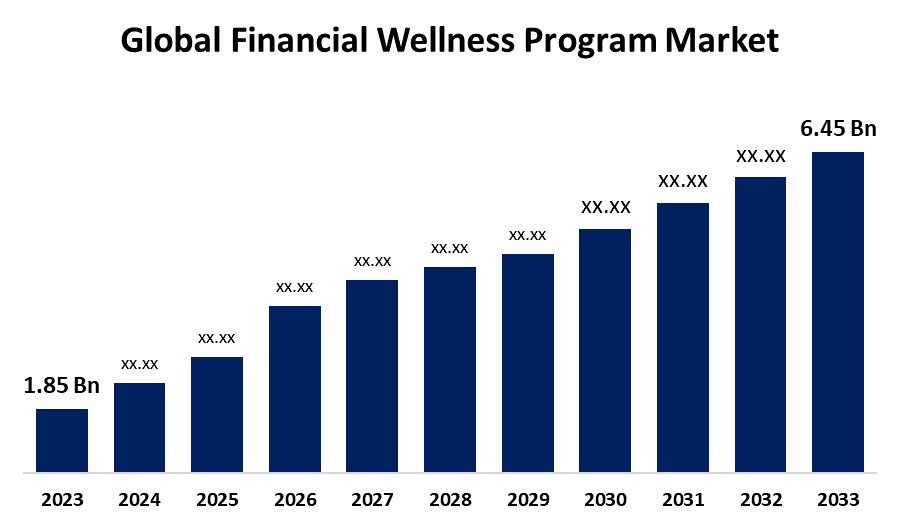

Global Financial Wellness Program Market Size To Exceed USD 6.45 Billion by 2033 | CAGR of 13.3%

Category: Banking & FinancialGlobal Financial Wellness Program Market Size to Exceed USD 6.45 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Financial Wellness Program Market Size is to grow from USD 1.85 Billion in 2023 to USD 6.45 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 13.3% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Financial Wellness Program Market Size, Share, and COVID-19 Impact Analysis, By Type (For Employers, For Employees), By Program (Financial Planning, Financial Education & Counseling, Retirement Planning, Debt Management, Others), By Application (Large Enterprises, Small & Medium Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023–2033." Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/financial-wellness-program-market

Financial wellness programs are intended to raise employee awareness of personal financial risks such as loss of income due to an unexpected death or illness, as well as unexpected medical bills. There are two types of financial wellness programs: employer and employee. Employers are individuals or organizations that hire and compensate employees in the public, private, non-profit, or commercial sectors. Furthermore, offering financial wellness programs may change the course of an employee's life, attracting and retaining talent. As a result, significantly reducing financial stress can have a negative impact on employees' overall productivity and efficiency in a number of ways. One of the primary drivers of the financial wellness program market is the strong link between financial well-being and employee productivity and engagement. An increase in the product is justified because it relieves the employee's financial stress. Also, there is a direct correlation between financial stress and poor performance, unstable mental health, and overall absenteeism. Moreover, the application reduces absenteeism and other factors because it offers health screening, health education, and disease management services, making employees more productive and efficient. However, employee awareness and engagement levels are low in the market for financial wellness programs. Despite the increased availability of these programs, many employees may be unaware of the resources and benefits available through their employers. This lack of awareness may jeopardize the effectiveness of financial wellness programs.

For employee segment dominates the market with the largest revenue share over the anticipation timeframe.

Based on the type, the global financial wellness program market is categorized into for employers and for employee. Among these, for employee segment is dominating the market with the largest revenue share over the anticipation timeframe. The market for financial wellness programs is expanding, providing more opportunities for personal empowerment and well-being. These programs offer a variety of tools to help people manage their money effectively, such as budgeting assistance and investment education. Employees are increasingly benefiting from employer-sponsored financial wellness initiatives as the value of overall employee wellness is recognized. These programs help to reduce stress, improve financial literacy, and provide a sense of financial security.

The small & medium enterprises segment is witnessing significant CAGR growth over the anticipation timeframe.

Based on the application, the global hydraulic filter market is categorized into large enterprises, small & medium enterprises. Among these, the small & medium enterprises segment is witnessing significant growth over the anticipation timeframe. Small and medium-sized enterprises (SMEs) are increasingly recognizing the value of implementing financial wellness programs to assist their employees. As the relationship between financial well-being and workforce productivity becomes more widely recognized, SMEs are implementing these programs to boost employee satisfaction, engagement, and retention.

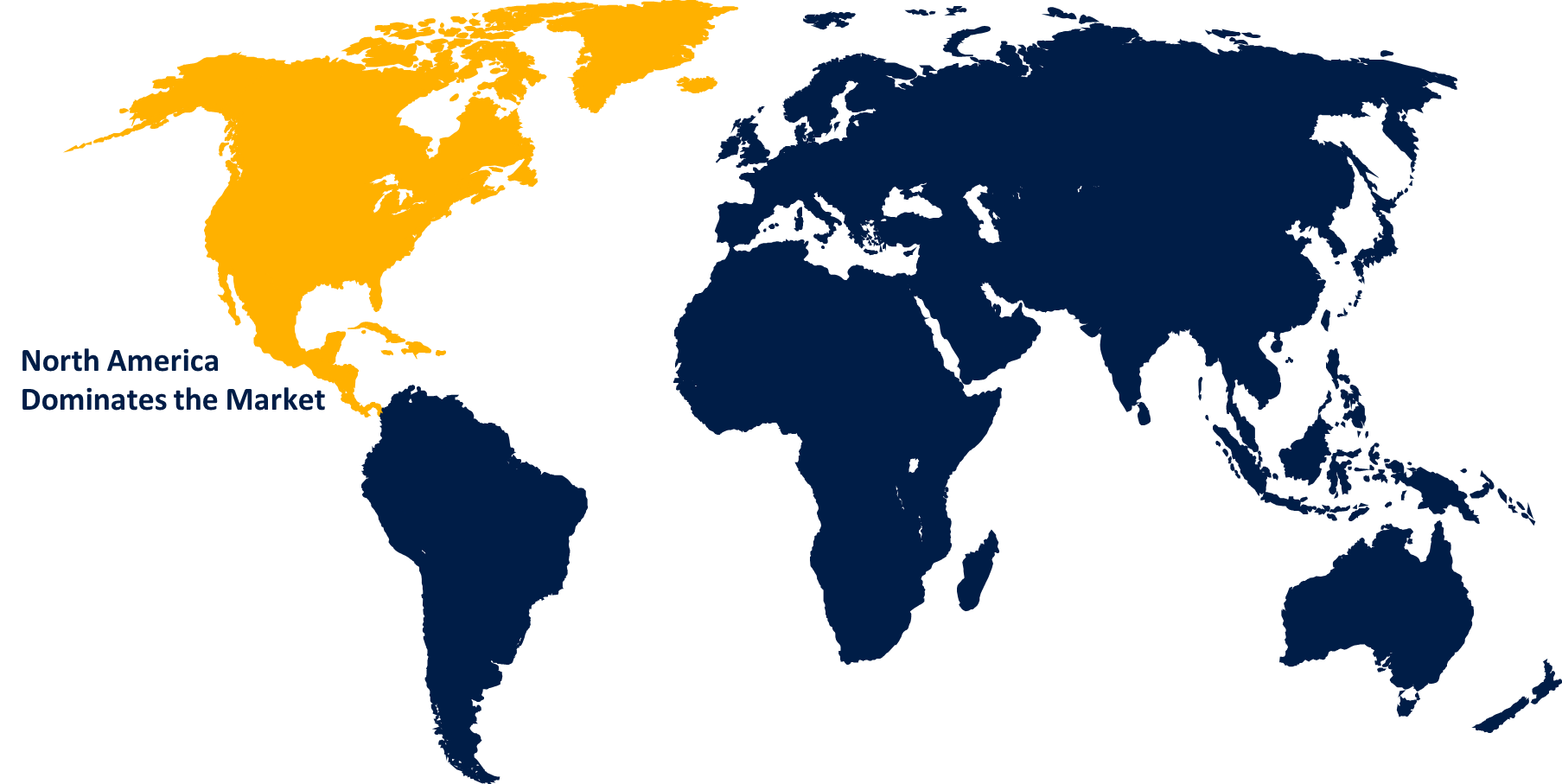

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global financial wellness program market over the forecast period. because of the government's extensive intervention. This is recorded because this region was successful in increasing market awareness, penetration, and industry players' focus on product research and development. Causes an increase in demand for a better user interface. The region's success in this market is attributed to heightened awareness of the impact of financial well-being on employee performance, as well as the presence of a diverse and technologically savvy workforce. Employers in North America are increasing their investments in comprehensive financial wellness programs that incorporate advanced technologies and personalized solutions.

Asia Pacific is expected to grow the fastest during the forecast period. This growth can be attributed to Asia-Pacific's digital transformation of financial services. Fintech companies play a significant role in promoting financial wellness. Mobile apps and online platforms are increasingly being used to provide financial education, budgeting tools, and investment options.

Major vendors in the global financial wellness program market are Bank of America, Empower Retirement, Prudential Financial Inc., Nationwide Mutual Insurance Company, The Massachusetts Mutual Life Insurance Company, Fidel ty Investments, Charles Schwab Corporation, Financial Fitness Group, Principal Financial Group, Enrich Financial Wellness, and among others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, The FPSA Financial Wellness Program was launched in response to a request from the Young Professionals Group. Truist Momentum developed this program to provide employees of FPSA member companies with the tools and education they need to feel confident about their financial future.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global financial wellness program market based on the below-mentioned segments:

Global Financial Wellness Program Market, By Type

- For Employers

- For Employees

Global Financial Wellness Program Market, By Program

- Financial Planning

- Financial Education & Counseling

- Retirement Planning

- Debt Management

- Others

Global Financial Wellness Program Market, By Application

- Large Enterprises

- Small & Medium Enterprises

Global Financial Wellness Program Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?