Global Financial Wellness Program Market Size, Share, and COVID-19 Impact Analysis, By Type (For Employers, For Employees), By Program (Financial Planning, Financial Education & Counseling, Retirement Planning, Debt Management, Others), By Application (Large Enterprises, Small & Medium Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Financial Wellness Program Market Insights Forecasts to 2033

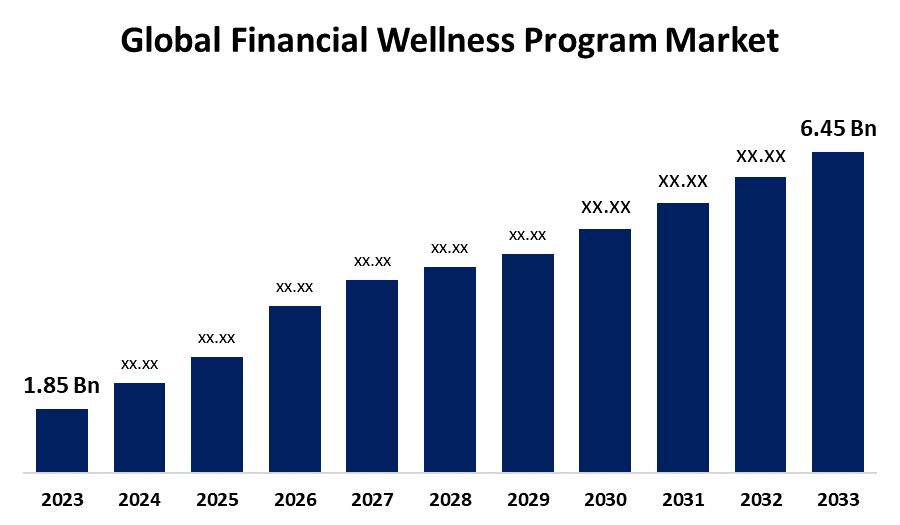

- The Global Financial Wellness Program Market Size was Valued at USD 1.85 Billion in 2023

- The Market Size is Growing at a CAGR of 13.3% from 2023 to 2033

- The Worldwide Financial Wellness Program Market Size is Expected to Reach USD 6.45 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Financial Wellness Program Market Size is Anticipated to Exceed USD 6.45 Billion by 2033, Growing at a CAGR of 13.3% from 2023 to 2033.

Market Overview

Financial wellness programs are designed to raise employee awareness of personal financial risks such as loss of income due to unexpected death or illness, as well as unexpected medical expenses. There are two main types of financial wellness programs employer and employee. Employers are individuals or organizations that hire and compensate employees in the public, private, nonprofit, or business sectors. Furthermore, providing financial wellness programs may alter the course of an employee's life, thereby attracting and retaining workers. As a result, drastically reducing financial stress can negatively impact employees' overall productivity and efficiency in a variety of ways. The program can improve employees' overall well-being and raise awareness about the product market. Financial stress, like any other type of stress, puts an unmanageable amount of pressure on the body, resulting in a variety of health complications. Offering a financial wellness program can reduce the amount of healthcare premiums offered by the employer while also assisting employees in planning for early retirement. The government's investments lead to advancements in peer-to-peer relationships, technological advances in cyber security, and newer procedures for introducing the financial wellness program market.

Report Coverage

This research report categorizes the market for the global financial wellness program market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global financial wellness program market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global financial wellness program market.

Global Financial Wellness Program Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.3% |

| 2033 Value Projection: | USD 6.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Program, By Application, By Region |

| Companies covered:: | Bank of America, Empower Retirement, Prudential Financial Inc., Nationwide Mutual Insurance Company, The Massachusetts Mutual Life Insurance Company, Fidel ty Investments, Charles Schwab Corporation, Financial Fitness Group, Principal Financial Group, Enrich Financial Wellness, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary factors driving the growth of the financial wellness program market is the strong link between financial well-being and employee productivity and engagement. An increase in the product is accounted for because it reduces the employee's financial stress. Furthermore, there is a clear link between financial stress and poor performance, unstable mental health, and overall absenteeism. Furthermore, the application reduces absenteeism and other listed factors because the product provides health screening, health education, and disease management services, resulting in employees becoming more productive and efficient. This development results in a more refined and elevated brand image in the market, as employees demonstrate increased levels of engagement and commitment, highlighting good working conditions and benefits. As a result, the market for financial wellness programs will grow. Moreover, government regulations in favor of the financial wellness program drive market growth by raising product awareness among businesses and their employees.

Restraining Factors

The financial wellness program market is characterized by low employee awareness and engagement. Despite the increased availability of these programs, many employees may be unaware of the resources and benefits provided by their employers. This lack of awareness can undermine the efficacy of financial wellness programs. Employees may not actively seek out or participate in financial wellness programs for a variety of reasons, including time constraints, perceived complexity, or a misunderstanding of the potential benefits. Employers must invest in comprehensive communication strategies to ensure that employees understand the existence and value of these programs.

Market Segmentation

The global financial wellness program market share is classified into type, program, and application.

- For employee segment dominates the market with the largest revenue share over the forecast period.

Based on the type, the global financial wellness program market is categorized into for employers and for employee. Among these, for employee segment is dominating the market with the largest revenue share over the forecast period. The financial wellness program market represents a growing source of personal empowerment and well-being. These programs provide a variety of tools, including budgeting assistance and investment education, to help individuals manage their finances effectively. Workers are increasingly benefiting from employer-sponsored financial wellness initiatives as the importance of overall employee wellness becomes more widely recognized. These programs help to reduce stress, improve financial literacy, and provide a sense of financial security. The trend demonstrates a positive shift towards prioritizing employees' overall well-being, which aligns with the changing expectations of a workforce that values comprehensive financial support.

- The small & medium enterprises segment is expected to hold the largest share of the global financial wellness program market during the forecast period.

Based on the application, the global financial wellness program market is categorized into large enterprises, small & medium enterprises. Among these, the small & medium enterprises segment is witnessing significant growth over the forecast period. Small and medium enterprises (SMEs) are increasingly recognizing the importance of implementing financial wellness programs to help their employees. As the link between financial well-being and workforce productivity becomes more widely understood, SMEs are using these programs to improve employee satisfaction, engagement, and retention. Modern financial wellness solutions are scalable and flexible, catering to the specific needs of SMEs by providing cost-effective tools for employees to manage their finances. This trend demonstrates the democratization of financial wellness initiatives, which enables smaller businesses to prioritize their employees' financial health and well-being as a strategic investment in overall organizational success.

Regional Segment Analysis of the Global Financial Wellness Program Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with the largest market share over the forecast period, due to high levels of government intervention. This is recorded because this region was successful in spreading product awareness in the market, as well as market penetration and industry players focusing on product research and development. Lead to increased demand for a better user interface and demand. The region's success in this market is due to increased awareness of the impact of financial well-being on employee performance, as well as the presence of a diverse and technologically savvy workforce. Employers in North America are increasing their investments in comprehensive financial wellness programs that use advanced technologies and personalized solutions. The well-established corporate landscape, combined with regulatory support, contributes to North America's leadership in shaping and driving the growth of the financial wellness program market.

Asia Pacific is expected to grow the fastest during the forecast period. This growth can be attributed to Asia-Pacific's digital transformation in financial services. Fintech companies play a significant role in providing financial wellness benefits. Mobile apps and online platforms are increasingly being used to offer financial education, budgeting tools, and investment opportunities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global financial wellness program market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bank of America

- Empower Retirement

- Prudential Financial Inc.

- Nationwide Mutual Insurance Company

- The Massachusetts Mutual Life Insurance Company

- Fidel ty Investments

- Charles Schwab Corporation

- Financial Fitness Group

- Principal Financial Group

- Enrich Financial Wellness

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, The FPSA Financial Wellness Program was launched in response to a request from the Young Professionals Group. Truist Momentum developed this program to provide employees of FPSA member companies with the tools and education they need to feel confident about their financial future.

- In September 2023, Lumevity introduces its Financial Wellness Platform to help employers support their employees' financial well-being. The platform provides a wide range of resources, including on-demand financial education modules, personalized financial coaching, and a retirement planning tool.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global financial wellness program market based on the below-mentioned segments:

Global Financial Wellness Program Market, By Type

- For Employers

- For Employees

Global Financial Wellness Program Market, By Program

- Financial Planning

- Financial Education & Counseling

- Retirement Planning

- Debt Management

- Others

Global Financial Wellness Program Market, By Application

- Large Enterprises

- Small & Medium Enterprises

Global Financial Wellness Program Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?