more money on insurance-related products, the use of insurtech solutions is rising, which is a good thing. Also, these solutions' health and property insurance plans are very flexible and can be changed to fit your needs. The overall growth of the market in the area is also helped by the growth of the insurtech startup community across the area. Asia-Pacific to hold a higher CAGR during the forecast period.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In April 2022, Shift Technology will tap into legendary data in order to assist insurers in making more informed decisions on questionable claims.

- In March 2022, DXC Technology has announced that they would be increasing their focus on insurance software and business process solutions starting.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global insurtech market based on the below-mentioned segments:

Global Insurtech Market, By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Global Insurtech Market, By Service

- Consulting

- Support & Maintenance

- Managed Services

Global Insurtech Market, By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Global Insurtech Market, By End User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Global Insurtech Market, Regional Analysis

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Insurtech market?As per Spherical Insights, the size of the Insurtech market was valued at USD 3.85 billion in 2021 to USD 166.7 billion by 2030.

-

What is the market growth rate of the Insurtech market?The Insurtech market is growing at a CAGR of 52% from 2021 to 2030.

-

Which country dominates the Insurtech market?North America emerged as the largest market for Insurtech.

-

Who are the key players in the Insurtech market?Key players in the Insurtech market are Oscar Insurance, Quantemplate, Shift Technology, Trov Inc., Wipro Limited, ZhongAn Insurance, Acko, and Coya.

-

Which factor drives the growth of the Insurtech market?Consumer benefits is expected to drive the market's growth over the forecast period.

Need help to buy this report?