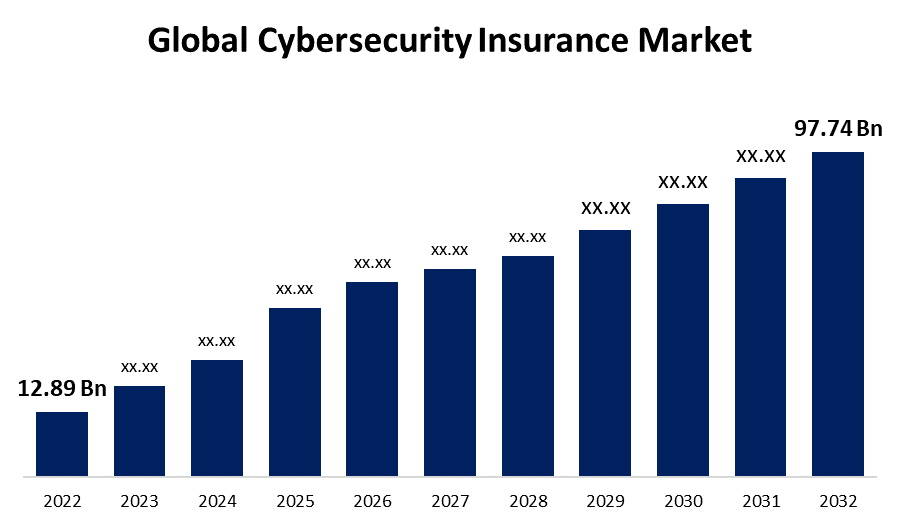

Global Cybersecurity Insurance Market Size To Exceed USD 97.74 Billion By 2032 | CAGR of 22.46%

Category: Information & TechnologyGlobal Cybersecurity Insurance Market Size To Exceed USD 97.74 Billion By 2032

According to a research report published by Spherical Insights & Consulting, the Global Cybersecurity Insurance Market Size is to Grow from USD 12.89 Billion in 2022 to USD 97.74 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 22.46% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 120 market data tables and figures & charts from the report on the "Global Cybersecurity Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Standalone and Tailored), By Coverage Type (First-party and Liability Coverage), By Enterprise Size (SMEs and Large Enterprise), By End-user (Healthcare, Retail, BFSI, IT & Telecom, Manufacturing, and Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/cybersecurity-insurance-market

The Cyber Security Insurance Market was established to assist organizations in the case of a cyber-related security breach or similar disaster. To reduce risk exposure, it covers both first-party and third-party claims, covering the costs associated with the recovery of internet-based cyber damages. It frequently involves, among other things, indemnification from data breach lawsuits, damages from network security breaches, and loss of privacy.

Because of the growing risk that these attacks pose to individuals, corporations, and governments, cyber security insurance solutions have been developed. Cyberattacks harm businesses in the form of a diminishing consumer base, economic disruption, regulatory fines, legal penalties and attorney bills, intellectual property loss, and damage to reputation. The cybersecurity insurance industry is expected to help organizations protect against losses caused by potential cybercrime risks such as ransomware, malware, distributed denial-of-service attacks, and other threats that could severely damage a network. The Cyber Security Insurance Market ensures a company's responsibility for a data breach that includes private customer information such as credit card, social security, account, driver's license, and health record numbers. It aids in the management of access controls, and the defense of the system against malware, viruses, unauthorized access, data protection, and other system-level threats.

COVID 19 Impact

The pandemic has forced people and companies to adopt remote working and has accelerated the digitalization of company processes. Organizations now require enterprise virtual private network (VPN) servers since workers work from home. As a result, cybercriminals all around the world found opportunities to profit from the crisis. During the pandemic time, there was an increase in mail spam, ransomware assaults, and phishing attempts, as hackers used the crisis as bait to imitate brands, fooling employees. Most cyber insurance policies include a wide range of current-environment-relevant coverage. This coverage safeguards the company's network security and privacy obligations. It addresses security responses, data recovery, ransom demands, reputational harm, system failures, and other sorts of business disruption.

According to the Swiss Re report, the insurance industry expanded due to growing premiums between 2016 and 2019. pre-COVID-19 demand was primarily driven by a shift in SMEs' business strategies, which focused on enhancing their e-commerce and digital capabilities. Thus, increased public cloud use among businesses, altering workspace models, rising cybersecurity risks, and desire for technical developments have all contributed to the rise of the cyber insurance industry throughout the pandemic.

Market segments

The Standalone segment dominates the market with the largest revenue share over the forecast period

Based on insurance type, the global cybersecurity insurance market is segmented into standalone and tailored. Among these, the standalone segment is dominating the market with the largest revenue share of 38.6% over the forecast period. By purchasing standalone insurance, an organization is protected from legal action for security or privacy violations based on a failure to protect sensitive information. Furthermore, standalone insurance covers a wide range of asset risks, including business interruption, data loss/destruction, and money transfer loss.

The First-party segment is witnessing significant CAGR growth over the forecast period.

On the basis of coverage type, the global cybersecurity insurance market is segmented into first-party and liability coverage. Among these, the first-party segment is witnessing significant CAGR growth over the forecast period. The first type of coverage gives companies financial support to lessen the impact of data breaches and cyberattacks. The rise in cyber theft, hacking, extortion, and data destruction is expected to propel the first-party industry.

The Large Enterprise segment is expected to hold the largest share of the Global Battery Binders Market during the forecast period.

Based on the enterprise size, the global cybersecurity insurance market is classified into SMEs and large enterprises. Among these, the large enterprise segment is expected to hold the largest share of the cybersecurity insurance market during the forecast period. Due to the volume of data generated, large organizations are expected to dominate the industry. This leads to an upsurge in cybercrime and huge data breaches. Large corporations invest heavily in risk management systems to protect the security of client and business data.

The BFSI segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of end- user, the global cybersecurity insurance market is segmented into healthcare, retail, BFSI, IT & telecom, manufacturing, and others. Among these, the BFSI segment dominates the market with the largest revenue share of 57.2% over the forecast period. The banking sector is an obvious target for hackers due to the vast volume of data generated. This is expected to drive segmental expansion by increasing demand for cybersecurity insurance in the BFSI industry.

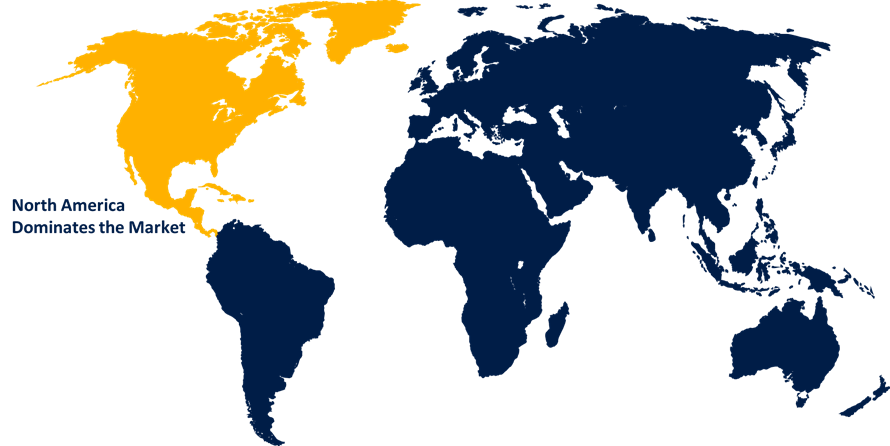

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

The United States market has the highest share in the region due to the country's strict government regulation and cybersecurity rules. Furthermore, the presence of premier solution providers helps to drive growth.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. According to a Cyber Risk Management report, cybersecurity insurance demand in Asia Pacific increased by 87%. Cyber insurance solutions are becoming increasingly popular in Asia Pacific as connection improves. As it accelerates its digital shift, the organization becomes more vulnerable to cyber-attack.

Major vendors in the Global Cybersecurity Insurance Market include Travelers Indemnity Company, AXA XL, Chubb, American International Group, Inc., Beazley Group, AXIS Capital, Holdings Limited, CNA Financial Corporation, BCS Financial Corporation, The Hanover Insurance, Inc., Zurich Insurance, Sayata Labs, Zeguro, Ivanti, SafeBreach, Cronus Cyber Technologies, Liberty Mutual, Lloyd’s of London, Lockton, Munich Re Group

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Saiber Innovation Technologies partnered with CYMAR Management Ltd., a cyber-insurance specialist, to fulfil the UAE marine and logistics sectors' cyber insurance needs and to assist in defending the maritime and logistics sectors from cyber-attacks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global cybersecurity insurance Market based on the below-mentioned segments:

Cybersecurity Insurance Market, Insurance Analysis

- Standalone

- Tailored

Cybersecurity Insurance, Coverage Analysis

- First-party

- Liability Coverage

Cybersecurity Insurance Market, Enterprise Analysis

- SMEs

- Large Enterprise

Cybersecurity Insurance Market, End-User Analysis

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

Cybersecurity Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?