Global Fintech Lending Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Consumer Lending, Small Business Lending, and Real Estate Lending), By Business Model (Peer-to-Peer (P2P) Lending, Marketplace Lending, Direct Lending, Crowdfunding, and Hybrid Models), By Technology (Artificial Intelligence (AI) and Machine Learning (ML), Blockchain, Mobile Technology, and Big Data Analytics), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Information & TechnologyGlobal Fintech Lending Market Insights Forecasts to 2033

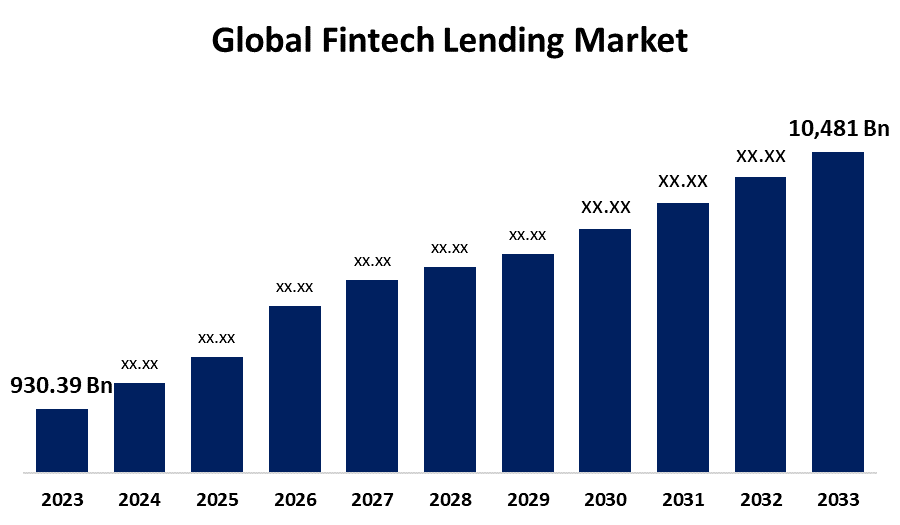

- The Global Fintech Lending Market Size was valued at USD 930.39 billion in 2022.

- The market is growing at a CAGR of 27.40% from 2023 to 2033

- The global fintech lending market is expected to reach 10,481.16 Billion by 2033

- Asia-Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Fintech Lending Market Size is expected to reach USD 10,481.16 billion by 2033, at a CAGR of 27.40% during the forecast period 2023 to 2033.

Market Overview

Fintech lending is known as online lending or digital lending, in which the use of technology to provide financial services, particularly loans, in a more efficient and convenient manner compared to traditional financial institutions. Fintech lending platforms leverage data analytics, automation, and online processes to streamline the loan application, approval, and disbursement process, making it faster and more accessible to borrowers. These platforms typically operate online, allowing borrowers to submit loan applications and supporting documents digitally, and receive loan offers and funds electronically. Fintech lending has gained significant traction in recent years, disrupting the traditional lending landscape by offering alternative lending options to consumers and businesses who may face challenges in obtaining loans from traditional banks due to factors such as credit history, lack of collateral, or complex application processes. Fintech lending has also spurred innovation in credit risk assessment and underwriting, using non-traditional data sources and algorithms to assess creditworthiness.

Report Coverage

This research report categorizes the market for fintech lending market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fintech lending market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the fintech lending market.

Global Fintech Lending Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 930.39 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 27.40% |

| 2032 Value Projection: | USD 10,481.16 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Service Type, By Business Model, By Technology, By End-User, By Region |

| Companies covered:: | LendingClub Corporation, Prosper Marketplace Inc., Upstart Network Inc., Social Finance, Inc., Avant Inc., OnDeck Capital Inc., Funding Circle Holding PLC, Kabbage, Upgrade, Zopa Limited, Earnest, Marcus (Goldman Sachs), Peerform, Credible, StreetShares, |

Get more details on this report -

Driving Factors

The fintech lending market is driven by various factors. First, technological innovation enables fintech platforms to leverage data analytics, AI, and automation, making loan processes efficient and accessible. Second, the demand for access to credit by borrowers who face challenges with traditional bank loans, such as credit history or collateral requirements, drives the growth of fintech lending. Third, the convenience and ease of online loan applications and disbursements attract borrowers seeking seamless digital experiences. Fourth, the ability of fintech lenders to use non-traditional data sources for credit assessment expands the lending options for underserved populations. Lastly, the potential for higher returns for investors compared to traditional investments fuels interest in fintech lending as an investment avenue.

Restraining Factors

The fintech lending market faces several restraints, including regulatory challenges and evolving frameworks, data privacy and cybersecurity concerns, higher interest rates or loan denials due to lack of established credit history or collateral, potential increased default rates and credit risk from non-traditional data sources, and competition from traditional financial institutions and other fintech players. These challenges highlight the need for robust risk management, compliance measures, and industry best practices to address regulatory compliance, data security, credit risk, and competition, and ensure the sustainable growth of the fintech lending market.

Market Segmentation

- In 2022, the Small business lending segment accounted for around 40.1% market share

On the basis of the service type, the global fintech lending market is segmented into consumer lending, small business lending, and real estate lending. Small business lending is dominating the market with the largest market share in 2022, due to a lack of collateral, limited credit history, and lengthy loan approval processes. Fintech lenders specializing in small business lending have addressed these pain points by leveraging technology and data analytics to streamline loan applications, assess credit risk, and offer quick funding solutions. The use of alternative data sources and credit scoring models has enabled fintech lenders to serve small businesses with limited credit history, expanding the addressable market. The convenience, speed, and flexibility offered by fintech lenders in the small business lending segment have positioned them as a viable alternative to traditional lenders, driving their dominance in the fintech lending market.

- The artificial intelligence & machine learning segment dominated with more than 47.8% market share in 2022

Based on the technology, the global fintech lending market is segmented into artificial intelligence & machine learning, blockchain, mobile technology, and big data analytics. Out of this, the artificial intelligence & machine learning segment is dominating the market with the largest market share in 2022. These technologies are being extensively used by fintech lenders to automate loan processing, credit risk assessment, and customer profiling, leading to faster and more accurate lending decisions. AI-powered chatbots and virtual assistants are also being utilized for customer service and support. Additionally, machine learning algorithms are enabling continuous improvement of credit models, fraud detection, and personalized loan offerings. The dominance of AI and machine learning in the fintech lending market is driven by their ability to enhance operational efficiency, reduce costs, and improve customer experiences through data-driven decision-making.

Regional Segment Analysis of the Fintech Lending Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with around 43.1% revenue share in 2022.

Get more details on this report -

North America holds a dominant position in the fintech lending market due to its mature financial ecosystem, established regulatory frameworks, large and diverse consumer and business market, technological innovation, and presence of fintech hubs and investment capital. These factors have propelled the growth of fintech lending in North America, with companies leveraging advanced data analytics and automation to offer efficient and convenient lending solutions. The region's favorable market conditions, supportive regulatory environment, and technological advancements have contributed to its dominant position in the global fintech lending market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global fintech lending market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- LendingClub Corporation

- Prosper Marketplace Inc.

- Upstart Network Inc.

- Social Finance, Inc.

- Avant Inc.

- OnDeck Capital Inc.

- Funding Circle Holding PLC

- Kabbage

- Upgrade

- Zopa Limited

- Earnest

- Marcus (Goldman Sachs)

- Peerform

- Credible

- StreetShares

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, M2P Fintech has revealed its acquisition of Finflux, a cloud lending platform, enabling M2P Fintech to launch advanced loan solutions that prioritize safety, scalability, and cloud readiness. This integration will also fast-track the implementation of next-generation digitization and process automation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global fintech lending market based on the below-mentioned segments:

Fintech Lending Market, By Service Type

- Consumer Lending

- Small Business Lending

- Real Estate Lending

Fintech Lending Market, By Business Model

- Peer-to-Peer (P2P) Lending

- Marketplace Lending

- Direct Lending

- Crowdfunding

- Hybrid Models

Fintech Lending Market, By Technology Type

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Mobile Technology

- Big Data Analytics

Fintech Lending Market, By End-User

- Individuals

- Businesses

Fintech Lending Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?