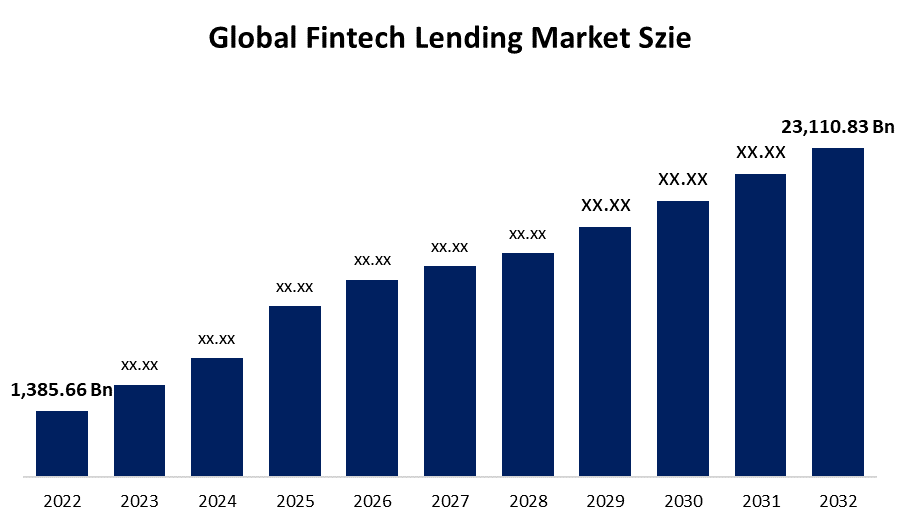

Global Fintech Lending Market Size To Surpass USD 23110.83 Billion by 2032 | CAGR of 32.5%

Category: Information & TechnologyGlobal Fintech Lending Market Size To Surpass USD 23,110.83 Billion By 2032

According to a research report published by Spherical Insights & Consulting, the Global Fintech Lending Market size is to grow from USD 1,385.66 billion in 2022 to USD 23,110.83 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 32.5% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 210 pages with 122 market data tables and figures & charts from the report on "Global Fintech Lending Market Size, Share, and COVID-19 Impact Analysis, By Business Model (Peer-to-Peer (P2P) Lending, Marketplace Lending, Direct Lending, Crowdfunding, and Hybrid Models), By Technology (Artificial Intelligence (AI) and Machine Learning (ML), Blockchain, Mobile Technology, and Big Data Analytics), By End-User (Individuals and Businesses), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032 " Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/fintech-lending-market

Fintech lending, also known as online lending or digital lending, is a rapidly growing sector that leverages technology and data-driven algorithms to provide loans through online platforms or mobile applications. It has disrupted traditional lending models by offering faster, more convenient, and accessible options for borrowers, especially those with diverse credit profiles. Fintech lenders utilize big data and machine learning for credit risk assessment, enabling quicker approvals and disbursements. This innovative approach is reshaping the lending landscape, providing alternative solutions for consumers, small businesses, and investors, and transforming the way loans are originated, underwritten, and serviced.

Consumer lending is expected to grow at a CAGR of 34.7% over the forecast period

The global fintech lending market is categorized based on service type. The consumer lending segment is poised for rapid growth in the fintech lending market, fueled by increasing consumer demand for credit, the widespread adoption of digital platforms and online lending, advancements in data analytics and credit scoring models, and changing consumer behaviors towards digital and mobile banking. These factors are expected to drive the growth of the consumer lending segment, making it one of the most dynamic and promising segments in the fintech lending industry with significant growth potential in the coming years.

The business segment dominated the market with around 45.1% revenue share in 2022

Based on the end-user, the global fintech lending market is segmented into individuals and businesses. The business category accounted for the largest share, approximately xx%, in the fintech lending market in 2022. This is due to high demand by businesses of all sizes, including small and medium-sized enterprises as well as large corporations, to meet their funding needs. Businesses often require credit for various purposes such as working capital, expansion, inventory financing, and equipment financing. Fintech lending platforms offer faster and more streamlined loan application processes, quicker approvals, and flexible loan terms compared to traditional lenders, making them attractive options for businesses.

Asia-Pacific is expected to grow at a higher CAGR of 37.5% during the forecast period

Get more details on this report -

The Asia-Pacific region is witnessing rapid growth in the fintech lending market. Factors driving this growth include a large and growing population with increasing demand for credit, expanding middle class, and rising internet and smartphone penetration. Additionally, regulatory reforms and government initiatives promoting financial inclusion and digitalization are fueling the growth of fintech lending in the region. Fintech companies in Asia-Pacific are leveraging innovative technologies and business models to cater to underserved segments, such as SMEs and unbanked populations. The dynamic economic landscape, evolving consumer behaviors, and supportive regulatory environment are contributing to the Asia-Pacific region emerging as the fastest-growing market in the global fintech lending industry.

Some of the major players in the global fintech lending market include Lendingclub corporation, prosper marketplace inc., upstart network inc., social finance, Inc., Avant Inc., OnDeck Capital Inc., Funding Circle Holding PLC, Kabbage, GreenSky, LLC, Upgrade, Zopa Limited, Earnest, Marcus by Goldman Sachs, Peerform, Credible, and StreetShares.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global fintech lending market based on the below-mentioned segments:

Fintech Lending Market, By Service Type

- Consumer Lending

- Small Business Lending

- Real Estate Lending

Fintech Lending Market, By Business Model

- Peer-to-Peer (P2P) Lending

- Marketplace Lending

- Direct Lending

- Crowdfunding

- Hybrid Models

Fintech Lending Market, By Technology Type

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Mobile Technology

- Big Data Analytics

Fintech Lending Market, By End-User

- Individuals

- Businesses

Fintech Lending Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?