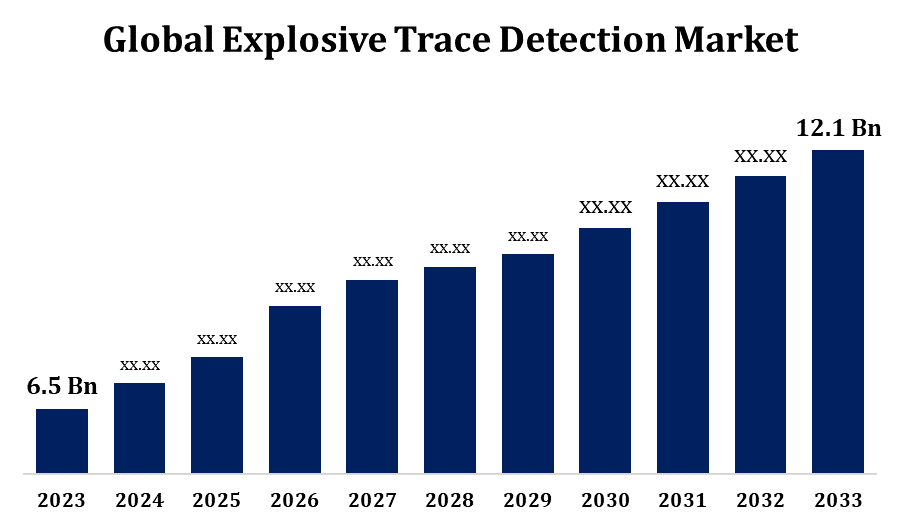

Global Explosive Trace Detection Market Size To Worth USD 12.1 Billion By 2033 | CAGR of 6.41%

Category: Aerospace & DefenseGlobal Explosive Trace Detection Market Size To Worth USD 12.1 Billion By 2033

According to a research report published by Spherical Insights & Consulting, the Global Explosive Trace Detection Market Size to grow from USD 6.5 billion in 2023 to USD 12.1 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 6.41% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 Market data tables and figures & charts from the report on the "Global Explosive Trace Detection Market Size By Product (Handheld, Portable/ Movable, and Fixed Point/ Standalone), By Technology (Colorimetrics, Ion Mobility Spectrometry, Thermo Redox, Chemiluminescence, and Amplifying Fluorescent Polymer), By End Use (Commercial, Defense, Public Safety & Law Enforcement, and Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/explosive-trace-detection-market

The Explosive Trace Detection (ETD) market deals with the equipment and technologies used to detect explosives in trace amounts. The primary forces behind this industry's growth are the increasing threat of terrorism and the need for stringent security measures in a number of sectors, including public safety, the defence of critical infrastructure, border security, and transportation. In response to the continuous rise in air traffic, airports are putting state-of-the-art ETD technologies into place to enhance security screening processes while maintaining operational efficiency. ETD technology is being adopted by other businesses, such as public places, event security, and cargo screening, in addition to the traditional aviation security domain.

Explosive Trace Detection Market Value Chain Analysis

The process begins with sourcing components like electronic parts, sensors, and circuits from vendors for manufacturing Explosive Trace Detection (ETD) systems. Manufacturers then use these materials to create various ETD systems, ranging from sophisticated airport screening units to portable detectors for checkpoints. They integrate components, sensors, software, and interfaces to make operational ETD systems. Concurrently, technology firms and research institutions advance ETD technology by developing integrated solutions, new detection techniques, and refining data analysis algorithms. Distributors manage the delivery of ETD systems to end-users like airports, government agencies, and private entities, ensuring efficient logistics and support. Installation businesses deploy ETD systems at customer sites, ensuring proper integration with existing security infrastructure. Training programs on ETD operation are provided by maintenance and training service providers to ensure optimal performance. End-users, including government organizations and private entities like airports and corporate buildings, utilize ETD technology to enhance security measures and mitigate the risk of terrorist attacks.

Explosive Trace Detection Market Opportunity Analysis

Growing security risks, including terrorism and the proliferation of IEDs, are the driving force behind the requirement for more advanced ETD systems. Strict regulations mandating the deployment of explosive detection devices in public areas, critical infrastructure sites, and transportation hubs promote a regulatory environment that is favourable to the growth of the ETD industry. While aviation security remains the primary use for ETD systems, other non-aviation sectors, such as critical infrastructure protection, mass transit, border security, and event security, are beginning to see the benefits of these technology. Growing international trade and globalisation necessitate higher security at ports, border crossings, and cargo facilities.

The rise in international terrorism has raised concerns about security in a number of areas, including government buildings, public spaces, critical infrastructure, and transportation. Thus, the requirement for security systems that are both efficient and able to identify explosive threats is growing. Because the airline sector is still a prime target for terrorist attacks, more money is being invested in aviation security infrastructure. The vital role ETD systems play in enhancing the security screening process for passengers, luggage, and cargo at airports throughout the world is what drives market demand in this industry. Because of the interdependence of the global economy, robust security measures are necessary to safeguard international trade routes, supply chains, and transportation networks against terrorist threats.

ETD systems can be costly to purchase, install, and maintain, particularly for smaller companies or those operating in resource-constrained environments. The high upfront and ongoing costs associated with ETD technology may deter some potential consumers from making an investment. Terrorist organisations constantly adapt their tactics in order to elude detection by security measures. ETD technology requires continuous updates, advancements, and R&D costs to stay competitive in the face of emerging challenges. The trade wars, geopolitical instability, and regulatory complexity characterise the global environment in which the ETD market operates. Due to the impact of trade barriers, geopolitical concerns, and economic shifts on investment decisions, supply chains, and market dynamics, market actors may encounter challenges.

Insights by Product

The handheld segment accounted for the largest market share over the forecast period 2023 to 2033. As Handheld ETD devices are portable and mobile, security personnel can conduct on-the-spot inspections in a range of locations, including airports, transportation hubs, border crossings, public events, and important infrastructure assets. This flexibility enhances security measures by enabling prompt and targeted inspections in response to specific risks or security issues. Handheld ETD devices are used in addition to stationary ETD systems that are installed at security checkpoints and screening stations. Mobile devices add an extra layer of protection for targeted inspections, sporadic checks, and secondary screenings in places where fixed systems would not be practical or available, even though permanent systems are still capable of conducting comprehensive screens for huge numbers of travellers and commodities.

Insights by Technology

The ion mobility spectrometry segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Ion mobility spectrometry (IMS) provides outstanding sensitivity and selectivity for the detection of trace levels of explosive compounds, including both conventional explosives and homemade explosive (HME) components. IMS technology can detect even minute levels of explosive vapour, making it particularly helpful for security screening applications. IMS systems provide real-time results in a matter of minutes or seconds, along with rapid trace explosive detection and analysis. This fast screening capacity enhances security screening processes at airports, transportation hubs, border crossings, and critical infrastructure facilities by cutting down on disruptions and delays while upholding high security requirements. Many IMS systems are designed to be lightweight and compact, which makes it easy to set them up in a range of operational contexts, including remote locations and field operations.

Insights by End Use

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. The evolving nature of security threats, including terrorism, insurgency, and asymmetric warfare, is driving up demand for advanced security solutions in the military sector. ETD systems are essential for identifying and mitigating explosive hazards posed by hostile actors and terrorist organisations. Security agencies and armed forces utilise ETD systems globally to combat terrorism, insurgency, and safeguard personnel. ETD technology assists military personnel in identifying explosive devices, improvised explosive devices (IEDs), and explosive materials in war zones, conflict areas, and high-risk sites by enhancing operational safety and effectiveness.

Recent Market Developments

- In November 2021, an agreement for USD 20 million was signed by the Transportation Security Administration (TSA) and Smiths Detection Group Ltd., a threat detection and security screening technology company, to supply CTX 9800 Explosive Detection Systems (EDS) for baggage screening at several US airports.

Major players in the market

- Smiths Detection Group Ltd. (UK)

- L3Harris Technologies Inc. (US)

- OSI Systems Inc. (US)

- Nuctech Company Limited (China)

- Teledyne FLIR LLC (US)

- Chemring Group PLC (UK)

- Analogic Corporation (US)

- Leidos Holdings Inc. (US)

- American Innovations Inc. (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Explosive Trace Detection Market, Product Analysis

- Handheld

- Portable/ Movable

- Fixed Point/ Standalone

Explosive Trace Detection Market, Technology Analysis

- Colorimetrics

- Ion Mobility Spectrometry

- Thermo Redox

- Chemiluminescence

- Amplifying Fluorescent Polymer

Explosive Trace Detection Market, End Use Analysis

- Commercial

- Defense

- Public Safety & Law Enforcement

- Others

Explosive Trace Detection Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?